Technical notes for yesterday

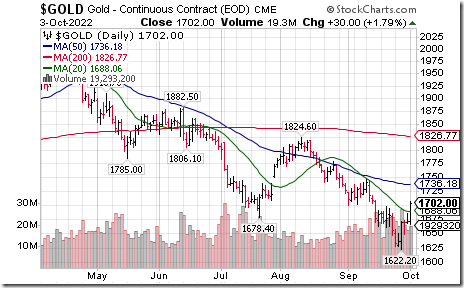

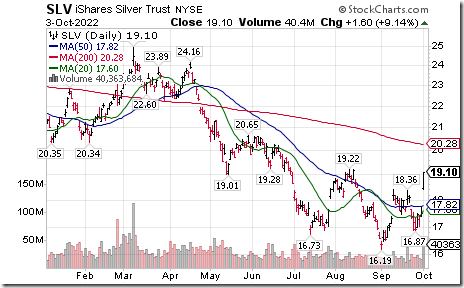

Highlight yesterday was strength in precious metal prices in response to U.S. Dollar weakness.

Gold bullion advanced $30.00 per ounce

Silver ETN $SLV moved above $18.43 completing an intermediate base building pattern.

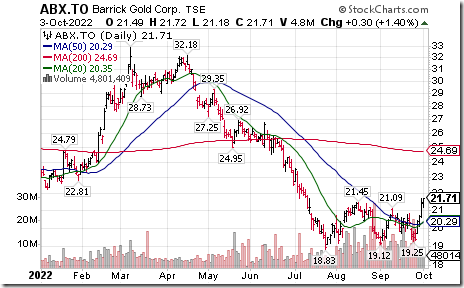

Canadian gold stocks led the advance by TSX Composite stocks

Barrick Gold completed a double bottom pattern by moving above Cdn$21.5. Agnico-Eagle competed a double bottom pattern by moving above Cdn$59.37. First Majestic $FR.TO a silver producer moved above US$11.28 extending an intermediate uptrend.

Israel iShares $EIS moved below $57.19 extending an intermediate downtrend.

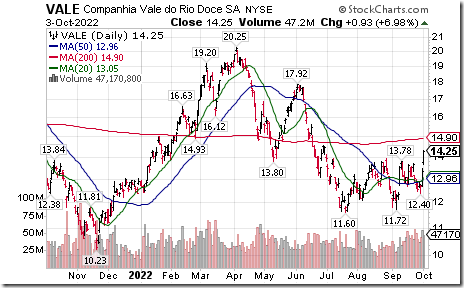

VALE $VALE one of the largest base metal producers in the world moved above $13.82 completing a double bottom pattern.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 3rd 2022

Green: Green: Increase from previous day

Green: Green: Increase from previous day

Red: Decrease from previous day

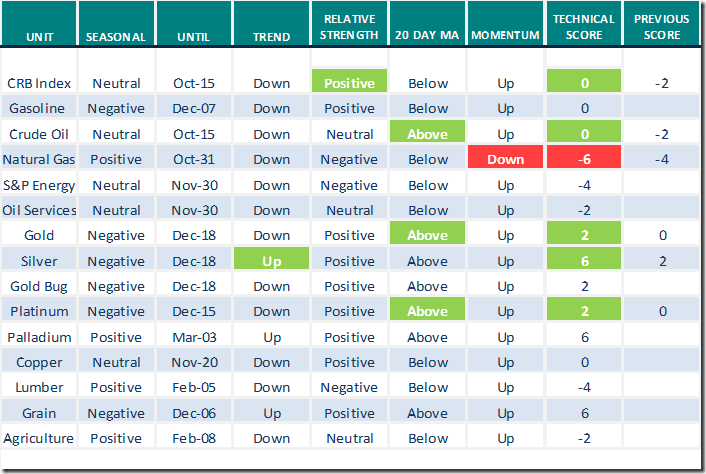

Commodities

Daily Seasonal/Technical Commodities Trends for October 3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

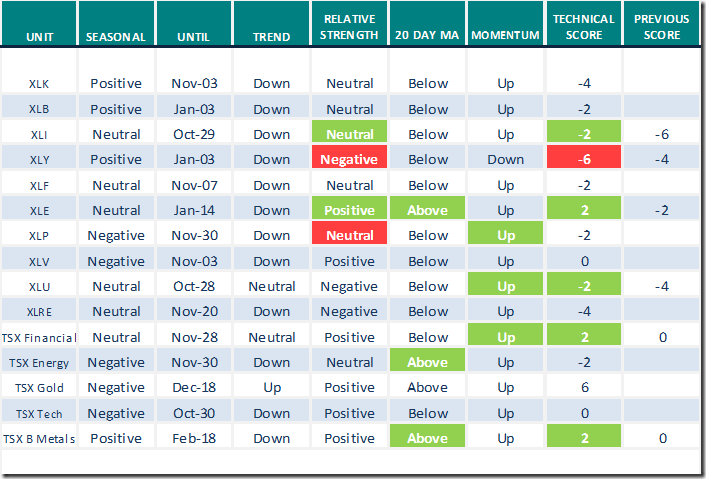

Sectors

Daily Seasonal/Technical Sector Trends for October 3rd 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Karl and Erin Swenlin say” Bear market rally ahead”.

S&P 500 Momentum Barometers

The intermediate term Barometer gained 5.40 to 8.60 yesterday. It remains Oversold. Trend has turned up.

The long term Barometer added 4.60 to 16.80 yesterday. It remains Oversold. Trend has turned up.

TSX Momentum Barometers

The intermediate term Barometer jumped 11.44 to 32.63 yesterday. It remains Oversold. Trend has turned up.

The long term Barometer advanced 6.78 to 25.85 yesterday. It remains Oversold. Trend has turned up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed