Technical Notes for yesterday

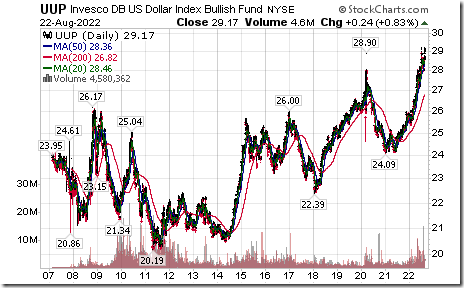

U.S. Dollar Index ETN $UUP closed at an all-time closing high at $29.17

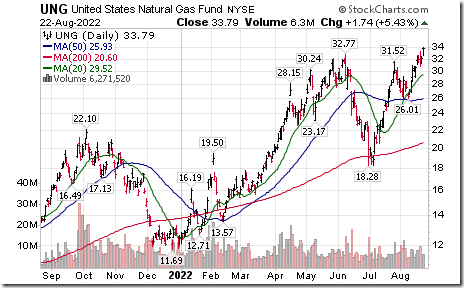

Natural Gas ETN $UNG moved above $32.77 extending an intermediate uptrend

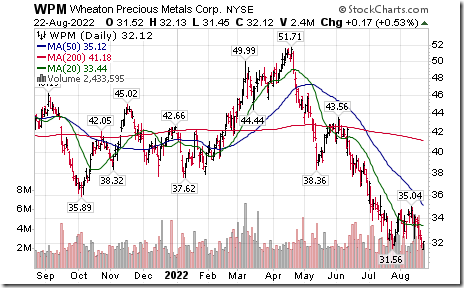

Wheaton Precious Metals $WPM a TSX 60 stock moved below US$31.56 extending an intermediate downtrend.

Match $MTCH a NASDAQ 100 stock moved below $59.15 extending an intermediate downtrend.

Berkshire Hathaway $BRK.B an S&P 100 stock moved below intermediate support at 290.42.

Trader’s Corner

Equity Indices and Related ETFs

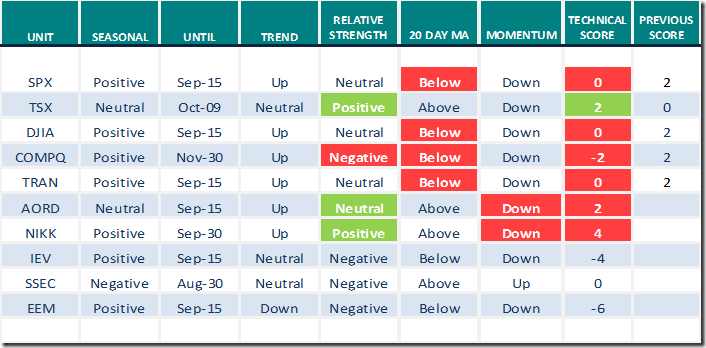

Daily Seasonal/Technical Equity Trends for August 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

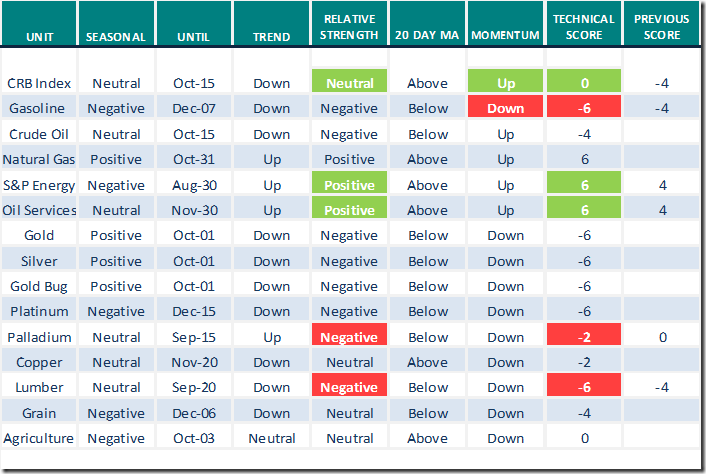

Commodities

Daily Seasonal/Technical Commodities Trends for August 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

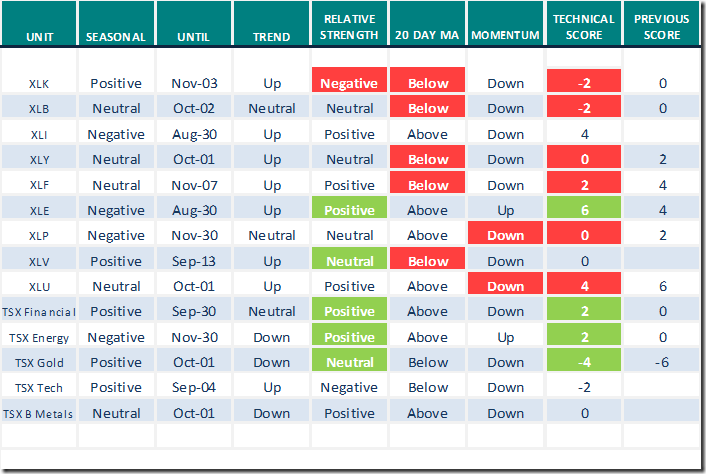

Sectors

Daily Seasonal/Technical Sector Trends for August 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by valued provider

RBC’s Calvasina: Stock rally can continue in very short term

https://www.youtube.com/watch?v=yDfFB41YLXM

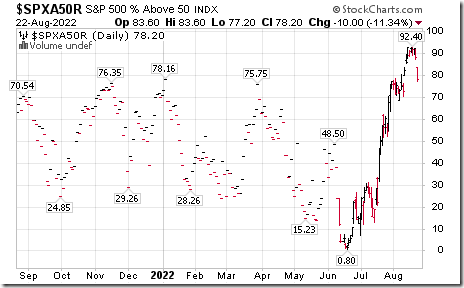

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 10.00 to 78.20 yesterday. It remains Overbought. Trend is down.

The long term Barometer dropped 7.20 to 37.80 yesterday. It changed from Neutral to Oversold after dropping below 40.00. Trend is down.

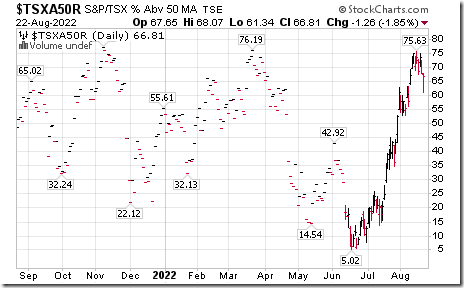

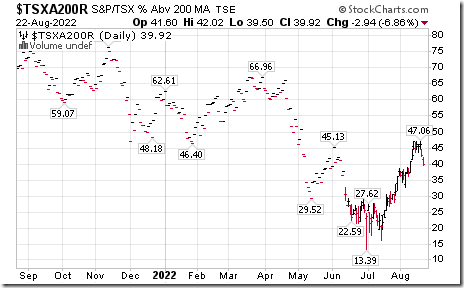

TSX Momentum Barometers

The intermediate term Barometer slipped 1.26 to 66.81 yesterday. It remains Overbought.

The long term Barometer dropped 2.94 to 39.92 yesterday. It changed from Neutral to Oversold on a drop below 40.00. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed