by Christopher Shipley, Head of Fundamental Equity, Northern Trust

The rate hike campaign continues as central banks try to shake inflation.

OUTLOOK

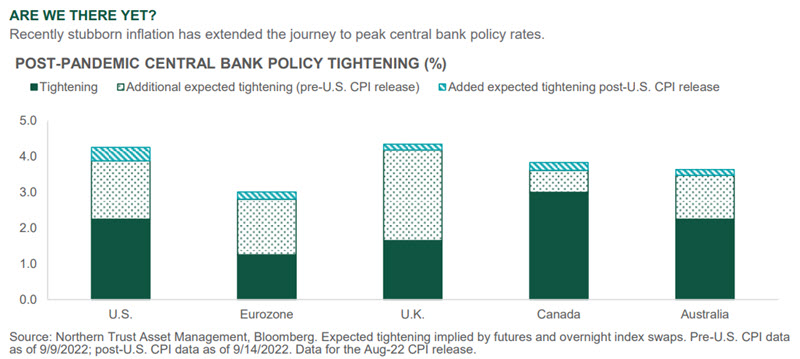

A negative inflation surprise for the month of August and more hawkish Federal Reserve rhetoric dashed investor hopes that the end of the Fed’s rate hike campaign was in sight. Instead, interest rates have moved higher and equity markets have moved lower. While commodities have been falling and goods inflation has eased, services inflation accelerated, driving up core inflation (6.3% y/y in August vs. 5.9% in July). This poses incremental challenges for the Fed, which strengthened its commitment to combating inflation, and the economic consequences it is willing to accept in exchange for price stability. Our base case calls for Growth Weaker by Design and an Inflation-Focused Fed, as the central bank endeavors to reduce the demand side of the equation to rein in inflation. We view Sticky Inflation as the dominant risk case for financial markets. The acceleration in core inflation this month could prove more challenging to correct, leaving the market still subject to disappointment. We also remain mindful of the Eastern Threats associated with Russia and the ever-present discord between the U.S. and China.

Equity and bond markets reacted materially to the likelihood of rate hikes extending into next year and the threat this incrementally restrictive policy poses. Rates increased significantly across the curve, weighted more heavily toward the front-end and further inverting the yield curve. Expectations for the peak Fed Funds rate rose 75 basis points (bps) in the past month, while 10-year Treasury yields added 65 bps – back to the June highs. The European Central Bank (ECB) also surprised with a larger than expected rate hike this month, though the dollar continued its upward climb. Higher rates combined with growing recession fears drove declines in equities – led lower by growth stocks – but remain above the year-to-date lows back in June. The S&P 500 fell 8%, the Russell 1000 Growth index dropped 10%, while non-U.S. markets held up somewhat better. We remain below consensus for corporate profits globally, reflecting our expectation for disappointing economic growth. Valuations for stocks near longer-term fair value alongside earnings estimates that we believe still need to fall leave us cautious.

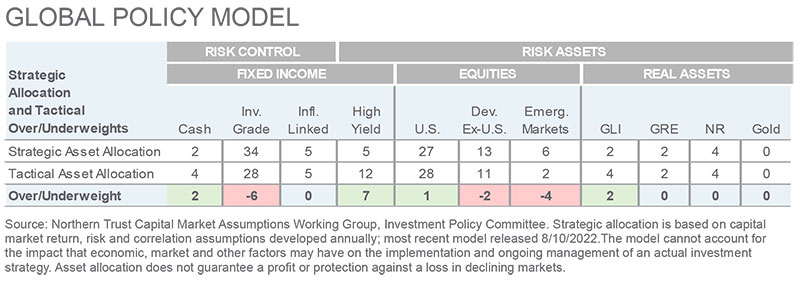

We went further underweight emerging market equities in our Global Policy Model (GPM) this month, putting the proceeds in cash. Overall, the GPM continues its preference for U.S. assets – specifically high yield bonds, which we view as a “less risky” risk asset. Going forward, we expect elevated market volatility to remain as investors assess the path of inflation and the resulting reaction from global central bankers – notably the Fed and the ECB.

INTEREST RATES

- Stubborn inflation and a persistent Fed have pushed both nominal and real interest rates higher.

- The Fed has inverted the yield curve to bring inflation under control.

- We remain fairly neutral duration in fixed income portfolios.

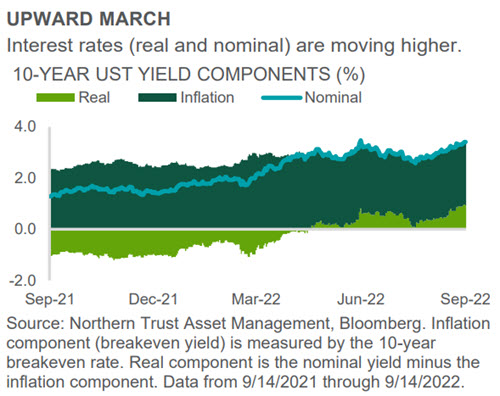

After starting the year negative, 10-year U.S. Treasury (UST) real yields have moved into positive territory. Real yield is the inflation-adjusted yield an investor receives, found by subtracting expected inflation from the nominal yield. 10-year real yields have risen over 200 basis points (bps), as inflation has forced the Fed to raise rates more aggressively. Thus far, the Fed has hiked rates by 75 bps twice, with the potential for more outsized hikes to come. Front-end nominal and real yields have also moved higher in expectation of a front-loaded hiking cycle.

Despite consistently high inflation, long-end inflation breakevens have moved lower. This suggests that investors expect the Fed to successfully contain inflation over the medium-to-longer term horizon. Per the chart, the recent rise in rates can be attributed to higher real yields. The Fed remains data dependent and will likely be forced to hike rates into restrictive territory. Fed Funds futures currently project a terminal rate above 4% by year end. We increased our Fed funds and 2-year target ranges – now projecting a central tendency of 3.75% for both over the next six months. We expect inflation will remain higher for longer, leading to central bank-induced slower growth.

CREDIT MARKETS

- Dispersion in high yield markets has opened opportunities for investors.

- The high yield fundamental backdrop remains solid despite macro fears of recession.

- High yield remains our largest tactical overweight.

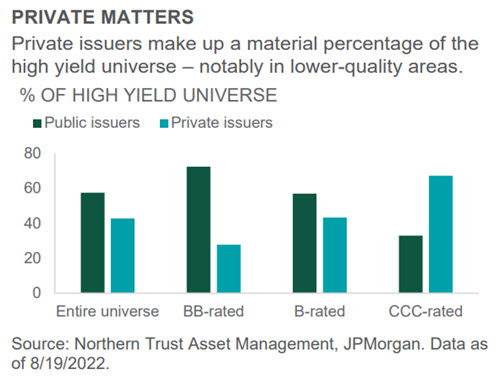

The high yield market has a large exposure to private issuers – a segment that has grown over the last two years due to cheap financing post pandemic. Private issuers make up 43% of the high yield market, with a greater concentration in the lower quality buckets (see chart). Moreover, private issuers tend to command a spread premium relative to public issuers, with an average spread differential of 120 bps above public issuer spreads. Spread dispersion within the high yield market has increased over the past year. One measure of this dispersion is the percentage of the market that’s trading within 100 bps of the index on a spread basis. Currently, roughly 30% of bonds in the index are trading within 100 bps of the index spread level. This is a sharp decline from 60% a year ago.

The majority of the increase in dispersion has been driven by lower-rate (CCC-rated) credits, with dispersion in this cohort at its highest level since 2020. Private issuer concentration in the CCC cohort may be influencing this uptick in dispersion, with limited visibility and information causing investors to pull back from this segment of the market in the volatile current environment. This provides an opportunity for investors with a strong bottoms-up process to outperform through security selection.

EQUITIES

- Stubborn inflation and resulting central bank tightening have put a ceiling on potential equity appreciation.

- We are now notably underweight global equities.

- Within global equities, we continue our preference for U.S.-based companies.

Global equities dropped over the past 30 days, reversing course from the gains seen the prior month. Rising interest rates represented a headwind to equity valuations while disappointing inflation readings renewed concerns over the magnitude and duration of restrictive central bank policy and its economic consequences. With interest rates up over the month, growth underperformed value (growth equities are “longer duration” and therefore more sensitive to rates) and the U.S. underperformed non-U.S. markets.

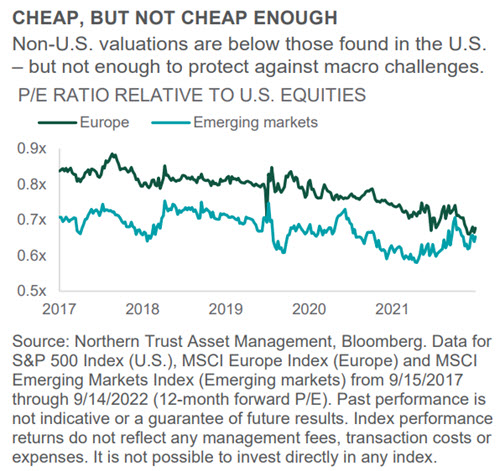

We continue to be concerned about the implications of China’s zero Covid policy, the strong U.S. dollar and commodity prices on emerging markets. Concerns about Europe remain as well, but we have seen valuations relative to the U.S. move lower in Europe, while relative valuations in emerging markets (EM) are more consistent with longer-term averages despite material headwinds (see chart). As we sought to modestly reduce risk, we went further underweight EM equities this month. Weakening global growth engineered by central banks should lead to further negative revisions to earnings. With valuations not sufficiently compelling, we are underweight global equities with a notable regional preference for the U.S.

REAL ASSETS

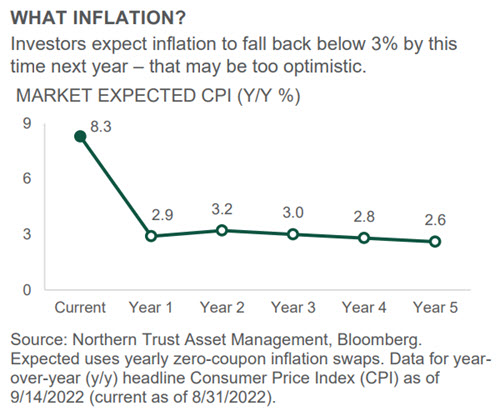

- Despite another stubbornly high inflation print, investors still expect prices to moderate.

- We are tactically overweight global listed infrastructure – balancing inflation risk with market risk.

- Natural resources, inflation-linked bonds and high yield can also help to deal with unexpectedly high inflation.

Another consumer price index (CPI) report, another uncomfortably high reading on inflation. Both “headline” and core inflation came in hotter than investors were anticipating, at 8.3% and 6.3% respectively. Despite this, market expectations for inflation in the years ahead remain relatively well-behaved – with a belief that the Fed is on the inflation case. As found in the chart, investors currently expect inflation to fall from current lofty levels to under 3% over the next year – and slightly lower from there the next half-decade. But have markets placed too much faith in the Fed’s ability to quickly bring inflation back under control?

Our Sticky Inflation risk case acknowledges the possibility that consumer price increases don’t cool off as quickly as the markets are pricing in, but how are we factoring this risk case into our asset allocation positioning? First, we continue our high yield overweight and inflation-linked bonds equal-weight – both of which we prefer over the underweighted investment grade debt, which can be more impacted by inflationary pressures. Within our formal “real asset” categories, we maintain our overweight to global listed infrastructure – a slightly less risky way to get some inflation exposure in the portfolio than natural resources, which we are maintaining at strategic levels.

- Chris Shipley, Chief Investment Strategist – North America

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2022 Northern Trust Corporation.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust's current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.

Christopher Shipley

Christopher Shipley

Head of Fundamental Equity

Chris Shipley is head of fundamental equities at Northern Trust Asset Management, where he oversees the firm's fundamental equity research and portfolio management efforts. Chris is a voting member of the firm's Tactical Asset Allocation and Investment Policy Committees.

Copyright © Northern Trust