by U.S. Global Investors

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.78%. The S&P 500 Stock Index rose 2.06%, while the Nasdaq Composite rose 4.56%. The Russell 2000 small capitalization index gained 2.43% this week.

- The Hang Seng Composite fell 0.54% this week; while Taiwan was down 20.61% and the KOSPI fell 21.06%.

- The 10-year Treasury bond yield rose 20 basis points to 3.084%.

Airline Sector

Strengths

- The best performing airline stock for the week was Norwegian Air Shuttle, up 8.1%. For the week, U.S. airline industry web traffic was 34% higher year-over-year versus a 24% increase last week. European carrier web traffic is up 75% year-over-year, in line with the 75% rise also seen last week.

- China domestic demand was down 49.3% year-over-year (versus down 76.6% year-over-year in May 2022), while domestic load factors improved to 68%. According to TravelSky data, China weekly volume fell 66% versus down 69% in the previous week (domestic volume was up 13.3% week-on-week to -49% versus 2019 levels, and from -54% in the previous week). Chinese airlines also marginally resumed some international flights recently.

- According to Morgan Stanley, Chinese aviation segment share prices increased by 17% on average versus 3% for HSI, led by outperformance amongst Chinese airlines (up 16%) and airports (up 23%). Positive sentiment was triggered by Hainan’s travel policy change as well as China’s recent adjustments to quarantine for inbound passengers.

Weaknesses

- The worst performing airline stock for the week was Jet2, down 12.1%. Intra-Europe net sales declined 17 points to -5% versus 2019 levels. This was partly driven by a 14% increase in the base, but also a 3% week-on-week decline. International net sales were down by 20 points to -21% versus 2019, with a 7% week-on-week decline. This led to a 19-point decrease in system-wide net sales to -17% versus 2019.

- EasyJet announced that COO Peter Bellew has resigned to “pursue other business opportunities.” Mr. Bellew has been in the role since 2019, after joining from Ryanair, and is an experienced industry executive.

- Economic concerns due to inflation and recession risks have dominated the headlines in June, driving significant underperformance this month for airlines. The group, which fell 25.3% in June, underperformed the S&P 500 by 16.9% this month. Further, after the group outperformed the market through May, airlines are now down 23.1% year-to-date compared to the S&P 500 down 20.6%.

Opportunities

- Copa Airlines’ board expanded the $100 million share buyback authorization announced on May 24 by an incremental $100 million, despite the initial program only partially executed. Moreover, Copa could reinitiate a dividend payment consistent with its pre-pandemic policy (40% of prior year adjusted income).

- Qantas Airways has again reduced its domestic capacity expectations to recover the current high cost of fuel. This has seen the company reduce its domestic capacity outlook to 102% of pre-Covid levels in the first half of 2023. On a positive note, the international recovery remains on track with capacity expected to reach 90% of pre-Covid levels by the end of fiscal year 2023. Bookings also appear to be strong with Qantas now expecting net debt to improve to A$4.0 billion as of June 30, 2022, with the company also hiring 1,000 operational staff since April to support the recovery.

- Passengers intend to fly more from 2023 and onward than they did prior to the pandemic, a new insights report by aviation IT supplier Sita shows. As recovery gathers pace, the study anticipates averages of 2.93 flights per passenger a year for business and 3.90 for leisure. When weighing whether to fly or not, the main barriers are ticket prices, health concerns and geopolitical risks.

Threats

- The reduction in summer flights has been a headwind for the airline industry. Most Canadian flights (54%) faced some disruption flying into the country’s four largest airports, according to analytics firm Data Wazo. The reductions are meant to provide a better service offering to customers and while staffing remains a challenge across all aspects of travel, Air Canada sits just shy of its pre-pandemic workforce. Other bottlenecks related to security and customs are out of the company’s control and require continued action on the part of the federal government.

- As reported by Cowen, according to the U.S. Federal Aviation Administration (FAA), the impact of the pandemic has caused the group to eliminate or reduce certain activities. On-the-job training of developmental controllers was reduced, for example, which delayed certification for candidates. The FAA tries to keep staffing ahead of airline traffic, and according to its published workforce plan, this continues to be the case. Attrition through the FAA Academy seems to be relatively high.

- British Airways announced a further reduction in its summer schedule with 10,300 flights cancelled to October, following a smaller trim earlier this week. Previously, the company cut back capacity by 10% at the first quarter results in May. This will amount to an additional 3% of British Airways capacity, taking the total to around 13% of the original schedule cancelled since May.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Poland, gaining 2.2%. The best performing country in Asia this week was India, gaining 2.5%.

- The Czech koruna was the best relative-performing currency in emerging Europe this week, losing 2.0%. The South Korean won, was the best performing currency in Asia this week, gaining 0.25%.

- Caixin China PMIs surprised to the upside in June, all crossing above the 50 mark that separates growth from contraction. Manufacturing PMI was reported at 51.7, Service PMI at 54.5, and Composite PMI at 55.3, levels last seen at the end of 2020.

Weaknesses

- The worst performing country in emerging Europe for the week was Romania, losing 1.0%. The worst performing country in Asia this week was Malaysia, losing 2.0%.

- The Russian ruble was the worst performing currency in emerging Europe this week, losing 14.1%. The Pakistani rupee, was the worst performing currency in Asia this week, losing 1.4%.

- Annual inflation in Turkey for the month of June was reported at 78.62%, beating the highest level in 24 years. Core inflation reached 57.26%. Turkey’s producer price index (PPI) increased by 138.31% on an annual basis, the Turkish Statistical Institute said on Monday.

Opportunities

- China is preparing to provide more stimulus. Bloomberg reports that the Asian nation’s ministry of finance is considering allowing local governments to sell CNY1.5T ($220 billion) in special bonds in the second half of the year as it attempts to accelerate infrastructure spending. In addition, the government may provide more tax breaks for buyers of electric vehicles.

- Alibaba shares in the U.S. are extending June’s 18% gain, the biggest since January 2019, even as American tech valuations continue to be depressed by Federal Reserve interest rate increases. Speculation that a crackdown on the tech sector may be drawing to a close is buoying bets on Alibaba, which has plenty of cash and looks cheap relative to its peers by some metrics, Bloomberg reports.

- Hong Kong has eased its travel curbs. Local authorities on Thursday suspended a system banning airline routes, which brought infected passengers into the city. The policy stated that if at least five passengers flying into Hong Jong tested positive for Covid-19 (or 5% of travelers, whichever is higher), a five-day flight ban would be implemented. This has led to many airlines staying away and to at least 100 flights being banned so far this year.

Threats

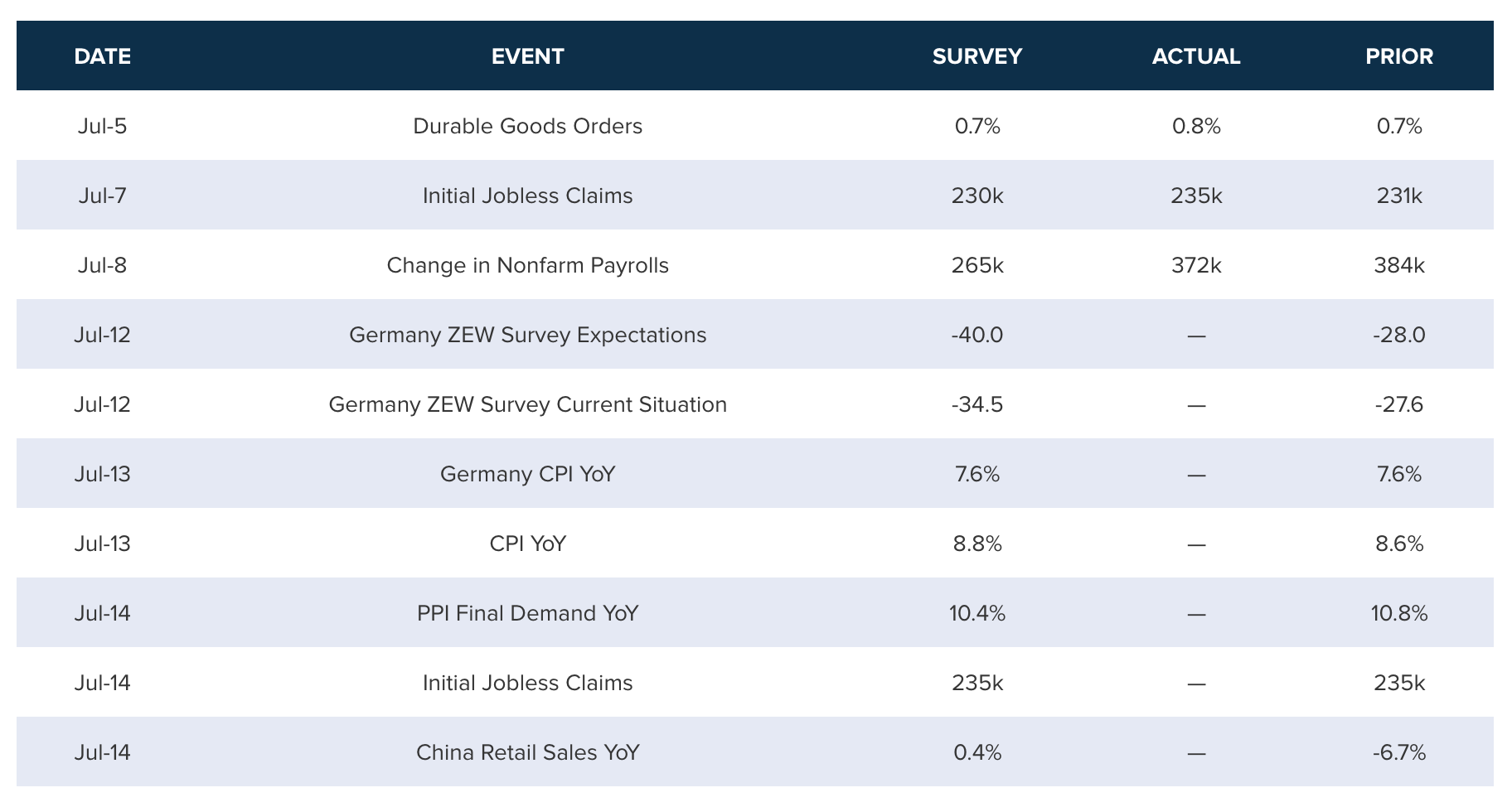

- The Eurozone ZEW Survey, that measures the direction of the economy over the next six months, may be reported weaker than anticipated next week. This comes on the back of this week’s weaker reading of the Sentix Investor Confidence Index. The ZEW data will be released on July 14.

- The flow of gas from Russia to Europe will be interrupted from July 11 to July 21, due to maintenance of the North Stream 1 pipeline. However, some observers speculate that Russia may use this as an opportunity to shut the flow of gas into the Eurozone for good. The price of gas spiked again. The European Union imports 40% of its gas from Russia and is working to diversify its gas suppliers.

- Hungary’s central bank delivered an unexpected 200-point hike to stop the sharp depreciation in the Hungarian forint. The forint dropped more than 2% against the euro on Wednesday as investors sold riskier assets amid growing concern that tighter monetary policy may tip parts of the world economy into a recession. The dollar has spiked to a level last seen in 2002, pushing emerging market currencies lower. Due to a hawkish Federal Reserve, this trend may continue. The Turkish lira is the worst performing global currency currently, down 21.5% year-to-date against the U.S. dollar.

Energy & Natural Resources

Strengths

- The best performing commodity for the week was wheat, up 5.59%, posting its first weekly advance in a month. Ivanhoe Mines Co-Chairs Robert Friedland and Yufeng Sun announced in a press release this week that the Kamoa-Kakula Mining Complex in the Democratic Republic of Congo has set a new quarterly production record in the second quarter of 2022. Kamoa-Kakula produced 87,314 tonnes of copper in concentrate in the quarter. Kamoa Copper milled approximately 1.95 million ore tonnes during the second quarter, at an average feed grade of 5.44% copper.

- Global upstream spending could increase by 22% in 2022. The war in Ukraine has accelerated the recovery, with operators pulling forward spending plans for a realigned global energy order. North American spending growth of 33% is led by privates and independents growing capex by 56% and 42%, respectively, while international growth of 18% is led by the Middle East, Asia, and Latin America.

- Shell Plc has decided to proceed with building Europe’s largest plant producing hydrogen from renewable power, reports Bloomberg, as oil majors bet the fuel could be key to cutting carbon emissions. A statement from Shell on Wednesday noted that Holland Hydrogen I will include 200 megawatts of electrolyzers, powered by a wind farm off the coast of the Netherlands.

Weaknesses

- The worst performing commodity for the week was crude palm oil, down 11.70%. The Food and Agriculture Organization of the UN reported global food prices fell for a third consecutive month, led by vegetable oil, cereals, and sugar, while dairy and meat rose. Oil demand destruction has now become more visible in certain pockets of the product slate. While global air traffic is recovering, it is lagging in non-OECD countries. There are clear headwinds to diesel demand from slowing manufacturing and trade activity. U.S. gasoline demand continues to consistently lag 2021 levels despite the post-Covid reopening.

- According to JPMorgan, with 16% of global oil capacity under sanctions, there is no cheap way to keep Russian barrels out of the market. At the onset of the Russian/Ukraine war, many oil market analysts and traders assumed that the impact of sanctions would increase over time. Russia initially struggled to find a replacement for Western consumers of its oil products and has had to shut in refining capacity. However, Russian crude oil has not only found new buyers, but waterborne flows of Russian crude are higher than they were before the Ukraine crisis.

- Copper fell to the lowest level in 17 months, with metals extending losses as global recession fears continue to dampen the demand outlook for commodities. Sentiment remains sour for industrial materials used in everything from construction to new energy vehicles. Copper, widely considered an economic bellwether, is trading solidly below $8,000 a ton, after metals posted their worst quarterly slump since the 2008 financial crisis.

Opportunities

- According to Baker Hughes, the total U.S. rig count was up 13 rigs last week with the oil rig count up 10 rigs and the gas rig count up three rigs. The U.S. Frac Spread Count was up five this week to 289, up for the third consecutive week. In the oil basins, ENLC marked the largest increase in rig count this week, up 15% to 38 rigs.

- Chile’s copper output rebounded to 480 thousand tons (kt) in May, up from 420 kt in April and the highest monthly output level seen since December 2021. The mine-by-mine breakdown is not yet available, but this brings year-to-date output to a 6.1% decline.

- According to JPMorgan, energy stocks offer the most attractive risk/reward opportunity within equities, especially after the recent sharp correction in the S&P 500 Energy and Small-Cap Energy indices. Energy is a deep value sector that is simultaneously improving on quality, growth, and income factors, according to the bank. The sector should deliver strong relative growth (with upside to current consensus estimates) and rising capital return at very cheap valuation.

Threats

- Zinc has material exposure to a slowdown/recession in Europe and the U.S. Deteriorating demand and a shift to China becoming a net zinc exporter to alleviate current tightness, could result in further price consolidation in the second half of 2022. Zinc has significant exposure to an expected slowdown in ROW construction activity versus muted construction recovery in China; constraints on discretionary spend are set to negatively impact white goods, and a sharp recovery in demand from the automobile sector may not happen.

- Currently, 5.5 million b/d of refining capacity is due to close over the 2019-2023 period. In addition, 2.2 mb/d of refinery nameplate capacity is functionally irrelevant, primarily in Venezuela, Mexico, and Nigeria. Lastly, 1mb/d of refining capacity in Russia and China remains offline, with no obvious catalyst nor incentive to restart. With oil demand normalized outside of China, refining run rates in swing refining regions are pushing to new all-time highs.

- The Chilean government announced on July 1 a new tax reform proposal, consisting of four bills. The bills raise taxes on the wealthiest 3% and increase copper mining royalties on companies that produce over 50,000 tons of copper per year. Copper mining companies that produce between 50,000 – 200,000 tons per year of fine copper will face an ad valorem tax between 1-2%. Those producing over 200,000 tons per year will face a rate between 1-4%.

Luxury Goods

Strengths

- Chinese automobile manufacturer NIO, which launched its ES8 SUV in Oslo last September, has more than doubled its electric car sales in Norway from a year ago, accounting for about 1% of its deliveries in the first half of 2022. NIO targets to build 20 battery-swapping stations by year-end and to launch the luxury ET7 sedan in the fourth quarter, followed by a more affordable ET5 model in Spring of 2023.

- London’s luxury property market is bouncing back post-lockdowns. Gucci’s former headquarters in London is up for sale for 66,000 million pounds ($66 million), making it the most expensive house currently being offered in the capital’s Mayfair district. Earlier this month, Bloomberg revealed that one of Switzerland’s richest men, Ernesto Bertarelli, bought a home in London’s Belgravia neighborhood for £92 million.

- The RealReal, an online retailer, was the best performing S&P Global Luxury stock for the week, gaining 18.83%. Although Raymond James lowered its price target from $14 to $9 for the stock, the target remains way above Friday’s closing price of $2.94.

Weaknesses

- Service PMI business activity in the U.S. continues to decline. Final June data released on Wednesday confirmed the weakening trend. Service PMI was reported at 52.7 versus 53.4 in May (although above the preliminary reading reported earlier in the month of 51.6).

- Investor confidence in the Eurozone declined, according to the Sentix Index, to -26.4 in June from -15.8 in May. The Index dropped more than expected, as most Bloomberg analysts were predicting a reading of -20.

- ResortTrust, a Japanese hotel operator, was the worst performing S&P Global Luxury stock for the week, losing 6.38%. The shares were down the most in seven weeks, and trading volume tripled.

Opportunities

- Luxury demand has remained solid in the second quarter of 2022, despite China lockdowns, Bank of America commented. The rest of the world has sequentially accelerated enough (mainly Europe and other areas of Asia) to largely compensate for China -30/40%. The bank’s luxury analyst believes that the three-year compound annual growth rate (CAGR) is unlikely to slow and will lead to broad-based revenue beats at the second quarter reporting period.

- Moncler, a well-established producer and distributor of specialty apparel clothing, was upgraded to “market perform” by RBC Capital Markets on Tuesday. Shares traded higher on the day of the new recommendation by Piral Dadhania. The current price remains below the target price of 47 euros. According to Bloomberg, 20 analysts have a “buy” recommendation on Moncler shares, while eight have a “hold” recommendation. There are no analysts recommending to “sell”.

- On July 1, China eased restrictions on international flights to the Asian nation. Passengers can now take direct flights or can transfer to China. Travelers can make multiple transfers and there is no requirement for transfer route. For transit passengers, nucleic acid tests and new health codes are required at transit points. This follows an announcement on June 30 of the reduced quarantine period to 10 days from three weeks.

Threats

- Morgan Stanley reports that Gucci raised prices globally last month by 7% versus February, specifically for its leather goods category, bringing the year-on-year increase to “a low double-digit percentage.” This is “a more significant” price hike than analysts had expected. Luxury brands will likely continue to pass on price increases.

- Barclays expects Burberry sales to be weak when the company reports quarterly data on July 15. The year-over-year sales are expected to decline by 40%, primarily on weak data coming from China. Burberry’s sales in China account for about 35%, with a higher exposure to the Asian nation relative to its peers.

- China placed 1.7 million people under lockdown in the central Anhui province, where authorities reported nearly 300 new cases of Covid on Monday. On Tuesday, a report came out that China also shut down the north-central city of 13 million residents following 18 newly reported cases of the Omicron variant. China’s Zero-Covid policy continues to prompt widespread lockdowns, ultimately impacting consumer spending habits. China is a major consumer of high-end luxury products and services.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Swirge SWG, rising 3,775.59%.

- Facebook parent company Meta is to proceed with its plans to bring digital collectibles to its users, reports CoinDesk, undeterred by the recent sharp downturn in the cryptocurrency market.

- Planetarium Labs, a Singapore-based web3 gaming technology firm, has raised $32 million in Series A funding led by Animoca Brands. Other investors in the round include Krust Universe, Korean technology giant Kakao’s investment arm, reports Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Nody NODY, down 96.87%.

- Crypto brokerage Voyager Digital has filed for chapter 11 bankruptcy protection, reports CNBC, becoming the latest casualty of chaos in digital asset markets. Voyager commenced bankruptcy proceedings in the U.S bankruptcy court for the southern districts of New York on Tuesday.

- The recent buildup in open interest for Bitcoin futures is eerily similar to that seen just before the contract began a long descent from late 2021, writes Bloomberg. This suggests the recent consolidation around the $20,000 mark could be merely a pause before another leg south.

Opportunities

- Bitcoin coasted over the $20,000 mark on Wednesday morning even as recession fears linger among investors and an institutional product to short the asset gained traction last week. Bitcoin rose 2% in the past 24 hours, reports Bloomberg, continuing a gradual recovery after last month’s sudden drop to the $17,700 level.

- Sorare is one of several companies attempting to take the idea of collectibles like baseball cards and bring them into the digital context. In May, Sorare announced a partnership with Major League Baseball in the U.S. as well as putting Serena Williams on the Board, writes Bloomberg.

- Crypto exchange Bitstamp cancelled a planned “inactivity fee,” reversing course just five days after announcing the charges. The Luxembourg-based company scuttled a plan to start charging non-U.S. users 10 euros a month on accounts that haven’t traded, deposited, withdrawn or staked assets for a year with a total balance of less than 200 euros, according to Bloomberg.

Threats

- Account holders at now-bankrupt Voyager Digital shouldn’t expect to get all their crypto back as the company reorganizes. The company’s plan to exit bankruptcy plainly states that it expects account holders to be “impaired” by the Chapter 11 process, meaning they won’t be getting back exactly what they’re owed, writes Bloomberg.

- Luxury British jeweler Graff Diamonds paid $7.5 million ransom in Bitcoin to a Russian hacking gang after it leaked data on the jeweler’s high-profile clients. Graff, that counts Middle East royalty among its client base, sued its insurer for losses over the extortion, saying that the payment should be covered under their policy, writes Bloomberg.

- Investors in the world’s biggest cryptocurrency are going into hibernation mode with on-chain activity dropping by 13% in early July from November’s highs, levels last seen in the bear phases of 2018 and 2019 (when Bitcoin was worth less than $10,000), according to Glassnode analysis. The risk-off market mood is spreading to the cryptocurrency exchanges as investors withdraw and stow their coins off-line in crypto wallets instead.

Gold Market

This week gold futures closed at $1,740.40, down $61.10 per ounce, or 3.39%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.29%. The S&P/TSX Venture Index came in off just 0.30%. The U.S. Trade-Weighted Dollar rose 1.74%.

Strengths

- The best performing precious metal for the week was palladium, up 11.01%, perhaps on new tightness in the market with the Stillwater Mine remaining offline for at least several more weeks. In May, central banks reported adding a net 35 tons to global gold reserves. This is the second consecutive month of net buying, reports the World Gold Council, having recently oscillated between monthly net purchases and sales.

- Petra Diamonds announced its final tender for the 2022 fiscal year (June year-end). The tender was $93 million, bringing fiscal year sales to $585 million, a 44% increase year-over-year. The positive surprise is driven primarily by realizations, although volumes (carats) were a little higher as well.

- Sandstorm Gold reported preliminary results for the second-quarter sales this week. The company sold 19,200 gold equivalent ounces, compared to 18,004 in the prior year’s second quarter. In addition, total revenues came in at $36 million, a record for the company, and is comprised of sales, royalties, and other income.

Weaknesses

- The worst performing precious metal for the week was gold, down 3.39%. Gold edged lower as the dollar strengthened, reports Bloomberg, on bets the deteriorating growth outlook for the euro area will lead to slower monetary tightening there than in the U.S. The greenback gained as much as 0.7% — putting pressure on gold — as the euro dropped amid weaker economic data in France. Concerns are growing about gas shortages because of cuts to supplies from Russia, with the fallout likely to restrain rate increases by the European Central Bank, the article continues.

- Exchange-traded funds (ETFs) cut 25,717 troy ounces of gold from their holdings in the last trading session, bringing this year’s net purchases to 6.17 million ounces, according to data compiled by Bloomberg. This was the fourth straight day of declines. The sales were equivalent to $46.5 million at the previous spot price. Total gold held by ETFs rose 6.3% this year to 104 million ounces, the lowest level since March 17.

- Hecla Mining has entered into an agreement with Wheaton Precious Metals Corporation to terminate its existing silver stream on Alexco Resources’ Keno Hill Silver property for $135 million, reports Zacks. Wheaton will have a 5.6% shareholding interest in Hecla’s shares after the Keno Hill silver stream deal ends.

Opportunities

- Hecla Mining and Alexco Resource Corp. announces a definitive agreement for Hecla to acquire all the outstanding common shares of Alexco that Hecla does not already own. Each outstanding common share of Alexco will be exchanged for 0.116 of a share of Hecla common stock implying consideration of $0.47 per Alexco common share and a premium of 23% based on the companies’ five-day volume weighted average price on the NYSE and NYSE American on July 1, 2022.

- According to Stifel, gold and silver have historically outperformed through the summer months, beating the S&P 500 by 1.9% and 4%, respectively on average, over the last 25 years. Stifel believes this dynamic will hold through 2022 as investors look to preserve wealth after the recent dramatic contraction in the broader equity market. Lending further support for the case for gold, a recent Bloomberg study covering the last 50 years and seven recessions, showed bullion outperformed the S&P 500 by about 50% on average in a two-year period (that included 12 months before and after the start of U.S. recessions).

- Leaders of the Economic Community of West African States (ECOWAS) on Sunday lifted economic and financial sanctions imposed on Mail, reports Reuters, after its miliary rulers proposed a 24-month transition to democracy and published a new electoral law. While gold mining activities in the country were largely unaffected by the sanctions, we believe that the removal of sanctions and the agreed election timelines should improve investor sentiment toward Mali. Producing gold mining companies in Mali include B2Gold, Barrick, Resolute Mining, and Hummingbird Resources. ECOWAS is a regional political and economic union of 15 countries located in West Africa.

Threats

- According to RBC, Argonaut Gold announced a capex update at Magino and associated financing as a tough but necessary measure to recapitalize the company in getting construction to the finish line. The current share price and depressed valuation reflect the market’s low level of confidence given successive budget overruns, which may be sustained until the project has greater visibility to completion in early-2023.

- Newmont Corp. announced an incremental 10% profit-sharing payment to the workforce at its Penasquito mine in Mexico (17% of EBITDA, 14% of NAV) that amounts to a 1-2% negative impact to both NAV and market cap.

- Emerging market bonds face a $237 billion cascade of defaults, reports Bloomberg, with Sri Lanka already stopping its payment to bond holders this year. Russia stopped in June. Now, El Salvador, Ghana, Egypt, Tunisia, and Pakistan are cited as particularly vulnerable. As history shows, the collapse of one government can create a domino effect with their traders pulling money from shaky markets. Ghana is of particular interest as it is Africa’s second-biggest cocoa and gold producer. Currently, Ghana is seeking financial assistance from the IMF for access of up to $1.5 billion to shore up its finances and win back access to the global capital markets.