by Vaibhav Tandon, Senior Economist, Northern Trust

Renewed lockdowns in China will complicate the supply chain recovery.

The pandemic has persistently disrupted global supply chains. Then the Ukraine-Russia conflict arose, producing shortages of supplies from the affected countries. The ripple effects of the war are weighing on production and prices across a range of industries and companies.

Coincidentally, COVID-19 returned with a vengeance in the world’s factory ─ China. Lockdowns in the nation’s major industrial and tech cities, including Shenzhen, are taking a toll on China’s factories and transport networks.

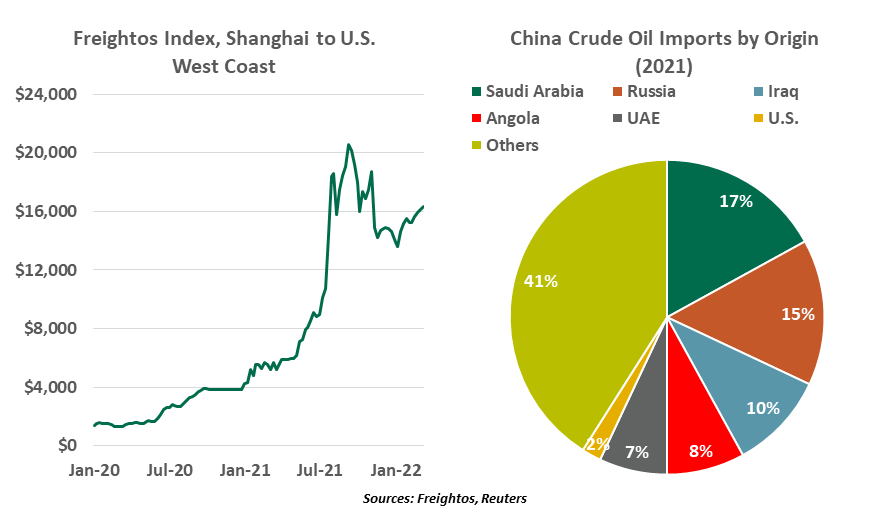

Fresh curbs are keeping factory workers and truck drivers at home, which has disrupted manufacturing of goods ranging from electronic components to mobile phones to cars. As an example, the supplier of a major American technology company shut two of its plants and relocated production elsewhere. Amid this disruption, container rates are rising, congestion is building at Chinese ports and goods are piling up in warehouses.

| The worst is not over for global supply chains. |

Domestic headwinds stemming from China’s zero-COVID approach, the property downturn and the Russia-Ukraine war will weigh on the Chinese economy. China is the world’s top importer of crude oil and the third largest importer of natural gas; Russia accounts for 15% and 10% of China’s oil and gas supplies, respectively. China had already been grappling with high producer and import prices. As a result, China will likely struggle to meet its growth target of 5.5% this year.

While external factors like the war are beyond Beijing’s control, and managing spillovers from the property downturn will be a long-term process, Chinese policymakers can alleviate economic pain in the short term by learning to live with the virus.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Copyright © Northern Trust