by John Lynch, Chief Investment Strategist, Comerica Wealth Management

We’ll never truly know whether the equity market lows are in for the year without successfully testing the June lows.

While the election headlines will be alarming, and the news on lockdowns in China and the War in Ukraine may prove troubling, recognize the importance of adhering to long-term targeted allocations. The markets may be volatile, but they often prove resilient for patient investors.

Key Takeaways

S&P 500® |

The S&P 500® closed below 3,900 last Friday, which was a significant technical development for the equity market’s trend. |

Index Reset |

Consequently, we suspect the Index will now have to retest the June lows in the 3,640 range, and successfully hold that level, to establish a classic “double bottom,” which could potentially provide investors a firm base from which to navigate a more positive market trend going forward. |

Inflation |

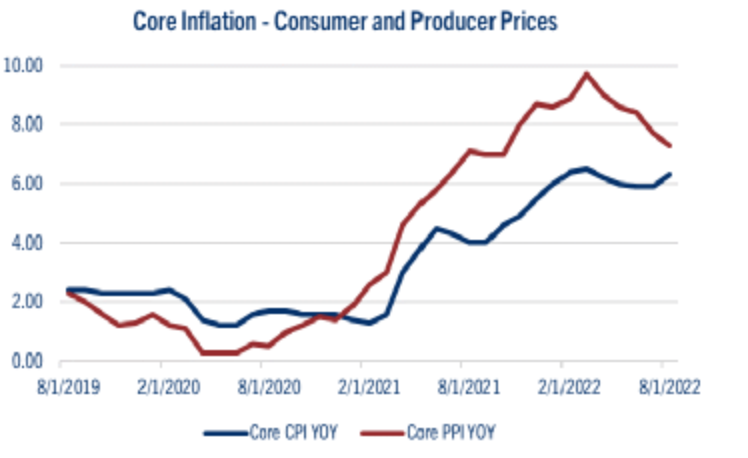

The inflation readings for August provided the financial markets with another reason to conclude that the mid-summer rally was indeed countertrend, as the core measures for consumer and wholesale prices were worse than anticipated. |

Fed Funds |

The fed funds futures market now projects a 75.0% chance of another 75-basis point increase in the benchmark target rate at the conclusion of this week’s monetary policy meeting on Wednesday. |

Equity Resilience |

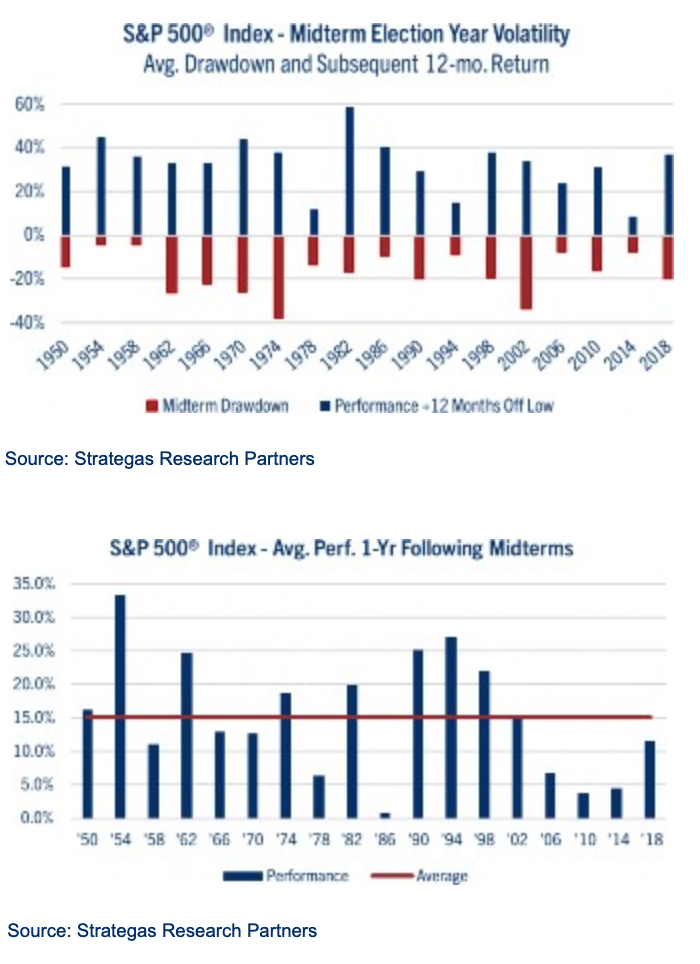

The equity market has displayed a long history of resilience following midterm election year volatility. |

We’ll never truly know whether the equity market lows are in for the year without successfully testing the June lows.

To be sure, the recent technical weakness in stock prices must now contend with the resolve of monetary policy makers in their fight against inflation. Moreover, third quarter earnings season may provide further insight into the degree of margin erosion for U.S. corporations, resulting in the possibility of additional fundamental headwinds for stock prices.

The S&P 500® closed below 3,900 last Friday, which was a significant development for the equity market’s technical trend. This level not only represented a big round number, but also an area of previous resistance, and now significant support, for the Index. Indeed, the 3,900-level proved worthy support in late spring, before serving as resistance which was ultimately breached in late July and early August as the bear market rally gathered steam. The market ran into significant resistance at its 200-day moving average (DMA) in mid- August, and after a previous attempt in early September, this important retracement level for the S&P 500® level failed to hold last Friday. See chart: S&P 500® Index.

Consequently, we suspect the Index will now have to retest the June lows in the 3,640 range, and successfully hold that level, to establish a classic “double bottom,” which could potentially provide investors a firm base from which to navigate a more positive market trend going forward.

Source: Bloomberg L.P.

Inflation

The inflation readings for August provided the financial markets with another reason to conclude that the mid- summer rally was indeed countertrend, as the core measures for consumer and wholesale prices were worse than anticipated.

Both the Consumer Price Index (CPI) and Producer Price Index (PPI) showed the core readings, which exclude the volatility in pricing for food and energy, indicated that price pressures were not only persistent, but also spreading to the costs for other goods and services. The core CPI rose 6.3% on a year-over-year basis (YOY) last month while the core PPI climbed 7.3% from the same period last year. See chart: Core CPI and Core PPI.

In response to these reports, market interest rates surged, with the yield for the 2-year Treasury bill jumping to 3.85%, while the major domestic equity market indexes all plunged within the 4.0% to 5.5% range last week.

The Federal Reserve has been very consistent in messaging the need to maintain the intensity of their tightening. Chair Jerome Powell has also frequently cited history, with the mistakes of the “stop and go” policies of the central bank in the late-1970’s responsible for the challenges of the early 1980’s, when it took the Fed three years and two recessions to ultimately defeat inflation.

As a result, the fed funds futures market now projects a 75.0% chance of another 75-basis point increase in the benchmark target rate at the conclusion of this week’s monetary policy meeting on Wednesday.

Midterm Election Resilience

Of course, the potential for higher market interest rates and additional equity downside is not an ideal scenario for investors. The combination of surging inflation, lockdowns in China, the war in Ukraine, rising market interest rates and a decline in profit growth expectations can all further weigh on near-term market sentiment.

Yet, over the long-term, the equity markets have consistently displayed an ability to adapt and recover as companies collectively find a way to innovate and grow. Indeed, a chart we showed on several occasions earlier this year shows the resilience of the S&P 500(R) Index following previous examples of midterm election year volatility. See chart: Midterm Election Market Volatility and Recovery.

Since 1950, market volatility during midterm election years saw the S&P 500® endure an average drawdown of 17.0%, just about where the Index’s year-to-date (YTD) performance stands currently. However, history also shows that from the midterm election year trough, the Index has rallied by an average of 32.0% in the subsequent twelve months, highlighting the importance of “time in” the markets versus “timing” the markets.

In addition, in the four-year presidential election cycle, year three tends to be the best performer, with an average annual return in excess of 16.0% for the S&P 500® Index. Also, while midterm election years tend to be volatile, data since 1950 shows that the S&P 500® has never experienced a negative during the 12-month period (Nov. to Nov.) following previous midterm elections, with an average return of 15.0% for the Index. See chart: S&P 500® Returns in 12-months Following Midterm Elections.

While the election headlines will be alarming, and the news on lockdowns in China and the War in Ukraine may prove troubling, recognize the importance of adhering to long-term targeted allocations. The markets may be volatile, but they often prove resilient for patient investors.

Be Well and Stay Safe!

Copyright © Comerica Wealth Management