Response to the FOMC announcement at 2:00 PM EDT

The Fed Reserve increase the Fed Fund Rate by 0.75 to 3.75%-4.00% as anticipated. It also indicated that more data points are needed before additional changes are made. Responses were as follows:

S&P 500 Index initially moved higher after 2:00 PM, but closed sharply lower.

U.S. Dollar Index ETN moved lower after 2:00 PM, but closed sharply higher.

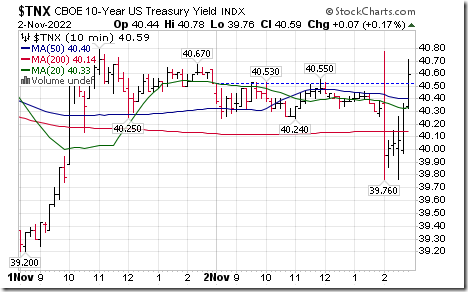

Yield on 10 year Treasuries moved lower after 2:00 PM, but recovered to turn slightly positive

Industrial commodity ETN GSG moved slightly higher after 2:00 PM, but closed slightly lower.

Gold ETN GLD moved sharply higher after 2:00 PM, but closed sharply lower.

Silver ETN SVR tracked the gold ETN

Gold equities and related ETFs followed the price of gold and silver

The Canadian Dollar in U.S. Dollars moved sharply higher after 2:00 PM, but closed sharply lower

Technical Notes for yesterday

Editor’s Note: All of the following technical events occurred before the FOMC announcements at 2:00 PM yesterday.

Aerospace & Defense ETF $PPA moved above $79.44 extending an intermediate uptrend. Aerospace & Defense ETF $ITA moved above $108.64 extending an intermediate uptrend.

IBM $IBM a Dow Jones Industrial Average stock moved above $139.34 extending an intermediate uptrend.

Bank of America $BAC an S&P 100 stock moved above $36.50 extending an intermediate uptrend.

CCL Industries $CCL.B.TO a TSX 60 stock moved below $62.58 extending an intermediate downtrend.

Trader’s Corner

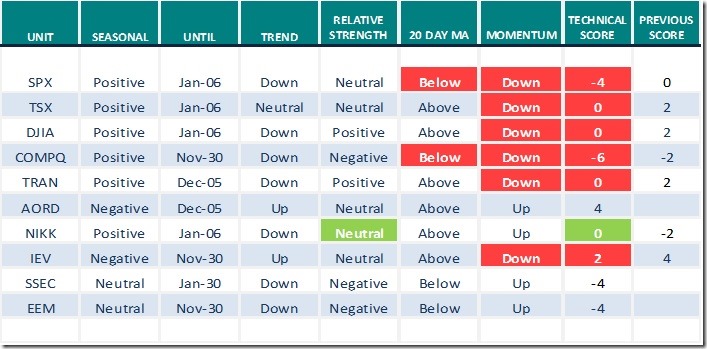

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 2nd 2022

Green: Increase from previous day

Red: Decrease from previous day

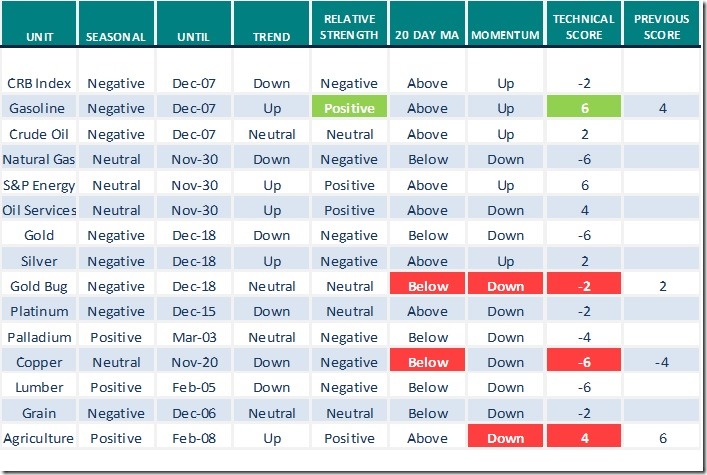

Commodities

Daily Seasonal/Technical Commodities Trends for November 2nd 2022

Green: Increase from previous day

Red: Decrease from previous day

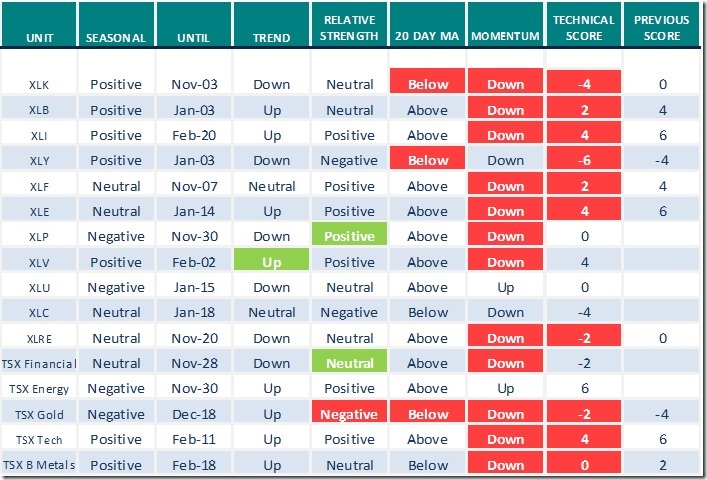

Sectors

Daily Seasonal/Technical Sector Trends for November 2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Link from Mark Bunting and www.uncommonsenseinvestor.com

How to Preserve Your Capital in Inflationary Times – Uncommon Sense Investor

Tom Bowley discusses “Positive Divergences vs the Fed”. Includes a comment on seasonality for U.S. equity markets in the month of November with a focus on Industrials.

Positive Divergences vs. The Fed | Tom Bowley | Trading Places (11.01.22) – YouTube

Market Buzz by Greg Schnell

https://www.youtube.com/watch?v=u_vMhwqDHI0

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 12.20 to 50.20. It changed from Overbought to Neutral on a drop below 60.00.

The long term Barometer dropped 3.60 to 34.40. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer slipped 8.47 to 48.31. It remains Neutral.

The long term Barometer dropped 6.36 to 30.51. It remains Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed