by Jared Dillian, The 10th Man

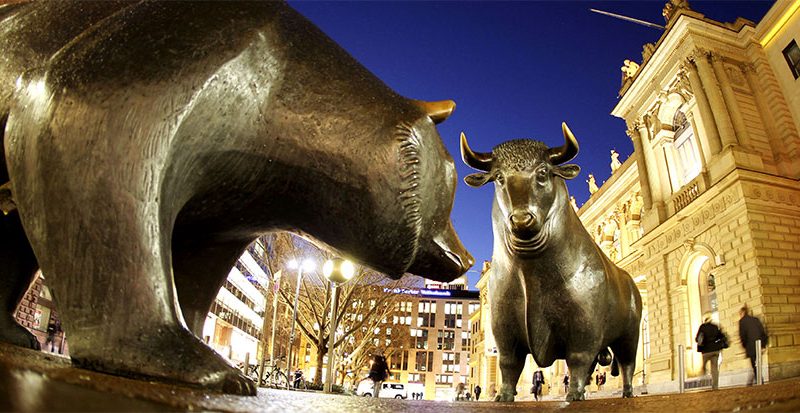

It is my belief that the bear market is over.

This is the subject of much debate. Lots of people, Michael Burry included, think speculation is returning to the stock market and that we will make a lower low one day. I’ll take the other side of that. But the easy part of the rally is over, and we’re going to have a lot of chop and flop over the next six months before we make a new high, rather than a lower low.

So, now is not a terrible time to make some strategic investments.

Why do I believe this? Because we had very bearish sentiment readings a couple of months ago. If you recall, the AAII Sentiment Survey showed that investors were even more bearish than they were in the financial crisis. As you know, I pay close attention to sentiment, and while I do think sentiment during the financial crisis was worse, it wasn’t by a lot. I can tell you that my sentiment readings got pretty low. And part of this game is to objectively examine your own feelings.

I’ll put it in layman’s terms:

- Inflation was high

- Which caused rate hike expectations to rise

- Which strengthened the dollar

- Which swung a wrecking ball across all risk assets

Now that inflation is trending downward, this process is running in reverse. I expect successive inflation readings to be a bit lower. This will make the Fed recognize progress on fighting inflation and taper off the rate hikes somewhere between 3.50% and 4% Fed funds. Of course, if you wait for that to happen, you will miss the entire trade. The market is in the process of discounting it.

At the time of writing, the S&P 500 is 17% off the lows and not too far from only being down single digits on the year. I’ll tell you something we used to say at Lehman: It is hard work being short stocks. The bears on Twitter are much quieter now. They are taking it in the shorts.

That’s another underappreciated aspect to this—hedge funds were very net short at the bottom, and they’ve been furiously short-covering. They got the trade completely wrong. I am getting my information from anecdotal reports from prime brokers passed around online. If these hedge funds want to be more successful, maybe they should pay attention to sentiment. Maybe they should subscribe to The Daily Dirtnap.

Trade Ideas

I’m pretty guarded about the trade ideas in my newsletters, but I will tell you in broad strokes what I am doing right now: I am very bullish on emerging markets. Emerging market stocks got to what I call the 6/6 zone: P/Es of 6 with 6% dividend yields. They are the cheapest stocks in the world. If you believe the dollar will decline from here, this is a no-brainer.

I think we are at the beginning of a long bull market in emerging markets. They are giving it away, and you usually want to buy when they are giving it away. You can get scientific about which fund you pick, and I recommend putting some thought into that. I would stay away from China, but beyond that, it doesn’t matter what you pick—it will work.

We haven’t heard the last of inflation. Inflation will decline, probably to about 5% or so, and stay there for a while. Then it will return in a few years since we never really addressed the root cause of inflation, which is psychology. In order to break the inflationary psychology, we need a severe recession. This recession that we’re in does not qualify as severe. The $3 trillion we pumped into the economy on the fiscal side is still sloshing around. The supply chain issues might have eased, but we did nothing about the demand side.

We just had a bear market in stocks, which is not all that common. It is pretty rare for the index to sink 20%. If you made it this far without puking, congratulations. Some people are wondering when the ARK Innovation ETF (ARKK) and the SPACs and crypto will bounce back. I would not bet on that happening. That was the last gag—time to figure out what the new gag will be. The new gag is never the same as the old gag. Outside of emerging markets, I don’t know what the new gag will be. Banks? Energy? Real estate? I have no idea. There aren’t any clear winners from the recent rally.

I have seen a few cycles in my career. If this is as bad as it gets in this one, I would say that we got off easy. And I do think this is as bad as it gets. Six months from now, we will all be amazed with the market making new highs. Nothing is ever as bad as it seems.

Jared Dillian