Technical Notes for yesterday

Financial SPDRs $XLF moved above $35.56 extending an intermediate uptrend

Healthcare SPDRs $XLV moved above $133.49 and $133.80 extending an intermediate uptrend.

Gilead $GILD a NASDAQ 100 stock moved above $64.65 extending an intermediate uptrend.

Biogen $BIIB a NASDAQ 100 stock moved above $220.20 extending an intermediate uptrend.

Abbott Labs $ABT an S&P 100 stock moved above $112.00 extending an intermediate uptrend.

Procter & Gamble $PG a Dow Jones Industrial Average stock moved above $148.01 extending an intermediate uptrend.

Berkshire Hathaway $BRK.B an S&P 100 stock moved above $302.30 extending an intermediate uptrend.

Lockheed Martin $LMT an S&P 100 stock moved above intermediate resistance at $434.96

Danaher $DHR an S&P 100 stock moved above $302.81 extending an intermediate uptrend.

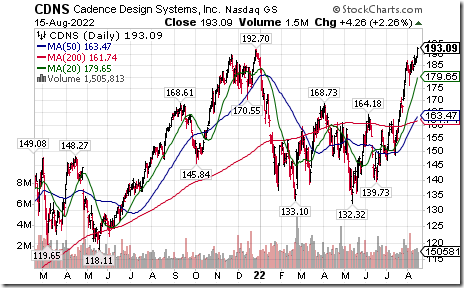

Cadence Design Systems $CDNS a NASDAQ 100 stock moved above $192.70 to an all-time high extending an intermediate uptrend.

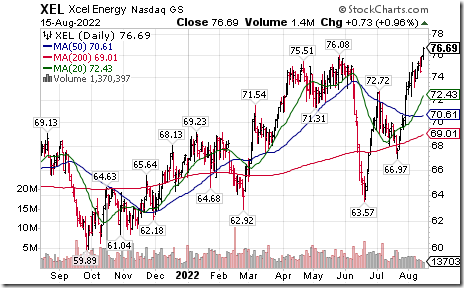

Xcel Energy $XEL a NASDAQ 100 stock moved above $76.08 to an all-time high extending an intermediate uptrend.

Horizons Medical Marijuana ETF $HMMJ.TO moved above $7.66 and $7.79 completing an intermediate base building pattern

Canopy Growth $WEED.TO a TSX 60 stock moved above $4.95 extending an intermediate uptrend.

Trader’s Corner

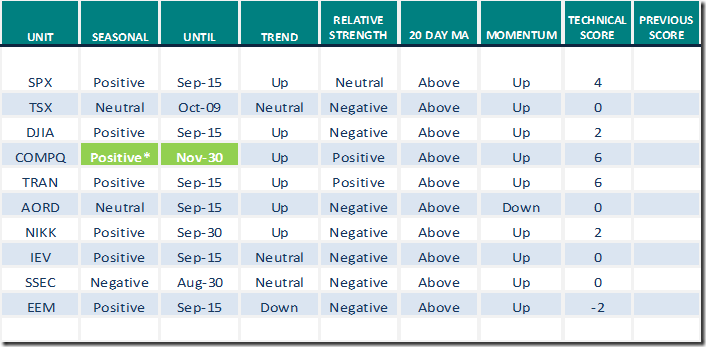

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

*Relative to the S&P 500

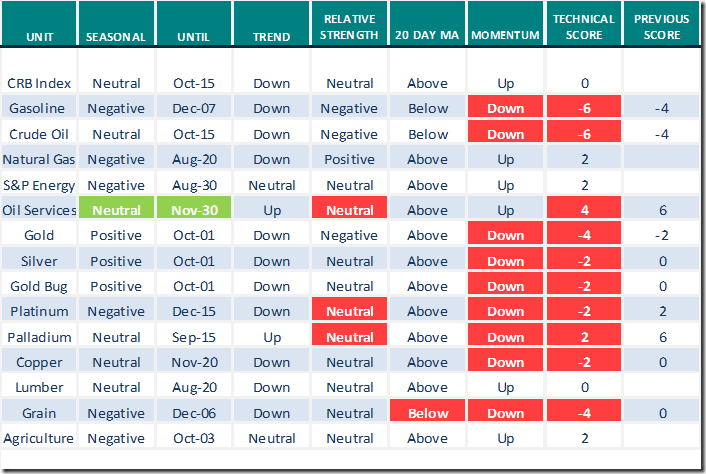

Commodities

Daily Seasonal/Technical Commodities Trends for August 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for August 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by a valued provider

Equity value through resistance, Dollar now a “No Go”: Bullish for the S&P 500

https://www.youtube.com/watch?v=r0RJo-tVCAY

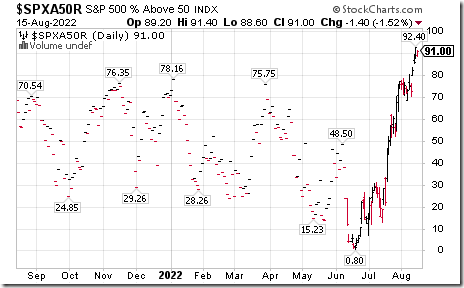

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.40 to 91.00 yesterday. It remains Overbought.

The long term Barometer added 0.80 to 48.80 yesterday. It remains Neutral.

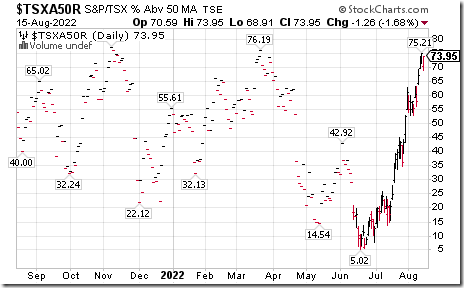

TSX Momentum Barometers

The intermediate term Barometer slipped 1.26 to 73.95% yesterday. It remains Overbought.

The long term Barometer eased 1.26 to 45.80 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed