The Bottom Line

U.S. equity markets responded strongly to the downside following Federal Reserve Chairman Powell’s Jackson Hole Conference speech on Friday. The Federal Reserve vowed to continue “Quantitative Tightening” until excessive inflationary pressures have been overcome. Implication is that the Federal Reserve will continue to reduce its balance sheet and will continue to increase the Fed Fund Rate. Economists and strategist are expected the Fed Fund Rate to increase by at least 50 basis points and possibly 75 basis points at the next FOMC meeting on September 21st.

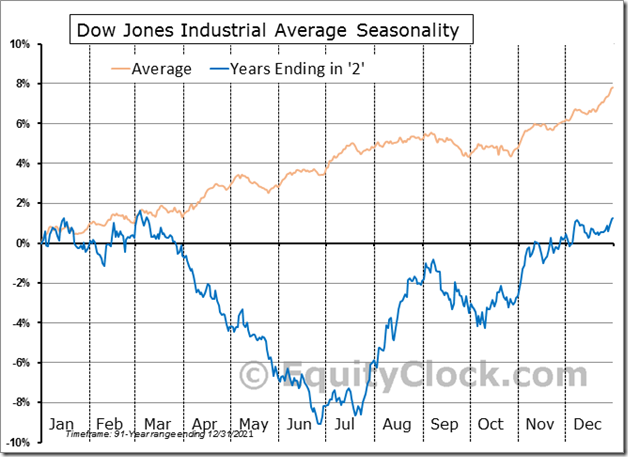

The Dow Jones Industrial Average closely is following its historic performance for years ending in “2”: Weakness occurs from January to the end of June followed by a recovery to late August followed by weakness to early October followed by an advance by the end of the year to new highs.

Note that half of the years ending in “2” were mid-term U.S. Presidential election years.

Consensus for Earnings and Revenues for S&P 500 Companies

Updates are scheduled to resume in Tech Talk on September 6th

Economic News This Week

Canadian second quarter real GDP released at 8:30 AM EDT on Wednesday is expected to grow at a 4.5% annualized rate versus a 3.1% rate in the first quarter.

August Chicago PMI released at 9:45 AM EDT on Wednesday is expected to remain at 52.1 set in July.

July Construction Spending released at 10:00 AM EDT on Thursday is expected to slip 0.1% versus a drop of 1.1% in June.

August ISM Manufacturing PMI released at 10:00 AM EDT on Thursday is expected to slip to 52.0 from 52.8 in July.

August Non-farm Payrolls released at 8:30 AM EDT on Friday is expected to drop to 285,000 from 528,000 in July. August Unemployment Rate is expected to remain unchanged from July at 3.5%. August Average Hourly Earnings are expected to increase 0.4% versus a gain of 0.5% in July. On a year-over-year basis, August Average Hourly Earnings are expected to increase 5.3% versus a gain of 5.2% in July.

July Factory Orders released at 10:00 AM EDT on Friday are expected to increase 0.2% versus a gain of 2.0% in June.

Selected Earnings News This Week

Trader’s Corner

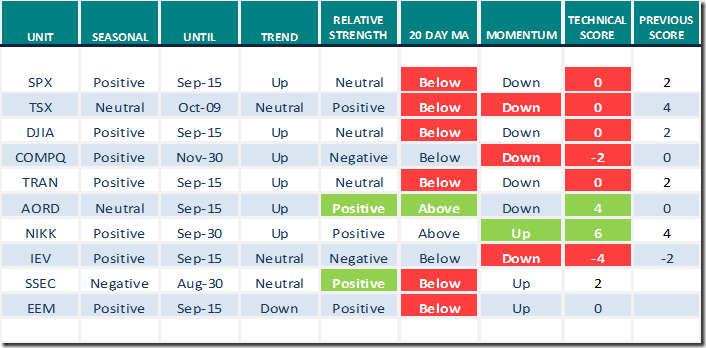

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

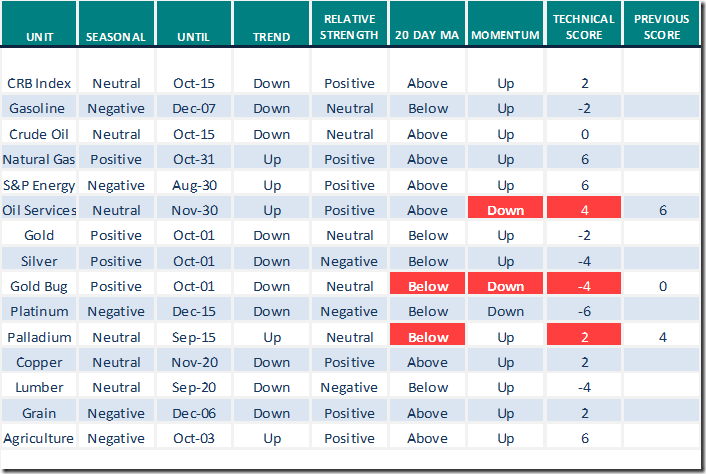

Commodities

Daily Seasonal/Technical Commodities Trends for August 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

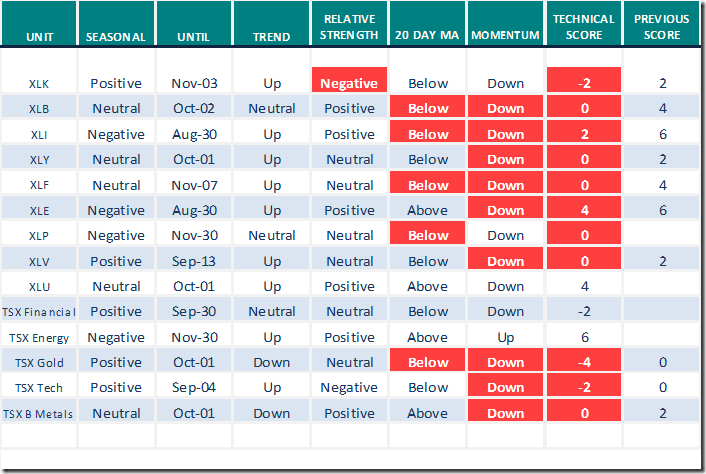

Sectors

Daily Seasonal/Technical Sector Trends for August 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

The U.S. Dollar Index closed at a 20 year closing high on Friday.

The Euro closed at a 20 year closing low on Friday.

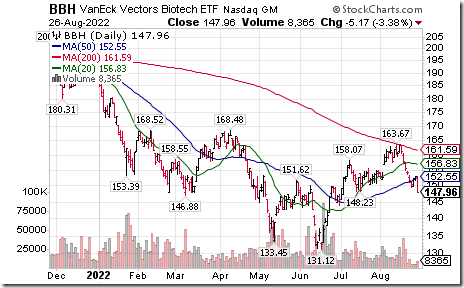

Biotech ETF $BBH moved below intermediate support at $148.23

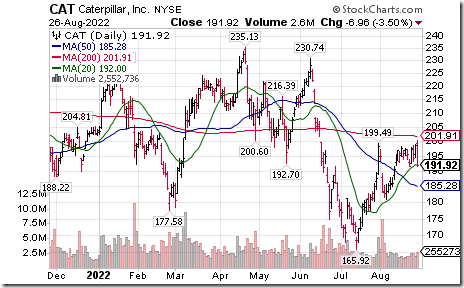

Caterpillar $CAT a Dow Jones Industrial Average stock moved above $199.49 extending an intermediate uptrend.

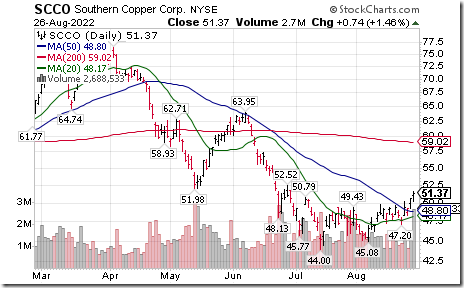

Southern Copper $SCCO, one of the world’s largest copper miners moved above $50.79 completing a reverse Head & Shoulders pattern.

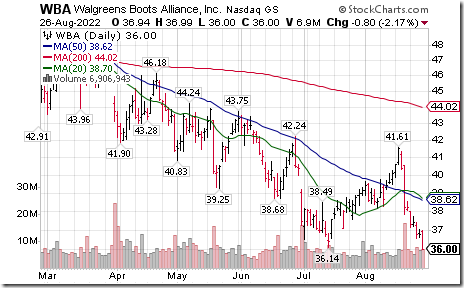

Walgreens Boots $WBA a Dow Jones Industrial Average stock moved below $36.14 extending an intermediate downtrend.

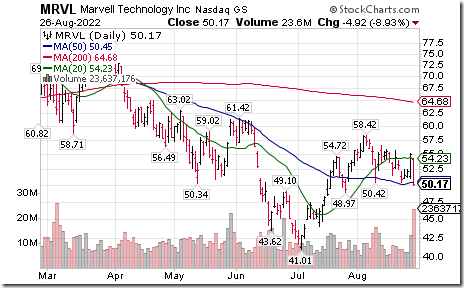

Marvell Technologies $MRVL a NASDAQ 100 stock moved below $50.42 setting an intermediate downtrend.

Open Text $OTEX.TO a TSX 60 stock moved below Cdn$45.55 and US$34.85 setting an intermediate downtrend. The company announced an acquisition valued at Cdn$6 billion that included cash and stock.

Links offered by valued providers

MarketWatch comment: The stock market in all likelihood has entered a new bull phase, so you’ll want to own these five stocks

David Keller discusses “Making sense of mass hysteria”.

Making Sense of Mass Hysteria | The Mindful Investor | StockCharts.com

Bruce Fraser says “ Stocks at a crossroad”

Stocks at a Crossroad | Wyckoff Power Charting | StockCharts.com

Tom Bowley says “Here are the two industry groups we need to watch closely”.

Mary Ellen McGonagle says “S&P 500 has broken below key level. Here’s what to watch for going forward”.

Tom McClellen says “A fishhook pattern on gold has been signalled”

A Signal Called Fishhook in Gold | Top Advisors Corner | StockCharts.com

Greg Schnell says “Technicians are betting on red”.

Technicians Are Betting On Red | The Canadian Technician | StockCharts.com

Money Talks with Michael Campbell for August 27th

August 27th Episode (mikesmoneytalks.ca)

Mark Leibovit on interest rates, gold and silver (at six minute mark)

This Week in Money – HoweStreet

Victor Adair’s Trading Desk Notes for August 27th

Trading Desk Notes For August 27, 2022 – HoweStreet

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

Strategist: Time to Raise Cash for Another Correction – Uncommon Sense Investor

The Ugliest Chart of Them All – Uncommon Sense Investor

7 Undervalued Quality Growth Stocks | Morningstar

Playing Favorites: 5 Top Stocks for Inflation | Kiplinger

Wall Street Bears Take Revenge After a $7 Trillion Rally (yahoo.com)

Technical Scoop from David Chapman and www.EnrichedInvesting.com

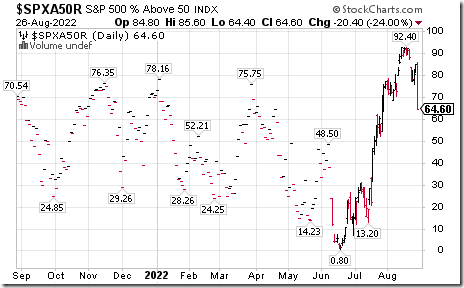

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 20.40 to 64.60 on Friday and 23.60 last week to 64.60. It remains Overbought. Trend is down.

The long term Barometer plunged 8.00 on Friday and 10.20 last week to 34.80. It changed back on Friday from Neutral to Oversold on a drop below 40.00. Trend is down.

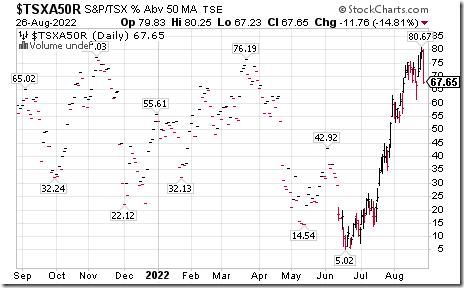

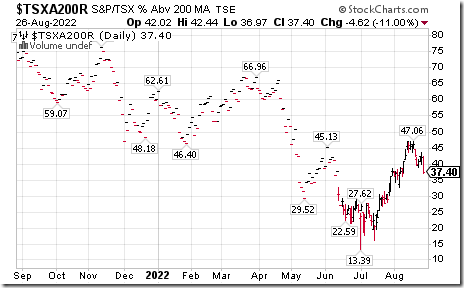

TSX Momentum Barometers

The intermediate term Barometer plunged 11.75 on Friday and 0.42 last week to 67.65. It remains Overbought and has rolled over.

The long term Barometer dropped 4.62 on Friday and 5.46 last week to 37.40. It changed on Friday from Neutral to Oversold on a move below 40.00. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed