by Ryan James Boyle, Senior Economist, Northern Trust

Rate hiking cycles can end with continued growth.

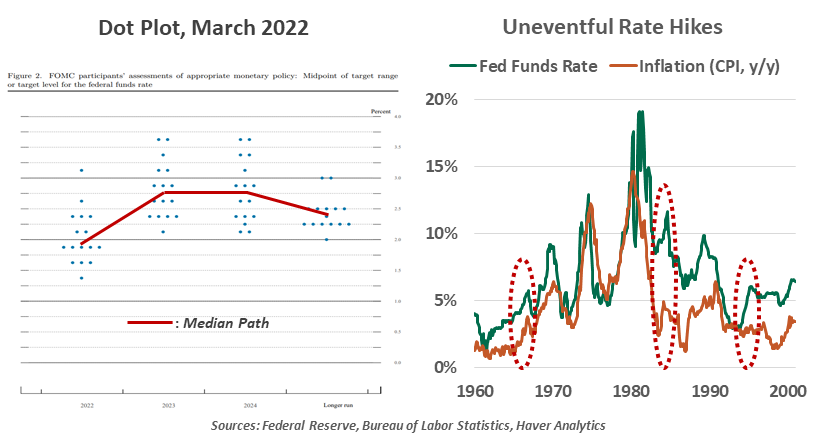

In the past week, the Federal Reserve has made it clear that managing inflation is their top priority. The “dot plot” outlook in the quarterly Summary of Economic Projections set an aggressive interest rate path that aims to bring inflation under control. The Fed Funds Rate is expected to rise quickly to a point above its neutral level before settling at a lower long-run rate.

The Fed is seeking to deliver a soft landing: tightening policy enough to slow the economy into a steady state, without initiating an excessive correction. The soft landing is a mixed metaphor: “Landing” an economy is not like landing an airplane or a gymnastic flip. Cycles play out over the course of years, and the economy never stops moving.

The process is more akin to a marathon or 24-hour auto race. After starting with an initial sprint, contestants settle into the right pace for the long haul. Runners train to manage their fatigue; drivers monitor their fuel and temperature gauges; both take rest stops accordingly. Whether we call it a landing or pace-setting, this will be a complicated maneuver, but history gives a few examples of where it was executed successfully:

- Mid-1960’s: The effective Federal Funds Rate rose from 3.4% in October 1964 to 5.8% in November 1966. Inflation reached a peak of 3.8% in October 1966 and fell thereafter, while the economy carried on for three more years of growth.

- 1984: The target rate increased by two percentage points from March to August of 1984. Inflation leveled off, with no recession until 1990.

- 1994: The Fed Funds target doubled from 3.0% to 6.0% in the span of a year; inflation stayed in check while the economy grew fervently for the rest of the decade.

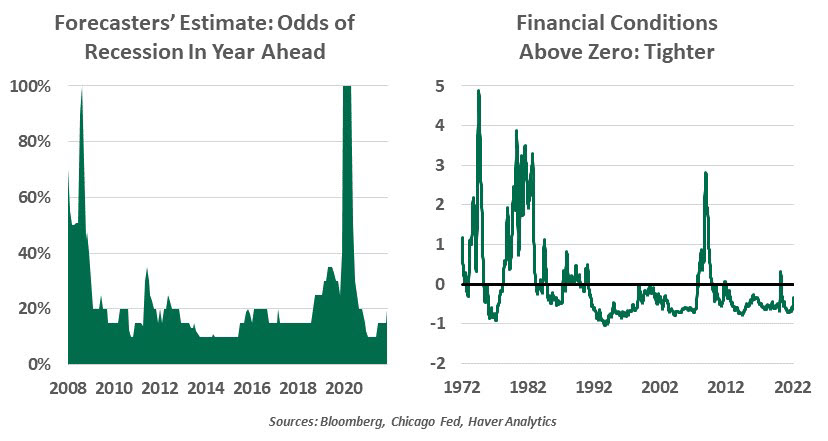

Of course, this is a selective recollection. Rate hiking cycles can culminate in recessions, as was the case when rates rose starting in 1988 and 1999. The Fed recognized the overheating economy in the 2000s, raising the target rate from 1.0% in 2004 to 5.25% in 2006, but that could not prevent a housing-driven correction. And the most recent set of hikes ended inconclusively. The Fed lifted rates without impairing growth, but COVID-19 brought the cycle to an abrupt and unavoidable halt.

Achieving an economic soft landing is not easy, but not impossible.

These past soft landings contained some elements of luck. No idiosyncratic events like pandemics or wars disrupted the economy. Circumstances were often favorable, like growth-supporting fiscal policy in the 1980s and the disinflationary combination of globalization and technology investment in the 1990s.

Circumstances today are very challenging. For starters, the Fed has an explicit inflation target: the optimal rate of 2% only became formal policy in 2012. Past successful policy pushes helped to arrest inflation from rising higher; bringing inflation down from an elevated starting point is a different challenge for central banks.

And it may be harder for interest rates to slow inflation this time around. Many of today’s price pressures have arisen from supply constraints, which are not directly affected by monetary policy. The last time we had persistently high inflation, supply constraints were also involved: the energy-driven challenges of the 1970s. Monetary policy can help to manage demand, but today’s elevated savings, low leverage, rapid hiring and inventory rebuilding are all economic tailwinds that can continue growth even amid higher interest rates.

The Fed is working to find a steady pace, but policy may have to sprint before settling. At the moment, the finish line seems a long way off.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Ryan James Boyle, Vice President, Senior Economist, Northern Trust

Ryan James Boyle, Vice President, Senior Economist, Northern Trust

Ryan James Boyle is a Vice President and Senior Economist within the Global Risk Management division of Northern Trust. In this role, Ryan is responsible for briefing clients and partners on the economy and business conditions, supporting internal stress testing and capital allocation processes, and publishing economic commentaries.