by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

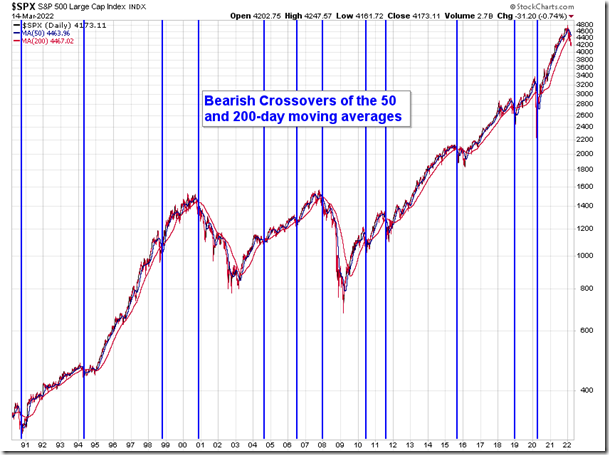

S&P 500 Index has now recorded a death cross of the 50 and 200-day moving averages, but the history of this indicator shows that it is typically unreliable for trading signals outside of periods of economic weakness. equityclock.com/2022/03/14/… $STUDY $SPX $SPY $ES_F

Platinum ETN $PPLT moved below $96.28 and $92.51 setting an intermediate downtrend.

Take Two $TTWO a NASDAQ 100 stock moved below $138.19 extending an intermediate downtrend.

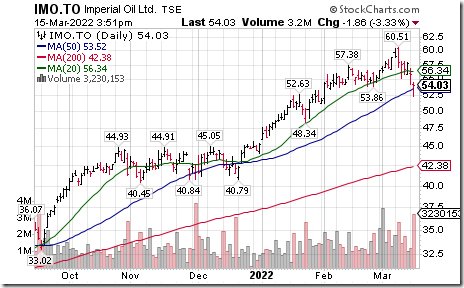

Imperial Oil $IMO.CA a TSX 60 stock moved below intermediate support at $53.86.

Trader’s Corner

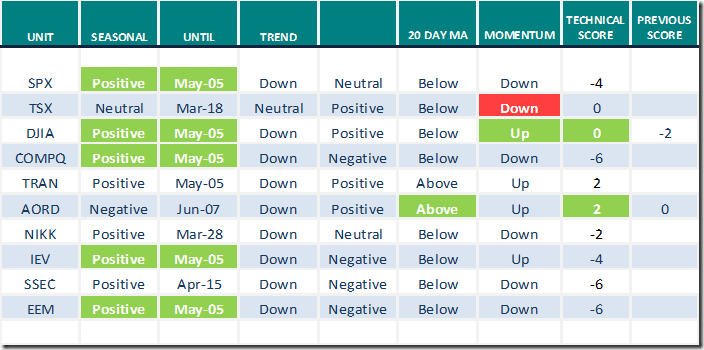

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

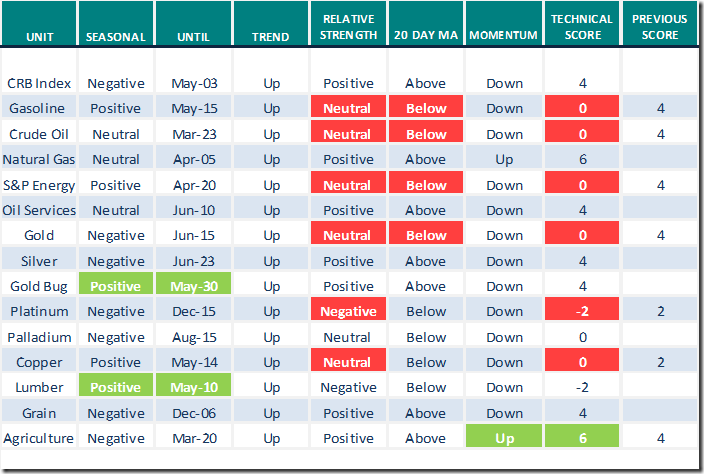

Commodities

Daily Seasonal/Technical Commodities Trends for March 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

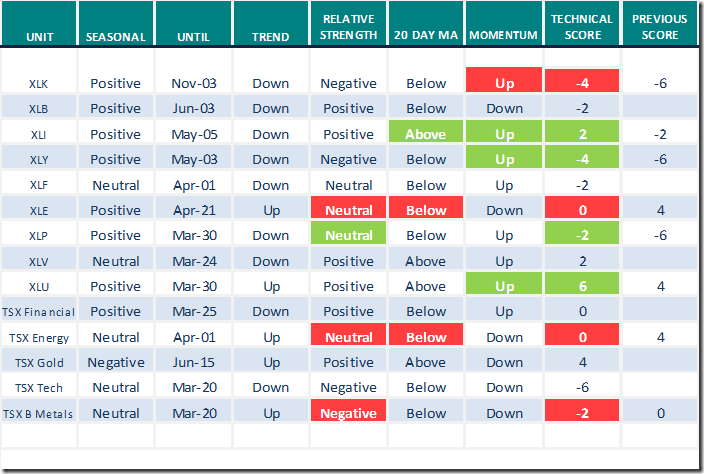

Daily Seasonal/Technical Sector Trends for March 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

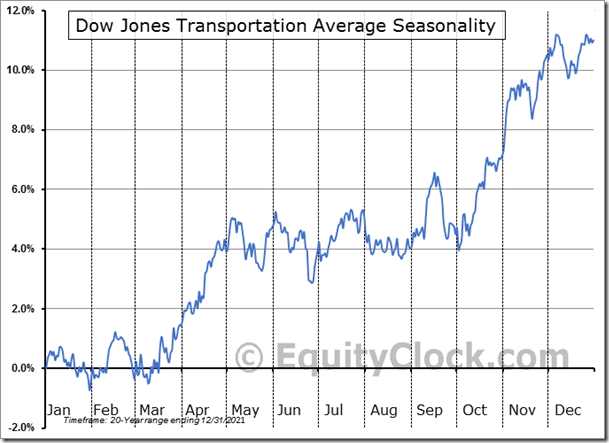

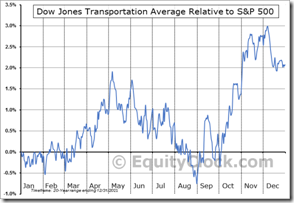

Seasonality Chart of the Day

The Dow Jones Transportation Average on average during the past 20 years has rallied on a real and relative basis (relative to the S&P 500 Index) between now and the first week in May.

Dow Jones Transportation Average Seasonal Chart

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 6.21 to 32.67 yesterday. Initial technical sign of recovery from a bottom?

The long term Barometer gained 3.61 to 41.68 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.91 to 53.48 yesterday. It remains Neutral.

The long term Barometer slipped 0.52 to 59.67 yesterday. It changed from Overbought to Neutral on a drop below 60.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.