by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

TSX Gold iShars $XGD.CA moved above $23.43 extending an intermediate uptrend.

U.S. equities related to the U.S. infrastructure sector are extending gains. Caterpillar $CAT a Dow Jones Industrial Average stock moved above $229.81 extending an intermediate uptrend.

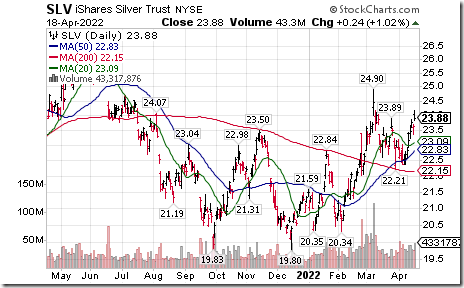

Silver iShares $SLV moved above intermediate resistance at $23.89.

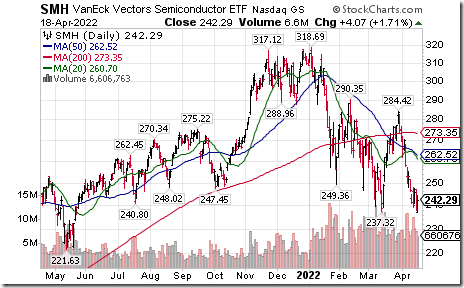

Semiconductor ETF $SMH moved below $237.32 extending an intermediate downtrend.

Soybean ETF $SOYB moved above $28.29 extending an intermediate uptrend.

Consolidated Energy $CEIX a NASDAQ 100 stock moved above $48.12 to an all-time high extending an intermediate uptrend.

Walt Disney $DIS a Dow Jones Industrial Average stock moved below $128.38 extending an intermediate downtrend.

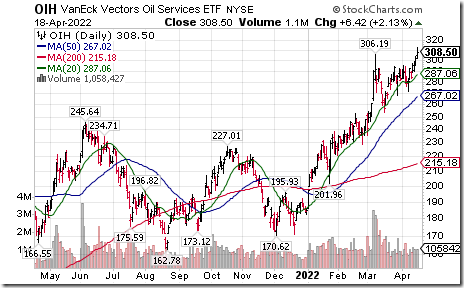

Oil Services ETF $OIH moved above $306.19 extending an intermediate uptrend. Seasonal influences are favourable to June 29th. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/vaneck-vectors-oil-services-etf-nyseoih-seasonal-chart

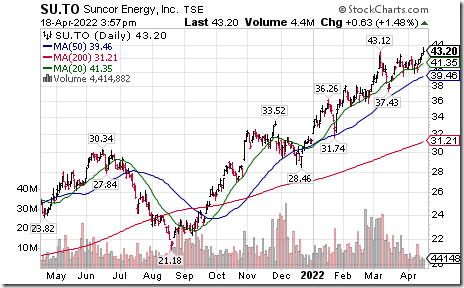

Suncor $SU.CA a TSX 60 stock moved above Cdn$43.12 extending an intermediate uptrend.

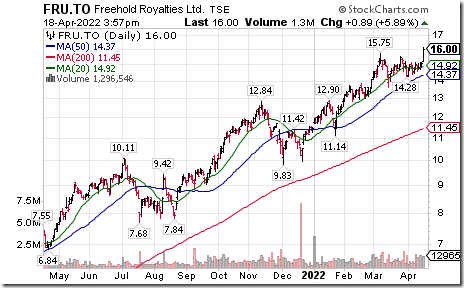

Canadian "gassy" stocks continue to advance. Freehold Royaties $FRU.CA moved above $15.75 extending an intermediate uptrend. Seasonal influences are favourable to August 10th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/freehold-royalties-tsefru-seasonal-chart

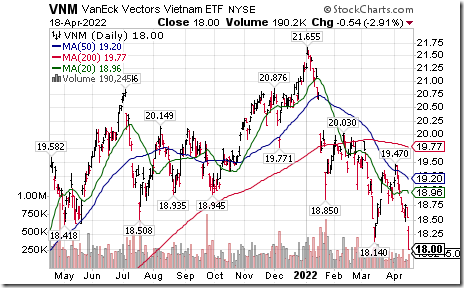

Far East equity indices and related ETFs remain under technical pressure. Taiwan ETF $EWT and Vietnam ETF $VNM are hitting annual lows. South Korea ETF $EWY is testing an annual low. Vietnam ETF moved below $18.14 extending an intermediate downtrend.

Starbucks $SBUX a Dow Jones Industrial Average stock moved below $78.92 extending an intermediate downtrend.

Bausch Health $BHC.CA a TSX 60 stock moved below Cdn$26.62 extending an intermediate downtrend.

Trader’s Corner

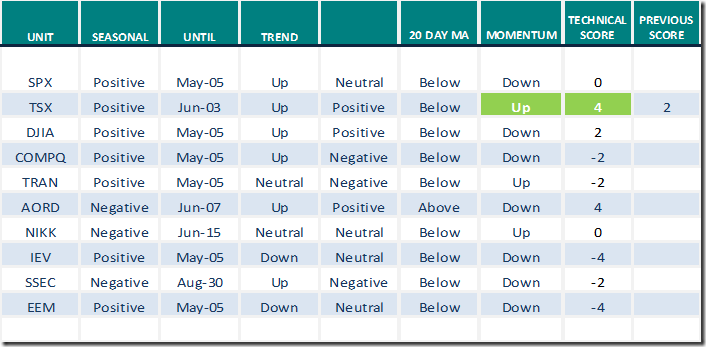

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 18th 2022

Green: Increase from previous day

Red: Decrease from previous day

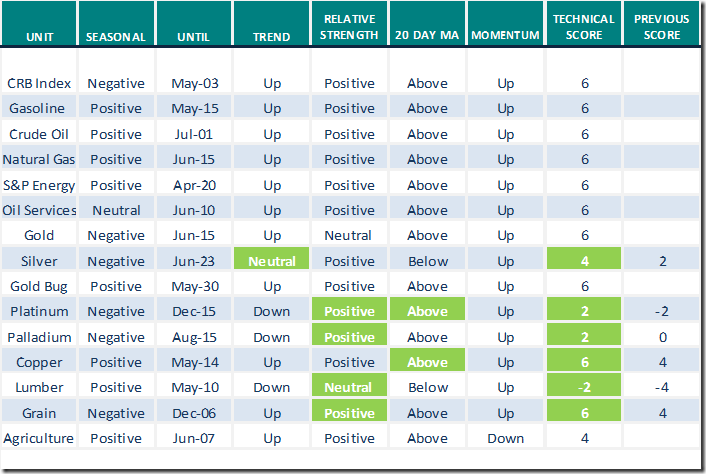

Commodities

Daily Seasonal/Technical Commodities Trends for April 18th 2022

Green: Increase from previous day

Red: Decrease from previous day

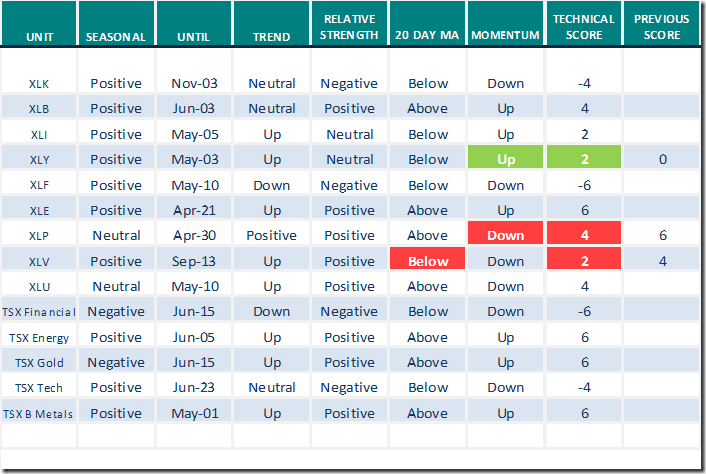

Sectors

Daily Seasonal/Technical Sector Trends for April 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 2.00 to 51.50 yesterday. It remains Neutral. Trend remains down.

The long term Barometer slipped 0.40 to 47.90 yesterday. It remains Neutral. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer slipped 2.82 to 58.37 yesterday. It changed from Overbought to Neutral on a drop below 60.00.

The long term Barometer added 0.56 to 62.90 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.