by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Solar ETF $TAN moved above $77.81 extending an intermediate uptrend.

Soybean ETN $SOYB moved above $28.07 extending an intermediate uptrend.

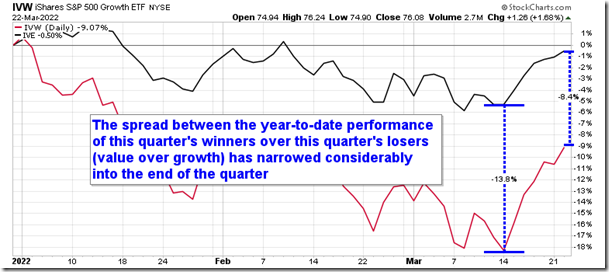

The spread between the performance of this quarter’s winners and this quarter’s losers has narrowed as quarter-end mean reversion progresses. equityclock.com/2022/03/22/… $IVE $IVW $STUDY

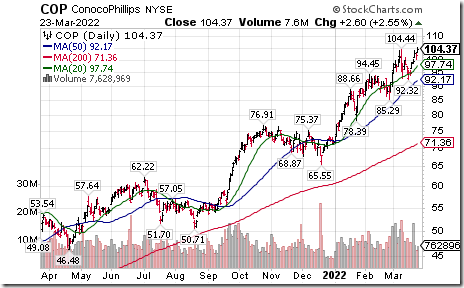

ConocoPhillips $COP an S&P 100 stock moved above $104.44 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to June 11th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/conocophillips-nysecop-seasonal-chart

Canadian Natural Resource $CNQ.CA a TSX 60 stock moved above Cdn$78.74 extending an intermediate uptrend. Seasonal influences are favourable to April 12th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/canadian-natural-resources-limited-tsecnq-seasonal-chart

Intel $INTC a Dow Jones Industrial Average stock moved above $48.99 completing a double bottom pattern.

Trader’s Corner

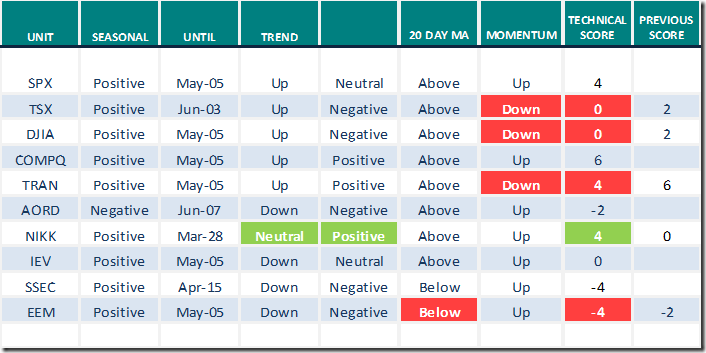

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

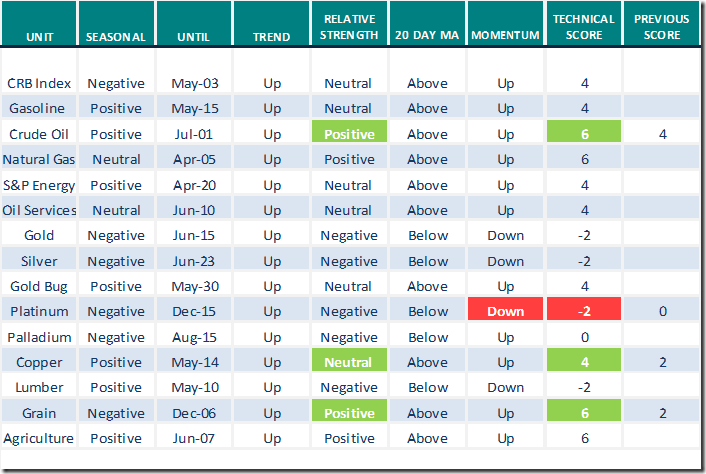

Commodities

Daily Seasonal/Technical Commodities Trends for March 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

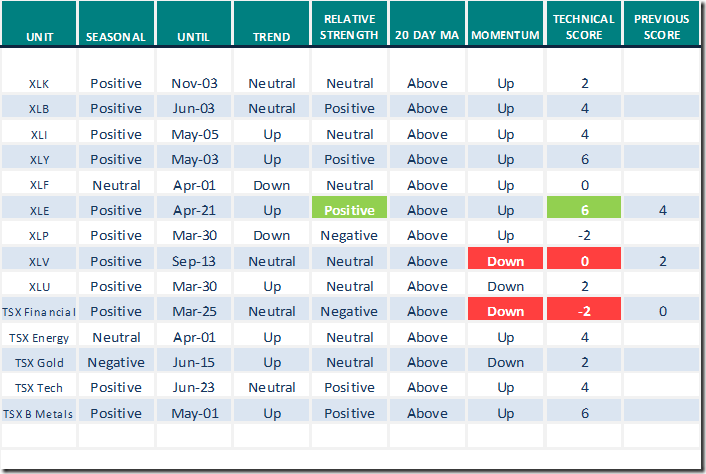

Sectors

Daily Seasonal/Technical Sector Trends for March 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following links:

Still Bullish Yardeni Says Tech Stocks Are "Awfully Cheap" – Uncommon Sense Investor

Is the Fed Leading the Economy Straight Into a Recession? – Uncommon Sense Investor

Greg Schnell discusses “Searching for crypto setups”.

Searching For Crypto Setups | Greg Schnell, CMT | Market Buzz (03.23.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 9.02 to 48.90 yesterday. It remains Neutra.

The long term Barometer slipped 4.41 to 47.70 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.50 to 70.69 yesterday. It is Overbought and showing early signs of rolling over.

The long term Barometer eased 2.44 to 64.22 yesterday. It is Overbought and showing early signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.