by Brian Levitt, Invesco Canada

Hawkish talk from the U.S. Federal Reserve hasn’t done much to calm investor concerns about long-term inflation. But it may yet be premature to call the end of this cycle for U.S. equities.

U.S. Federal Reserve (Fed) Chair Jerome Powell’s comments on Thursday at a panel hosted by the International Monetary Fund were viewed as exceedingly hawkish, and yet long-term inflation expectations rose. What, as investors, do we make of this? Maybe it’s not as dire as it seems at first blush.

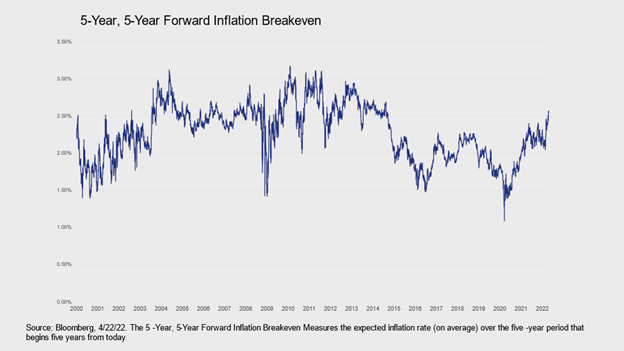

Equity investors seemed to have voted on Thursday and Friday, with the S&P 500 Index falling over 4% from Wednesday’s close.1 The pessimistic narrative hinges on the fact that long-term inflation expectations have climbed by nearly 30 basis points this month and are now close to 2.6% — despite all of the hawkish talk by Fed members in recent weeks.2 Clearly, the market still views the Fed as being woefully behind the curve. Imbedded in that view is that we can hold out hope for a soft landing, but we shouldn’t hold our collective breaths that the Fed can make this happen. To suppress long-term inflation expectations, the Fed may ultimately have to hit the brakes harder than any of us would have hoped — and beyond what the market has priced in so far.

Has U.S. inflation already peaked?

I acknowledge that is a reasonable assessment. The risks to the cycle are, in fact, elevated. However, the irony of the narrative is that the much-anticipated peak in U.S. inflation may now finally be here, albeit at a very elevated level. Used car prices have been declining.3 Commodity prices have cooled.4 Consumers appear to even be balking at higher Netflix subscription costs!5 I believe disinflation will likely persist in the coming months as the U.S. economy slows. Nonetheless, I believe it will be very difficult for the Fed to get inflation to 2% without a meaningful rise in the unemployment rate, which would probably cause a recession.

As such, the directional path of inflation for this cycle may prove more important to the Fed than the ultimate level. Perhaps, the rise in inflation expectations is simply the market coming to grips with a Fed that may be comfortable with a higher-than-2% inflation rate. The probability of that scenario is still reasonably high, in my view, so long as long-term inflation expectations do not become unanchored, which does not yet seem to be the case.

Long-term inflation expectations

5-year, 5-year forward inflation breakeven

Conclusion

Investors can likely expect volatility to persist. U.S. financial conditions are likely to further tighten in the weeks ahead. However, it may yet be premature to call the end of this cycle. If the Fed does become comfortable with a falling, but still-elevated, inflation rate, I believe U.S. stocks potentially stand to benefit.

1 Source: Bloomberg, L.P.

2 Source: Bloomberg, 4/22/22. Based on the 5-Year, 5-Year forward inflation breakeven, which measures the expected inflation rate (on average) over the five-year period that begins five years from today.

3 Source: U.S. Bureau of Labor Statistics, 3/31/22.

4 Source: Bloomberg, 4/22/22. As represented by the S&P Goldman Sachs Commodity Index. The S&P GSCI is a composite index of commodities that measures the performance of the commodities market.

5 Source: Reuters, “Netflix rocked by subscriber loss, may offer cheaper ad-supported plans,” April 20, 2022

This post was first published at the official blog of Invesco Canada.