Technical Notes for yesterday

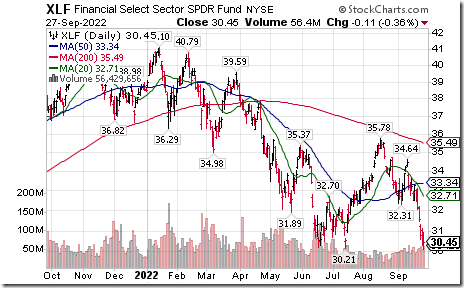

Financial SPDRs $XLF moved below $30.21 extending an intermediate downtrend.

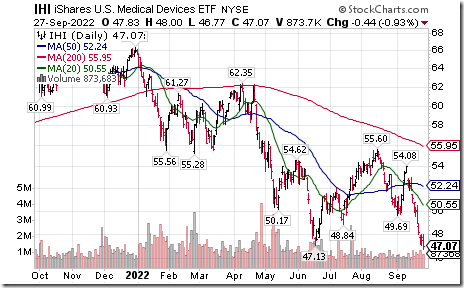

Medical Devices iShares $IHI moved below $47.13 extending an intermediate downtrend.

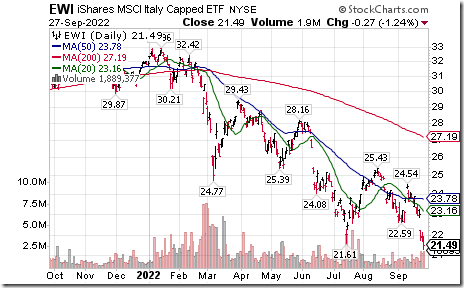

Italy iShares $EWI moved below $21.21 extending an intermediate downtrend.

Insurance iShares $IAK moved below $78.17 extending an intermediate downtrend.

JP Morgan $JPM a Dow Jones Industrial Average stock moved below $106.06 extending an intermediate downtrend.

Phillip Morris International $PM an S&P 100 stock moved below $87.03 extending an intermediate downtrend.

Exelon $EXC an S&P 100 stock moved below $39.87 extending an intermediate downtrend.

Fox $FOX an S&P 100 stock moved below $28.73 extending an intermediate downtrend.

Mondelez $MDLZ a NASDAQ 100 stock moved below $57.49 extending an intermediate downtrend.

BCE $BCE.TO a TSX 60 stock moved below $60.52 extending an intermediate downtrend.

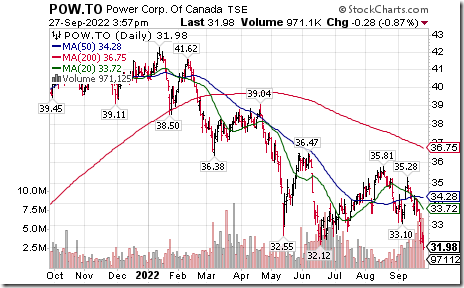

Power Corp $POW.TO a TSX 60 stock moved below $32.12 extending an intermediate downtrend.

Trader’s Corner

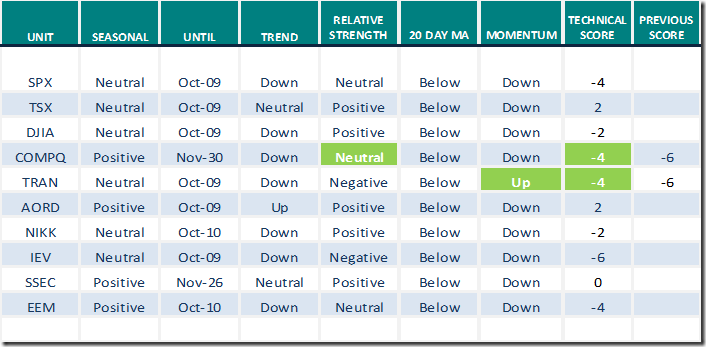

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

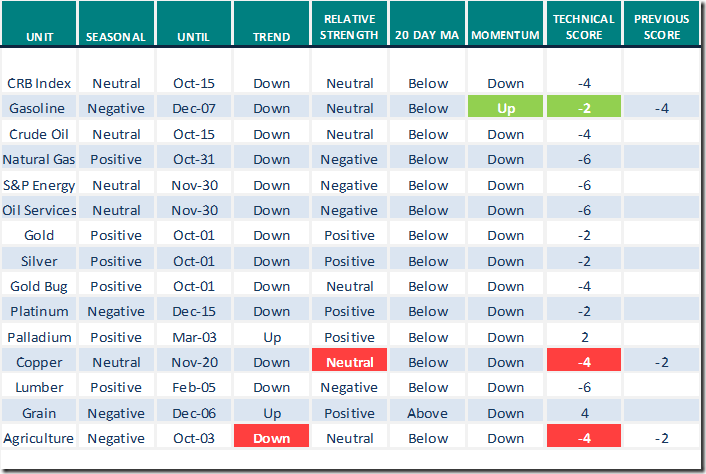

Commodities

Daily Seasonal/Technical Commodities Trends for September 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

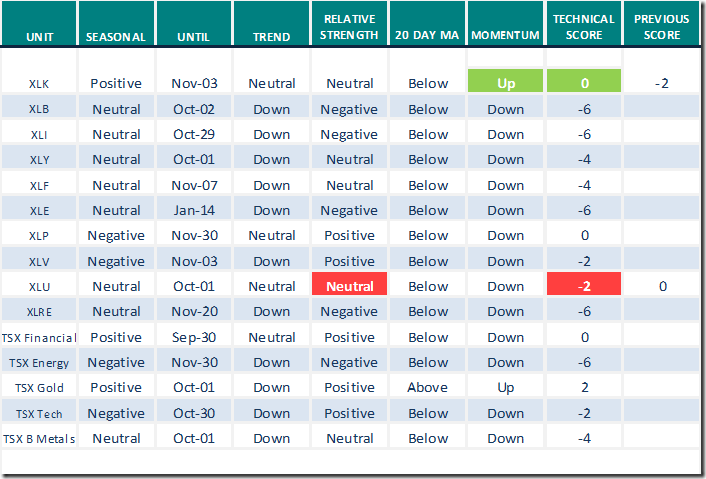

Sectors

Daily Seasonal/Technical Sector Trends for September 27th 2021

Green: Increase from previous day

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Tom Bowley says “I’m calling this market bottom 2.0”.

I’m Calling This Market Bottom 2.0 | Tom Bowley | Trading Places (09.27.22) – YouTube

Greg Taylor says “If the U.S. Dollar breaks down, gold could be the best performing asset”

If the U.S. dollar breaks down, gold could be the best-performing asset class: Greg Taylor – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 3.40 yesterday. It remains extremely Oversold, but showing early signs of bottoming. Trend remains down

The long term Barometer dropped another 1.20 to 11.40 yesterday. It remains Oversold. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer added 0.85 to 8.05 yesterday. It remains extremely Oversold, but showing early signs of bottoming. Trend remains down.

The long term Barometer added 0.42 to 17.37. It remains Oversold, but showing early signs of bottoming. Trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed