by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

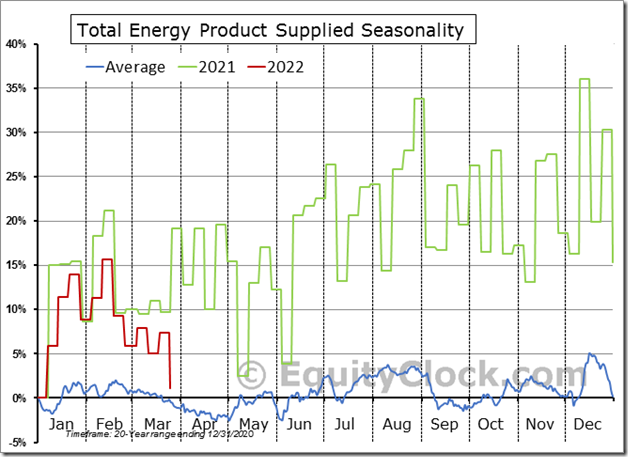

Demand for petroleum products has fallen sharply since the middle of February as the high cost of fuel forces consumers to reconsider their driving habits. equityclock.com/2022/03/30/… $STUDY $MACRO $XLE $XOP $IYE $VDE $USO $UGA $CL_F $RB_F

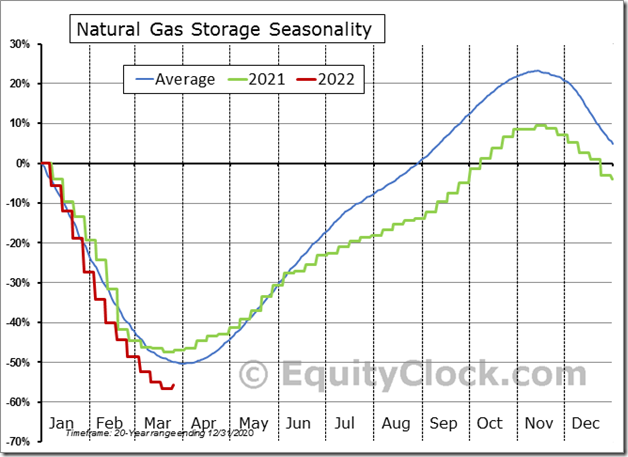

A significant sign of spring has arrived with the first injection to Natural Gas stockpiles of the year. The change in inventories has been trending firmly below average all year, conducive to the rise in the price of the commodity. $UNG $UNL $NG_F $UGAZ $DGAZ #NATGAS

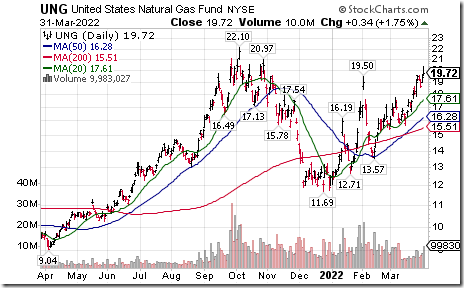

Natural gas ETN $UNG moved above $19.50 extending an intermediate uptrend. Weekly storage report released at 10:30 AM EDT was in line with consensus.

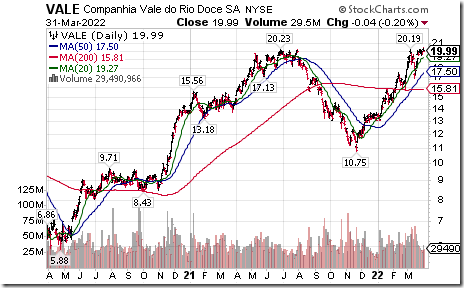

Vale $VALE one of the world’s largest base metals producers moved above $20.23 to an 11 year high extending an intermediate uptrend.

Imperial Oil $IMO.CA a TSX 60 stock moved above Cdn$60.51 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to June 2nd. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/imperial-oil-limited-tseimo-seasonal-chart

Fortis $FTS.CA a TSX 60 stock moved above $61.74 to an all-time high extending an intermediate uptrend.

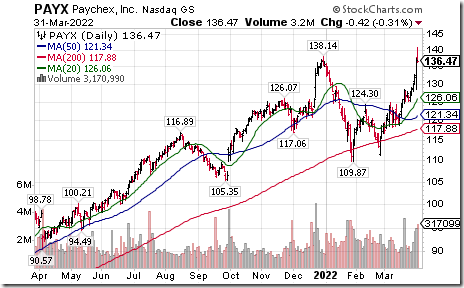

Paychex $PAYX a NASDAQ 100 stock moved above $138.14 to an all-time high extending an intermediate uptrend.

Kinder Morgan $KMI an S&P 100 stock moved above $19.15 extending an intermediate uptrend.

Waste Connections $WCN.CA moved above $175.86 to an all-time high extending an intermediate uptrend.

Algonquin Power $AQN.CA a TSX 60 stock moved above $19.52 extending an intermediate uptrend.

Lowe’s $LOW moved below $206.24 extending an intermediate downtrend.

Citigroup $C an S&P 500 stock moved below $55.83 extending an intermediate downtrend. Responding to the narrowing of interest rate spreads.

Trader’s Corner

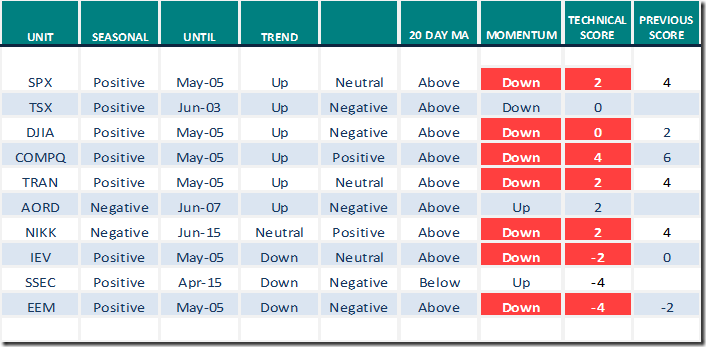

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 31st 2022

Green: Increase from previous day

Red: Decrease from previous day

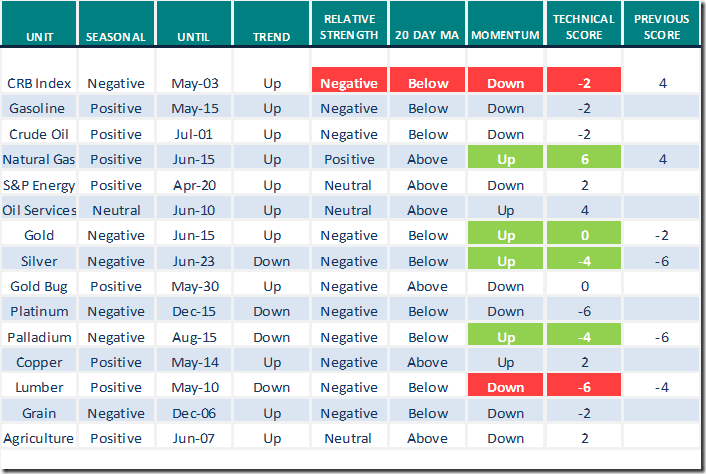

Commodities

Daily Seasonal/Technical Commodities Trends for March 31st 2022

Green: Increase from previous day

Red: Decrease from previous day

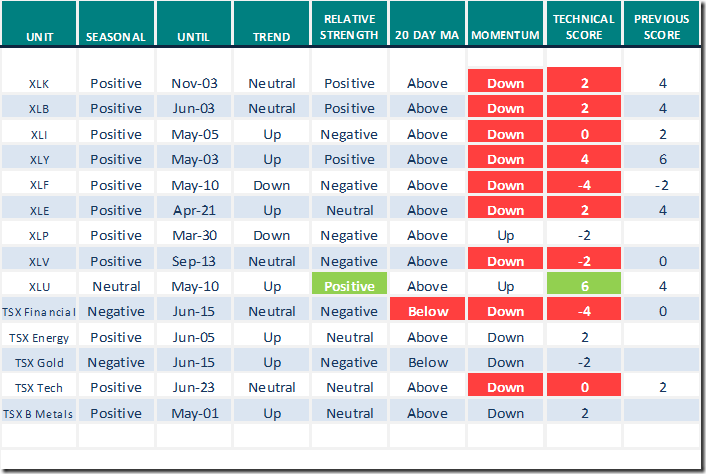

Sectors

Daily Seasonal/Technical Sector Trends for March 31st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.61 to 62.53 yesterday. It remains Overbought, but showing short term signs of rolling over.

The long term Barometer dropped 4.01 to 53.91 yesterday. It remains Neutral and showing short term signs of rolling over.

TSX Momentum Barometers

The intermediate term Barometer dropped 3.34 to 68.40 yesterday. It remains Overbought and showing short term signs of rolling over.

The long term Barometer dropped 3.32 to 63.64 yesterday. It remains Overbought and showing early signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.