Technical Notes for Yesterday

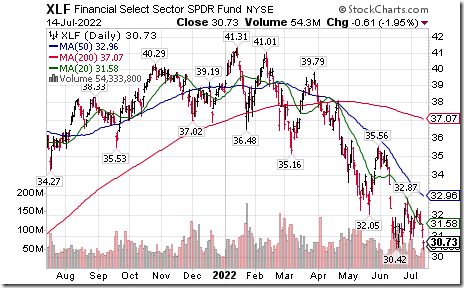

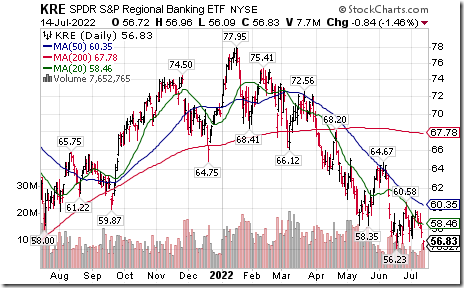

Financial ETFs were notably weaker in early trading. Financial SPDRs $XLF moved below $30.42 extending an intermediate downtrend. Regional Bank SPDRs $KRE moved below $56.23 extending an intermediate downtrend. U.S. brokers iShares $IAI moved below $80.82 extending an intermediate downtrend.

Weakness yesterday was led by U.S. financial stocks following release of less than consensus second quarter results by JP Morgan $JPM and Morgan Stanley $MS. S&P 100 Financials and Financials in the Dow Jones Industrial Average breaking intermediate support included American Express, Bank of New York Mellon, JP Morgan, Morgan Stanley, Goldman Sachs, American International Group, US Bancorp and Travelers.

Other S&P 100 and NASDAQ 100 stock moving below intermediate support included Wallgreens Boots, Emerson Electric, PACCAR, Union Pacific and Accenture.

Selected technology equities and related ETFs recorded encouraging technical patterns yesterday. Notable was strength in semiconductor equities and ETFs following release of better than consensus quarterly results from Taiwan Semiconductor, the leader in the industry. Nice move by Analog Devices $ADI above intermediate resistance at $153.16!

Dow Jones Transportation Average $TRAN moved below 12,777.25 extending an intermediate downtrend.

Emerging Markets iShares moved below $38.62 extending an intermediate downtrend.

WTI Crude Oil $WTIC moved below $92.93 setting an intermediate downtrend.

Royal Bank $RY.TO a TSX 60 stock moved below $122.36 extending an intermediate downtrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 14th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 14th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.80 to 19.00 yesterday. It remain Oversold.

The long term Barometer eased 1.60 to 18.40 yesterday. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer dropped 2.94 to 17.65 yesterday. It remains Oversold.

The long term Barometer dropped 2.10 to 20.59 yesterday. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.