by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

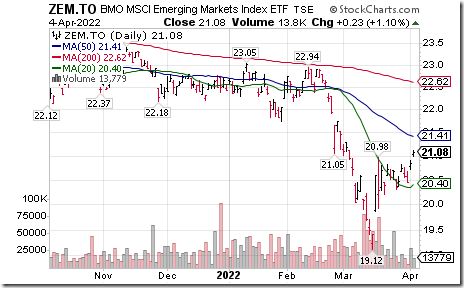

Lots of technical action by emerging market ETFs this morning!: Breakouts from intermediate base building patterns! BMO Emerging Markets ETF $ZEM.CA moved above Cdn$20.98. Frontier iShares $FM moved above $33.35. Vietnam ETF $VNM moved above $19.35. India ETF $PIN moved above $26.79.

Gold equities are responding nicely to higher gold prices. Kinross Gold $K.CA moved above Cdn$7.58. Agnico-Eagle $AEM advanced above $63.73

Another Canadian gold producer breakout! Yamana Gold $YRI.CA a TSX 60 stock moved above $7.35 extending an intermediate uptrend.

TSX Energy iShares $XEG.CA moved above $14.83 to an 8 year high extending an intermediate uptrend.

Shanghai Composite Index $SSEC moved above 3,279.89 completing an intermediate bottoming pattern.

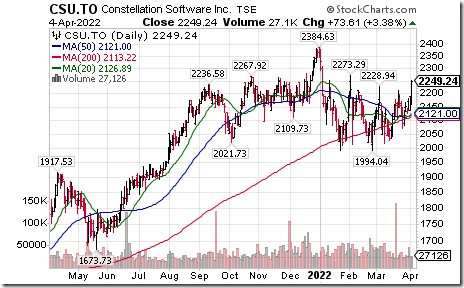

Constellation Software $CSU.CA a TSX 60 stock moved above $2,228.94 resuming an intermediate uptrend.

First Trust Biotech ETf $FBT moved above $154.63 completing a double bottom pattern.

Fox $FOX an S&P 100 stock moved below $35.57 and $FOXA moved below $38.58 extending an intermediate downtrend.

U.S. money center bank stocks are under technical pressure. Bank of New York Mellon $BK moved below $48.84 extending an intermediate downtrend. US Bancorp $USB moved below $52.02 extending an intermediate downtrend.

Paccar $PCAR a NASDAQ 100 stock moved below $82.97 extending an intermediate downtrend.

Wal-mart $WMT a Dow Jones Industrial Average stock moved above $151.27 to an all-time high extending an intermediate uptrend.

Trader’s Corner

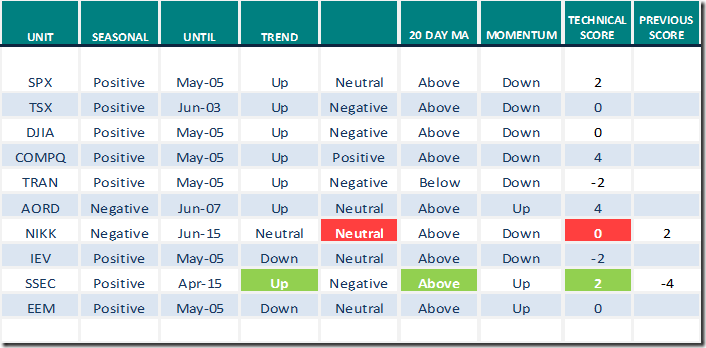

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

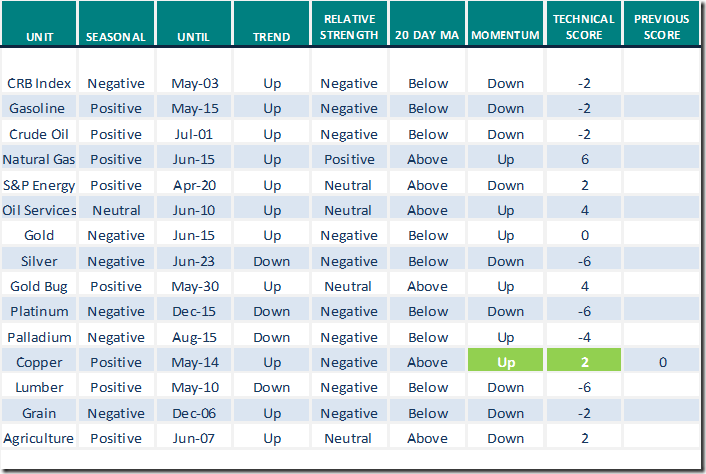

Commodities

Daily Seasonal/Technical Commodities Trends for April 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

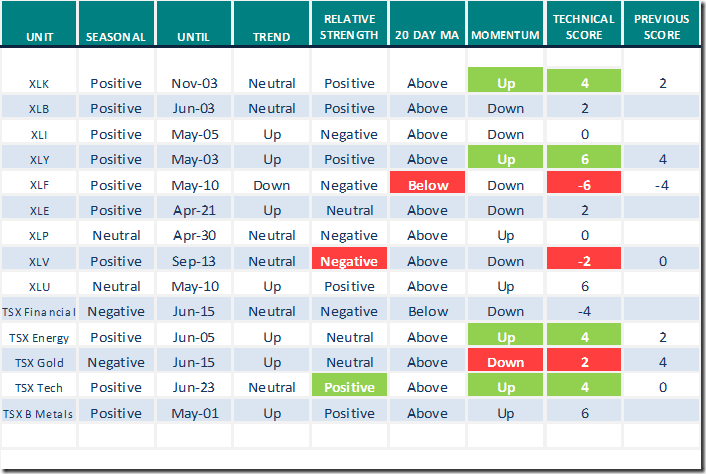

Sectors

Daily Seasonal/Technical Sector Trends for April 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Contributors

Greg Schell asks “How do trains make U-turns”?

How Do Trains Make U-Turns? | The Canadian Technician | StockCharts.com

Trading Survival and Success Strategies | Bruce Fraser & Andrew Cardwell

https://www.youtube.com/watch?v=aQjhRpaqj4E

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.40 to 65.73 yesterday. It remains Overbought.

The long term Barometer added 0.20 to 52.71 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 1.44 to 66.81 yesterday. It remains Overbought.

The long term Barometer eased 0.76 to 62.01 yesterday. It remains Overbought and showing signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.