by Jim McDonald, Chief Investment Strategist, Northern Trust

Higher interest rates to fight the inflation surge may result in modestly disappointing U.S. economic growth.

OUTLOOK

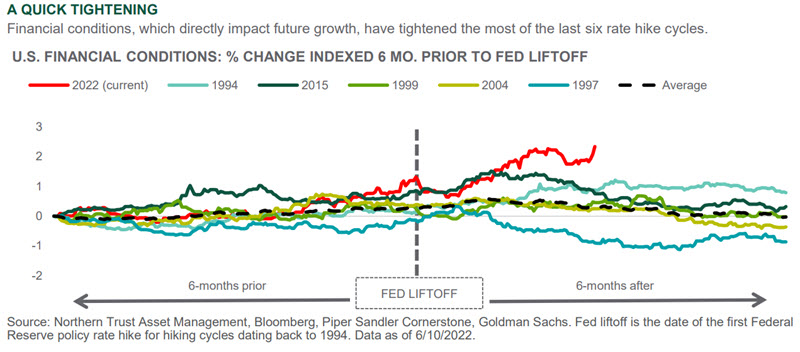

Market volatility has picked up of late as investors assess the outlook for global growth, inflation and monetary policy. The S&P 500 has failed to gain traction as the 10-year Treasury yield has moved from 2.9% to 3.2%. The root cause of the uncertainty remains the outlook for inflation, and its resulting impact on monetary policy and growth. Central bank policy is frequently described as working with a lag and major central banks are early in their hiking campaigns – but we think this understates its impact. As shown below, financial conditions – a broad measure including interest rates, credit spreads, equity valuations and exchange rates – have tightened much more than average over the prior five rate hike cycles.

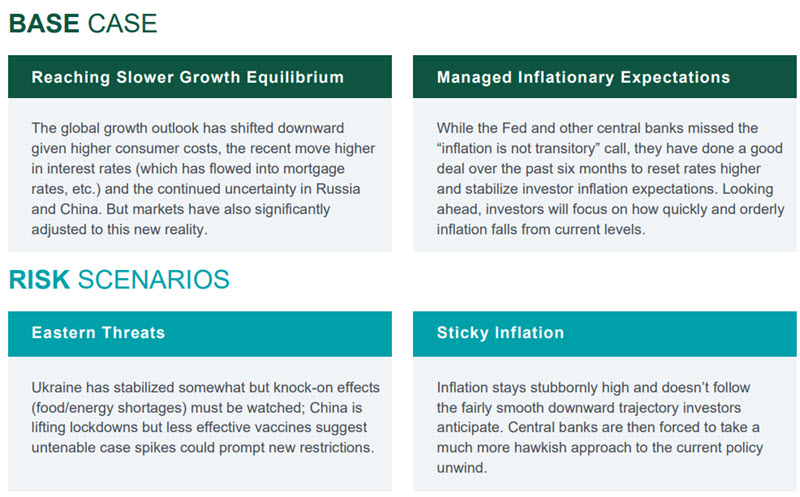

We now expect modestly disappointing growth in the U.S. over the next year – joining our cautious outlook toward European and Chinese growth – as the impact of tightening financial conditions takes hold. We have also seen the savings rate of the U.S. consumer fall to just 4.4% – the lowest level since the global financial crisis and down from 33% at the height of the pandemic. No doubt, this is a result of wage growth of just 5.2% over the last year while consumer prices have jumped 8.6%. Such a drawdown in savings will likely limit growth in consumer spending over the next year, as will financial market volatility. We do expect slowing growth to start to reduce pressure on inflation globally over the next year. But we see limited evidence of this so far, as May U.S. consumer prices exceeded estimates and European inflation of 8.1% was also above expectations. This underpins our risk case of Sticky Inflation, where stubbornly high inflation leads to more hawkish central bank policy.

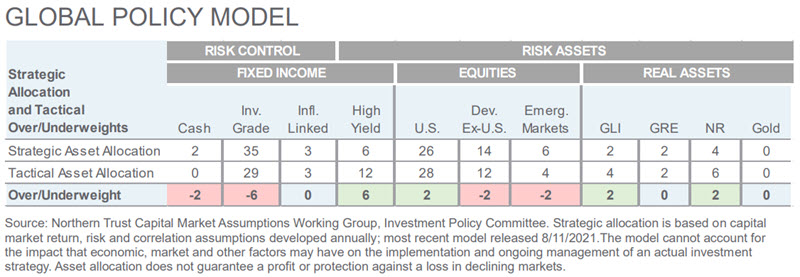

Our base case calls for slower growth globally, as inflation and higher interest rates join risks from Ukraine and the Chinese zero-COVID policy to hamper growth. We are also focused on central banks’ management of inflation expectations. In response to our more cautious outlook for U.S. growth, we made one change in our global policy model this month. We reduced our recommended allocation to U.S. equities by 2%, reinvesting in the more defensive global listed infrastructure asset class. Equity markets have adjusted significantly to higher interest rates and the more uncertain growth outlook. Looking out over the next year, we favor real assets like natural resources and global listed infrastructure which are benefiting from supply shortages and are an inflation hedge. We also continue to like high yield bonds, where we think the current yield of 7.8% is attractive as we think the market is overstating the odds of recession in 2023.

INTEREST RATES

- Markets now expect the Fed to raise rates above neutral.

- Updates on the Fed’s view of neutral will be key.

- We think rates are range-bound in this more uncertain environment.

The natural interest rate, sometimes referred to as the neutral rate or R*, is the rate consistent with growth neither surging nor stalling, full employment and stable prices. However, R* is only known in hindsight, often resulting in the Fed raising rates more than the economy can handle.

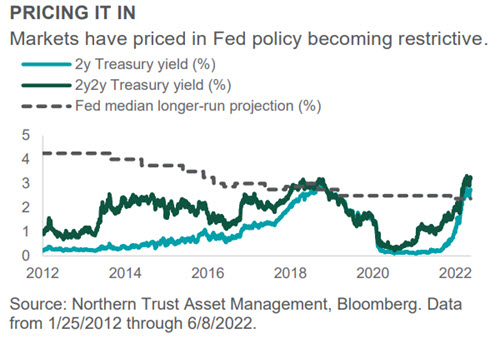

The Fed has become extremely hawkish and reiterated its desire to control inflation, even if that means hiking rates above neutral. Here, raising above neutral may very well be a policy choice. The 2-year, 2-year forward (the 2-year rate in 2 years) and the 2-year Treasury yields have risen above the Fed’s median longer-run projections. In other words, current pricing suggests that the market believes the Fed must continue to hike rates above what it considers neutral. Market participants will watch the Fed projections for any indication of how high terminal rates might be when new projections are released on June 15. Fed funds futures project a Fed funds rate of ~3.2% by year end and a terminal rate of ~3.7% (reached next year). Economic data (particularly inflation) will determine how fast the Fed hikes. The direction of longer-dated rates will depend on the direction of the neutral rate and/or recession odds. The bimodal, fatter-tailed outcome is leading to a current range-bound trading environment.

CREDIT MARKETS

- Higher quality credits rallied over the last month.

- This has left lower-quality credits looking attractive on a valuation basis as fundamentals look strong.

- We remain overweight high yield bonds as we think the market is overestimating recession risk.

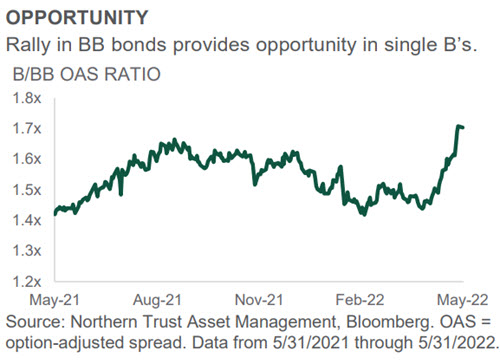

With elevated uncertainty on inflation and monetary policy, the resilience of the economy has been top of mind for high yield investors. During May, the high yield market sold off on fears that an aggressive Fed may sacrifice growth to tame inflation. Mid-month, the release of the Fed’s meeting minutes signaled that the central bank may reassess the pace of its policy tightening, causing the high yield market to rally sharply. Most of the rally was in higher quality credits while lower quality credits lagged in the rally. As a result, the ratio of B to BB spreads has widened from 1.4x to 1.7x over the course the month of May (see chart).

This is the widest that B-rated credits have traded relative to BB-rated credits in the past year and compares to a five-year average of 1.5x. This makes B-rated credits look particularly attractive on a valuation basis. Additionally, fundamentals continue to improve within the B-rated cohort with leverage declining for a fourth quarter in a row to 5.7x and default risk remains low with limited upcoming maturities and strong liquidity profiles. With BB spreads ending the month near their tightest levels relative to BBB spreads in the past year, it seems likely that a rotation into B-rated securities will occur. The next move tighter in high yield spreads is likely to come from this rotation.

EQUITIES

- Europe and emerging markets outperformed the U.S. over the last month.

- Greater value exposure outside the U.S. has helped.

- We reallocated some U.S. equity exposure to global listed infrastructure this month.

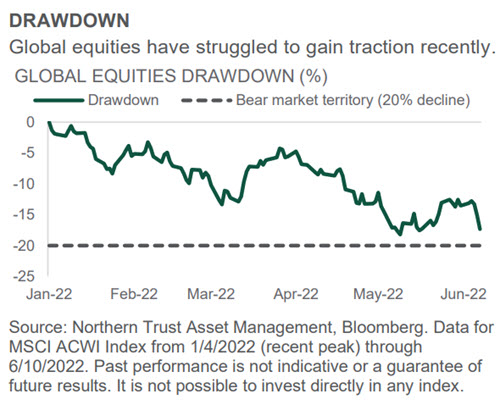

Global equities were very volatile over the past month. After flirting with bear market territory in mid-May (see chart), equity markets recovered some of the lost ground before reversing course somewhat throughout early June. Regionally, Europe, Japan and emerging market equities outperformed the U.S. In contrast to earlier this year, Europe’s return over the past month was supported by some dollar weakness, as well as the continued outperformance of value versus growth. The energy sector had another strong month, as the agreement to sanction Russian oil exports pushed up oil prices.

Looking ahead, more cautious investors have largely priced in the more immediate headwinds to growth and corporate profitability. That said, risks with respect to the war in Ukraine, Covid in China and sticky inflation across the world remain. Absent a major deterioration in the outlook, we do not foresee a recession in the U.S., however, we do expect a more challenging growth outlook given higher consumer costs and tighter Fed policy. For Europe the risk of recession is somewhat higher but not our base case. Tactically, we moderated the size of our U.S. equities overweight. We are now 2% underweight equities overall but maintain a preference for the U.S.

REAL ASSETS

- We’ve moved to an overweight position in GLI.

- GLI has shown favorable historical returns in the interest rate environment we expect.

- We retain our overweight to natural resources, which also helps deal with inflationary risks alongside GLI.

As our outlook on growth shifts lower but with inflation still uncertain, global listed infrastructure (GLI) has become more attractive and has earned a tactical overweight in our global policy model. GLI – alongside also-overweighted natural resources – can provide portfolio protection against inflationary pressures. We’ve seen historical evidence of this protection – both GLI and natural resources have outperformed broad equities during “high inflation” periods (as defined by “top quartile” inflation using data going back to 2001). And we’ve also seen contemporary evidence – in this year’s inflationary backdrop, GLI and natural resources have both provided hard-to-come-by positive returns.

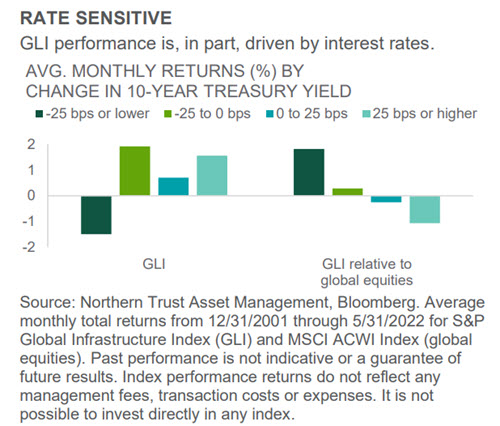

However, GLI can also provide protection against a slowing economy. Slowing economic growth often comes with slowing (sometimes reversing) interest rate increases. And GLI does best relative to broader equities during periods of falling interest rates. As seen in the chart, GLI does show absolute losses during large (0.25% or greater) falls in the 10-year U.S. Treasury yield – but outperforms global equities greatest in those periods (dark green bars). During small declines in 10-year yields (0 to 0.25%), GLI performs best, slightly outpacing equities (light green bars). We find the latter interest rate experience to be most likely.

- Jim McDonald, Chief Investment Strategist

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2022 Northern Trust Corporation.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust's current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.

Jim McDonald

Jim McDonald

Chief Investment Strategist

Jim McDonald is an executive vice president and the chief investment strategist for Northern Trust. He is responsible for overseeing the strategic and tactical asset allocation policy for our institutional and wealth management clients globally.