by Jared Dillian, The 10th Man

I learned recently that we have some new subscribers to The 10th Man. So, let’s review the purpose of The 10th Man.

- The name comes from the movie World War Z. I’ll skip the background story, but the main idea is that the role of the 10th man is to ask the hard questions when everyone else is in agreement. Right now, everyone can agree: there is a lot of inflation. The 10th man would say: what if there isn’t?

- Like most financial newsletters, the goal of The 10th Man is to help you make money. But not in a direct way—I’ll never pitch stocks or other financial instruments. My goal is to get you to think about the markets in a different way. Having said all that, we’re not reflexively contrarian for the sake of being contrarian.

- To have fun.

What I want to talk about today is this moral panic we’re having about inflation. I chose the words moral panic for a reason—we had a moral panic about obscene song lyrics in the 1990s, and it turned out to be nothing. I suspect this will turn out to be nothing as well.

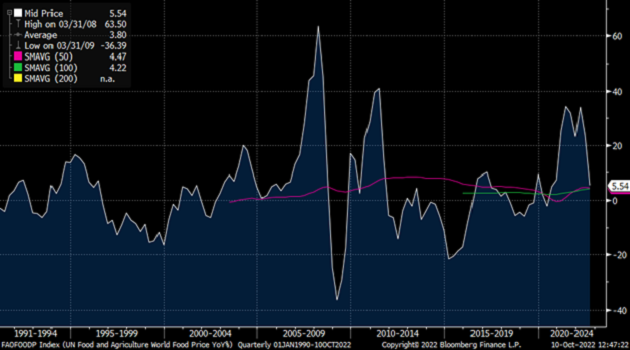

I’ll give you two charts: the first is a chart of food inflation, which is turning sharply lower. The conventional wisdom is that food inflation leads to broader inflation.

Source: Bloomberg

The second chart is one of job openings, which is cratering as the tight labor market loosens up sharply.

Source: FRED

These charts are only a sample size of two, but these are highly deflationary signals. And one thing I’ve noticed: the bellyaching about inflation seems to have leveled off a bit. I could blind you with science and put a bunch more charts in here, but there are reams of data saying that inflation is slowing. Like, used car prices, for starters.

I’m writing this before the CPI number is released, and while I’d like to think that this will feed into this month’s number, it might not. We might be doomed to another month in the bond market washing machine. I hope not.

Chart Magic

But when I do my chart magic on the bond market, it tells me that we’re pretty close to a reversal. I might point out that it is pretty much the consensus at this point that interest rates are going to go higher. We haven’t had any magazine covers on the bond market, but we’ve had two on the dollar, and if you think the dollar is going to sell off, it’s probably because interest rates went lower. Correspondingly, sentiment in the stock market is at zero. I repeat—zero. There is nowhere to go but up from here.

It was funny—on Monday, Columbus Day, when the bond market was closed, TLT, the long bond ETF, was down over 2%. I have a fantastic story of trading TLT when the bond market is closed, but I will have to tell you that over an iced tea sometime. When the bond market is closed, TLT can be viewed as expectations as to where the bond market will open the next day—2% in the bond market is a pretty big move. And keep in mind that these are dumb equity guys that are doing this, people who wouldn’t know convexity if it punched them in the nose. That sounds like a contrary indicator to me.

But yes, we’re set up for reversals across asset classes, and I think it will happen in the near future. Maybe it will happen this week.

Permabull

In the last few weeks, I’ve been called a permabull a handful of times on Twitter. Clearly, those people weren’t following me in 2021. I’m bullish when others are bearish, and bearish when others are bullish. Being bullish doesn’t come naturally to me. I am a guy whose career on Wall Street was born in a big bear market and ended in a big bear market. My trading life was bookended by two crashes. I tend to think that things will crash all the time. But not this time. There is no leverage in the system. This is a valuation bear market—nothing more serious than that.

I think the narrative is growing that the Fed should pause and think about this before blowing up the financial system. Let me be clear: I think it is a good thing that the Fed is hiking rates. They must fight inflation. I think they did it a year too late, but it is good that they are doing it. But these are the fastest rate hikes in history, and it would be smart to take a break and evaluate how the rate hikes were feeding through the system and to see their effect on inflation. Anyway, this is a mess of their own creation, and I’m deriving some degree of pleasure in watching them try to wiggle out of it.