by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Russ Koesterich, CFA, JD, Managing Director and member of the Global Allocation Team advocates a greater emphasis on portfolio income given today’s environment.

When trying to balance an asset allocation, there are times to lean into risk and times to step back. With stocks just finishing their best month in two years, many are asking whether we’ve seen the bottom; is it time to start adding back more equity risk? My take is to focus less on risk and more on income or what fund managers refer to as “carry.”

There are three reasons I would advocate a greater emphasis on portfolio income: Equities are reasonable but not cheap; earnings are vulnerable to a slowdown; and credit valuations appear the better bet.

The “P” looks better but watch the “E”

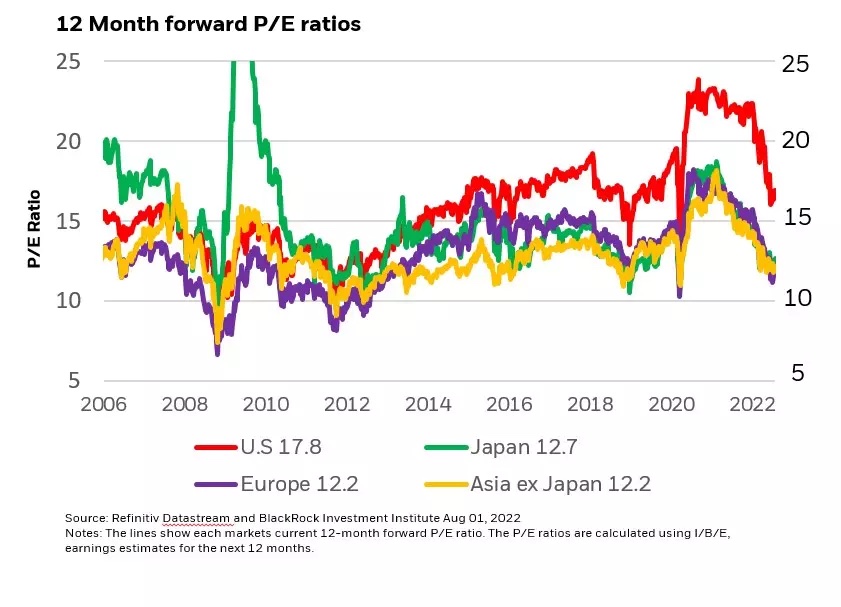

After a grinding and often brutal start to the year, equities entered June with more reasonable valuations than at the start of the year. Equity multiples are now down 20 to 30%, leaving stocks in a much more sustainable place. The forward price-to-earnings (P/E) ratio for developed markets is roughly 16, right at the 10-year average. U.S. valuations, while moderately higher at 17.8, are also in line with the 10-year average (see Chart 1).

That said, while stocks are reasonably priced, they are not cheap. Although a 16 or 17 P/E ratio looks reasonable compared to the norm of the past decade, it is less compelling when you consider multi-decade highs in inflation and the Federal Reserve’s most aggressive tightening cycle since the early 1980s.

Aside from valuations the other risk is earnings. A softer economy will mitigate inflationary pressure and may allow valuations to steady at current levels, but slower growth is not going to help earnings. Should nominal GDP (NGDP) continue to moderate, earnings are likely to slow with it.

Better positioned

The argument for adding credit is that valuations are reasonable, and we are unlikely to experience a meaningful spike in corporate defaults. Starting with spreads, the measure of a corporate bonds excess yield versus a comparable Treasury, both U.S. investment grade and high yield spreads are now above average, suggesting a reasonable entry point. At the same time spreads on emerging market hard currency debt are more than one standard deviation above average. And while a mild recession is a threat to earnings, it probably won’t be severe enough to lead to a substantial spike in corporate defaults, at least not for better rated companies.

There will likely come a point, either later this year or early next, when equities may be cheaper and/or we’re closer to the end to the Fed’s tightening cycle. That may arguably be a better time to add back substantial equity risk. For now, the likelihood of slower growth, stubborn inflation and tighter financial conditions suggests a more modest approach: a conservative allocation and income to get you through to better times.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock