by Vinod Chathlani, Portfolio Manager—Multi-Asset Solutions, Mark Gleason, CFA, Director—Multi-Asset Business Development, AllianceBernstein

The highest inflation in 40 years has spurred more investors to search for assets that can help offset its bite. Commodities exposure, designed carefully, can provide effective inflation defense and portfolio diversification. But after many years of being mostly overlooked by investors, commodities have only recently re-entered the conversation—we think for the right reasons.

Supply-Demand Challenges End a Dry Spell for Commodities

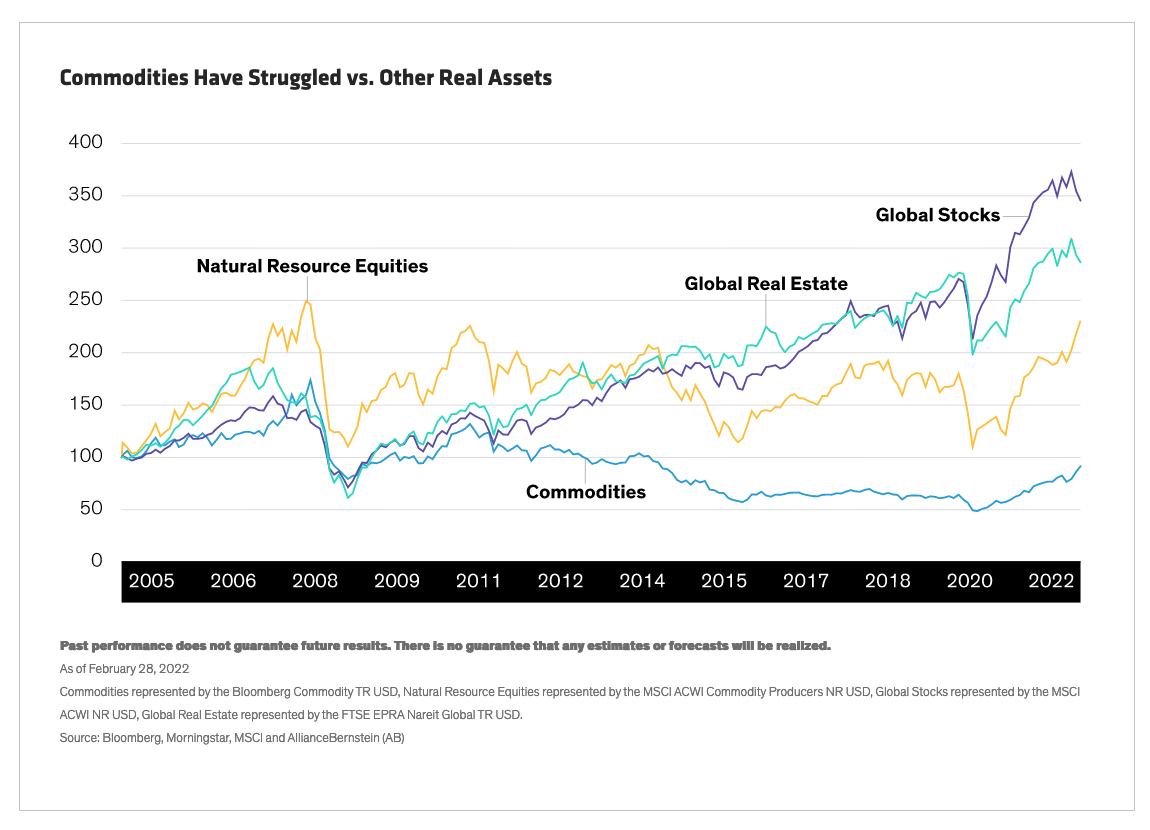

Whether it’s commodities’ volatile nature, excess capacity from the last cycle or a growing emphasis on environmental, social and governance investing, commodities have taken a back seat to other real assets and equities for many years. After nearly a decade of struggles (Display) and underinvestment, the supportive infrastructure and supply for many commodities have become strained.

Today, lingering supply-chain disruptions from COVID-19, higher-for-longer inflation and geopolitical risks have only exacerbated these pressures. Adding fuel to the fire is elevated demand across a broad array of commodities as much of the world recovers from COVID-19. But suppliers still struggle to meet that demand, a challenge we think will take years to reverse. This dynamic between supply and demand should support pricing strength going forward, and it’s one reason why commodities look much more compelling now.

More Commodities Are Gaining Traction… Together

It’s hard to paint commodities as a homogenous asset class, given that their risk/return profiles—from crude oil and cattle to soybeans and zinc—can be all over the map and hypersensitive to developments in their own worlds or more broadly.

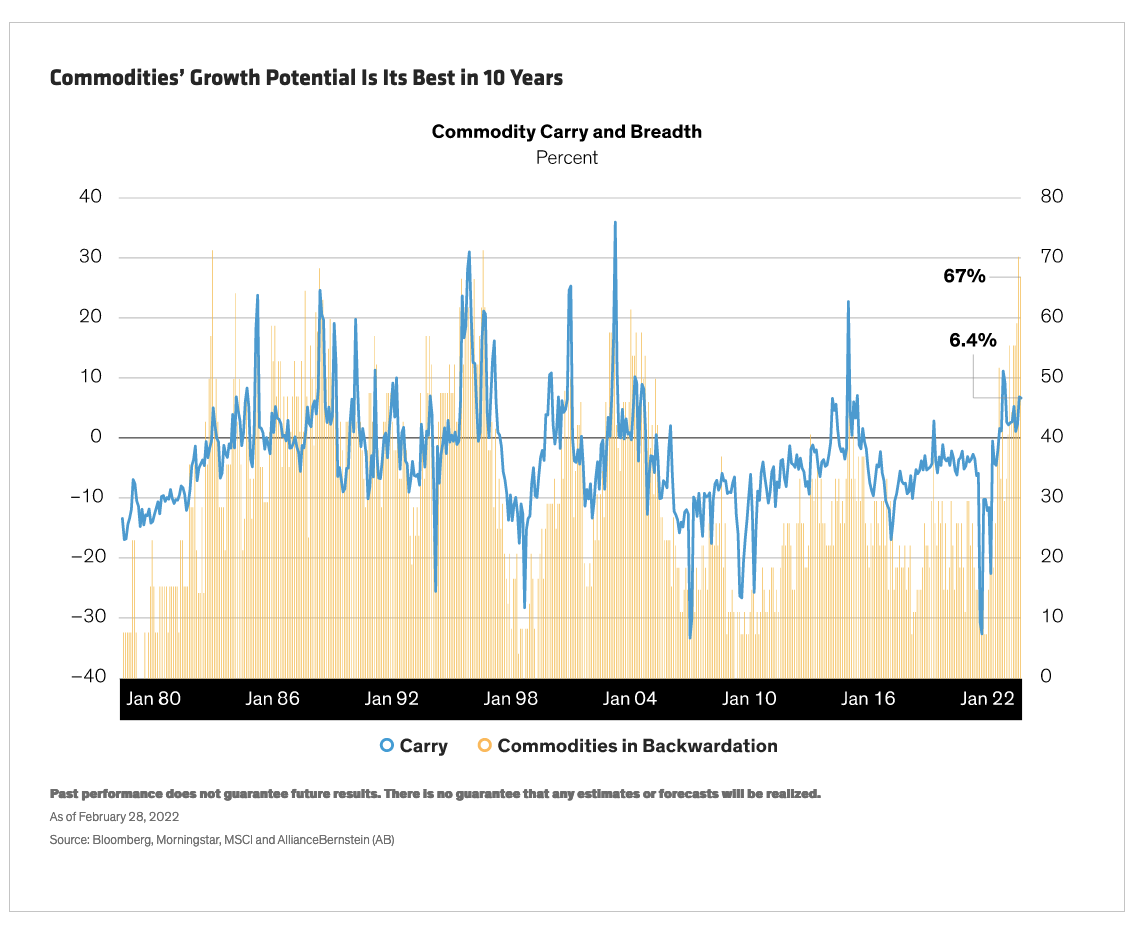

Lately, however, we’re seeing fundamental strength across a broad range of commodities at the same time. Specifically, widespread scarcity has most commodities currently experiencing backwardation: their current prices exceed their prices in comparable contracts for future delivery, indicated by positive carry numbers (Display).

That is a bullish sign, indicating strong demand, weak supply and low inventories—which historically has typically suggested strong return potential. The backwardation in commodities is quite broad, encompassing 70% of the commodity complex—a breadth not seen in years. Strong and broad backwardation bodes well for commodities’ potential—in fact, it’s the strongest in a decade.

Despite Price Hikes, Many Commodities Still Have Room to Grow

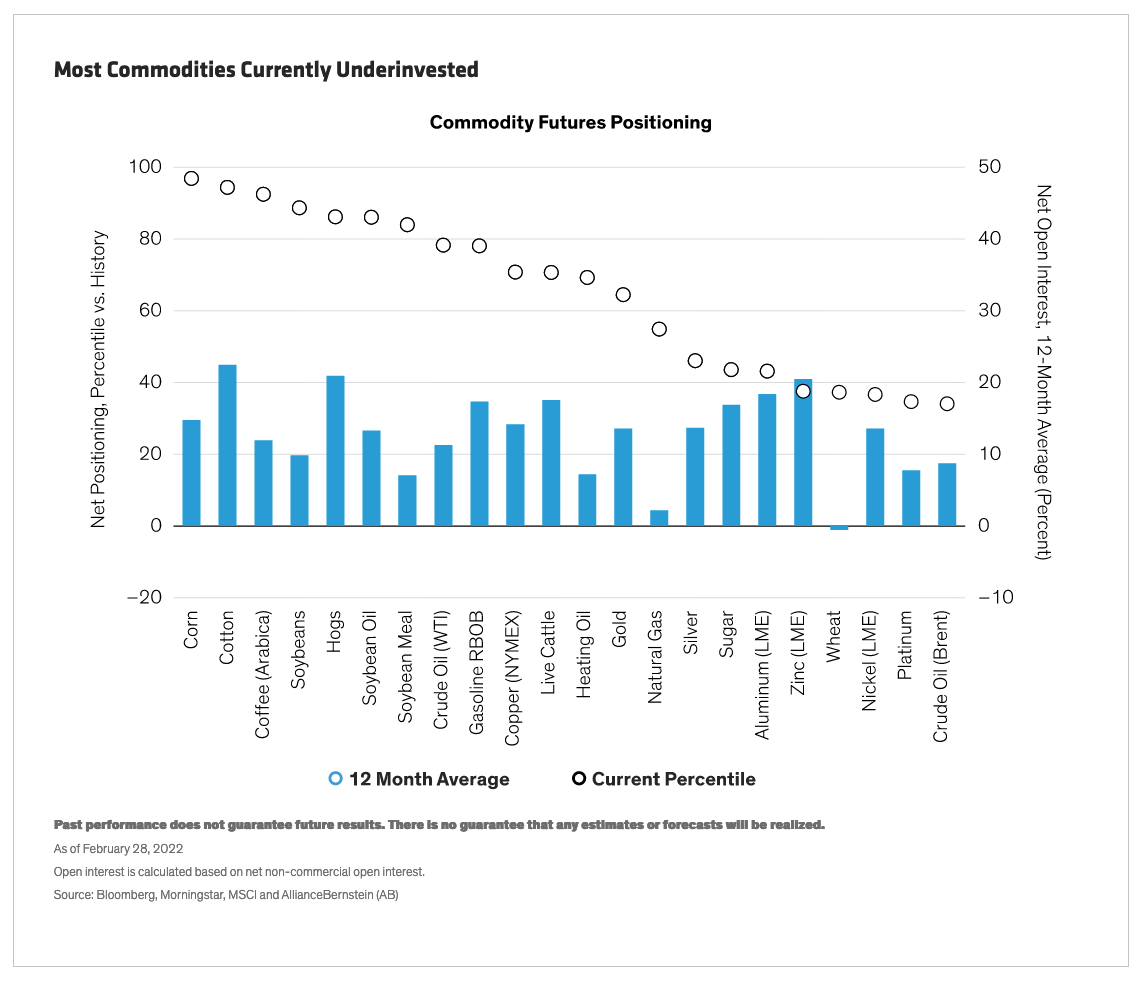

Commodities don’t all travel in lockstep, of course. Some have more potential than others, even with the recent price spikes we’ve seen. In fact, the valuations of many types of commodities seem far from stretched, judging from investors’ net positions (Display, below).

Crude oil, for instance, has averaged a 9% long investor position in the last 12 months, just under the 40th percentile over the longer term. In other words, current speculation in oil isn’t very aggressive, so the likelihood of a mass exit is also low. Conversely, agricultural commodities, such as corn and cotton, have long positions of around 35% and 45%, respectively. This is near the 100th percentile historically, suggesting these commodities are stretched. In these cases, a fully invested market could leave a lot less wiggle room in a significant drawdown.

The takeaway? Commodities are performing well as an asset class, but they’re not monolithic; investors still need to be selective.

Generally, commodities seem increasingly attractive, and they’ve historically outperformed in high-inflation and geopolitically risky environments, much like the one today. But they’re extremely volatile and can underperform equities over extended periods. So, it’s important to take a measured approach to commodities exposure.

We think an effective strategy could be a diversified mix of real assets. In addition to commodity futures, this mix would include real estate equities, natural resources stocks, gold and inflation-sensitive stocks. And by staying flexible, investors can adapt that diversified real asset exposure as part of a well-balanced multi-asset strategy.