Wolf on Bay Street

Don Vialoux is a guest on Wolf on Bay Street radio show on Saturday. Connect at Corus Radio 640. Show starts at 7:00 PM EDT

Technical Notes for yesterday

Dow Jones Industrial Average stocks led the advance yesterday after reporting higher than consensus third quarter results. Caterpillar $CAT moved above $199.04 extending an intermediate uptrend. McDonalds $MCD moved above $266.51 to an all-time high. Home Depot $HD moved above $292.97 resuming an intermediate uptrend.

Big cap high tech equities remained under pressure following release of less than consensus quarterly results. Meta Platform $META was notably weaker following a break below $122.53. Alphabet $GOOGL moved below $94.38 extending an intermediate downtrend. Amazon also moved sharply lower after the close.

Money center U.S. banks continued to move higher. Wells Fargo $WFC moved above $46.31 extending an intermediate uptrend.

South Africa iShares $EZA completed a double bottom pattern on a move above $39.03.

NASDAQ 100 stocks breaking resistance and extending intermediate uptrends included AbbVie $ABBV on a move above $153.61 and Check Point Software $CHKP on a move above $118.80 and $126.01

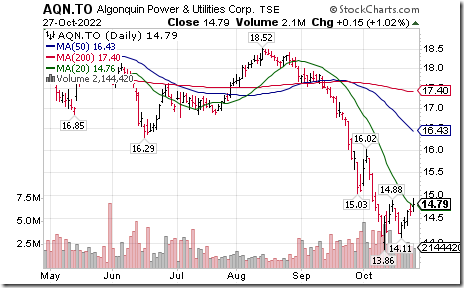

TSX 60 stocks tracking higher included Algonquin Power $AQN.TO completing a double bottom pattern on a move above $14.88, Restaurant Brands International $QSR.TO extending an intermediate uptrend on a move above $79.69 and Shopify $SHOP.TO moving above intermediate resistance at $Cdn.46.46.

Trader’s Corner

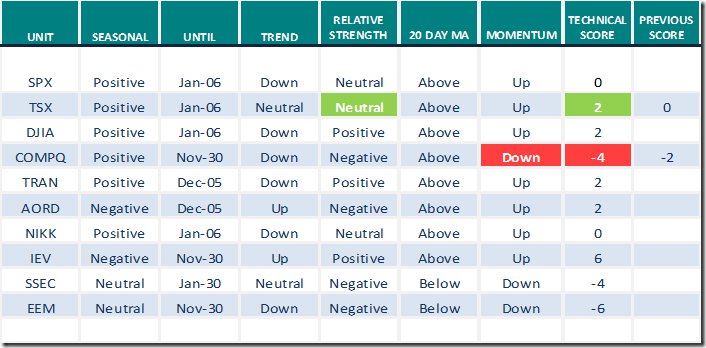

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

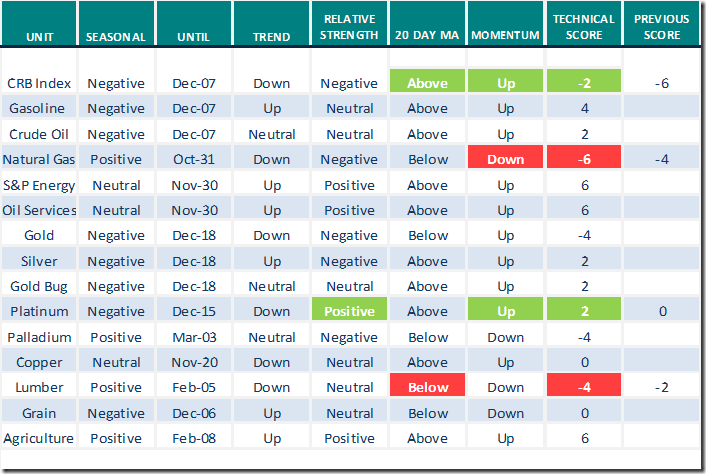

Commodities

Daily Seasonal/Technical Commodities Trends for October 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

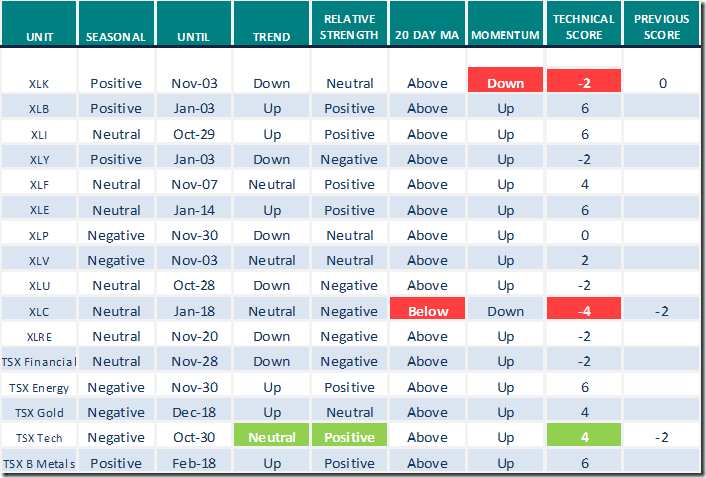

Sectors

Daily Seasonal/Technical Sector Trends for October 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by a valued provider

Tom Bowley says “History says buy stocks now”.

https://www.youtube.com/watch?v=UMvcb03HXPE

Chart of the Day

Strength in Shopify triggered significant technical gains by Cdn. Technology iShares (XIT.TO) Technical score increased from -2 to +4:

· Price moved above $32.16 changing trend from down to neutral (i.e. Score:-2 to 0)

· Strength relative to the S&P 500 changed from Negative to Positive (i.e. Score: -2 to +2)

· Price also moved above its 50 day moving average, another encouraging sign

· Seasonality rating changes from Negative to Positive on October 30th

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.20 to 50.40 yesterday. It remains Neutral. Trend remains up.

The long term Barometer added 1.20 to 32.20 yesterday. It remains Oversold. Trend remains up.

TSX Momentum Barometers

Intermediate term Barometer added 2.97 to 52.54 yesterday. It remains Neutral. Trend remains up.

The long term Barometer slipped 1.27 to 33.90 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed