by Talley Léger, Invesco Canada

Equity strategist Talley Léger explores a tail risk scenario for markets — the probability of which may be increasing.

If you’re a blissful investor with a 20-year or longer investment horizon, stay the course and stop reading this blog immediately! If not, you’ll have to pardon me for indulging in the doom and gloom that has understandably engulfed the tactical investment community. To be clear, the scenario I’m about to explore doesn’t represent the Global Market Strategy Office’s base case. Rather, it’s a tail risk scenario — the probability of which may be increasing.

After all, the S&P 500 Index fell 14% from its high on Jan. 3, 2022, through the end of April, with no major low in sight.1 True, a playable rally of 11% did develop from March 8-29,1 but that brief bounce ultimately faded into what now appears to be a sequence of lower highs and lower lows.

Broad economic recession or tactical contraction?

Admittedly, I had been working under the assumption that stocks would experience some typical volatility in anticipation of U.S. Federal Reserve (Fed) liftoff, but that the market would have time to fully recover (and then some) before the onset of the next recession.

Now, I’m not so sure. Inflation has broadened – exacerbated by food and energy supply disruptions related to the Russian invasion of Ukraine – the Fed is behind the curve with its interest rate hikes, and real economic growth seems to be stagnating. As such, I’m concerned that the U.S. monetary authorities may be unable to get price pressures under control without causing even more harm to the economy.

Given the discouraging downward trajectory of U.S. manufacturing activity and the overall economy’s recent direction of travel, at the very least I think investors should consider the possibility of a tactical contraction regime in the next six to nine months.

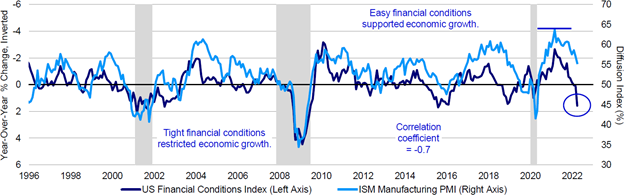

Indeed, an incrementally hawkish Fed alongside tight financial conditions is worrisome, pointing to declining industrial production and a potential earnings recession sometime later this year (Figure 1).

Figure 1: Tight financial conditions are already restricting U.S. manufacturing activity

U.S. financial conditions (dark blue, reversed) and manufacturing activity (light blue) since 1996

Recessionary deflation or “immaculate” disinflation?

Is there a scenario where the Fed doesn’t have to hike so much because of the sharp tightening in financial conditions? Will negative wealth effects curb demand enough to cool down an overheating U.S. economy? Could falling oil prices alongside easing supply chain disruptions create a sort of “immaculate” disinflation?

Despite my bearish apprehension, I can see a path out of this grim situation, but I doubt the road to recovery 2.0 will be easy. A lot has to start going right for a change when so many things have been going wrong.

From my lens, a potentially positive chain of events could include:

1. Moderating economic activity – check

2. Lower oil prices – check

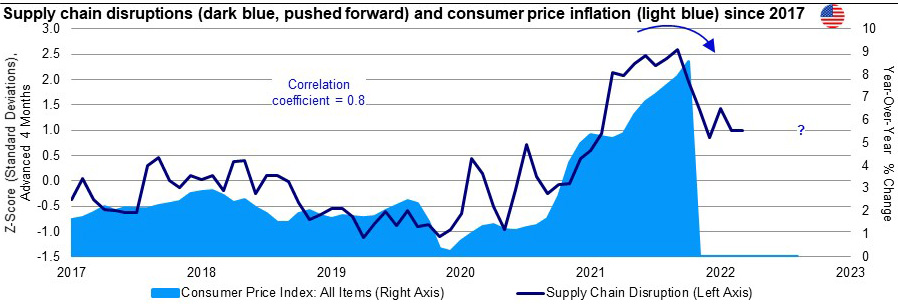

3. Easing supply chain disruptions – early signs of hope (Figure 2)

4. Peaking inflation – ?

5. A less hawkish or even slightly dovish Fed – ?

Figure 2: Pandemic-related supply chain disruptions appear to be easing, which may help take consumer prices off the boil.

Supply chain disruptions (dark blue, pushed forward) and U.S. consumer price inflation (light blue) since 2017

Defensive rotation or buying opportunity for risk assets?

Whether a tactical contraction devolves into a broad economic recession depends on the intensity of the Fed’s tightening cycle and threshold for pain. Regardless, either scenario would probably feel just as bad to stock market investors in real time.

In the months ahead, watch for a dip in the Institute for Supply Management Manufacturing Purchasing Managers Index below 50 for confirmation of a tactical contraction. In such regimes, market dynamics are typically characterized by a rotation from stocks and cyclicals to bonds and defensives, the beginnings of which we could already be witnessing.

It may be a bit early, but I believe balanced investors may want to consider raising their exposure to bonds. There’s a compelling argument to be made that higher bond yields may already reflect the path to a neutral federal funds rate target. Moreover, that asset class now offers better income and more attractive valuations, in my view, and could benefit from a downshifting economic outlook. Indeed, yields usually melt when output comes under pressure.

As for stocks and cyclicals, I’m inclined to reduce exposure by lightening up into any spontaneous rally that materializes. Granted, we’ve made some progress on my list of positive events. However, a clear signal to take risk and increase exposure likely awaits an inflection point in consumer prices and a calmer Fed reaction function. Stay alert.

1 Source: Bloomberg, L.P.

This post was first published at the official blog of Invesco Canada.