by Susan Hutman, Director—Investment Grade Corporate Credit Research,Will Smith, CFA, Director—US High Yield, Robert Hopper, Director—Corporate Credit and Economic Research, AllianceBernstein

Investors are shifting their focus from runaway inflation to slowing global growth as central banks hike rates to tame price pressures. Historically, creditworthiness soured quickly when growth slowed. Does that mean investors should brace for a wave of downgrades and defaults among corporate issuers? We don’t think so.

This Time Is Different (Really)

First, we don’t expect a recession. We think central banks can thread the needle to curb inflation without tipping their economies into a nosedive. Second, even in the event of a recession, we expect the corporate sector to hold up well.

Typically, a sharp slowdown or recession is bad news for corporations, which can struggle to secure cheap and adequate funding, given tighter credit conditions and slowing demand. That struggle is largely a function of a company’s creditworthiness at the start of the slowdown—that is, a company that is already overstretched will run into problems very quickly when the spigot dries up.

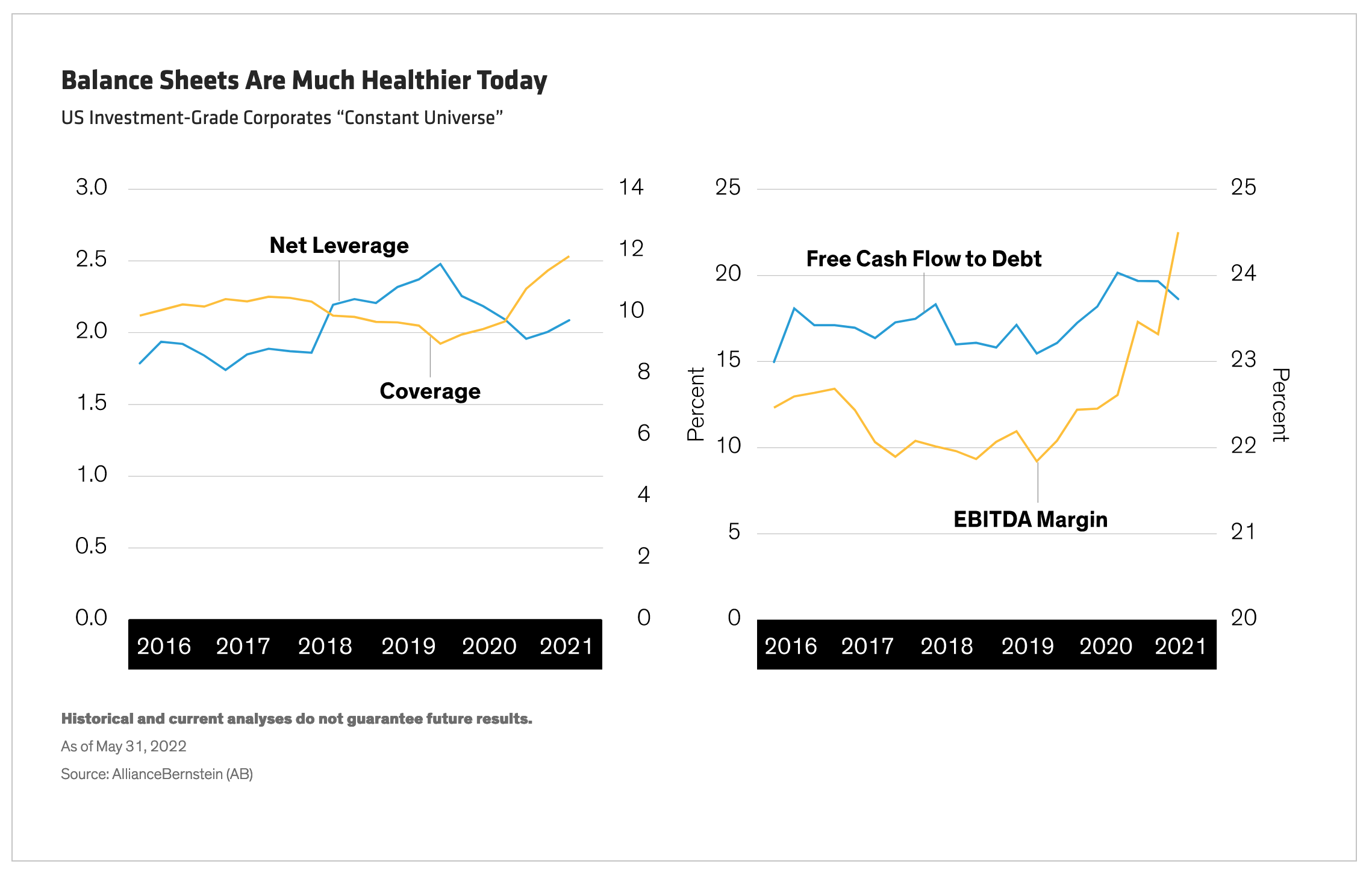

But today’s corporate bond issuers are in much better shape financially than issuers entering past recessions, thanks in part to an extended period of uncertainty surrounding the coronavirus pandemic. This uncertainty led companies to manage their balance sheets and liquidity conservatively over the past two years, even as sales and earnings recovered.

As a result, leverage and coverage ratios have improved, as have free cash flow and margins, across Europe and the US, and for high-yield and investment-grade credits. To confirm these metrics, we conducted an in-depth historical “constant universe” analysis of the US investment-grade corporate market, adjusting our issuer universe to eliminate survivorship bias, changes in composition and other distortions.

The result is a “constant universe” that shows just how much leverage has declined and coverage ratios have increased over the past 12 months, compared to the precipice of the COVID-19 pandemic in early 2020 (Display).

This relative strength in balance sheets means corporate issuers can withstand more pressure as growth and demand slow.

This relative strength in balance sheets means corporate issuers can withstand more pressure as growth and demand slow.

Defaults and Downgrades in the Rearview Mirror

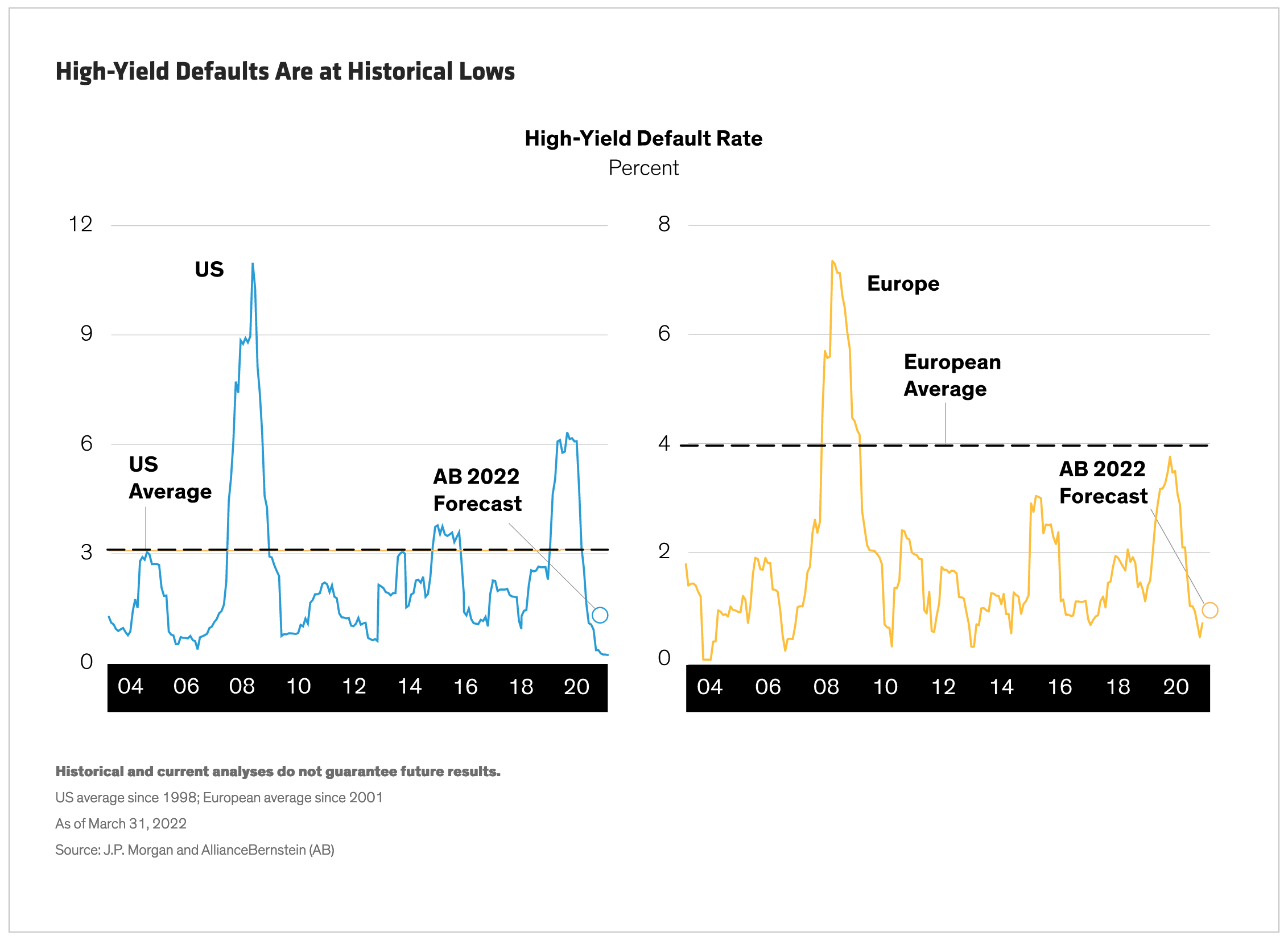

Prudent fiscal management isn’t the only reason the corporate universe is well positioned to weather a storm. The default cycle trigged by the pandemic—with defaults peaking at 6.3% in October 2020—effectively cleaned up the sector. The weakest companies at the time went ahead and defaulted and are now no longer part of the investable universe. The surviving companies were the strong ones.

That was less than two years ago, and since then, there simply hasn’t been enough time for the surviving companies to develop unhealthy financial habits. As a result, we expect the default rate to remain low for 2022—around 1% for Europe and 1% to 2% for the US—even if we tip into recession (Display).

The recent wave of defaults and downgrades also strengthened the quality of the high-yield market. At the same time that many of the lowest-rated high-yield bonds defaulted and fell out of indices, many of the lowest-rated investment-grade bonds fell into the high-yield market as fallen angels. Today, the quality of the high-yield market is the highest it’s been in more than a decade.

This is also true of many troubled industries, such as energy, retail and telecom, which got cleaned up in the last downturn and today are both higher quality and a smaller share of the market.

M&A Risk Is Muted

During expansionary periods, companies often take on more debt to fund mergers and acquisitions (M&A) or increase returns to shareholders. When the cycle turns down, they might be left with too much debt or too little liquidity, putting them at risk of ratings downgrades and defaults.

But today, companies’ appetite for borrowing to fund M&A activity is low. In fact, there’s scope for their appetite to grow without impinging on ratings.

To gauge companies’ borrowing appetite, we classify financial policies as conservative, neutral or aggressive. In our analysis, financial policy is currently conservative in half of investment-grade industries and neutral in the other half. This is also mostly true for the high-yield market, except for one industry—technology—which we classify as aggressive.

Collectively, financial policy is likely to become more aggressive over the next 12 months, but our forward credit ratings are stable for more than half of investment-grade issuers, and we expect improvements in credit profiles to outnumber deteriorations in nearly every investment-grade and high-yield industry. That represents the continuation of a recent trend: in the first quarter, ratings upgrades outnumbered downgrades 3.3 to 1.

This doesn’t preclude private-equity funds with large cash balances pursuing leveraged buyouts, but for now the favorable outlook for corporate fundamentals outweighs the risks of re-leveraging via non-strategic buyers. Further, even where we’ve seen private-equity activity, the impact on bond market metrics has been muted.

No Looming Maturity Wall

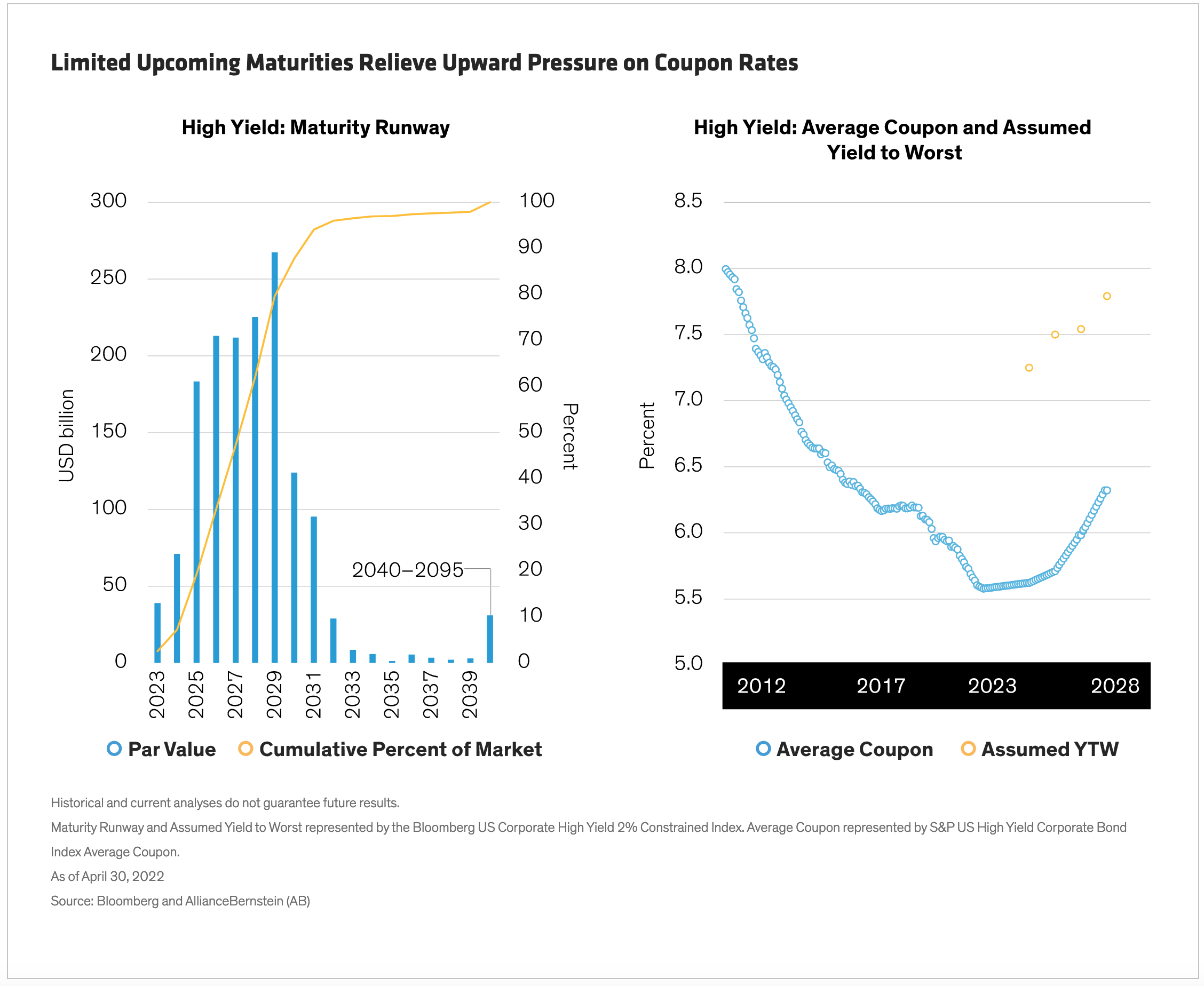

What’s more, companies have been focused on extending their maturity runways since the start of the pandemic. As a result, there’s no approaching maturity wall, where a large share of bond issues mature and issuers are compelled to procure new debt at prevailing rates. In fact, only 20% of the market will mature by the end of 2025, with the lion’s share of maturities coming between 2026 and 2029.

This is akin to opening a pressure valve as yields rise, because gradual and extended maturities will slow the impact of higher yields on companies (Display). Today, the average coupon in the high-yield market is 5.7%—significantly lower than the current yield to worst. Even if we assume that yields continue to rise and remain high for the next four years, this extended maturity runway means that coupon rates won’t return to pre-COVID levels north of 6% until January 2026.

In other words, companies will enjoy low coupons for many years to come, even if yields stay elevated for years.

Signs Point to Yes

In short, fundamentals have never been stronger heading into an economic slowdown. Balance sheets are healthy, free cash flow is expanding, profitability is up, companies are maintaining relatively conservative financial policies, and most issuers have extended their maturity runways.

At the same time, valuations are far more compelling today than just a few months ago. Yields and spreads are at multi-year highs, with investment-grade European corporate yields more than 200 basis points higher on average than in August 2021, when half the index offered negative yields. In just four months, US investment-grade corporate yields have risen from the 13th percentile to the 99th percentile when viewed over the past 10 years.

And even if yields and spreads remain volatile for the rest of the year, as we expect, history tells us that the high-yield market’s yield to worst tends to be an excellent proxy for average return over the next five years, thanks to the sector’s consistent, high income.

Lastly, many investors remain on the sidelines, having underweighted fixed income in their asset allocations for years because of exceptionally low yields. This could position corporate bonds for a technical-led rally, as strong fundamentals combined with much higher yields lure investors back.

In our view, they’d be right to jump on the bandwagon. Rarely have we seen a better time to invest in investment-grade or high-yield corporate credit.

The authors would like to thank Nicholas Stern for his invaluable contribution to this article.

About the Authors

Susan Hutman is a Senior Vice President and Director of Investment Grade Corporate Credit Research. She joined AB in 1999 and now oversees a team that provides fundamental analysis of global investment-grade credits and manages AB Fixed Income's broader CRISIL relationships, which include a group of 20 analysts based in India, China and Argentina. As IG research director, Hutman is also responsible for driving the corporate credit research outlook for the Fixed Income department and has authored several published papers on topics that include climate change effects on the energy sector, the impact of COVID-19-induced corporate borrowings on default rates and fallen angels, prospects for rising stars following COVID-19, and US inflation risks. In the past several years, she led the Fixed Income department's efforts to develop its responsible investing strategy, specifically focusing on broadening ESG integration and engagement across asset classes, while leveraging her role in the firmwide Responsible Investing Steering Committee. Hutman was named Director of Investment Grade Corporate Credit Research in 2018. Earlier in her tenure at AB, she was a fundamental credit research analyst and covered a range of consumer and commodity sectors. Before joining the firm, Hutman worked as a fixed-income salesperson at PaineWebber. She holds a BA in economics from Barnard College, Columbia University, and an MBA from Columbia Business School. Location: New York

Will Smith is a Senior Vice President and Director of US High Yield Credit. He is also a member of the High Income, Global High Yield, Limited Duration High Income, Short Duration High Yield and European High Yield portfolio-management teams. Smith designed and is one of the lead portfolio managers for AB's Multi-Sector Credit Strategy, which invests across investment-grade and high-yield credit sectors globally. He leads the monthly High Yield portfolio-construction meeting, and is a member of the Credit Research Review Committee, which determines investment policy for the firm's credit-related portfolios. Smith has authored several papers and blogs on high-yield investing, including one on the importance of using a probability-based framework to build better portfolios. He joined AB in 2012, and spent 2014 in London as part of the European High Yield portfolio-management team. Smith started his career with UBS Investment Bank, working as an analyst with the Credit Risk team and then later on the Fixed Income sales and trading desk. He holds a BA in economics from Boston College and is a CFA charterholder. Location: New York

Robert Hopper is a Senior Vice President and the Director of Corporate Credit and Economic Research. He joined AB in 2013 and now oversees the teams that provide fundamental analysis of global investment-grade, high-yield and emerging-market corporate and sovereign issuers and global economic analysis. Hopper is also responsible for driving the corporate credit research outlook for the Fixed-Income department. He sits on various internal investment committees and is the author of a number of published papers, focused on insights into corporate defaults and fallen angels during the COVID-19 pandemic, inflation risks, and rising star candidates. Earlier in his tenure at AB, Hopper was responsible for coverage of the high-yield telecom, cable, satellite and media sectors. Prior to AB, he was a managing director and head of the High-Yield and Investment-Grade Credit Analyst team at UBS Investment Bank, where he was also the senior high-yield and investment-grade telecom, media and technology analyst. Earlier in his career, Hopper served as an equity analyst at UBS and Bear Stearns. He holds a BS in accounting from Saint Michael's College and an MBA from Boston College. Location: New York