Technical Notes yesterday

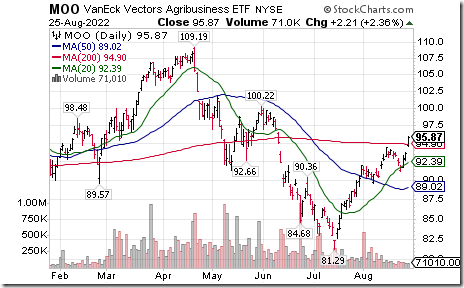

Agribusiness ETF $MOO moved above $94.47 extending an intermediate uptrend.

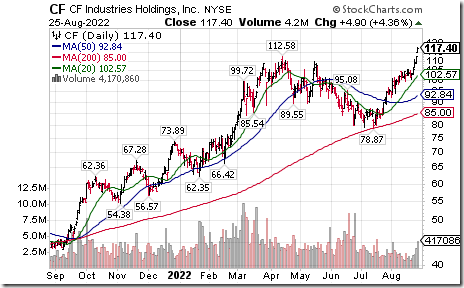

CF Industries $CF one of the world’s largest fertilizer producers moved above $112.58 to an all-time high extending an intermediate uptrend.

Chinese technology and related equities and ETFs (e.g JD.com, Baidu).moved significantly higher on news that Peoples Bank of China has taken steps to reflate the economy.

Chevron $CVX a Dow Jones Industrial Average stock moved above $163.18 resuming an intermediate uptrend.

Dollar Tree $DLTR a NASDAQ 100 stock moved below $147.77 completing a double top pattern. The company reported less than consensus second quarter results.

Bristol-Myers $BMY moved below $71.71 and $71.22 completing a Head & Shoulders pattern.

Cameco $CCO.TO a TSX 60 stock moved above intermediate resistance at Cdn$35.41.

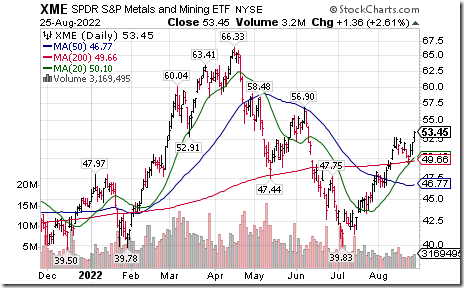

Metals and Mining SPDRs $XME moved above $52.78 extending an intermediate uptrend.

Copper Miners ETF $COPX moved above $32.36 extending an intermediate uptrend.

BMO Equal Weight Global Metals ETF $ZMT.TO moved above $49.15 extending an intermediate uptrend. Several key Canadian based base metal stocks led the advance.

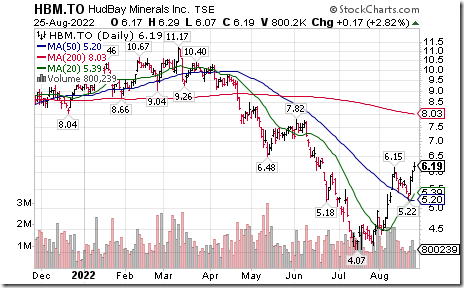

HudBay Minerals $HBM.TO moved above $6.15 extending an intermediate uptrend. The company reached an agreement to resume development.

Lundin Mining $LUN.TO moved above $7.48 completing a reverse Head & Shoulders pattern.

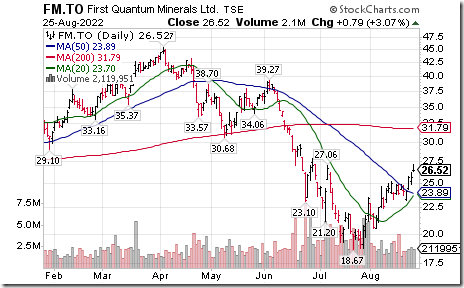

First Quantum Minerals $FM.TO moved above $27.06 extending an intermediate uptrend.

Trader’s Corner

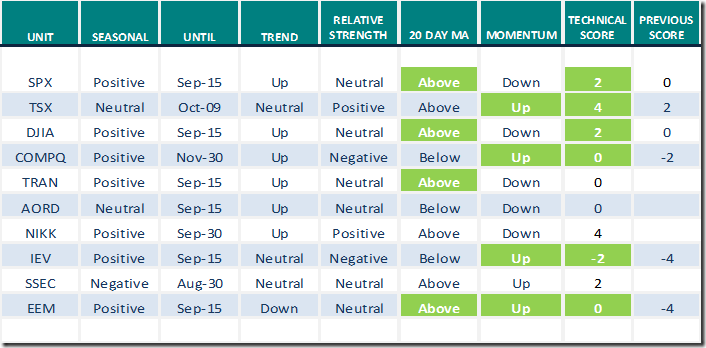

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 25th 2022

Green: Increase from previous day

Red: Decrease from previous day

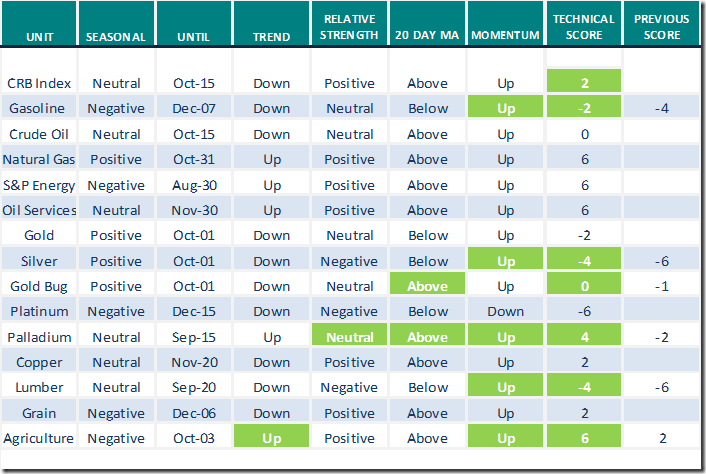

Commodities

Daily Seasonal/Technical Commodities Trends for August 25th 2022

Green: Increase from previous day

Red: Decrease from previous day

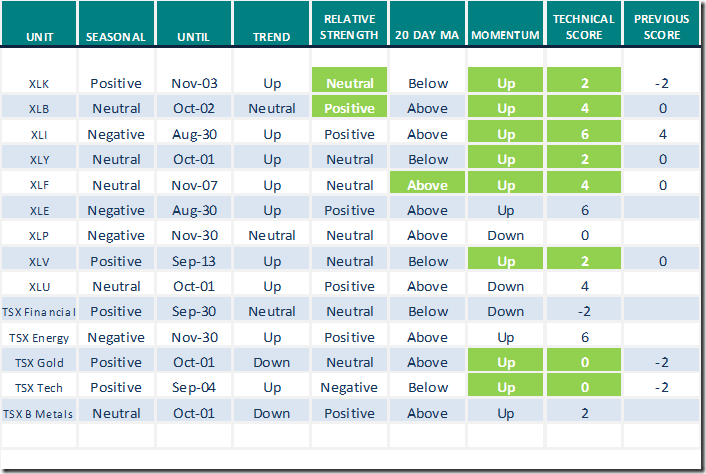

Sectors

Daily Seasonal/Technical Sector Trends for August 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Tom Bowley says “S&P 500 ready to rip higher”.

S&P 500 Ready To Rip Higher | Tom Bowley | Trading Places (08.25.22) – YouTube

David Keller and Tony Dwyer discuss “It’s all about the R word”.

It’s All About the R Word | David Keller, CMT | The Final Bar (08.25.22) – YouTube

Jeffrey Huge says “Buyer beware”!

Buyer Beware! | Jeffrey Huge, CMT | Your Daily Five (08.25.22) – YouTube

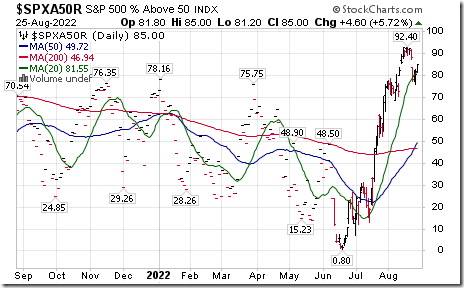

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.60 to 85.00 yesterday. It remains Overbought.

The long term Barometer added 4.00 to 42.60 yesterday. It returned to Neutral from Oversold on a move above 40.00.

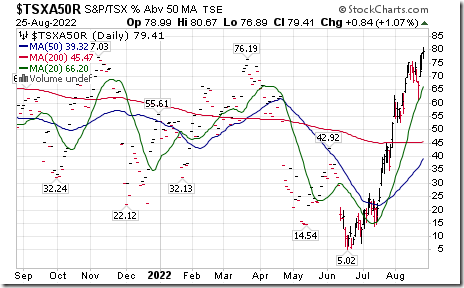

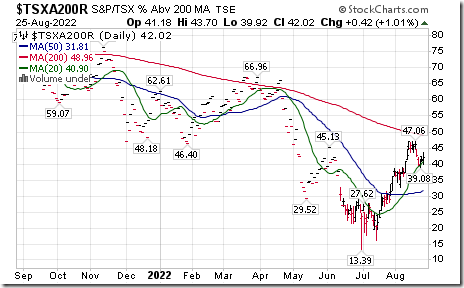

TSX Momentum Barometers

The intermediate term Barometer added 0.84 to 79.41 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 0.42 to 42.02 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed