by Lance Roberts, RIA

Investor sentiment has become so bearish that it’s bullish.

One of the hardest things to do is go “against” the prevailing bias regarding investing. Such is known as contrarian investing. One of the most famous contrarian investors is Howard Marks, who once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Currently, everyone is bearish. As noted in “Stock Market Rollercoaster,” everything, everywhere, is bearish. CNBC is running “Markets In Turmoil” specials, and individuals get convinced the world is ending. However, as Howard Marks once stated

“In good times skepticism means recognizing the things that are too good to be true; that’s something everyone knows. But in bad times, it requires sensing when things are too bad to be true. People have a hard time doing that.

The things that terrify other people will probably terrify you too, but to be successful an investor has to be stalwart. After all, most of the time the world doesn’t end, and if you invest when everyone else thinks it will, you’re apt to get some bargains.“

Such is the point where investors make the most mistakes. Emotions make them want to sell. However, from a contrarian view, such is precisely the time you want to be a buyer.

But that is always a difficult thing to do.

Everybody Is Bearish

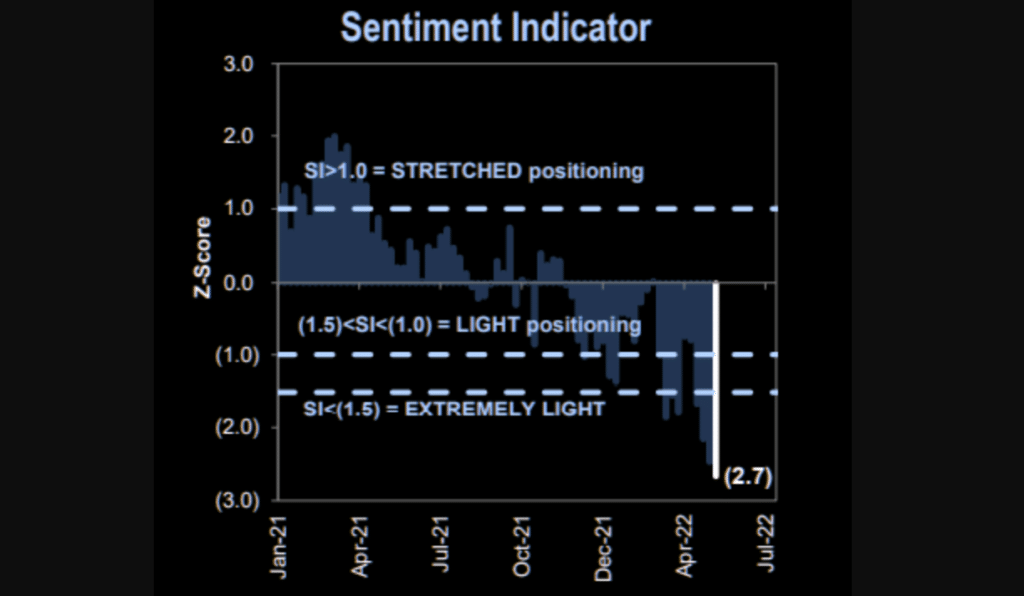

Currently, everybody is bearish. Not just in terms of “investor sentiment” but also in “positioning.” As noted by MarketEar on Friday, the Goldman “Sentiment Indicator” measures stock positioning across retail, institutional, and foreign investors versus the past 12 months. Readings below -1.0 or above +1.0 indicate extreme positions that are significant in predicting future returns.

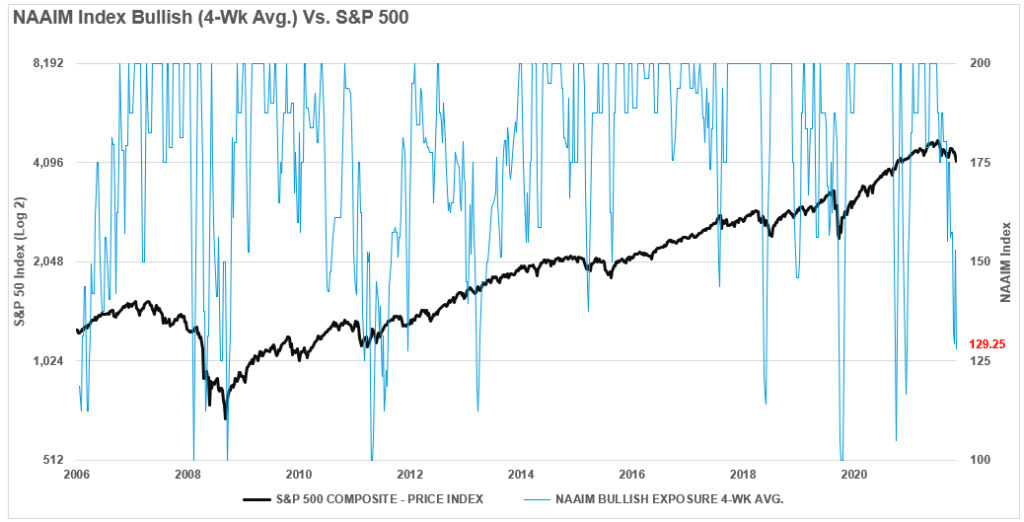

More importantly, investor allocations, particularly among professional investors, remain extremely light, suggesting a much higher level of caution. The following is the 4-week moving average of the National Association of Investment Managers bullish index. At a reading of 129.25, such is often coincident with short-term market bottoms.

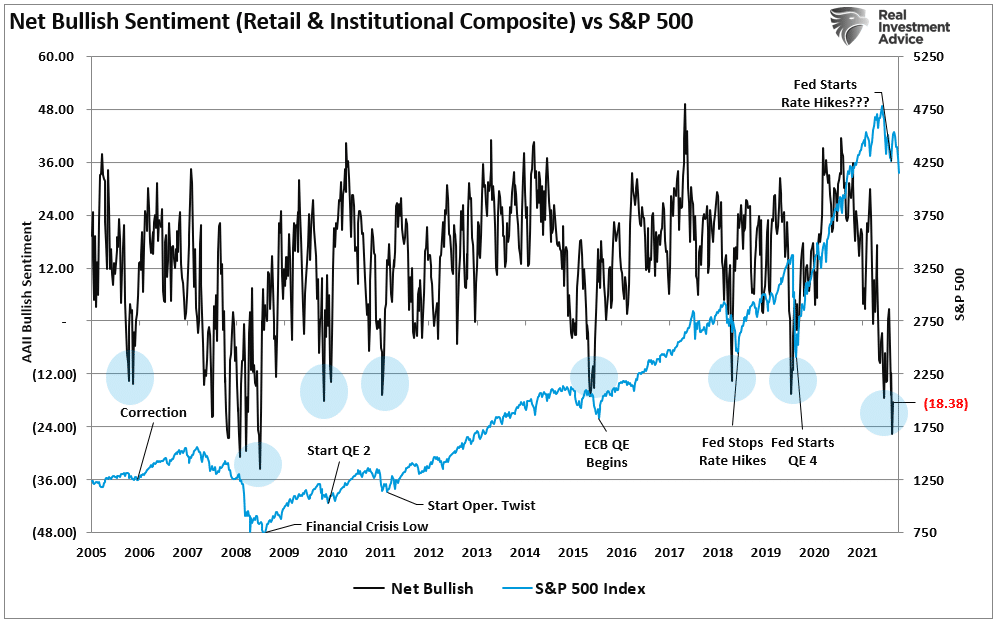

The composite index below, which combines both retail and institutional investor sentiment, is extremely negative and typically marks short- to intermediate-term market bottoms.

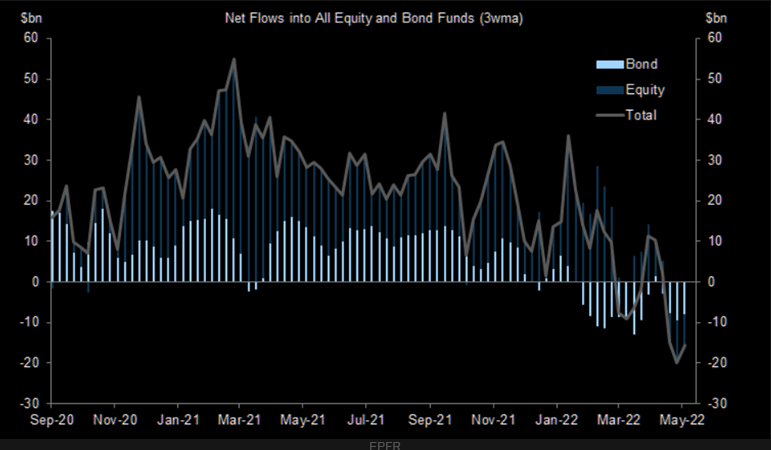

Of course, with investor sentiment negative, net flows into global equity and fixed-income funds also turned negative. Since the second week of January, global bond funds have experienced $125bn of net selling, and flows have been negative for 16 of the last 17 weeks.

As shown, when levels of negativity have reached or exceeded current levels, such has historically been associated with short- to intermediate-term market bottoms.

“A dovish Fed, excessively bearish sentiment for risk assets and a lot priced-in relative to current fundamentals. We think that risk assets can trade reasonably robust over the next 4-8 weeks” – Citi

However, there are two critical points to note:

- During bull markets, negative sentiment was a clear buying opportunity.

- During bear markets (2008), negative sentiment stays negative while markets decline.

Such raises the vital question: Are we still in a bull market, or are we in the early stages of a bear market?

Longer-Term The Outlook Remains Bearish

While the negative sentiment is “bearish” currently enough to be “bullish,” the longer-term fundamental and technical dynamics suggest a continued correction is possible. As noted above, the negative sentiment levels could support a rally over the next couple of months. Such would lure investors into the market just as the more bearish fundamental and technical backdrop unfolds.

However, the NYSE index is currently down to the 100-week moving average. Michael Hartnett recently noted:

“A recession/crises over the last 25-years has always seen our favorite Wall Street barometer break decisively below the 100-week moving average.”

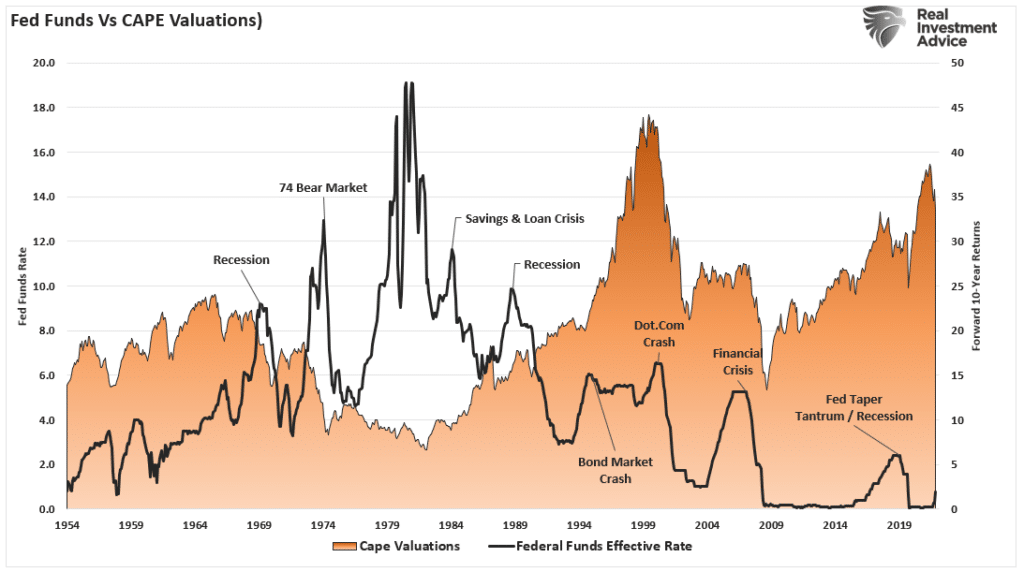

More importantly, like in 2008, 2000, and 1929, valuations on stocks are incredibly high. While the bullish mantra over the last decade was “low rates justify high valuations,” rates are rising, which puts valuations at risk. The Fed historically hikes rates until “something breaks,” which drastically lowers valuations (i.e., prices fall sharply.)

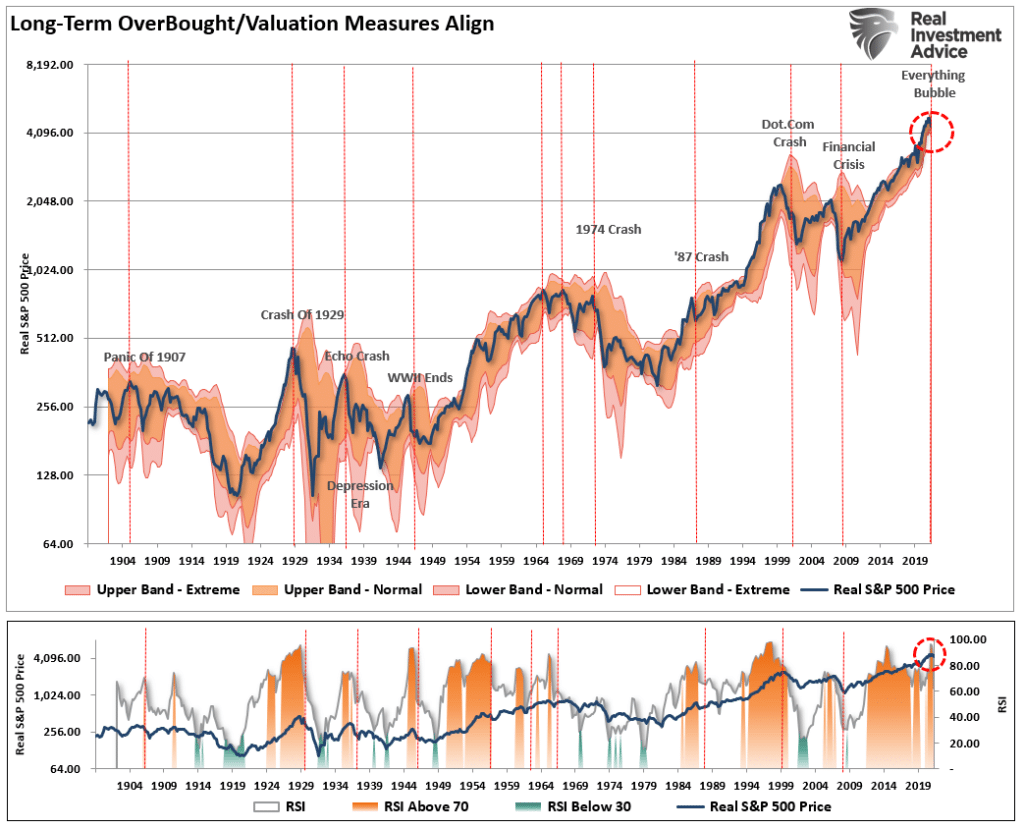

Furthermore, the market remains exceptionally overbought in terms of both standard deviations from long-term means and relative strength (RSI) from a long-term technical perspective.

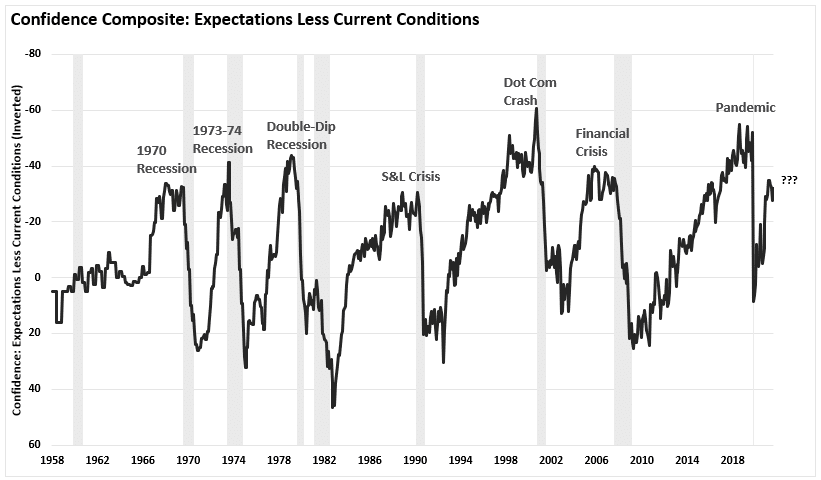

Notably, consumer confidence is also at levels that historically align with more substantial mean-reverting events. (The chart below is the consumer confidence composite index of UofM and Conference Board measures.)

These fundamental and technical measures can take long periods before they matter. Positioning for adverse outcomes today can both appear wrong in the short-term and cost capital appreciation opportunities.

However, these measures will likely prove beneficial in limiting capital losses in the longer term. The trick will be recognizing when they start to matter.

But when they do matter, they tend to matter a lot.

Don’t Let Emotions Control Your Investing

As Bob Farrell’s rule number-9 states:

“When all the experts and forecasts agree – something else is going to happen.

As a contrarian investor, excesses get built by everyone being on the same side of the trade. Currently, everyone is so bearish that the reflexive trade will be rapid when the shift in sentiment occurs.

As Sam Stovall, the investment strategist for Standard & Poor’s, once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

The takeaway from this commentary is not to let media headlines, financial narratives, or concerns over long-term issues like valuations, economics, or geopolitical events impact the decision-making process in your portfolio strategy.

Our job as investors is to capitalize on available opportunities but avoid the long-term risks.

There are plenty of reasons to be very concerned about the market over the next few months. However, markets can often defy logic in the short term despite the apparent weight of evidence to the contrary. As I noted previously:

“It is always important to never discount the unexpected turn of events that can undermine a strategy. While we continue to err on the side of caution momentarily, it does not mean we will remain wed to that view.”

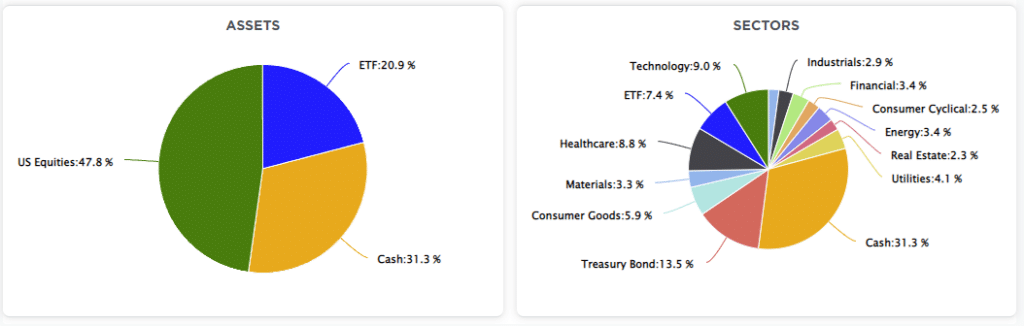

The next few weeks, and even the next couple of months, will likely be frustrating. Markets are likely to remain rangebound with little progress made for either the bulls or the bears. We are maintaining our exposures to higher-than-normal levels of cash and underweight both equities and bonds.

There is little value in trying to predict market outcomes. The best we can do is recognize the environment for what it is, understand the associated risks, and navigate cautiously.

Leave being “bullish or bearish” to the media.