by Rick Rieder, Managing Director, Chief Investment Officer, Global Fixed Income, Blackrock

Historically, roughly every 30 years, a Category 5 hurricane has made landfall in the United States. Only five such hurricanes have ever made landfall since record-keeping began; such is their rarity. The physical damage that such storms cause is devastating, as evidenced by hurricanes like 2005’s Katrina (which made landfall as a Cat 3), or even 2012’s Sandy in NYC, “just” a Cat 1 storm.

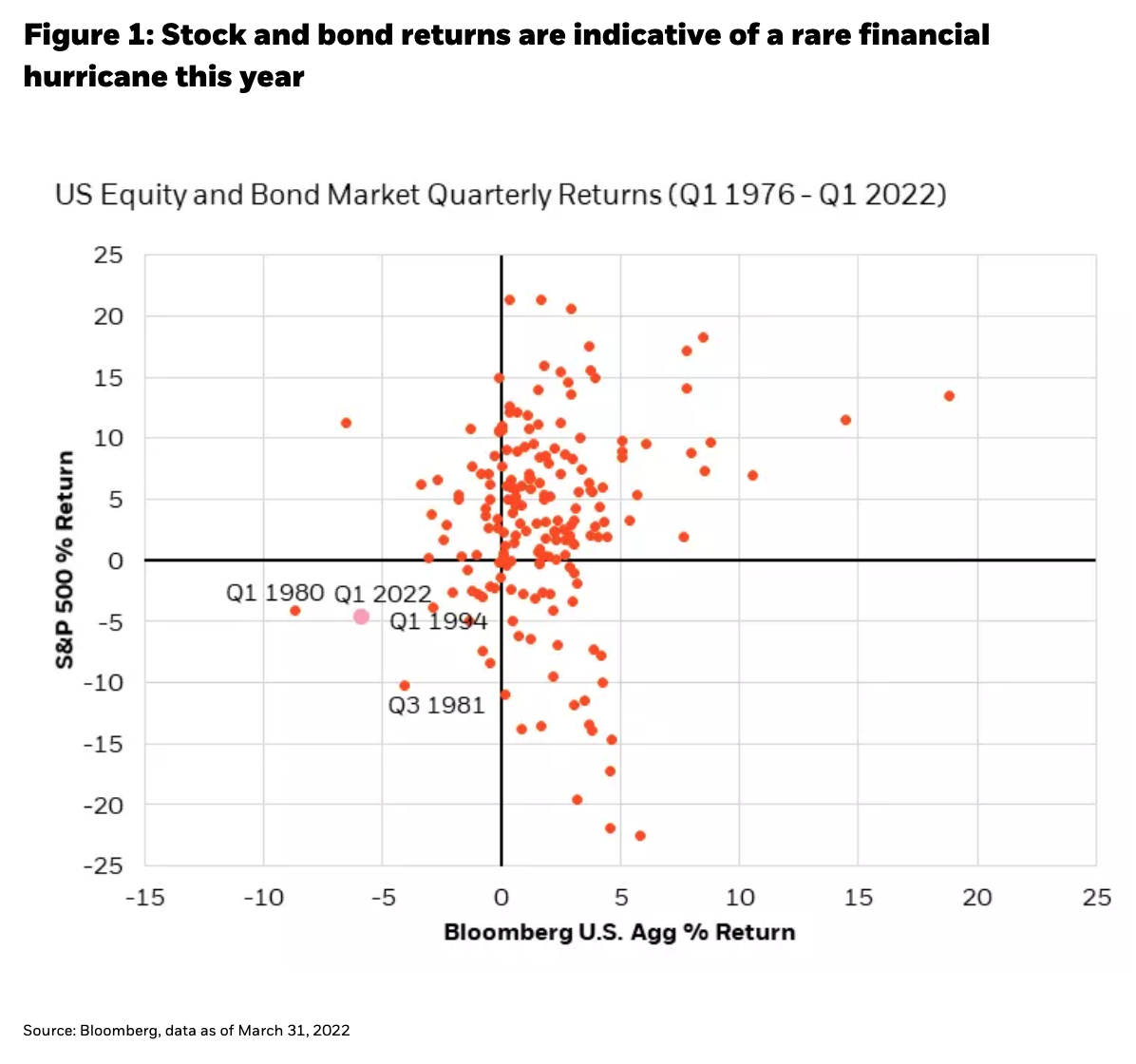

Financial hurricanes, on the other hand, can cause devastating monetary losses, even as physical losses are (fortunately) minimal. Today, we find ourselves in the midst of a unique financial hurricane: since at least 2000, there has never been a year when both the Bloomberg-Barclays U.S. Aggregate Bond Index and the S&P 500 Index of large capitalization equities were negative (which is where we stand in 2022, as of May 10, see Figure 1), and since the creation of the U.S. Long Treasury Agg in 1973, there hasn’t been a year when both stocks and long bonds were down double digits (as they currently stand this year).

While there are still too many unknowns for us to say that this is a Category 5 equivalent, like the Global Financial Crisis or like the Great Depression, it is nonetheless a unique and complex “5 category” hurricane, encompassing: 1) inflation (globally, but especially in the U.S.), 2) China lockdowns (and the evolution of policy), 3) the war in Ukraine (and its impact on commodity prices), 4) recession fears (especially in Europe) and 5) a Federal Reserve (Fed) that is tightening financial conditions at the fastest pace in decades. We will examine each of these categories, in turn, and will conclude with thoughts on how to allocate capital in the midst of this storm, in a sense, how to “polish your surfboard” in preparation for the opportunities that should arise once the tempest has calmed.

Inflation (globally, but particularly in the U.S.)

There is no shortage of reasons for inflation’s push higher this year – commodity shortages due to the war in Ukraine, continued demand for housing amidst strong fundamentals and low inventory and fresh lockdowns in China creating new waves of supply chain issues.

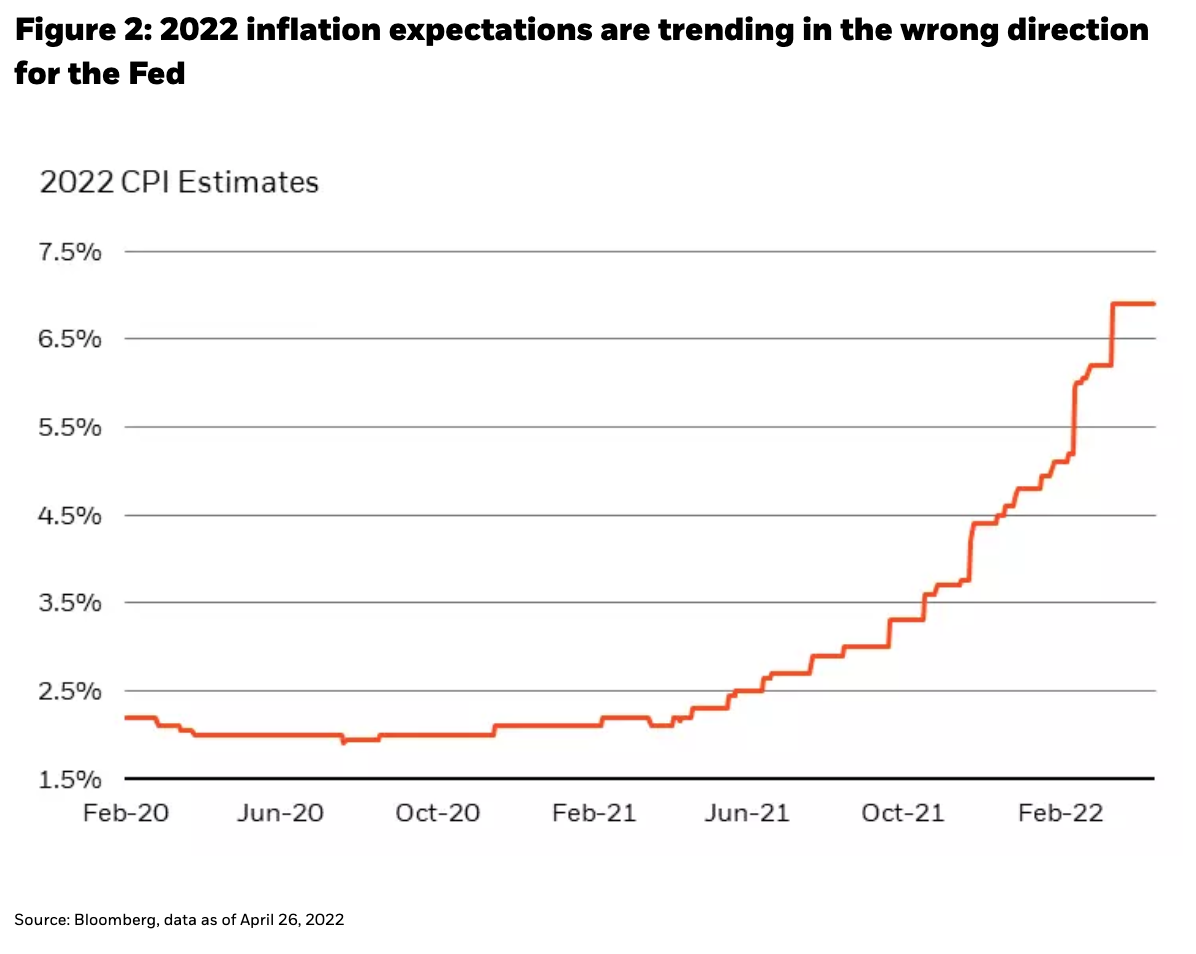

Still, there are reasons to believe that several important components may have already peaked. While Chinese ports are backed up, congestion around U.S. ports has eased. Copper is now below where it was a year ago, and the U.S. oil and gas rig count has almost recovered to pre-Covid levels after plunging by 70% during the pandemic, incentivized by the economics of $100-a-barrel oil this year. House prices are almost certain to slow their advance too, in light of mortgage rates that have now surpassed their 2018 peak. While inflation has shown some signs of peaking, its stickiness at this high a level (2022 is likely to average 6.9% according to the Bloomberg consensus) is still a problem for the Fed, and hence for markets (see Figure 2).

Lockdowns in China, and the evolution of policy

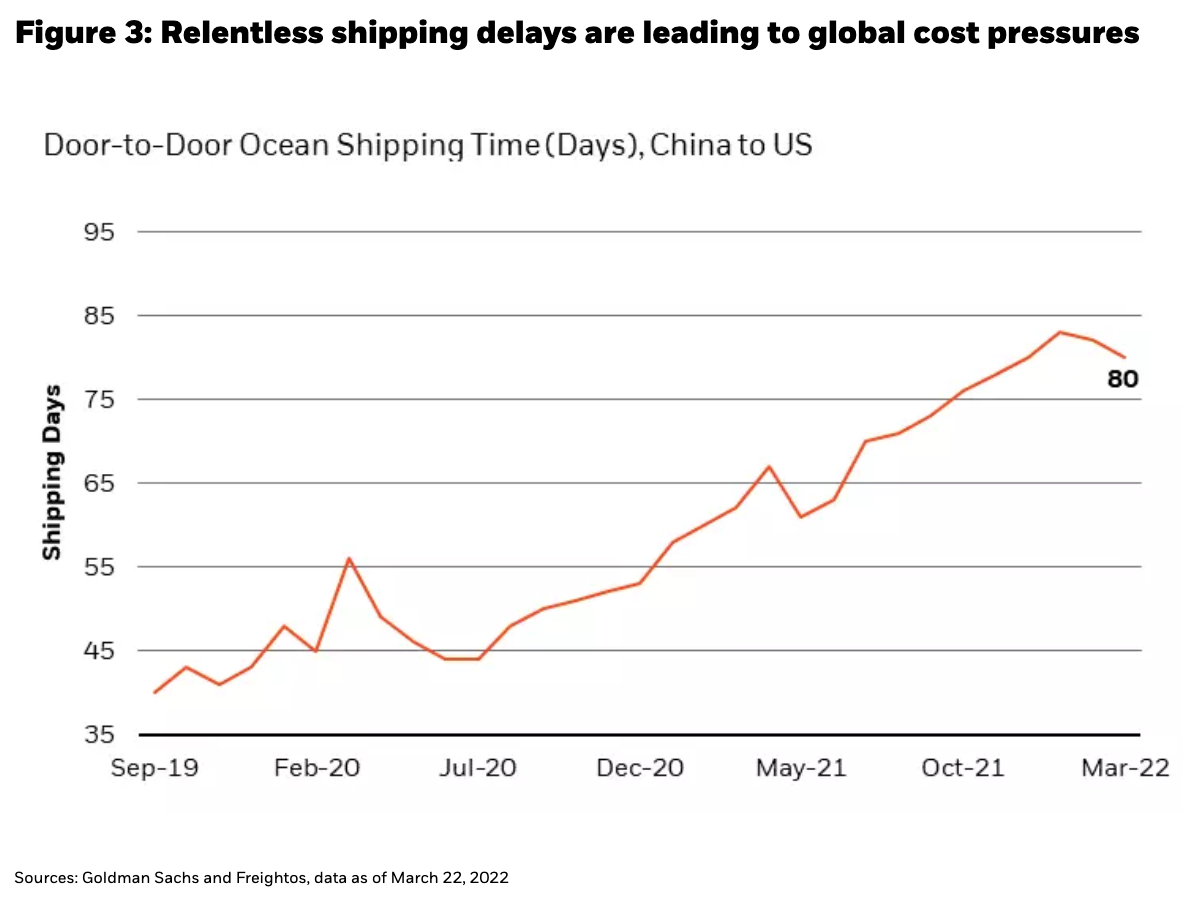

The global growth impulse from China is especially complex because while it takes the form of a negative supply shock to the U.S.; it is primarily a negative demand shock in China. City-wide lockdowns have virtually ceased day-to-day activities, leading to renewed disruption and delays at the ports, further clogging parts of the global supply chain (see Figure 3). The unclear trajectory of economic growth, Covid developments, as well as uncertain regulatory and geopolitical conditions surrounding China, have led to a great set of uncertainties for investors.

The continuing challenge from the Ukraine-Russia situation

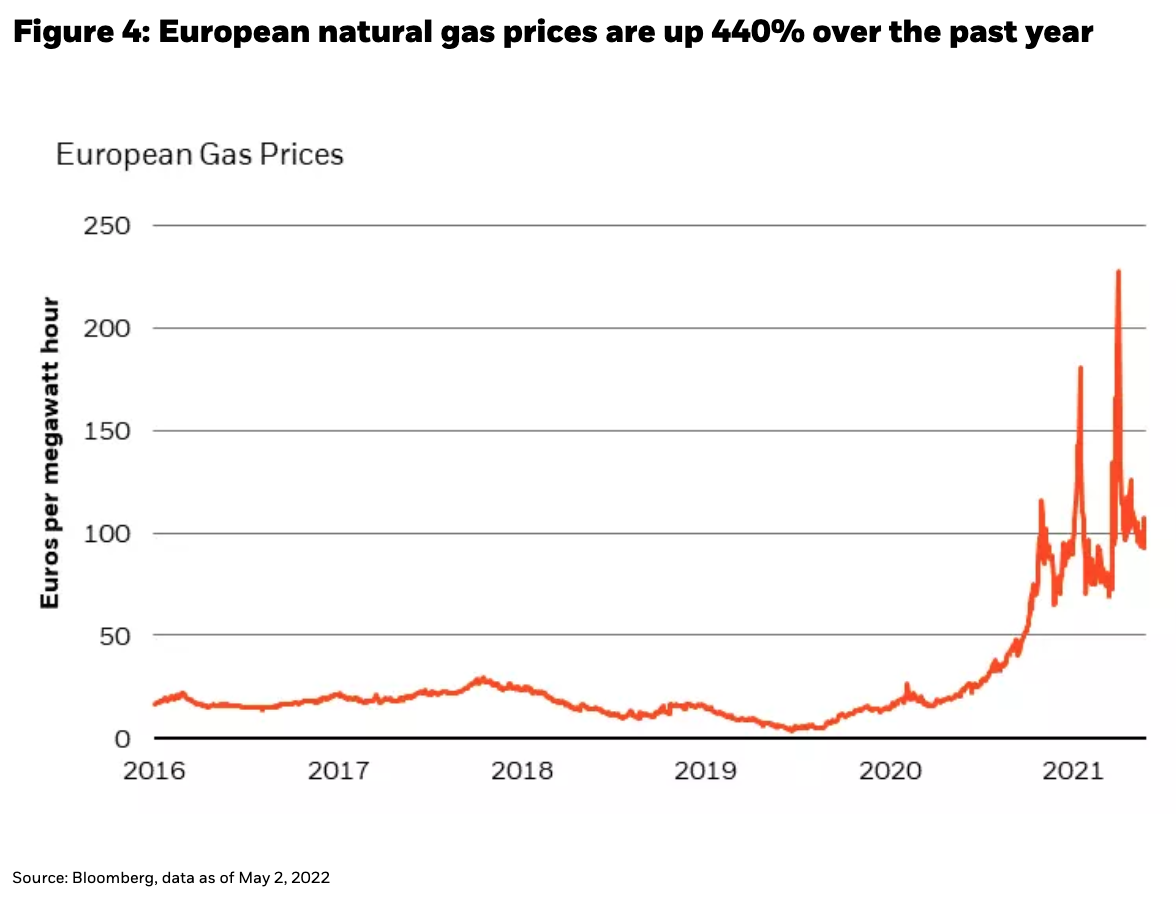

Wheat, natural gas, crude oil, and a variety of other commodities continue to be buffeted by the interruption to the global commodity trade. Nowhere has this been more apparent than in European natural gas prices (see Figure 4). This near-immediate breakage of trade relations with a major global trading partner may have instigated a “deglobalization wave” that is now being exacerbated by Chinese lockdowns and their associated supply chain disruptions. This deglobalization wave is also creating a tug-of-war in the composition of nominal GDP (as smaller trade quantities create higher prices), which could create business interruptions, a longer-term stickiness to inflation and hence further geopolitical tensions. Yet, putting geopolitics aside, an investor can justifiably feel more comfortable with investments in areas tangential to this concept of a stickier supply environment for commodities.

Potential U.S. recession?

Recession has been a buzzword ever since the yield curve inverted in early 2022. Forecasts suggest that the likelihood of a recession has increased dramatically since the beginning of the year, for both the U.S. and for Europe. Simultaneously, consumer confidence has trended downward, largely due to inflation concerns, an ill omen for consumption-oriented economies.

Yet there is a labor market-sized hole in the theory of a U.S. recession. The shortages of goods and commodities from abroad extends to a shortage of workers domestically, creating one of the tightest labor markets in history. Not only does a tight labor market continue to support robust consumption, but ironically, this labor shortage and short-term inflationary impulse creates the need for investment in automation and other productivity-enhancing technology that will ultimately be disinflationary in the long run. While both the labor market and corporate investment activity are highly likely to slow from their unsustainably torrid pace, they are unlikely to grind to a halt. In fact, it is quite likely that the labor market stays strong enough for long enough for tomorrow’s businesses and consumers to enjoy the fruits of today’s investments.

Follow Rick Rieder on Twitter

Interestingly, the tightest labor market in history is also coinciding with U.S. household financial health that is the best in modern history. While sentiment readings may be poor (e.g., consumer confidence), spending is quite the opposite. Through the pandemic, consumers have, on average, paid down debt and grown cash balances. Households saved about $5 trillion during the pandemic, $2.5 trillion of which is now pent-up excess savings. Through March 2022, households have only drawn down about $30 billion from this $2.5 trillion excess savings hoard, leaving plenty of dry powder to absorb price increases without having to change consumption patterns as much as net debt burdens would have suggested in prior cycles.

So, the data doesn’t suggest an imminent recession in the U.S., but does policy have to reverse its course of the last three years at a speed that ends up engineering an economic downturn in the fight against inflation? That would seem irrational to us, but markets won’t know the ultimate answer for a few months (making for a highly conditional investing environment, as explained in our last Market Insights commentary (If…Then, Making Sense of Uncertainty in Markets).

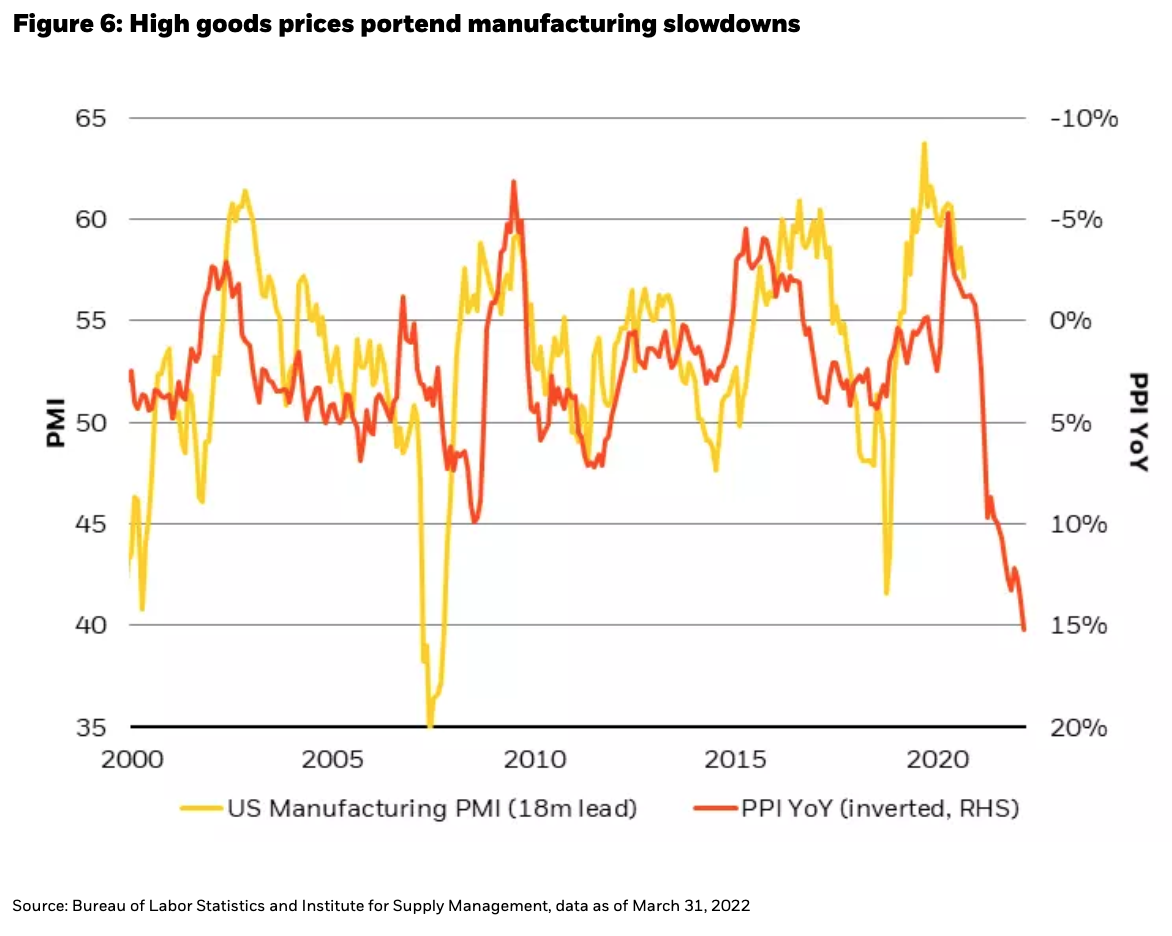

The U.S. is already feeling some of the effects of the hurricane in the goods economy, albeit in what is a well-built house with a strong foundation. The combination of high goods prices and a natural rotation back to services spending (leading to less goods sector demand) could likely spell a goods recession; the good news for the U.S. is that this is only about 20% of GDP and the strength of the other 80% should be more than enough to offset this weakness at the headline level. Markets like one-word answers to complex problems, and it’s possible they may focus on manufacturing’s implied growth slowdown for a few months, but a manufacturing survey is not the tell-all of a much more complex (and more durable) economy (see Figure 6).

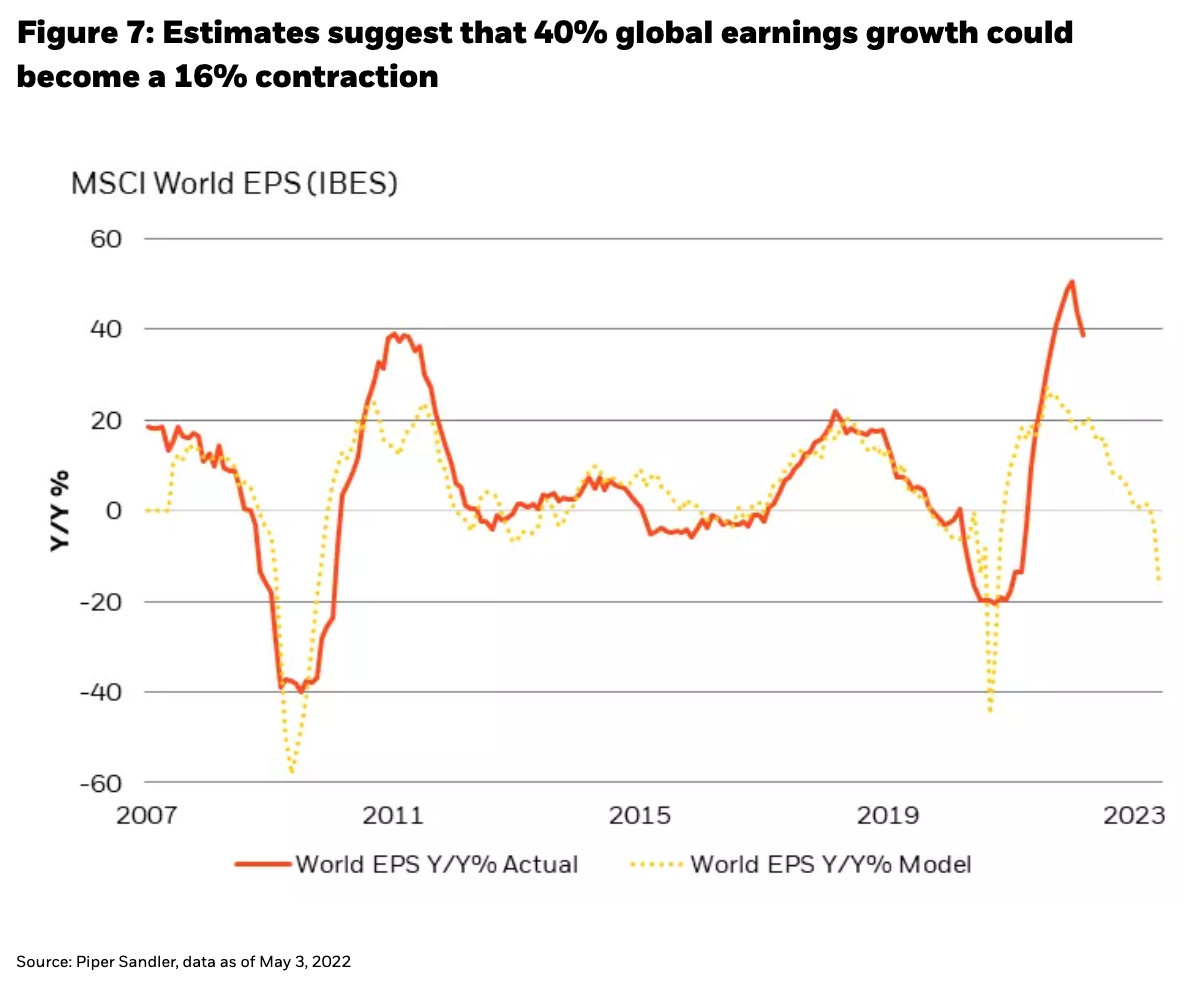

However, the situation is much different in Europe and China. While the U.S. economy benefits from its services-heavy makeup, its lack of external exposure and its status as an energy exporter, Europe and China do not enjoy such luxuries. Uncertainty around Eurozone and global earnings adds to the challenges of managing a global portfolio (see Figure 7). Positioning today should reflect the fear of at least some slowing global data pervading investor psyche. While being right about an economic forecast is intellectually gratifying, preserving capital by protecting downside in the short-term, while setting up for future upside (polishing one’s surfboard in a hurricane), is more important than being ultimately right on the timing or depth of a potential economic slowdown.

Monetary Policy

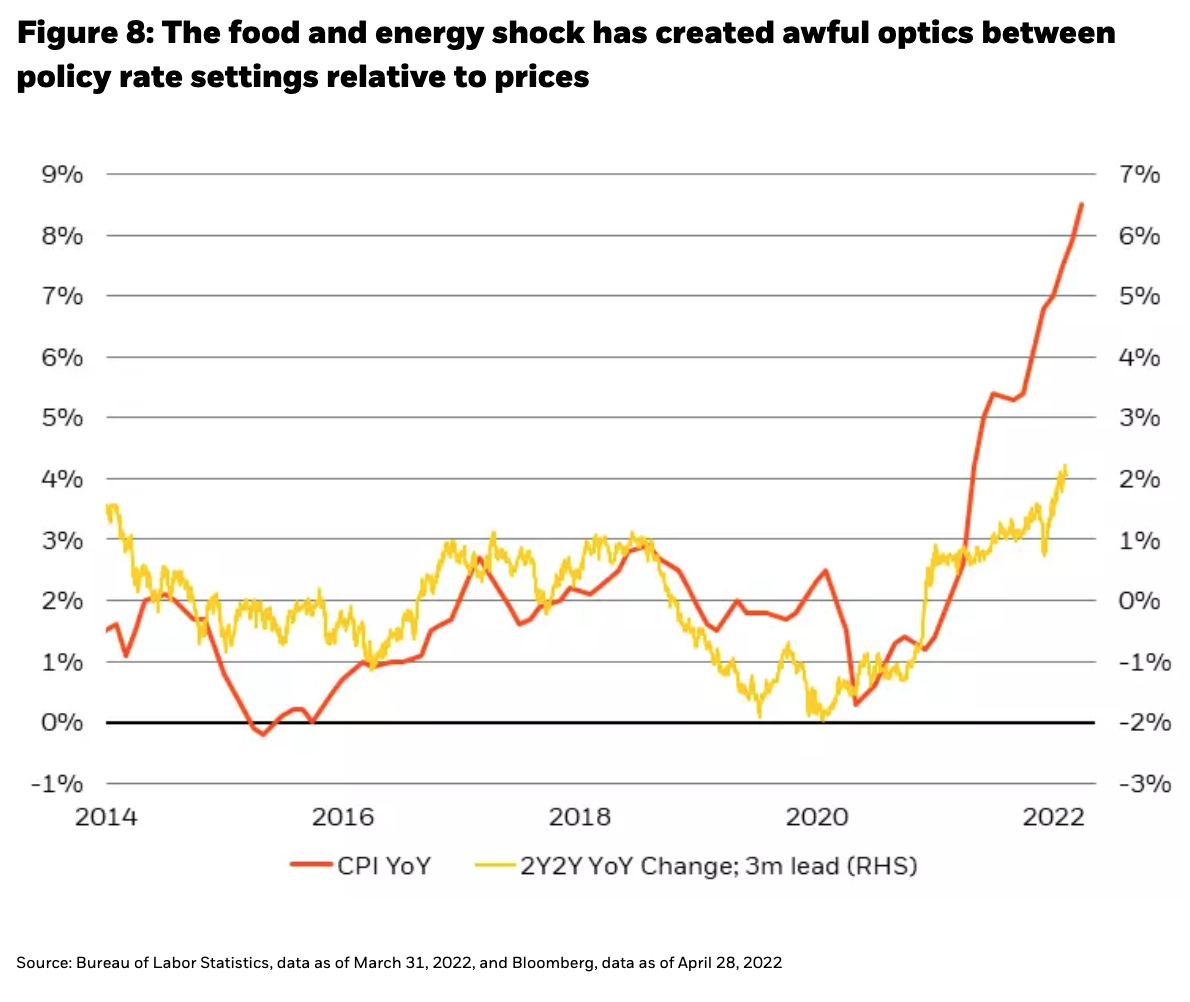

While the absolute highs of inflation are likely behind us, inflation is still much too high and central banks are still much too far behind the curve. The implications are that the Fed will need to continue aggressively tightening monetary policy. While supply chains and geopolitics are out of the Fed’s control, they cannot afford to let house prices rise unabatedly, in a repeat of 2006-07, nor can they let elevated inflation expectations become engrained (see Figure 8). Hence, they are forced to continue down a hawkish path.

While we have probably already seen most of the repricing in the Treasury market, particularly further out the curve, it is hard to bet on interest rates moving materially lower. The path of forward Fed rate hikes is fairly certain over the next few quarters and is well-priced by markets. In contrast, the path forward for both global and domestic central bank liquidity is highly uncertain, and the tail risks for markets are more significant than the broad economy.

If liquidity is suddenly contracted proactively (central banks reduce the size of their balance sheets by effectively net selling Treasuries), it removes critical support for the financial economy. Importantly, this process is not linear but is digital, such that credit markets can quickly lurch from “smoothly functioning” to “shuttered.” It is possible that the disruption of smoothly functioning financial markets leads the Fed to stop tightening well before inflation decelerates to its 2% target, which would implicitly signal that the Fed is comfortable with a slightly higher inflation target.

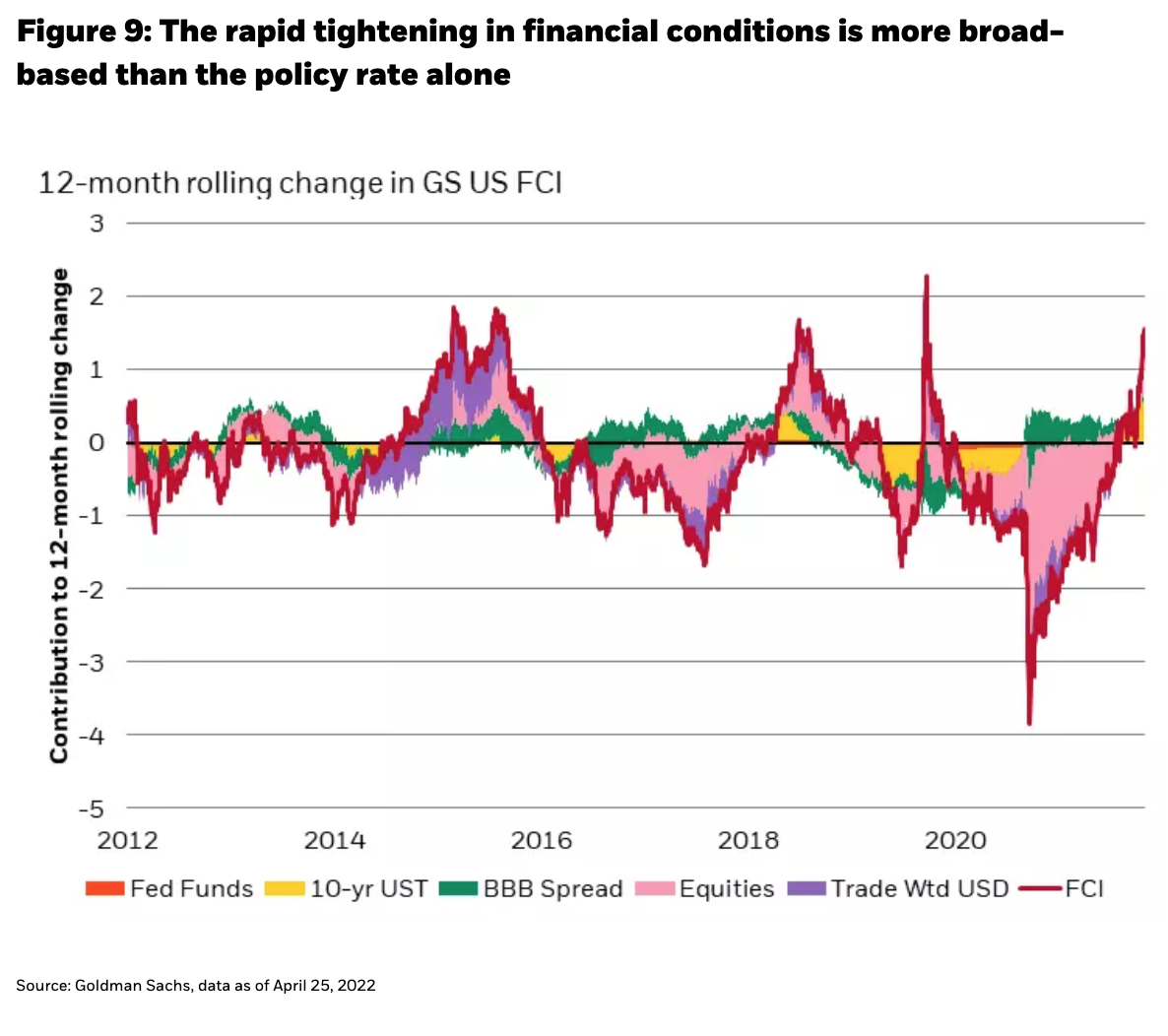

Indeed, a broader view of financial conditions today suggests that they are closer to longer term averages than the policy rate alone would suggest (see Figure 9). Credit spreads, the U.S. dollar and an equity repricing have combined to tighten financial conditions by the most since 2018, at an annual pace seen only three other times in the last decade. While it may be necessary to tighten financial conditions even further as a late play to arrest runaway inflation, prolonged tightness in excess of prior peaks could be onerous enough to cause a capital market shutdown.

Asset allocation in a hurricane

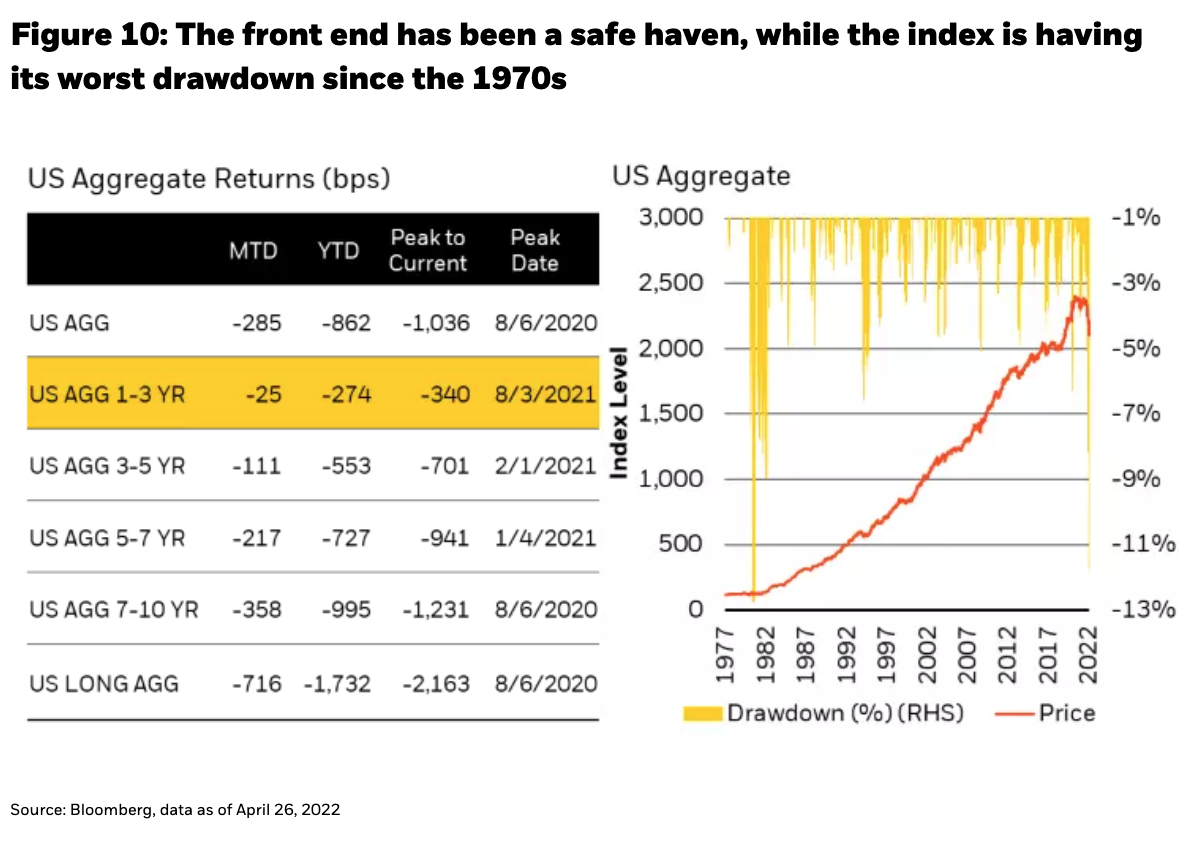

During a financial hurricane, an investor’s goal of capital appreciation may need to take a back seat to the goal of capital preservation. An overweight cash allocation can go a long way toward preserving capital, and allowing for future buying opportunities at better prices, a theme that has certainly played out over the last year in fixed income markets and as recently discussed in our March 2022 commentary Navigating Market Icebergs. However, we are now getting to a point where deploying some of that cash makes sense, especially in high quality fixed income (Figure 10).

Some parts of credit markets do also look interesting from a historical perspective, but this is mostly in the investment grade space, and largely due to the simultaneous widening in rates and spreads, pushing yields to their 99th percentile over the period of the last decade. In the lower quality parts of fixed income (high yield), spreads at their 40th percentile haven’t widened sufficiently to compensate investors for the risk of this financial hurricane being worse than expected. This pattern of higher quality assets having better forward return profiles is true in securitized markets as well – high quality CMBS, CLO and ABS spreads have widened more than their low-quality counterparts would suggest.

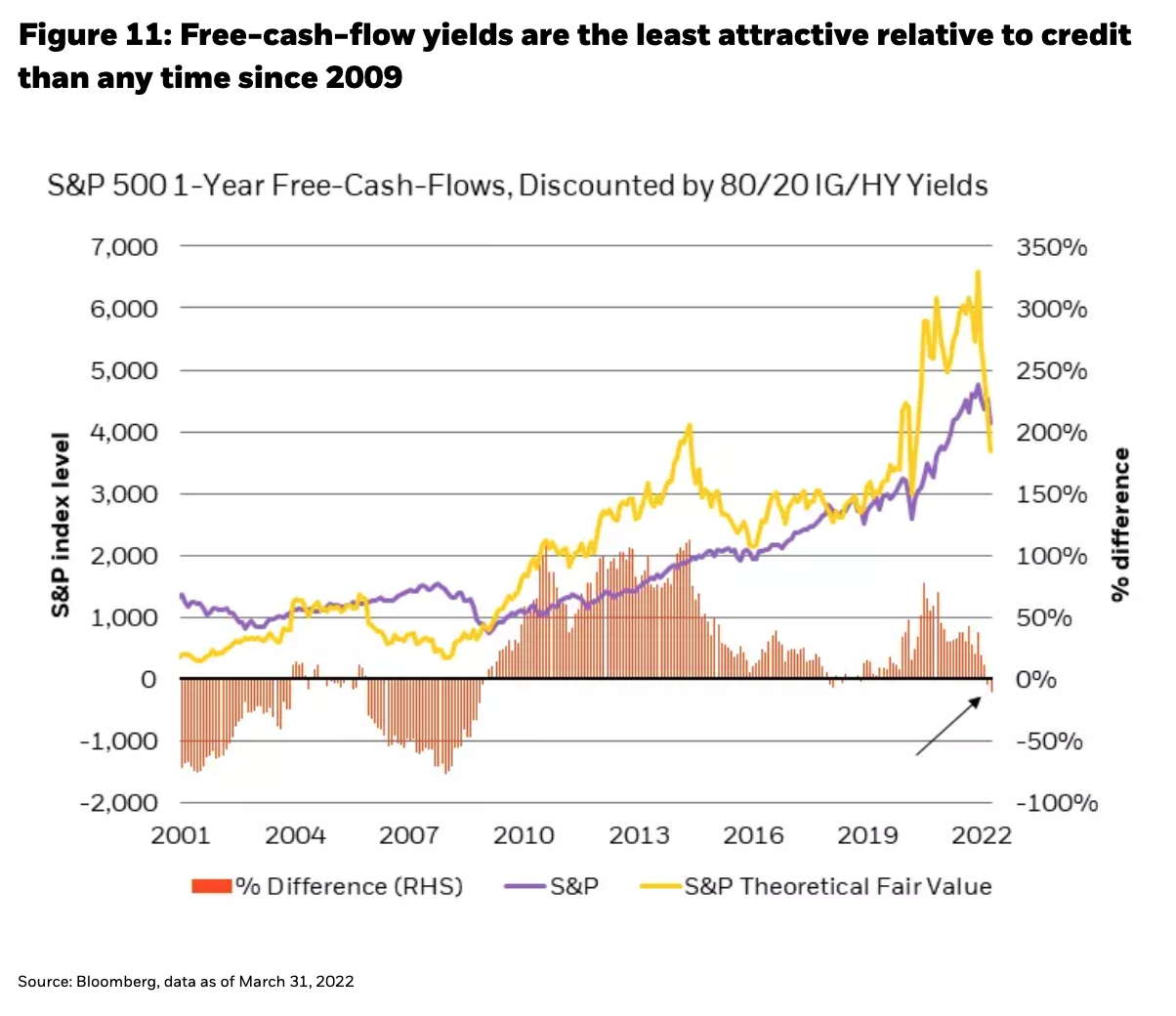

At the bottom of the capital stack, in equities, robust fundamentals and earnings that should benefit from a high nominal GDP environment are in a tug-of-war with valuations that are now at the low end of their range of over the last two decades. On a relative basis, the repricing in credit markets has rendered once attractive free-cash-flow yields in equities as “just okay” today (not because cash flows per se are in question, but due to the dramatically rising discount rate against which future cash flows are measured, see Figure 11).

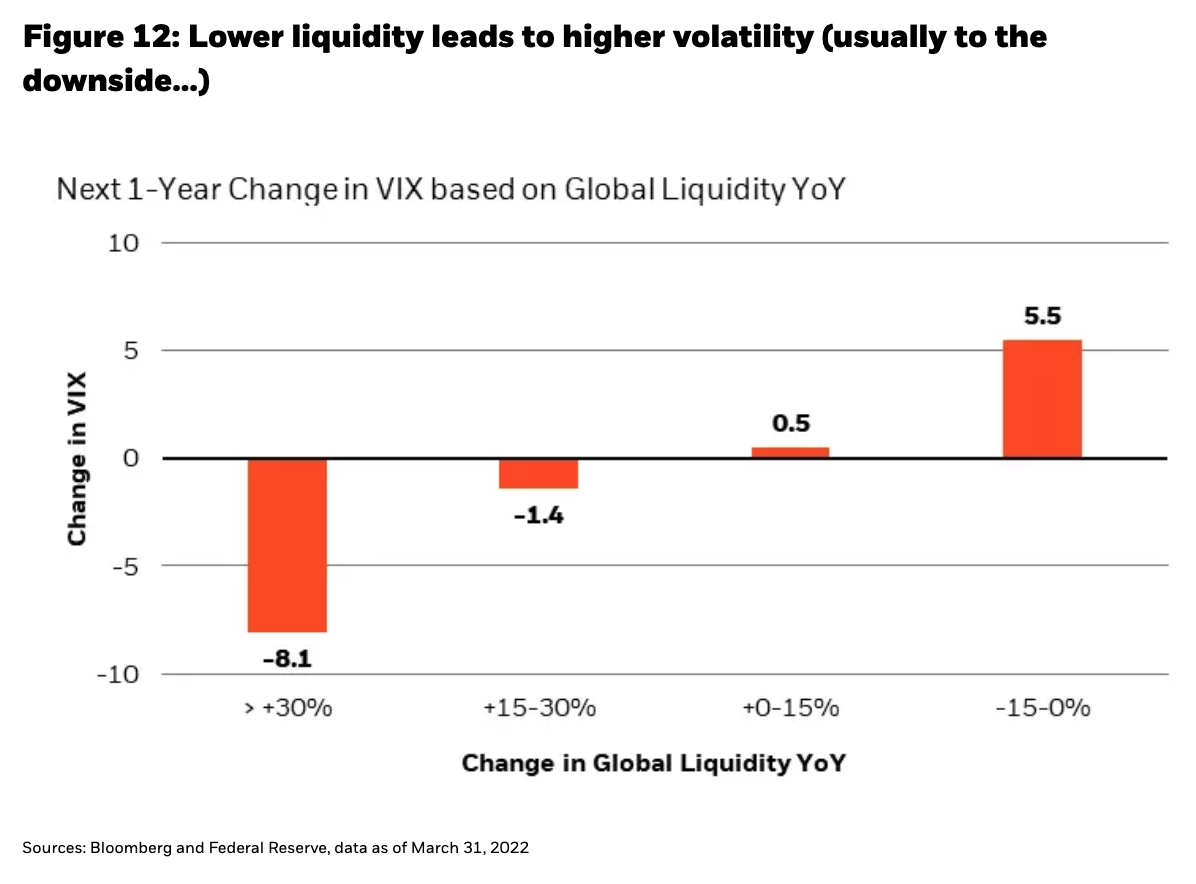

During a hurricane of global liquidity contraction, the accompanying volatility can provide for excellent entry points in equities, especially in sectors with stable cash flows that are being liquidated by those in need of cash (see Figure 12). In just the last few weeks, these technical conditions may have resulted in certain equities already undershooting “fair value.”

Further, as the hurricane passes through and is on the verge of ending, it is usually the best time to sell insurance. The price of insurance tends to be influenced by recency bias, and often overshoots the fair value of what it should cost to insure a portfolio from losses in tail-risk outcomes. The price of insurance has indeed risen rapidly in recent months: it costs 60% more to buy insurance against the S&P 500 declining 10% than it is to insure against a move higher by 10%, and the option market on some of the largest companies in the world is implying that they move by 40% over the next year – a gain or loss of a whopping $1 trillion in market cap in Apple, for example. In fixed income, the option market is suggesting a 68% chance of a 1.5% move in the 2-year swap rate – a huge range of 2% to 5% given its 3.5% starting point. All things considered, insurance premiums may be one of the most attractive sources of income today (while still allowing one to hold cash), but an investor must make sure to sell insurance only on assets that one would be happy to own at lower prices.

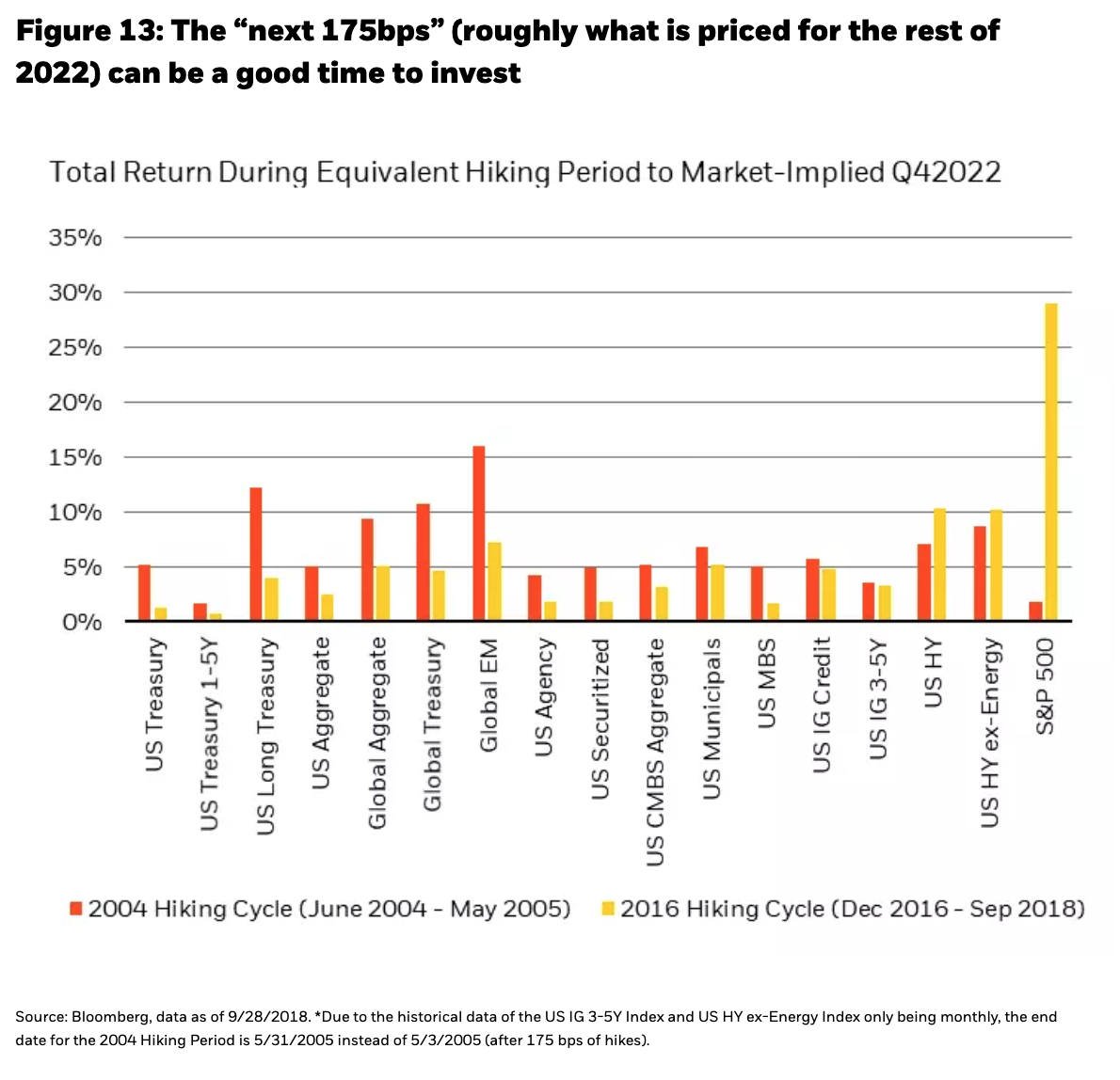

Eventually, this financial hurricane too shall pass. During the last two hiking cycles, returns from the second hike to the equivalent policy rate that is being priced by year-end 2022 were accompanied by uniformly positive returns (see Figure 13). The current cycle has more crosscurrents, but we cannot rule out the potential for a rebound in financial assets given the amount of price adjustment that we have just witnessed in the first several months of 2022. So, we think investors would be well advised to find a safe place for this hurricane to pass, but do not stay in that place forever, because when we have enough visibility to know that the hurricane is indeed moving on, some spectacular returns could follow in its wake.

Rick RiederManaging DirectorRick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income and is Head of the Global Allocation Investment Team.

Rick RiederManaging DirectorRick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income and is Head of the Global Allocation Investment Team.

Copyright © Blackrock