by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Russ Koesterich, Managing Director and Portfolio Manager, of the Global Allocation team explains why investors should expand their definition of quality in today’s market environment.

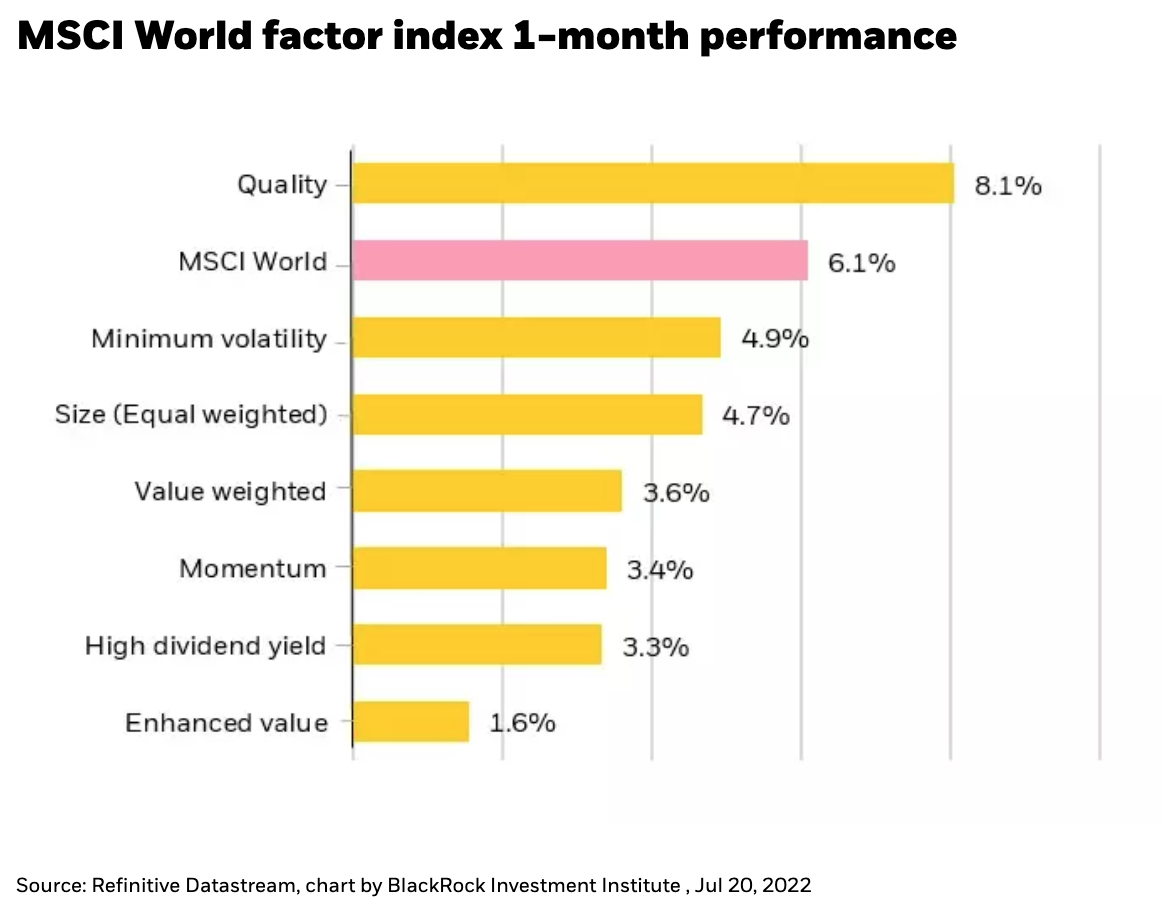

After a difficult start to the year, quality is staging a recovery. Since the equity market bottomed in June, the quality factor has been a top performer (see Chart 1). The turnaround in quality arguably reflects shifting investor concerns.

While headline inflation continues to grind higher, hitting new multi-decade highs, investors are increasingly more worried about a potential recession. Buying quality is a typical reaction to an economic downturn. As investors become more cautious, they rotate towards companies best positioned to withstand a slowdown.

This leaves the question of what constitutes a “quality” company? When describing quality, one of the more ambiguous investment styles, investors typically emphasize characteristics such as earnings consistency, profitability and manageable leverage.

Importance of pricing power today

While these characteristics are likely to be valued during the current downturn, today’s circumstances are unique. Despite a cooling economy inflation remains at a 40-year high. Stubbornly high inflation is both a drag on consumer spending and source of rising input costs. As a result, investors need to worry about both lower top-line growth and collapsing margins. Given these unique circumstances, investors should adjust their definition of quality to include another characteristic: pricing power.

To help identify companies likely to display consistent pricing power my colleagues Randy Berkowitz, Isabelle Liu and Paul de Vassal created a multi-pronged test. The key criteria are margin consistency, i.e., the ability to maintain margins throughout the economic cycle and competitive advantage, defined as better operating profits relative to peers.

In addition to the above characteristics, investors should also focus on companies with strong organic sales growth and, where applicable, increasing ticket size. Combining these different factors creates a more robust stock selection approach than focusing on any one characteristic. The approach is also equally useful in identifying names to avoid. Companies that score poorly on these metrics tend to underperform their peers.

What is this approach currently suggesting?

Focusing on consumer related companies, many of which are now facing a buyers strike after 18-months of robust demand, we found many of the best firms concentrated in certain industries: beverages, food and staples retailing and specialty retail. Another interesting result: the approach identified companies on both ends of the consumer income spectrum. In other words, both deep discounters and luxury goods manufacturers are represented. As with past slowdowns, it may be the companies in the middle, such as traditional department stores, that are most vulnerable to a consumer retrenchment.

Going forward investors will have to have to contend with sticky inflation, a slowing economy and a less ebullient consumer. As is typical in slowdowns, consistent earnings will take on a newfound importance. Companies most likely to maintain earnings with be those most likely to hold the line on prices and maintain their margins.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock