by Tony DeSpirito, BlackRock Fundamental Active Equity Investment Team

Buy low, sell high. The age-old wisdom can run counter to human instinct when markets are in a tailspin. But history is instructive, and it tells us that times of pain can be ideal moments to position for future gains. As the second half begins, we see:

- Market direction driven by Fed machinations

- Need for diversification and resilience in equity portfolios

- An underappreciated opportunity in healthcare stocks

Market overview and outlook

The first five months of the year marked the worst start for the S&P 500 since 1970 ― and the sixth worst back to 1928.* While caution is warranted, we believe the equity risk premium (ERP) continues to make a case for equities.

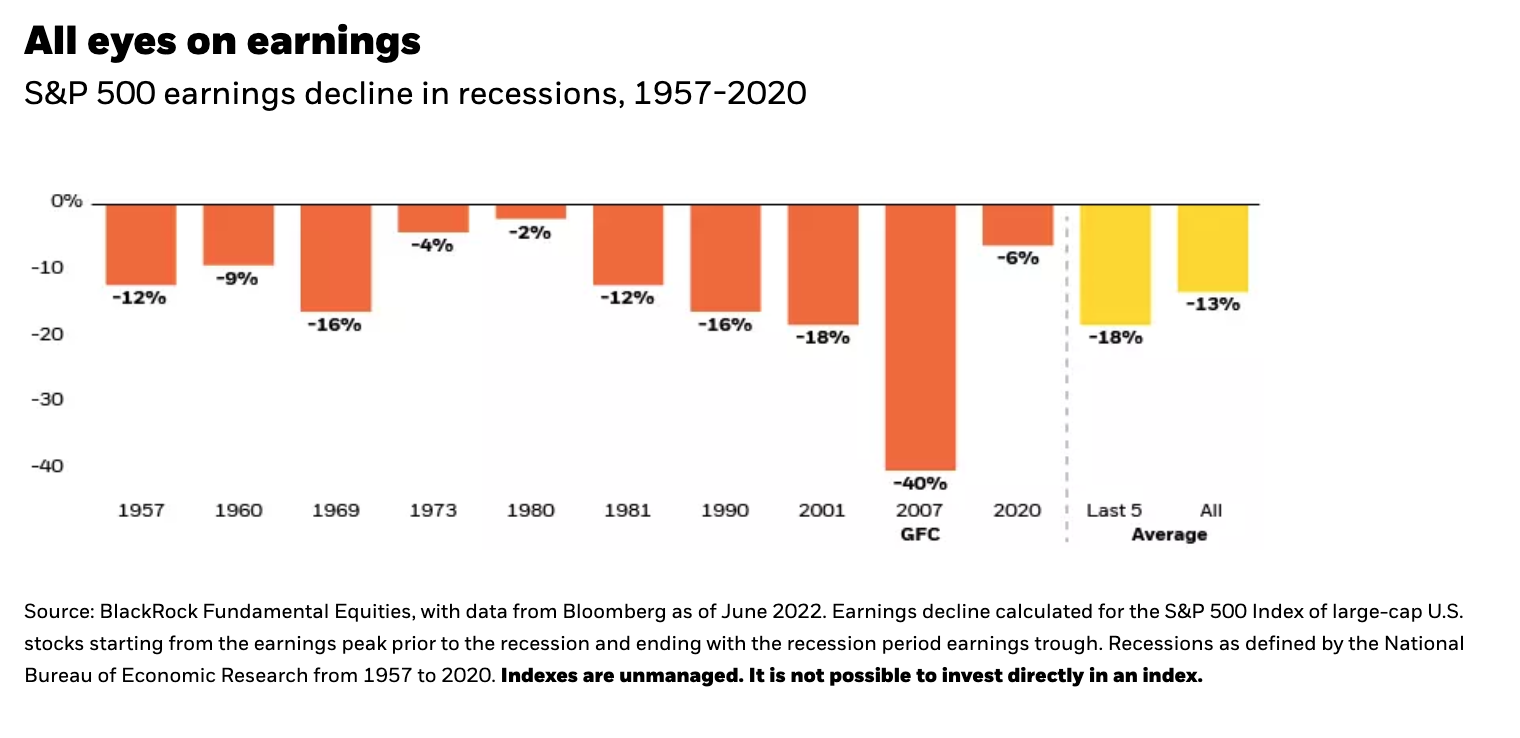

Stock valuations have come down, but company earnings remain solid. This keeps the ERP ― which compares the earnings yield on the S&P 500 to bond yields ― above its historical average. Our models suggest the 10-year Treasury yield would have to rise to 4% or earnings decline by more than 20% for the perceived “margin of safety” in stocks over bonds to disappear. Earnings will slow, but 20% is hard to imagine, even in a recession. The average earnings drop in prior recessions was 13%, with the Global Financial Crisis (GFC) skewing the results. See chart below.

Playing offense through defense

While it is important to maintain a long-term lens, particularly when investing for long-term goals, it is also prudent to protect and position portfolios for the prevailing environment ― a key advantage of active management. Today’s uncertainty argues for a focus on stability and resilience.

Waiting on the Fed

The Fed’s ability to raise interest rates and reduce its balance sheet in a way that neither inflames inflation nor stifles economic growth will have significant bearing on the market backdrop. We are not calling for a recession, but we are cognizant that the risks of a recession are rising: The Fed is tightening monetary policy, bringing an end to “easy money” policies; 30-year mortgage rates have climbed from 3% last year to nearly 6% today; inflation is beginning to erode household savings; and inventories of goods are elevated as both pandemic-induced supply shortages and voracious demand ease.

If the Fed tightens too much, the result could be a recession. If it tightens too little, inflation is the greater threat. The ideal scenario runs in the middle, allowing for a soft landing as policy transitions.

We are not placing odds on any particular outcome but are generally positioning more defensively. The optimal portfolio to combat inflation is very different from the optimal portfolio for a recession. We advocate using a barbell strategy to position for these competing outcomes. This includes owning energy and financials as inflation fighters, and healthcare for a dose of resilience. We find other traditionally defensive sectors, including utilities and staples, to be expensive relative to the broader market.

The weight of inflation

Notably, our analysis of sector dynamics during the Great Inflation period of the 1970s found energy, financials and healthcare to be the top performers. While the backdrop is different today, we do believe these three sectors could outpace the broader market once again, with financials potentially doing even better in this cycle given stronger bank balance sheets after restructuring and rigorous stress testing in the wake of the GFC.

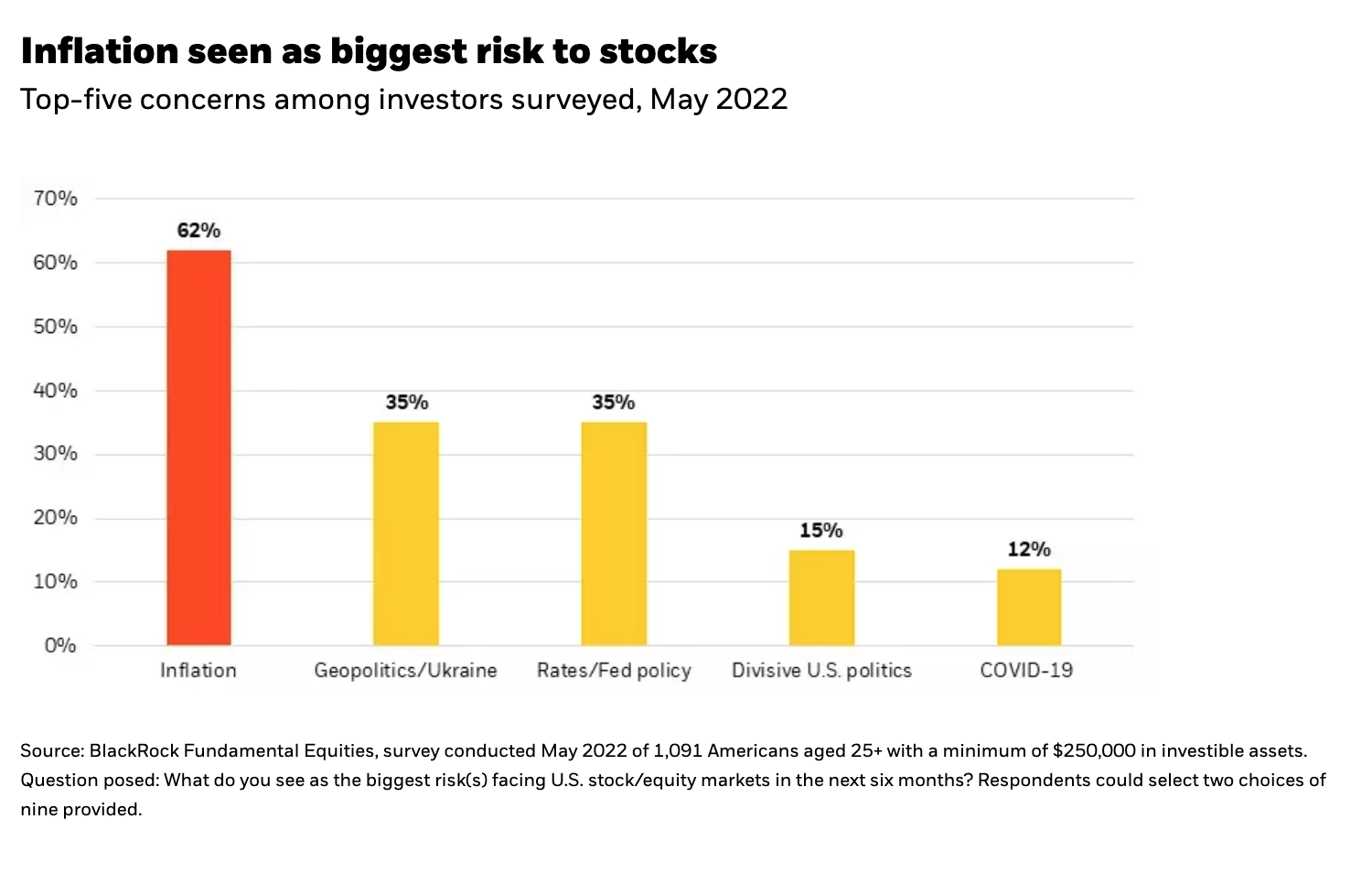

Inflation surfaced as the perceived greatest risk to equity markets over the next six months in a BlackRock Fundamental Equities survey of more than 1,000 U.S. investors. See chart below. What are Americans doing in the face of higher prices? 50% reported reducing their discretionary spending while 26% said they have made no changes.

“At times like this, the instinct may be to exit the markets. But starting points matter ― and we just got a better entry price.”

Maintaining a long-term lens

Uncertainty is high and daily volatility can test investors’ fortitude. We believe these are the moments when active, fundamental-based stock selection and thoughtful portfolio construction can provide a measure of solace and have a profound impact in the pursuit of long-term financial goals.

Copyright © Blackrock