by Gene Podkaminer, CFA, Head of Research Franklin Templeton Investment Solutions & Chris Ratkovsky, CFA, Senior Research Analyst, Franklin Templeton Investment Solutions

Equity markets have clearly taken notice of rising inflation—and not in a good way. Here, Gene Podkaminer and Chris Ratkovsky of Franklin Templeton Investment Solutions explore how different investments have performed during various inflation scenarios, which strategies or asset classes might provide an inflation hedge, and whether a “soft landing” economic scenario is possible.

Since 1983, inflation in the United States has been relatively tame. Until recently, it hovered around 2% on an annualized basis. The effects of high inflation on the health of an economy are well understood. Unexpected inflation hurts creditors, because they are later paid back in currency that is then worth less. It is destructive to capital formation, because it makes capital suppliers (creditors) hesitant to lend money. However, the effects of inflation shocks (changes to current inflation or inflation expectations) on asset classes, rather than economies, are not as well known. Here, we focus on some of the key lessons we’ve learned from history.

The typical 60/40 portfolio

Conventional wisdom has traditionally said different things about how equities and bonds should behave in an inflationary environment—some hold to the notion that stocks should be protected from high inflation. But as we know, theory does not always hold up to reality.

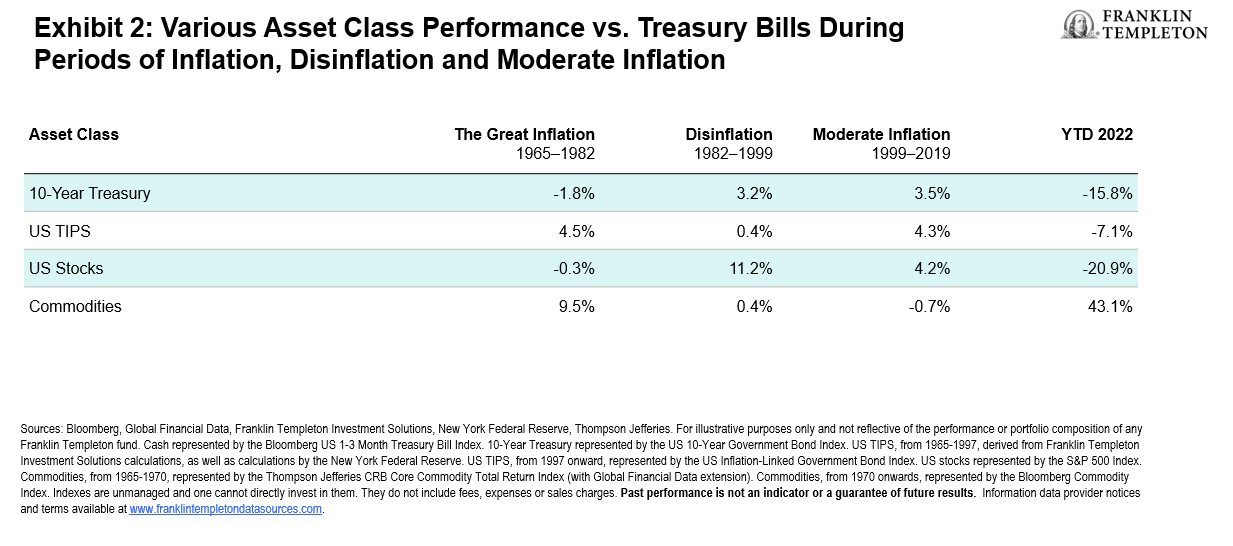

Traditionally, some academics and investors believed that the real value of a firm should have nothing to do with inflation from first economic principles, as firms are in the business of buying real assets—factories, trucks, labor contracts, patents—and selling real assets (consumer or producer goods and services). However, during the “Great Inflation” of 1965-1982, stocks did not earn their risk premia—they returned less than Treasury bills (an oft-used proxy for cash). Using economic principles, we surmise that unexpected inflation is bad for equities, at least in the short term. It causes a double whammy on equities: (1) higher nominal discount rates, and (2) the fact that companies cannot always raise selling prices fast enough to compensate for their rising wage and other costs.1

Over the long term, stocks may find some support if companies are able to make gradual adjustments to pass on higher input costs to consumers in the form of higher prices—not necessarily enough to turn large profits (thrive), but enough to survive. Eventually, economies tend to revert to a demand/supply equilibrium; soaring prices should dampen demand, which in turn normally forces prices lower. Demand then recovers. In this type of disinflationary phase, stocks could also do well, much as they did in the early-mid 1980s.

Unanticipated inflation is thought to be terrible for bond holders because the borrower pays back a debt in currency that is cheaper than originally expected. Unlike with equities, this theory has held up.

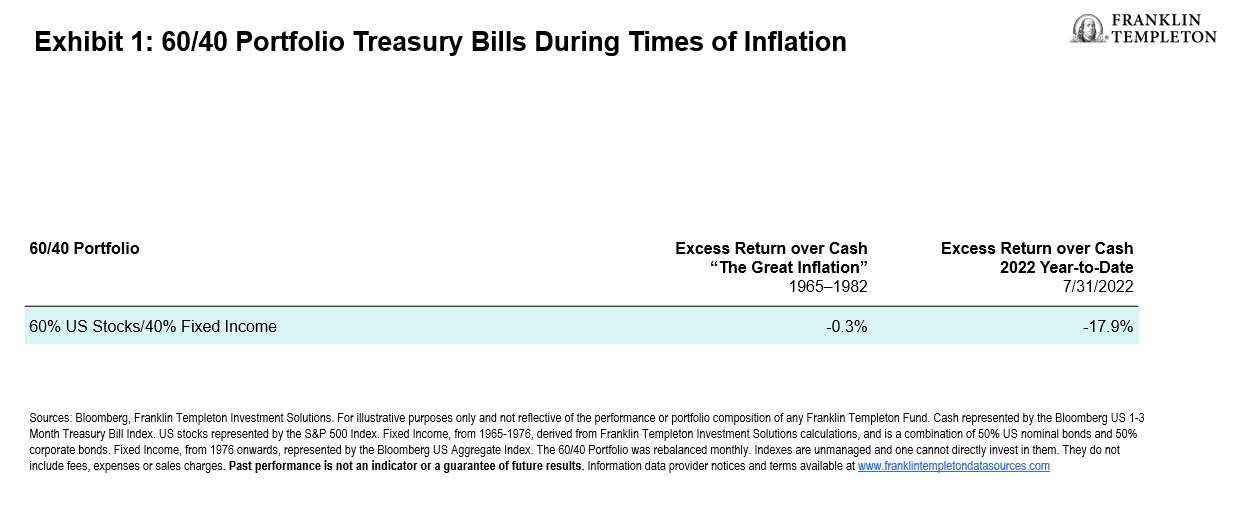

Here, we display the return of a “plain-vanilla” 60/40 portfolio consisting largely of US equities and core fixed income versus Treasury bills during the Great Inflation of 1965-1982, as well as 2022 year-to-date (YTD). The amount of equities held by households, as a percentage of their financial assets, was approximately 40%, as of December 31, 2021, close to the record high set just one quarter prior at almost 42%.2 Therefore, it is not surprising that investors are justifiably worried and are seeking out investments that could offer inflation protection.

Active portfolio management may be able to offer some protection from inflation by picking favorable stocks and bonds. These methods include adding to:

- Stocks that can more easily pass on cost increases to consumers in the form of higher prices (pricing power).

- Stocks and bonds of a foreign currency not experiencing inflation (or at least not to the degree of other markets). But this comes with its own set of risks.

- Shorter-duration bonds over longer-duration bonds, the prices of which are less impacted by rising rates.

- Laddered Treasury bills.

However, we believe the most effective way to insulate a portfolio from inflation damage is to include assets mechanically linked to rising prices. As we noted in our 2022 paper,3 assets that fall into this category are Treasury Inflation Protected Securities (TIPS), private real estate and commodities.

- TIPS: a variable rate mechanism provides automatic exposure to the Consumer Price Index.

- Private real estate: rents, thus selling prices, tend to rise with nominal incomes.

- Commodities: these are our economy’s most basic inputs of production. As an asset class, they are comprised of energy, base metals, precious metals and agriculture—everything that is used to “make stuff.”

Other key portfolio management takeaways

As we mentioned, though historically not effective short-term inflation hedges, stocks and bonds have performed remarkably well when inflation rates have fallen. Long-term investors may benefit from holding these assets even during times of high inflation, because—like trying to time market dips—timing inflection points when it comes to inflation is also exceedingly difficult.

We expect private real estate to provide a more effective inflation hedge than public stocks, at least in the short term. Many lease agreements have inflation riders built into them, automatically tying rents to inflation. And during times of economic growth, demand for rental space may be high. However, this connection to the real economy can also hamper private real estate’s effectiveness as an inflation hedge. The nuance of this give and take is beyond the scope of this note, but we would direct you to a recent paper by our Franklin Templeton colleagues at Clarion Partners, “Private Real Estate as a Hedge Against Inflation,” for more information on this topic.

We also note that publicly traded real estate investment trusts (REITS) may offer investors exposure to a specific sector, but tend to correlate closer to public equities (a less effective inflation hedge in the short term than private real estate).

Unlike the previously mentioned asset classes, commodities have experienced mixed performance during times of positive inflation and disappointed investors during periods of disinflation (just eking out excess return over Treasury bills). Regarding commodities, we note that:

- The recent long-term trend of commodity prices is volatile, and down, partially due to greater efficiency in using them, making them a risky hedge.

- Commodity futures generally outperform commodity spot prices, potentially offering a better inflation hedge.

- There is no “one size fits all” playbook for commodities and inflation, because the performance of some commodities will depend upon what is driving the inflation shock. When inflation is caused by a specific supply shock, the price of that commodity would likely soar. For example, the price of Brent crude oil has risen 23.4% year to date, yet broad industrial metals are down 9.4%, as of August 18.4

- However, if inflation is driven by strong demand, it is possible that commodities more broadly will participate in an upswing.

Nevertheless, as a whole, the volatility of the asset class most likely warrants a limited exposure for most investors, in our view.

Lastly, though low yields will not offer a strong absolute return, a portfolio of laddered T-bills offers an effective inflation hedge if consistently reinvested at new, higher rates.

Current inflation and the Federal Reserve (Fed)

The Fed is very hawkish and has noted its commitment to bringing down inflation. Raising interest rates puts downward pressure on inflation by tempering demand. As noted above, this ultimately helps the economy along toward a supply/demand equilibrium. However, the world is currently experiencing a number of supply side shortages, driven by COVID-19-related lockdowns in China, weak labor force participation and commodity disruptions due to the Russia/Ukraine war. Interest-rate levels minimally affect these issues. While a soft landing (tightening monetary conditions without inducing a recession) is possible, we think it will be very difficult to pull off. Indeed, our base-case economic outlook is that the United States will experience a shallow recession in the next 12 months.

For more details on our current economic outlook, portfolio preferences, and whether markets are pricing in a recession, please see our recent paper “Fed prayer becomes a plea.”

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Investments in infrastructure-related securities involve special risks, such as high interest costs, high leverage and increased susceptibility to adverse economic or regulatory developments affecting the sector. Alternative investments include private equity, commodities, hedge funds and property. They may be difficult to sell in a timely manner or at a reasonable price. It may be difficult to obtain reliable information about their value. The value of derivatives contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivatives, which may result in gains or losses that are greater than the original amount invested. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results. Diversification does not guarantee profit or protect against the risk of loss.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the Income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal. Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction. Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute

__________________________________________

1. Some companies may have inflation controls in the form of contracts that lock in the price of commodities (input costs) used in the course of creating products or providing services. These firms may be partially initially insulated from an inflation shock. We say “partially,” because higher prices cause pain to the consumer, who may be less willing to purchase goods and services.

2. Source: Federal Reserve Economic Data (FRED), St. Louis Fed, Households and Nonprofit Organizations; Directly and Indirectly Held Corporate Equities as a Percentage of Financial Assets; Assets, Level. Data begins Q4 1945.

3. Source: Podkaminer, E., Tollette, W. and Siegel, L. 2022. Protecting Portfolios Against Inflation. The Journal of Investing, vol. 31(3)

4. Source: Bloomberg, as of August 18, 2022. Metals represented by the Bloomberg Industrial Metals Spot Index. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.