Technical Notes for yesterday

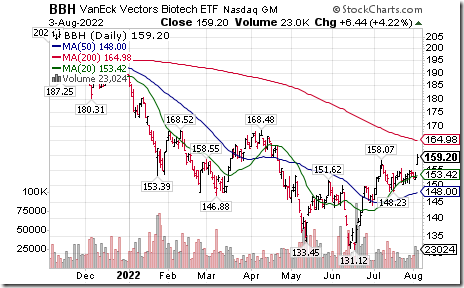

Biotech ETFs moved above intermediate resistance extending an intermediate uptrend. Van Eck Biotech ETF moved above $158.07, NASDAQ Biotech iShares moved above $127.15 and AMEX Biotech ETF moved above $144.25.

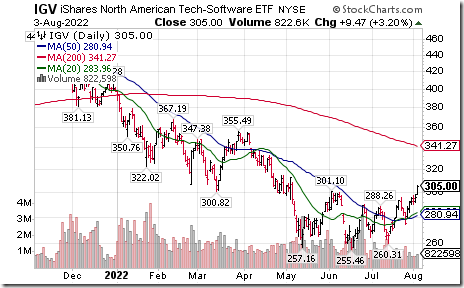

Software SPDRs $IGV moved above $301.10 completing a reverse Head & Shoulders pattern.

CVS Health $CVS an S&P 100 stock moved above $96.57 and $98.30 completing a reverse Head & Shoulders pattern.

Blackrock $BLK an S&P 100 stock moved above $687.95 completing a double bottom pattern.

NASDAQ 100 stock breakouts above intermediate resistance levels:

Lululemon $LULU moved above $312.90 completing a double bottom pattern.

Moderna $MRNA moved above $180.73 and $1.88.00 resuming an intermediate uptrend

Skyworks Solutions $SWKS moved above $110.88 extending an intermediate uptrend.

Peloton $PTON moved above $11.40 completing a reverse Head & Shoulders pattern.

Microchip Technology $MCHP moved above $73.36 extending an intermediate uptrend.

CrowdStrike $CRWD moved above $194.85 extending an intermediate uptrend.

Docusign $DOCU moved above $70.71 completing a double bottom pattern.

Match $MTCH a NASDAQ 100 stock moved below $63.33 extending an intermediate downtrend.

Shopify $SHOP.TO a TSX 60 stock moved above $52.41 and $53.01 completing a base building pattern.

Gildan Activewear $GIL.TO a TSX 60 stock moved above $37.63 and $37.78 completing a reverse Head & Shoulders pattern.

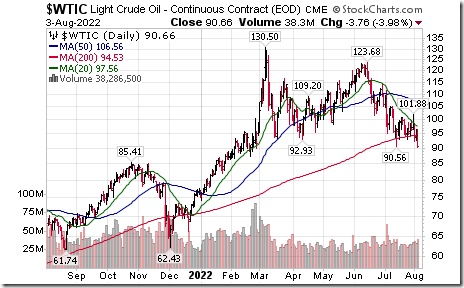

WTI Crude Oil moved below $90.56 extending an intermediate downtrend.

Trader’s Corner

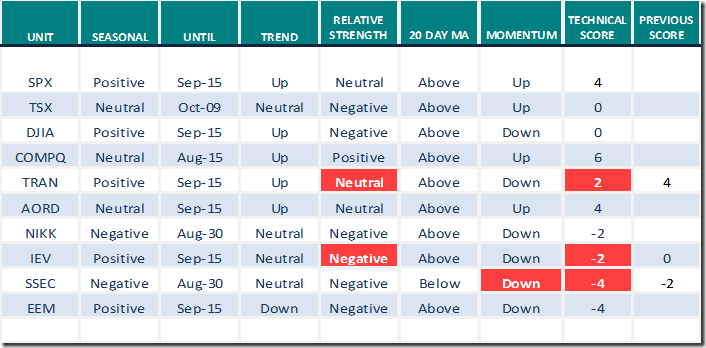

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

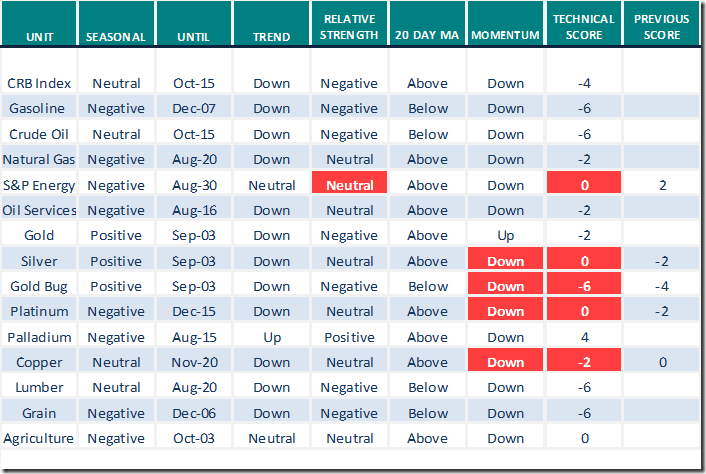

Commodities

Daily Seasonal/Technical Commodities Trends for August 3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

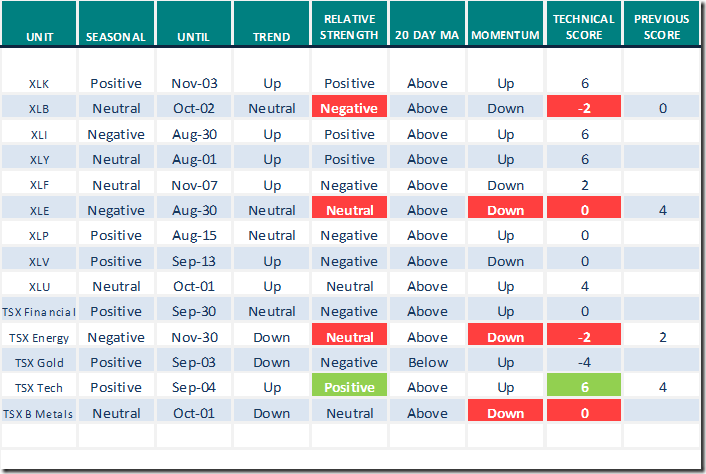

Sectors

Daily Seasonal/Technical Sector Trends for August 3rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Greg Schnell asks “More Corrective Price Action Ahead”?

More Corrective Price Action Ahead? | Greg Schnell, CMT | Market Buzz (08.03.22) – YouTube

David Keller discusses “The risk of the rising dollar”.

The Risk of a Rising Dollar | David Keller, CMT | The Final Bar (08.02.22) – YouTube

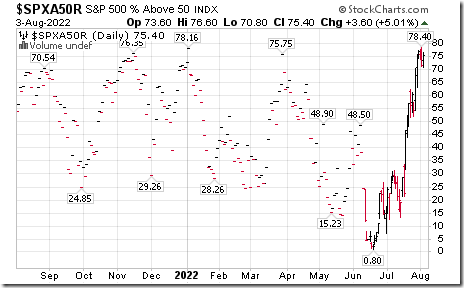

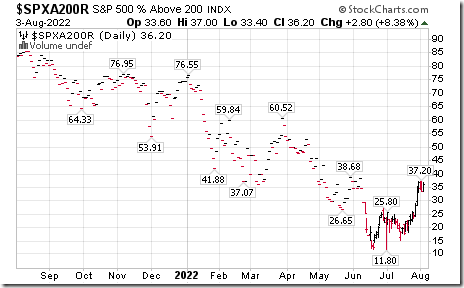

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.60 to 75.40 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 2.80 to 36.20 yesterday. It remains Oversold. Trend remains up.

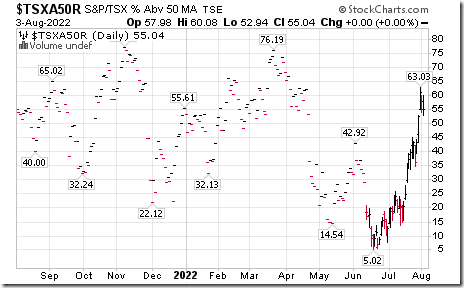

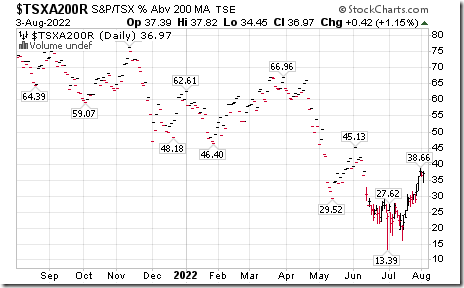

TSX Momentum Barometers

The intermediate term Barometer was unchanged at 55.04 yesterday. It remains Neutral.

The long term Barometer added 0.42 to 36.97 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed