by Jim McDonald, Chief Investment Strategist, Northern Trust

One word, nine letters, two very different outlooks.

OUTLOOK

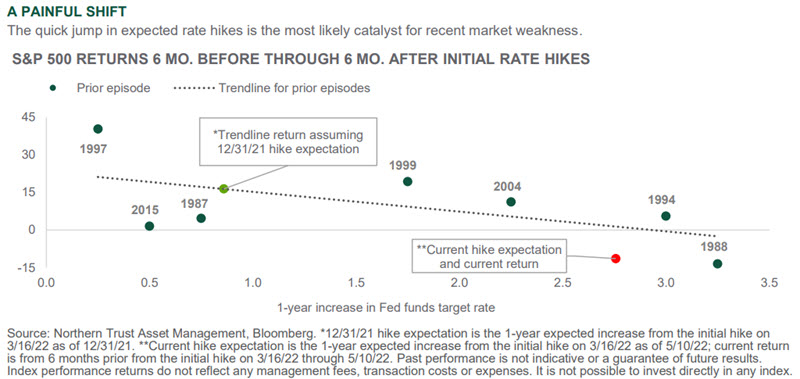

The rate angst of March bled into equities in April, and has tipped U.S. small cap stocks, the Nasdaq Index, and select international markets like the Shanghai Composite into bear market (20% decline) territory. The most speculative parts of the markets have been hit the hardest with crypto being front and center. Bitcoin and Ether fell 23% and 30%, respectively, while the “stablecoin” Terra effectively lost all of its value in just 6 days. The interest rate jumps of March moderated over the last month, however the damage has been done. History suggests that the rate hikes anticipated at the start of the year would have a benign impact, while the current pace suggests a much worse outcome (as has been experienced).

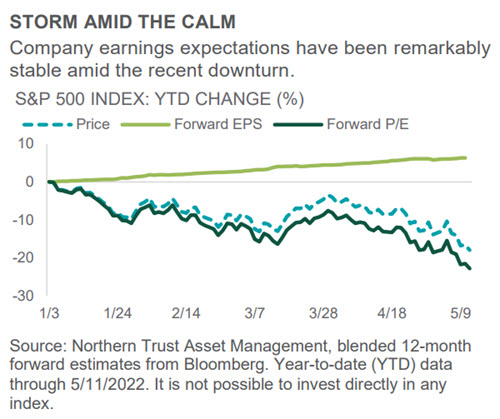

So, is the stock market signaling an impending recession, or is this more of an adjustment to higher rates and slower growth? Credit markets are evidencing greater concern, with both investment grade and high yield spreads increasing significantly over the last month. The jump in April consumer prices was higher than expected, and the 65% increase in 30-year mortgage interest costs and 36% increase in gasoline prices are material growth headwinds. The Dollar surged 5% over the last month and is up 16% over the last year. While this should help limit imported inflation, it will also likely hinder export growth. The yield curve is still positively sloped, however, with the 2’s-10’s curve at 0.33% and the Fed Funds to 10-year curve a robust 2.00%. We have come through 1st quarter earnings in good form in the U.S., and forward estimates have edged up. This means the decline in stock prices has all been driven by a drop in valuation – a long-term positive.

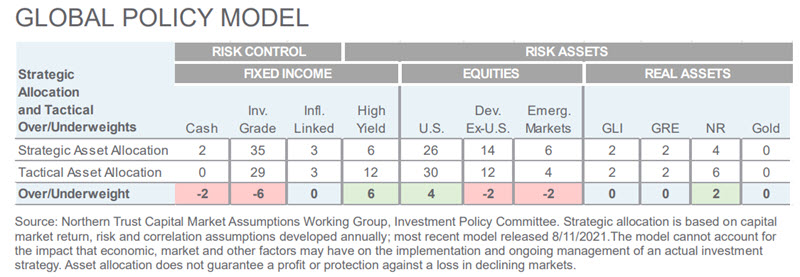

The global economic outlook changed meaningfully when Russia invaded Ukraine in late February, hurting growth prospects while increasing inflationary pressures. Our base case of Navigating Economic Shocks encompasses this environment, alongside the negative impact of China’s zero-COVID policy. Much of the market concern centers around how far the Fed should go with rates, which captures our A Relentless Fed risk case. Economic Degradation is our other risk case, reflecting the potential of weakness outside of the U.S., alongside higher interest rates, to derail the U.S. expansion. We made no changes in our Global Policy Model this month, where we are neutral on equities – and tilted toward the U.S. We also continue to favor natural resources (commodities) which are benefitting from tight supplies and inflationary concerns. Finally, we think the increase in credit spreads presents an attractive risk/return for high yield bonds, especially when compared with equities.

INTEREST RATES

- Monetary policy uncertainty has led to interest rate uncertainty – especially on shorter-term rates.

- Somewhat dried-up liquidity has further exacerbated the daily interest rate moves.

- We believe volatility will subside as investors gain comfort with the Fed’s rate hike trajectory.

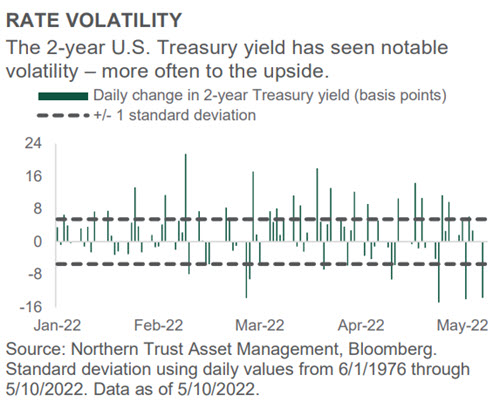

Year-to-date, the 2-year U.S. Treasury (UST) yield has increased by ~2% – and it has done so at historical speeds and with above average volatility. While highly sensitive to Fed policy, poor liquidity and forced buying/selling by highly levered investors have begun to distort fundamental moves in yields. Measured by market depth, liquidity across the curve is approaching levels not seen since the depths of the pandemic. Liquidity itself is not a core driver of yield moves, but it can exacerbate overall volatility.

As the Fed has turned markedly more hawkish, the market has repriced short-end yields. As an example of the above-mentioned volatility, the 2-year UST yield has repeatedly experienced daily yield changes outside of its longer-term standard deviation band. In fact, it has breached the +/- one-standard-deviation band 39% of the trading days this year. To further explain current conditions, we can turn to “swaptions”, which are market proxy for interest rate volatility. One-month two-year swaptions are trading at levels not seen since the Global Financial Crisis. The move in yields has reverberated across nearly all fixed income assets. We expect upward Treasury yield moves to subside over the next six months and are forecasting a 2-year Treasury yield with a central tendency of 2.75%.

CREDIT MARKETS

- Unusually large interest rate moves have had an unusually large impact on the high yield market.

- High yield market participants have more favorable “market mechanics” in which to invest.

- Fundamentals keep us overweight high yield; current market mechanics and technicals support that view.

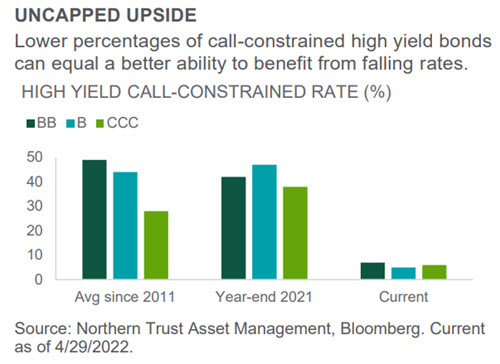

High yield bond prices have sold off sharply this year mainly due to rising interest rates alongside a more hawkish Federal Reserve, more persistent inflation and geopolitical uncertainty. This has provided a rare entry point for investors to capture an attractive convexity profile (in an asset class typically exhibiting negative convexity). In periods of falling interest rates and tightening spreads, the potential for price appreciation is limited by a call feature (that most high yield bonds have) as the expected life of the bond shortens to a near-term call date rather than the stated maturity. Due to the decline in bond prices this year, the call-constrained rate of high yield has dropped dramatically to 6% (see chart).

To start 2022, roughly 80% of the high yield index was priced above par. Now, only 20% is. This has pushed the convexity profile of high yield into the most attractive level since March 2020. A bond with positive convexity should have a larger price increase during declining yields than a decline in price from yields rising, creating a more attractive upside/downside profile. Given the strength of underlying fundamentals, increasingly attractive valuations and an improved convexity profile, high yield continues to look attractive even through the current period of volatility.

EQUITIES

- Stable earnings expectations alongside falling equity markets means more attractive valuations.

- The risk case is that a relentless Fed eventually causes earnings expectations to roll over.

- We remain neutral across broad global equities – with a U.S. overweight offset by a non-U.S. underweight.

Global equities suffered over the past month, with roughly 10% drawdowns in each major region. Non-U.S. benchmarks held up somewhat better in local currencies, but continued dollar strength masked that outperformance. U.S. markets were hit particularly hard, driven by growth stock underperformance as interest rates moved higher and several U.S. tech and internet retail companies offered disappointing guidance.

Overall, fundamentals in the U.S. remain durable. Estimates continue to move modestly higher (though, notably, positive revisions have been largely concentrated in areas like energy). As seen in the nearby chart, year-forward estimates have improved despite input cost inflation and supply chain challenges, suggesting that the decline in equities this year is coming from lower valuations. The more cautious investor stance toward equities largely reflects a fear that inflationary pressures will prove more persistent, necessitating more aggressive action on the part of the Fed to quell demand – risking recession. We maintain a neutral position toward global equities, while maintaining a preference for the U.S. given our expectation of more resilient fundamentals.

REAL ASSETS

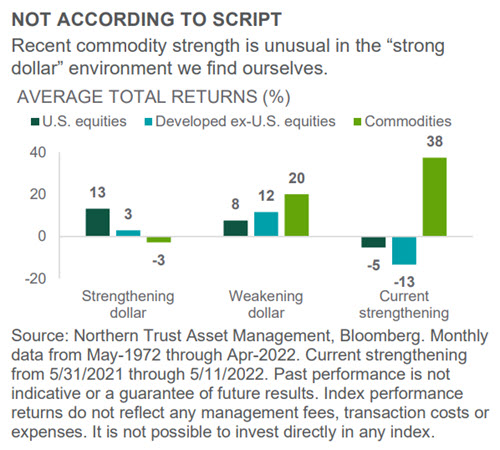

- Commodities have not been slowed by the recently strong dollar – despite the historical experience.

- Strong fundamentals (strong demand and challenged supply) are enhanced by attractive valuations.

- We retain our recommended overweight to natural resources – and equal-weight to global real estate and infrastructure.

Amid volatile markets, the dollar has shown extraordinary strength. Recent greenback strength goes back a year – with the dollar index up 16% over the last year. Generally, dollar strength means commodity weakness. Most commodities are priced in dollars – but by a global marketplace where the intrinsic value is independent of its dollar quote (gold is the best example). The relationship commodities have with the dollar is not dissimilar to non-U.S. equity markets – generally showing weakness in times of dollar strength and vice versa (see chart).

However, while non-U.S. equity markets have retained historical relationships during the recent dollar strength, commodities have not. Futures-based commodities are up 38% during recent dollar strength (while an equity-based approach is up 16%). The “pro-commodity” inflationary narrative has overwhelmed the “pro-dollar” geopolitical and “Fed liftoff” narratives. Looking ahead, we retain our recommended natural resources overweight – as we believe still-inexpensive valuations and strong fundamentals (increased demand/tight supplies) will allow continued outperformance even amid further dollar strength – and possibly even better should the dollar reverse course.

- Jim McDonald, Chief Investment Strategist

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2022 Northern Trust Corporation.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust's current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.