by Gene Podkaminer, CFA, Franklin Templeton Investments

The 10-year vs. two-year US Treasury yield curve momentarily inverted, and many are worried about the negative signals this may send for risk assets and the economy at large. In the past, yield curve inversions have signalled increased odds of a recession, and sometimes, poor equity performance. However, to accurately assess the likelihood of these events requires a nuanced view of the details in conjunction with an analysis of the macroeconomic backdrop. We analyse why yield-curve slope measures can diverge and what the implications are for US recession risk, growth momentum, and equity performance.

Key Points

- Understanding yield-curve signals: The Treasury yield curve captures expected government bond yields at different maturities. Usually there’s a clear relationship between expectations at one point and the next, but sometimes differences emerge during times of policy shifts.

- Implications of yield-curve inversion:

- Recession Risk: in our view, recession risk has increased, but it would be unusual merely given the steepness in the front end of the yield curve.

- Growth Momentum: 10-year vs. two-year yield-curve inversions have typically been associated with growth slowdowns, which is in line with our view that growth will slow towards trend.

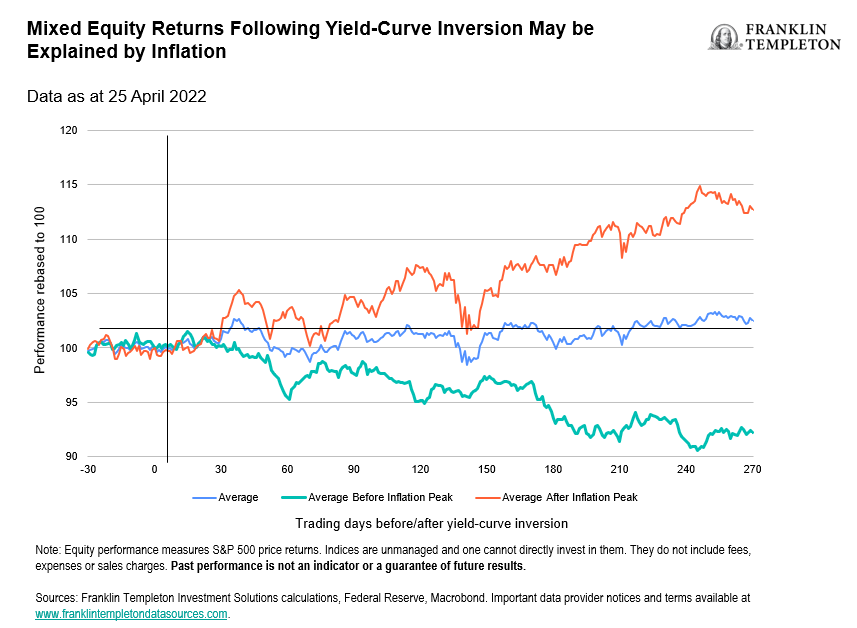

- Equity Performance: equity performance has been mixed following 10-year vs. two-year yield-curve inversions. The inflation backdrop appears to be a differentiator here, and poses a headwind given our high inflation environment.

- Multi-asset implications: our analysis warrants a nimble and cautious approach to risk assets. Recently, we have further reduced our preference for equities relative to fixed income.

Different Yield Curves, Different Signals

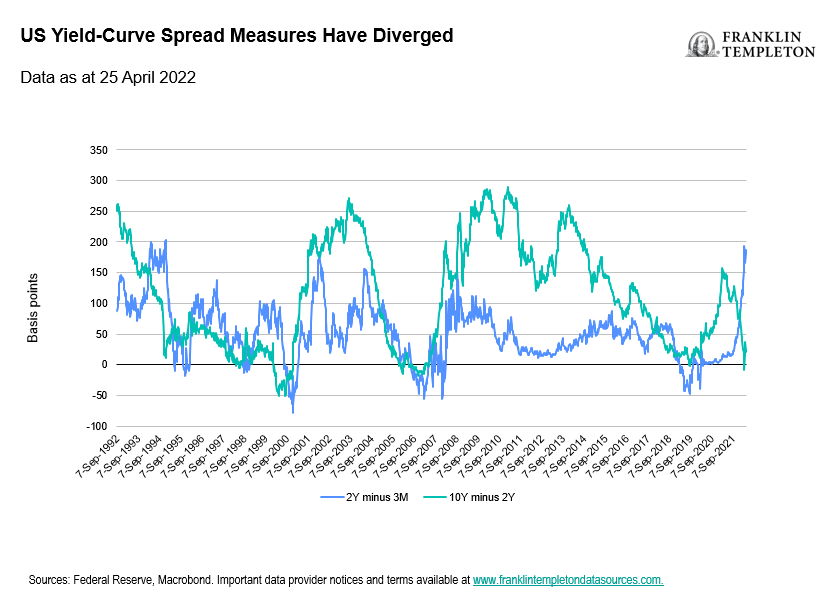

The 10-year vs. two-year Treasury yield-curve slope had momentarily inverted on 31 March, but a shorter-term measure of yield-curve slope, proxied by the two-year vs. three-month, remains very steep. Why are these distinct yield-curve measures providing different signals? One key reason is that the two yield-curve slopes are measuring different aspects of policy.

- The three-month part of the yield curve measures near-term monetary policy expectations.

- The two-year part of the curve measures cyclical expectations of policy rates over the next two years.

Consequently, the two-year vs. three-month curve measures the impulse of monetary policy—how policy will evolve over the next two years.

- The 10-year point of the curve is a projection for monetary policy over the next 10 years. Because of this longer duration, more normalised—or equilibrium—policy expectations are captured. In other words, the cyclical component of policy settings is diluted.1

Therefore, the 10-year vs. two-year yield-curve slope measures how cyclical expectations of the current monetary policy compare against more normalised monetary policy conditions.

Are Today’s Conditions Normal?

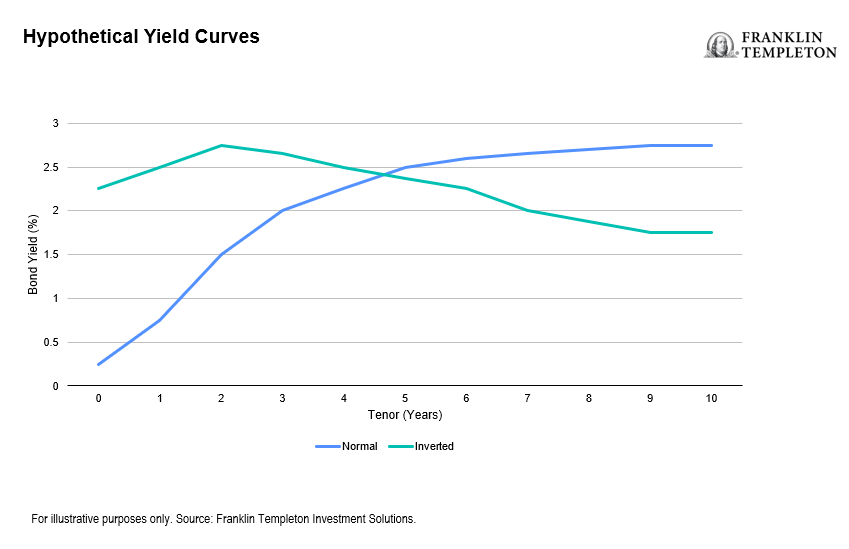

Under normal conditions, the yield-curve trends upward as duration increases; longer-term bonds offer more yield than shorter-term bonds. When the yield curve inverts and the three-month yield is greater than the two-year yield, this suggests that policy rate cuts are expected over the next two years—usually a sign that economic growth is expected to weaken. If the two-year yield is greater than the 10-year yield, this suggests that near-term policy expectations will be restrictive for the economy, as the Federal Reserve (Fed) will raise the policy rate above what is considered the long-term equilibrium level.

Exhibit 1: Hypothetical Yield Curves

Over time, these two measures of yield-curve slope (two-year vs. three-month and 10-year vs. two-year) are usually correlated with one another. However, since the yield-curve measures focus on different periods of policy, they can at times provide different signals. Today, the steepness in the three-month vs. two-year yield-curve slope signals the expectation for a series of policy rate hikes over the next two years. The relative flatness, and momentary inversion, of the two-year vs. 10-year yield-curve slope suggests policy will eventually reach restrictive levels for the economy, as the Fed aims to slow down growth and bring inflation closer to its 2% target.

Exhibit 2: US Yield-Curve Spread Measures Have Diverged

What Are the Implications of a 10-Year vs. Two-Year Inversion?

Business Cycle and Recessions

For timing around the business cycle and recessions, utilising both yield-curve signals can be helpful. Historically, the 10-year vs. two-year slope has been (too) early in providing a recession signal; the three-month vs. two-year slope has provided a timelier signal. Unless the short-term yield curve has inverted, it’s unusual for a recession to occur with only the 10-year vs. two-year curve being inverted. This conclusion is in line with a study by the Fed, which found that the short-term yield curve is a better recession indicator since long-term bond yields, like the 10-year, are more subject to risk premiums.1

Another important takeaway from our analysis is that yield-curve inversion is not a consistent tactical indicator of recessions. Even with our preferred measure, the lead time has varied from four to 18 months.

Applying this analysis to today’s environment, we think the yield-curve signals are correctly indicating that a recession seems unlikely over the upcoming year, but that odds have increased in the medium term and there is downside risk. For additional insights, particularly related to the difficulty of the Fed achieving a “soft landing”, please reference our previous piece, “Fed Pivot Becomes Fed Prayer” .

Exhibit 3: Short End of the Yield-Curve Slope Has Provided a Better Recession Signal

Growth Momentum

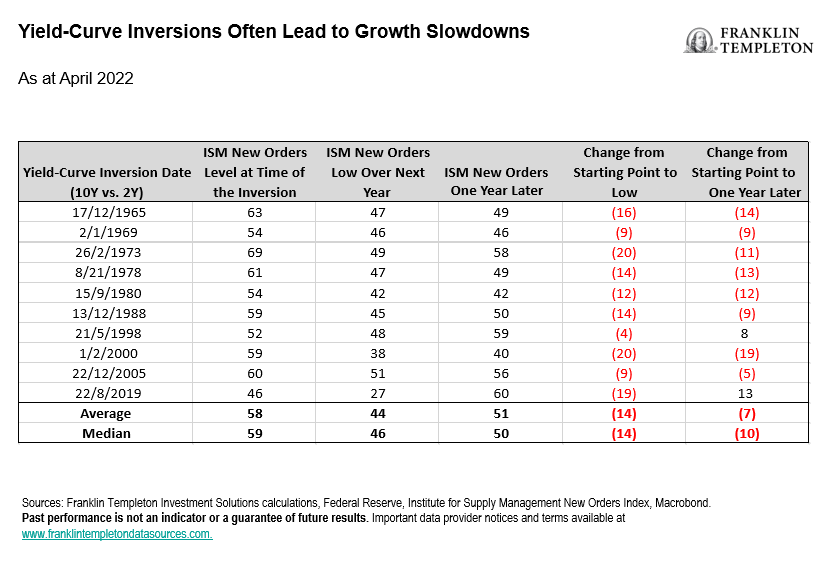

Growth momentum has consistently slowed following the inversion of the 10-year vs. two-year yield curve slope. We proxy growth momentum using the ISM Manufacturing New Orders Index, which is a leading indicator for the broader economy. After a 10-year vs. two-year inversion, manufacturing new orders are usually lower a year ahead, and often experience an even larger drawdown during that period.

Applying this analysis to today’s environment, our broad expectations are for growth levels to fall back to trend levels. We have already seen ISM Manufacturing New Orders fall to 53.5, their lowest level since June 2020. New orders at a level above 50 suggests economic growth, while levels below 50 indicate economic contraction. The below analysis suggests this growth outlook may have risks tilted to the downside.

Exhibit 4: Yield-Curve Inversions Often Lead to Growth Slowdowns

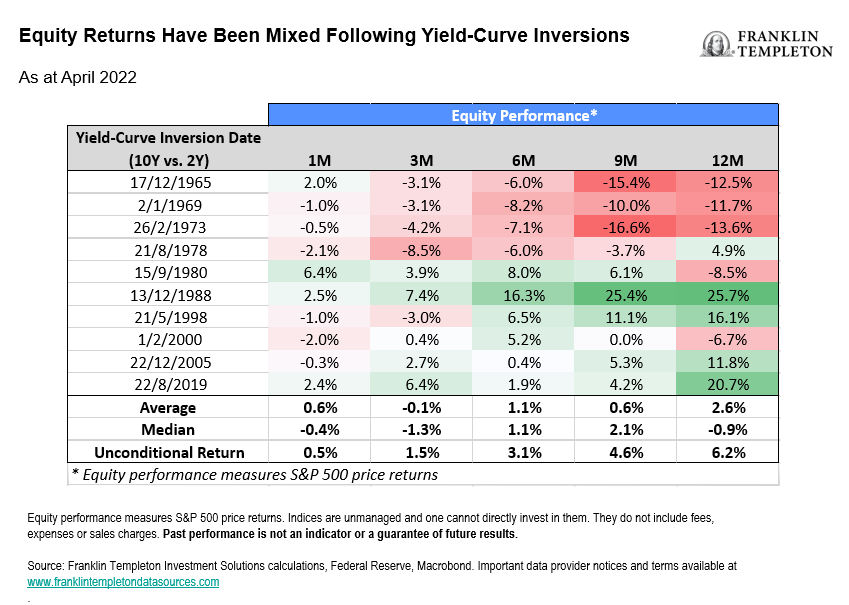

Equity Performance

The most straightforward analysis suggests that equity performance is mixed after the 10-year vs. two-year yield curve has inverted. There is an interesting divergence in the last 35 years (particularly after inflation peaked in the early 1980s), where yield-curve inversion has been less predictive of negative equity returns (arguably, even sometimes a positive signal). But during the Great Inflation,3 yield-curve inversion was generally detrimental to equity returns.

Today’s environment presents some unique considerations in addition to the yield-curve analysis. We have noted before that the macro backdrop is becoming more precarious. In addition, equity valuations are generally historically expensive. However, given the level of real bond yields, relative valuations still suggest average equity risk premium relative to history. Some market pundits have called this phenomenon “TINA”, short for “There Is No Alternative”. So, despite a weakening macro backdrop and high valuations, investor appetite for equities remains.

Exhibit 5: Equity Returns Have Been Mixed Following Yield-Curve Inversions

Exhibit 6: Mixed Equity Returns Following Yield-Curve Inversion May be Explained by Inflation

Multi-Asset Implications

The inversion of the 10-year vs. two-year yield curve does not signal an imminent recession on its own, but it does add to our list of worries as we move into the second quarter of 2022. A recession in the next 12 months is not our base case; therefore, we have not positioned our portfolios in an outright defensive manner. Instead, we are shifting to a more cautious posture. Most recently, we have reduced our preference for equities and now have a neutral view versus fixed income.

We are forecasting a US growth slowdown towards trend levels, and our analysis around yield-curve inversions supports this outlook, but we highlight downside risks. Equity performance has been mixed following yield-curve inversions; in high inflation environments, as we are currently experiencing, it has signalled a more negative outlook for equity returns. Overall, our analysis warrants a nimble and cautious approach to risk assets.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline.

Past performance is not an indicator or guarantee of future performance. There is no assurance that any estimate, forecast or projection will be realised.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions, and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this presentation has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Franklin Distributors, LLC. Member FINRA/SIPC. Prior to July 7, 2021, Franklin Templeton Distributors, Inc., and Legg Mason Investor Services, LLC served as mutual fund distributors for Franklin Templeton.

______________

1. Note that risk premiums, also referred to as term premiums, are also embedded in bond yields. Risk premiums are usually greater for longer duration bonds, reflecting added compensation for a longer holding period. Over the last several decades, most measures of term premiums have drifted lower.

2. Source: Engstrom, E., Sharpe, S. “(Don’t Fear) The Yield Curve, Reprise,” The Federal Reserve, 25 March 2022.

3. A macroeconomic event in the United States from 1965-1982, characterised by a soaring inflation rate that peaked at nearly 15% in 1980.

This post was first published at the official blog of Franklin Templeton Investments.