by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Russ Koesterich, CFA, JD, Managing Director and member of the Global Allocation Team discusses the challenges facing investors before adding more equity risk.

Stocks have staged an unexpected and impressive rally the last few weeks. With a 17% advance from mid-June through mid-August, the S&P 500 has recouped more than half of its peak-to-trough decline. While I think it likely that the market has put in a bottom, it’s not obvious that stocks go straight up from here. Before chasing the rally, consider some of the near-term challenges that suggest being patient before adding more equity risk.

The Fed’s not done

Both real and nominal interest rates have plunged since the June peak. Yields on the 10-year U.S. Treasury are down more than 0.50%, with the decline coming mostly from a sharp drop in real (i.e. inflation-adjusted) rates. The drop in yields has come as investors digest softer economic data, particularly manufacturing, and some evidence that headline inflation has peaked.

Unfortunately, while inflation may have peaked it will take time for it to fall back into the Federal Reserve’s comfort zone. At the same time, parts of the economy, notably the labor market, remain resilient. All of this suggests the market may be too optimistic that the Fed will pivot and cut rates in 2023. Instead, near-term financial conditions are likely to tighten, creating a headwind for the economy and stock valuations.

Earnings likely to slow

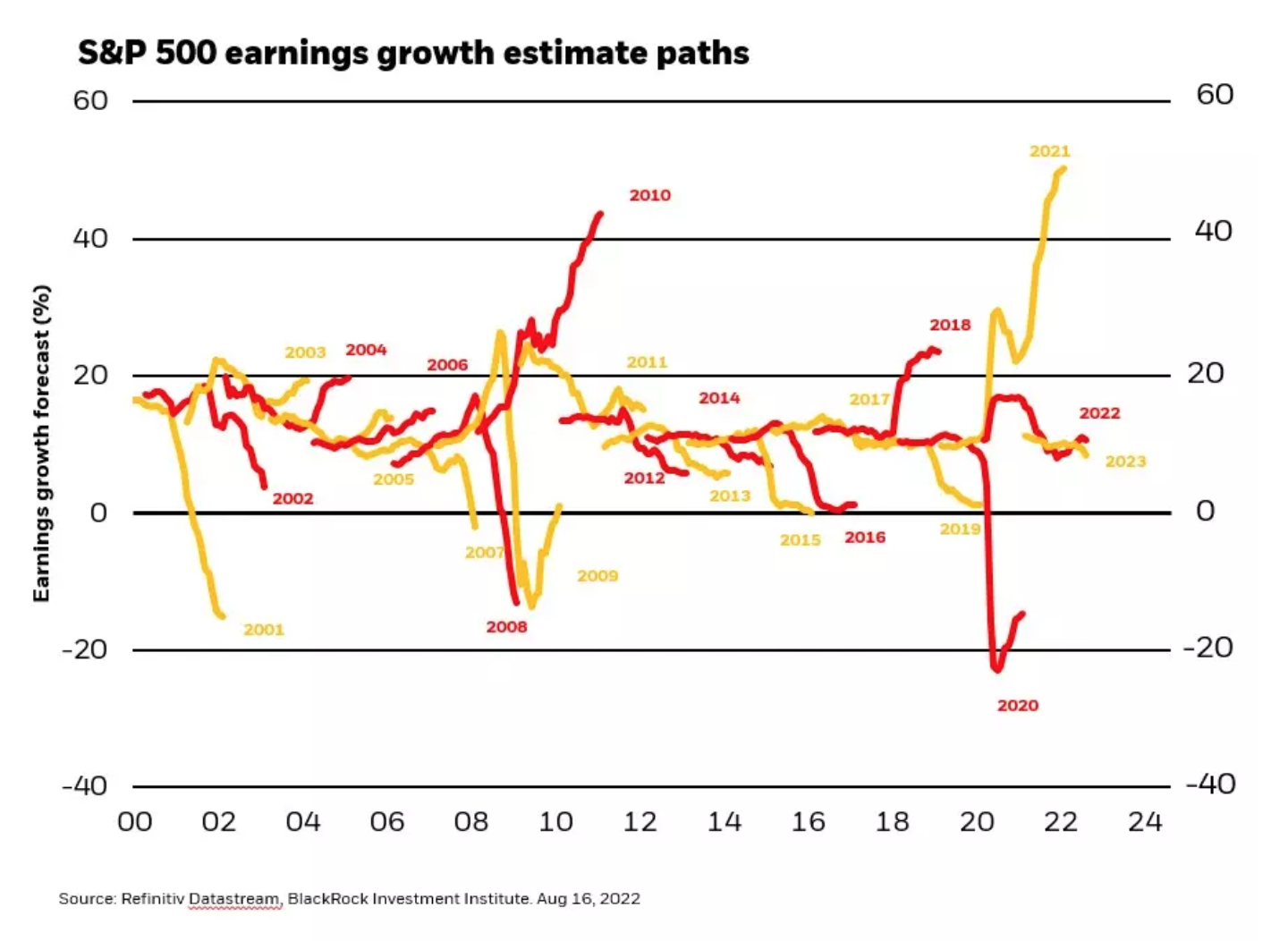

According to Bloomberg, analyst estimates still suggest nearly 12% earnings growth this year and another 7.5% for next year. These numbers appear aggressive in the context of tighter financial conditions, a sharp slowdown in manufacturing and a more circumspect consumer. Earnings estimates probably need to come down from current levels (see Chart 1).

The cruelest month

As I’ve discussed in previous blogs, investors sometimes overstate the effects of seasonality on stock market returns. But there is one exception: September. Historically, September has been the month with a distinct and statistically significant seasonal bias. Unfortunately, that bias is negative. Going back to the 1920s, September has been the most negative month of the year, a distinction that has held up in recent times. To make matters worse, the negative seasonality tends to be more pronounced when momentum is decidedly negative, as it is today. Since 1987, when the market is down at least 10% during the previous 12 months, the average monthly return in September is -6%.

Be patient and add on weakness

While I’m cautious on the near-term, I’m more constructive on the next 6-12 months. Valuations have reverted to a more reasonable level; lower gasoline prices provide some relief for consumers; and long-term rates and rate volatility have probably peaked. That said, near-term the rally may hit an air pocket. In short, don’t abandon stocks but consider waiting for a better entry point before adding more.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock