by Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, Blackrock

Highlights

1) A stagflationary shockThe Russian invasion of Ukraine may spell higher prices and lower growth for the global economy—increasing downside risks to markets and heightening central bank policy uncertainty.

2) The vaccination for inflation?Central banks have prescribed a regiment of rate increases and the end of QE to stop the spread of inflation, but the dosage may not be adequate to protect against its many variants.

3) Expanding return sources

Rising political tensions make the Fed’s fight with inflation even more tenuous. New sources of diversification and return may be needed as inflation undermines the traditional diversifying properties of bonds.

The U.S. Federal Reserve’s (“Fed”) pivot away from the view that inflation is “transitory” signaled the beginning of the end for the ultra-low rate environment we have come to think of as normal.

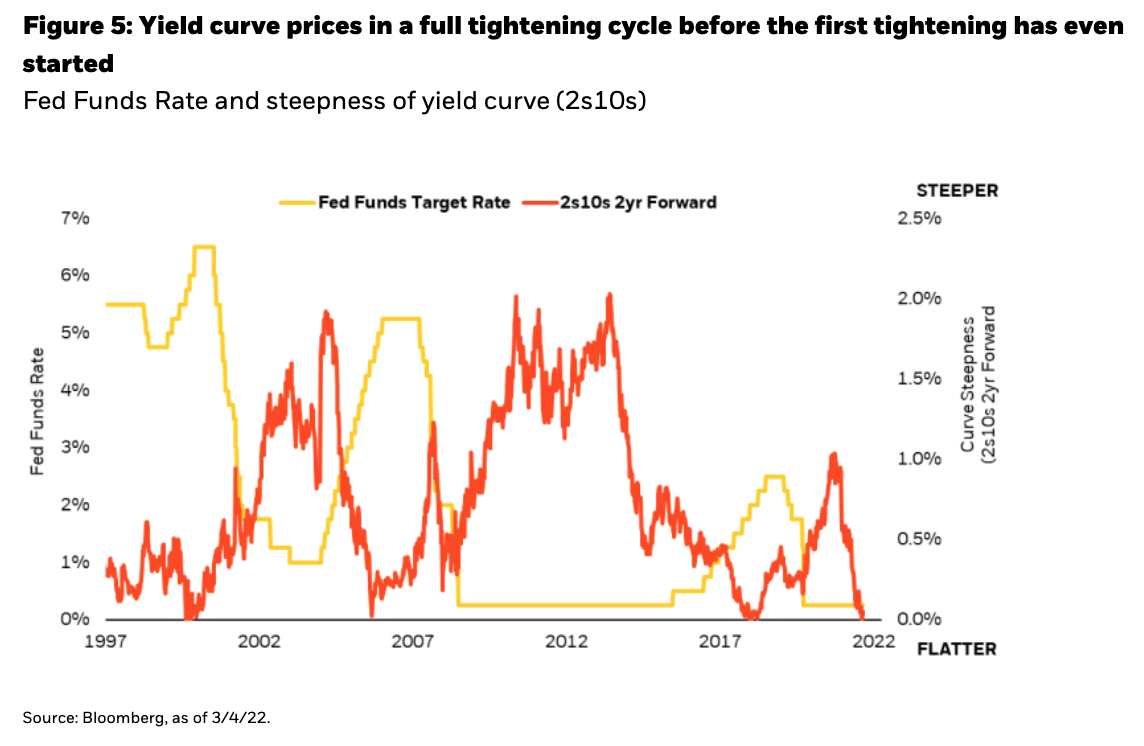

Financial markets reacted to this new information by aggressively repricing shorter-term interest rates to start the year. The exit from these policies now appear well priced-in for the U.S. as yield curves have flattened to levels typically associated with the end of a tightening cycle. Investors are now debating the terminal rate and what happens if inflation does not fall as much as consensus and the Fed expects.

It looks almost certain that the Fed must end the era of quantitative easing (“QE”). Was QE a success? We must wait for quantitative tightening (“QT”) to see. The ultimate judge of more than a decade long experiment in unconventional policies lies in how the Fed can balance its conflicting objectives of maximum employment and stable prices without fully knowing how financial conditions will respond.

Past inflationary cycles rarely end well for financial markets. The Russian invasion induced spike in commodity prices holds the potential to further exacerbate what might already be in train: a wage-price spiral. The risks surrounding this scenario have clearly increased and a more cautious outlook for this downside possibility is increasingly warranted.

A stagflationary shock

The economic and financial impact of the Russian invasion of Ukraine represents a stagflationary shock for the global economy. The prices of commodities, including fuel, food and metals are all surging. Stagflation, an economic environment of stagnant growth and rising inflation, was once a long-tail risk, but now appears to be a real possibility.

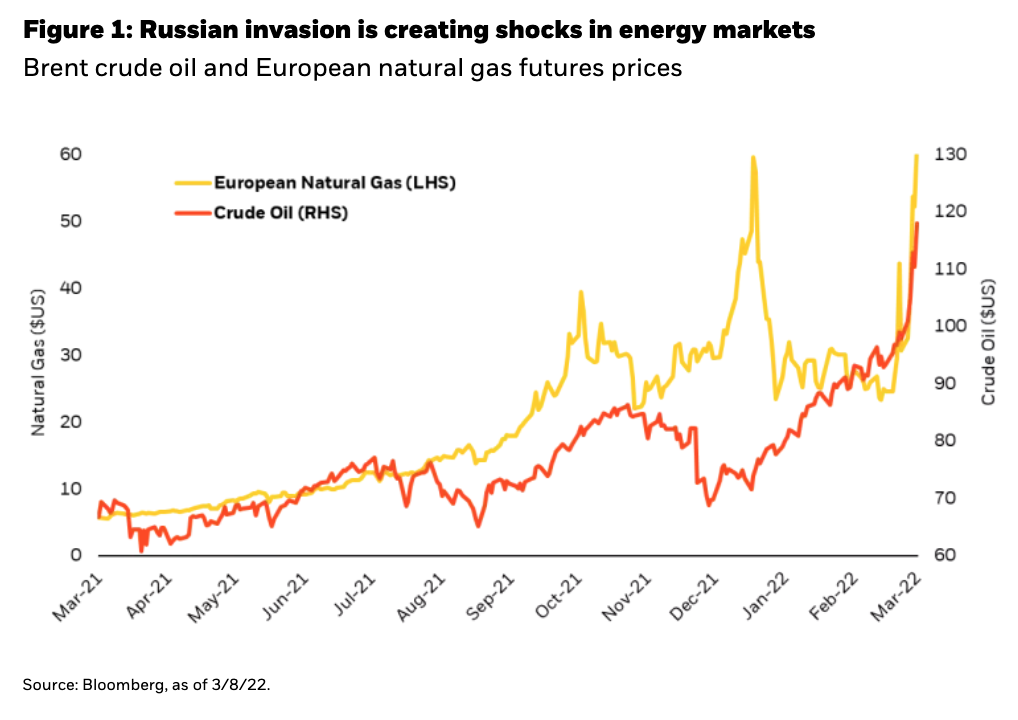

Figure 1 highlights crude oil and European natural gas prices have spiked to multi-year highs in a matter of days. As the Russian-Ukraine conflict continues, higher energy and commodity prices may feed through to broader increases in inflation and—combined with negative sentiment and confidence—a decline in global growth. So far, estimates for those impacts remain modest but hinge critically on the severity of the energy price spike, its duration, and the potential secondary effects.

Markets typically price geopolitical risks quickly. However, with no clear near-term off-ramp for the conflict, we may be at the beginning of a more permanent reordering of Russia’s role in the global economy and more uncertainty as the West counteracts these rising tensions.

Such ramifications are still being assessed in financial markets particularly on the outlook for the policy response. For Europe, with a more direct hit to both inflation and growth, dramatic shifts in security and energy policy suggest an accommodative fiscal policy response while the European Central Bank (“ECB”) outlook has become more balanced between the inflationary (tighter) and growth (loosening) impacts.

For the U.S., higher commodity prices may flow into a longer period of elevated inflation, further bringing into question the forecast for its rapid decline in the second half of 2022.

That will keep pressure on the Fed to normalize its currently highly accommodative stance. Flight-to-quality assets, a popular safe haven during periods of rising geopolitical tensions, may be a less sure outcome given the backdrop of tightening monetary policy.

Expect more shockwaves

The unprecedented level of sanctions imposed on Russia is tantamount to completely removing the country from the global economy. Government officials and Russian-owned companies have been targeted. Its banking sector has been removed from the SWIFT messaging system—essentially disconnecting it from the financial system. Its capital markets have been cut out of global indices. Foreign private companies have stopped selling products and services in Russia. Even yachts have been seized.

The latest move by the U.S. to ban its imports of Russian oil sent oil prices even higher. Extending this ban into Europe particularly in the short run and for Russian gas may not initially be possible, given the current dependency of Europe on Russian gas. However, the realization of the vulnerability has sent European energy and security policy on a new course with significant longer-term consequences. The magnitude of the energy price shock and its length will be key to the economic consequences. Failing to see an easy off-ramp for the crisis, the disruptions to energy markets may prove longer than initially anticipated, raising the uncertainty in the fight to rein in inflation and likely extending its duration.

The vaccination for inflation?

Vaccines gave us great hope that they could ease the scourge of the health pandemic. Analogously, the market expects the central bank “vaccination” for inflation will do the same. Both the Fed and most economic forecasters expect inflation to steadily return to the pre-COVID levels of around 2%. For central banks, vaccinating against inflation means moving away from the pandemic-era policy prescription of massive liquidity support and persistent negative and zero policy rates.

But like the unpredictable peaks and valleys of the virus’s case count curve, markets may face the realization that these inflation vaccines may not be entirely effective against the “variants” of inflation. If so, markets may need to learn to live with more “endemic” inflation rather than a swift to return to “normal” that markets have experienced for the past decade.

Retiring “transitory”

The start of 2022 has not been kind to the old “transitory” view of inflation. Alongside “still dancing” and “subprime is too small to matter”, Fed Chair Jerome Powell retired “transitory” to the ash heap of historic market quip fails. Now, he has pivoted the Fed to acknowledging a more balanced view of inflation and a need to shift policy to a much less accommodative stance. Incoming data has made this reaction appear even further behind the curve, with continuously elevated readings signaling pressures beyond the supply chain bottlenecks associated with COVID disruptions.

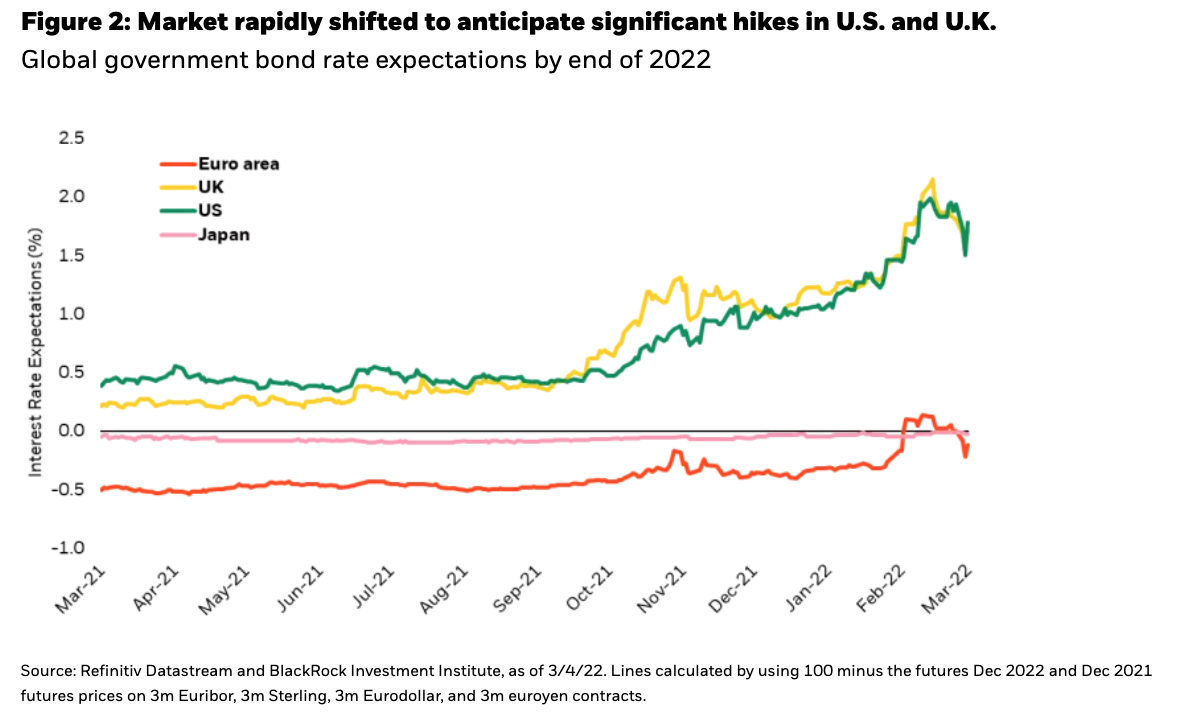

This inflation situation is not just a U.S. dilemma. European inflation data has started to break higher, and the ECB seems ready to break its policy commitment to hold rates constant throughout 2022. As a result, global rate expectations have moved significantly higher since the start of the year (Figure 2).

These market moves stand in contrast to the still benign inflation view held by both central banks and most economic forecasters. Though market expectations stand above official central bank forecasts, both parties anticipate a reduction in inflation back towards long-run goals of 2%.

Despite retiring the "transitory" label, Fed policy forecasts reflected a transitory view of inflation. However, as inflation continues to be high and with recent energy price shocks, policymakers have clearly highlighted that the risks to inflation are on the upside to these forecasts. The key is whether inflation can actually decline even with above average longer-run real GDP growth, below longer-run unemployment levels, and with negative real policy rates. If not, absent changes in the first two, the Fed will need to set real policy rates higher than zero to bring inflation down or hope the supply side improvements underlying the "transitory" view on inflation can alone account for a return to pre-COVID inflation levels.

Risks assuming inflation is benign

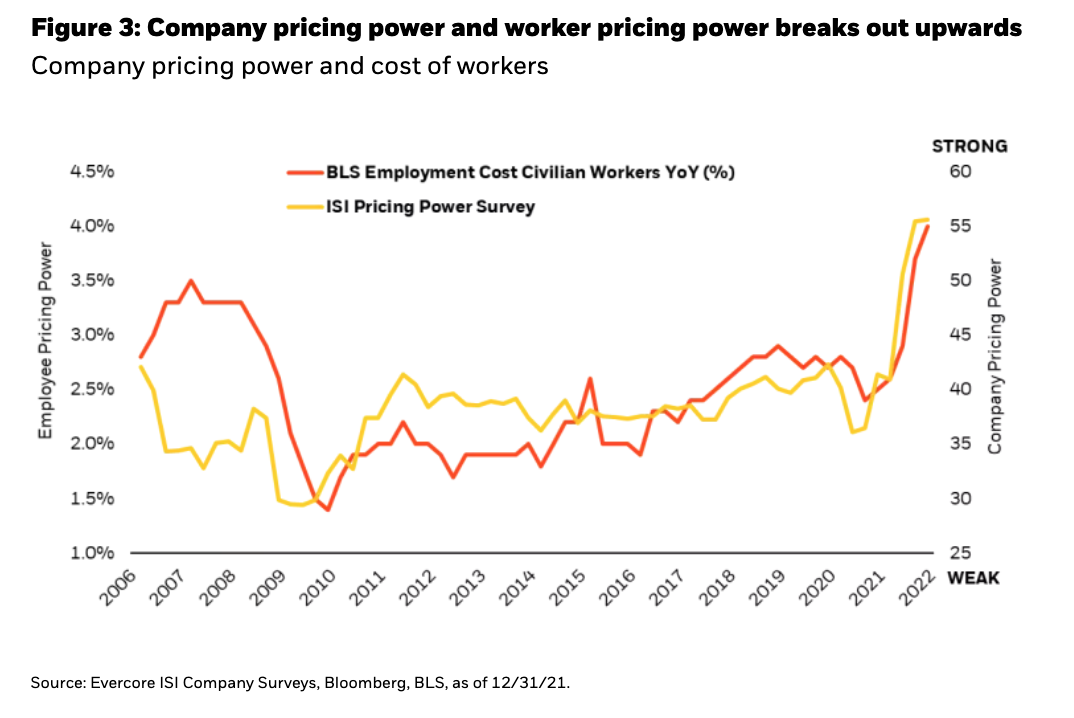

To use our virus metaphor, one of the key signposts of inflation moving from a spreading “pandemic” to more of a constant “endemic” is firm and worker pricing power. Both companies and workers have discovered they have pricing power (Figure 3). Historically high levels of “quits rate” indicate workers are exercising pricing power through elevated job switching. Similarly, companies report for the first time a strong ability to pass on price increases. Add to that now a more prolonged inflationary environment from the commodity spike, and the risks grow that transitory inflationary becomes entrenched.

This combination might have already kicked off a wage-price spiral—where rising wages lead firms to pass on price increases and rising prices embolden workers to demand higher wages. The risk is a continuous cycle of inflationary pressures that is endemic and not necessarily benign.

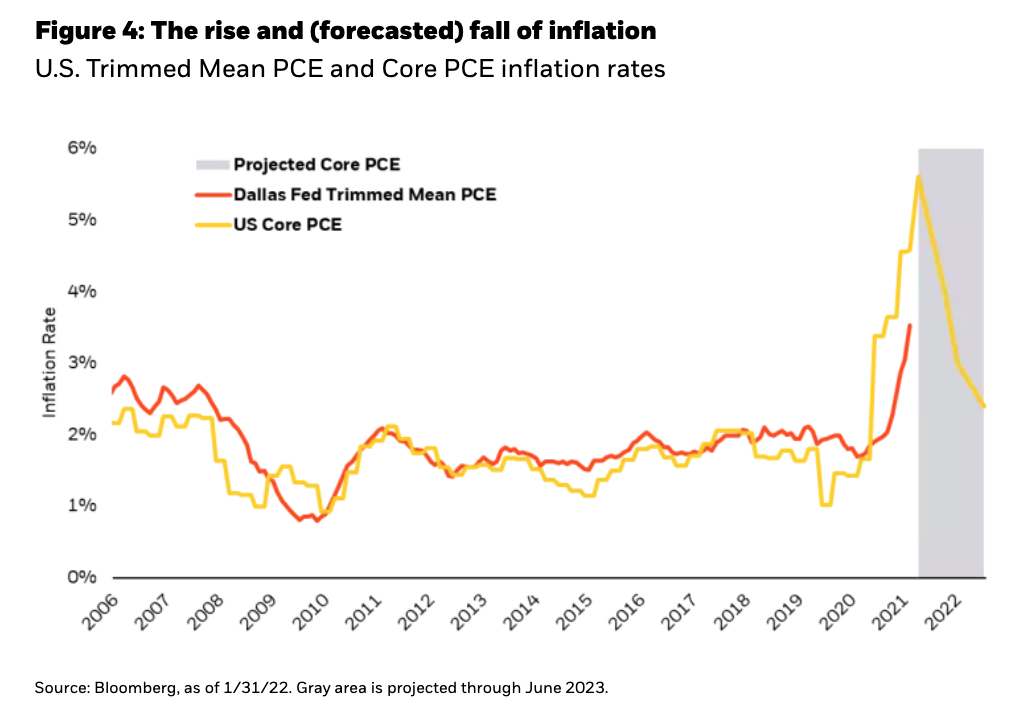

Both the benign and endemic inflation scenarios have merit. Looking at Figure 4, the expectations for the path of inflation (yellow line), will rely on the broad strength of its underlying components (red line) and whether the forecasted declines start to show up in late spring and early summer. Policymakers will need to shift their current strategy if their assumptions do not play out.

Determining the dosage

The surprisingly strong inflation data and its belated recognition by global central banks still only shows up in markets as an expectation for a faster move towards normalization—not a materially higher level of rates. Where normalization ends up remains relatively unchanged.

Market expectations in the U.S. now price in a 25 bp hike at each meeting beginning in March. In Europe, the market initially priced in 50 bps worth of hikes by the end of the year before unwinding those expectations in face of the Russian invasion. Figure 5 highlights in the U.S., that measured in 2 years forward, the difference between the yield on 2-year and 10-year maturity bonds is essentially zero. This is one example of how yield curves have already flattened to a level typically associated with a level expected at the end of the tightening cycle.

At the end of 2021, the Fed's terminal rate forecasts had projected long-term policy rates around 2.5%. Coupled with the median longer-run inflation forecast of 2.5% (on CPI equivalent basis) implies a terminal zero real Fed Funds rate. All those estimates are likely to change in future Statement of Economic Projection releases and the bias is towards higher inflation forecasts and a higher path of policy rates along the way.

Whether the Fed projects that the terminal rate returns to pre-COVID levels will be a key determinant of longer maturity yields performance. However, looking back through historical tightening cycles one lesson becomes clear: Fed policy rates typically end up eventually at a level above inflation in order to bring that inflation back down.

More persistent inflation in the longer-run may imply a need for either a higher terminal rate or a higher rate along the way to terminal that actually tightens policy in order to bring inflation back down to that 2% longer-run forecast.

Was QE a success? That depends on QT

2022 may mark the end of the historic global central bank experiment we have come to call quantitative easing (“QE”). Undoubtedly, QE saved the world’s economies from certain disaster in 2008 and 2020, but knowing if it was a success will depend on the exit strategy: quantitative tightening (“QT”). Inflation and geopolitics make QT much more difficult for central banks.

So far, the forecast looks good, but a more cautious outlook may be warranted when considering the sheer size and reach of QE programs. Markets have become accustomed to over a decade of massive central bank balance sheet expansions supporting an asset inflation program geared around principles of the “portfolio rebalance” channel.

Think of portfolio rebalance as the result of central bank policies that influence investors to shift their investments away from safe-haven assets towards assets with higher expected returns. The effect of portfolio rebalance can be seen in capital markets and in real assets like housing.

Recall that the Fed took a similar path to combat the Global Financial Crisis (“GFC”). Accommodative policies helped to stabilize and then ease financial conditions. The appeal of safe-haven assets declined, and the attractiveness of risky assets grew. This asset reflation helped restore the confidence needed to support a consumption-based economy.

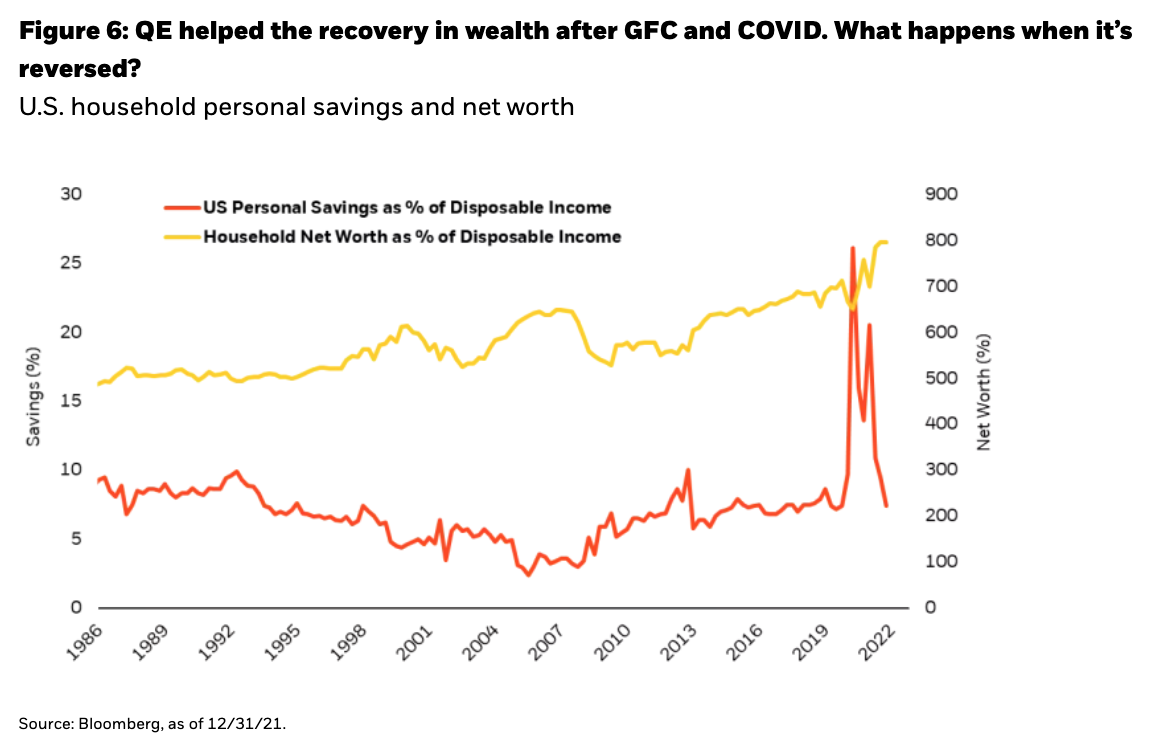

During COVID, portfolio rebalance was even more immediate and effective as it was coupled by enormous fiscal policy support including direct transfers. That helped to support a rapid recovery in wealth in assets and maintained consumer consumption power as seen in Figure 6 with the surge in savings rates and subsequent decline once the spending kicked in as the worst COVID fears were averted.

During COVID, portfolio rebalance was even more immediate and effective as it was coupled by enormous fiscal policy support including direct transfers. That helped to support a rapid recovery in wealth in assets and maintained consumer consumption power. Figure 6 demonstrates the surge in savings rates and subsequent decline once consumer spending restarted as the worst COVID fears were averted.

The (de facto) third policy objective

The problem with the QE-era policy of relying on portfolio rebalance is that it moves financial conditions into a de facto third policy objective and constraint. Because the policy transmission function relies on financial conditions (i.e. stable interest rates and rising stock markets), those aspects become additional constraints to traditional policy objectives (inflation and employment).

Policymakers can’t raise rates suddenly and dramatically to fight off inflation because it could cause a severe decline in valuations of risky assets like stocks. Investors understand this, and increasingly factor policy support into their investment decisions. The results have been mutually beneficial as the rise in measured wealth in the U.S. is beyond any historical comparisons.

Growth in the U.S. today relies on consumption, and wealth effect fueled confidence can drive up or down that confidence. Using the portfolio rebalance channel post GFC in 2008 both recognized and codified this relationship. But in doing so, the Fed made normalizing highly accommodative policy through balance sheet reductions more difficult. The 2013 Taper Tantrum proved market expectations correct that when faced with too rapid of a tightening in financial conditions, the Fed would pull back on policy normalization.

Normalizing now becomes much more challenging for the Fed due to inflation. In 2013, inflation was still low, limiting any perceived cost from slowing normalization. Today, the Fed needs to thread the needle even more carefully between tightening enough to look credible on fighting inflation without pushing financial markets into a panic, harming confidence, and risking a recession.

Portfolio construction implications

We see two scenarios where inflation significantly impacts asset allocation decisions. The first is a return to the “secular stagnation” of the 2010s when inflation and growth were consistent but low. The second scenario is one where we must learn to live with higher levels of uncertainty around both inflation and growth.

A return to secular stagnation

The market expects inflation and growth to return to the pre-COVID level of 2% by 2024. This low growth, low inflation environment led primarily to persistent zero and negative real interest rate policies. Flat term premia for inflation risk in an environment of low and stable inflation imply similarly low real rates of interest on longer-maturity bonds. Low real yields imply low expected real returns from bonds. And low safe asset returns lead to the outward shift in risk taking in pursuit of higher returns—the portfolio rebalance effect. Analog to this, the equity market saw the persistent outperformance of growth stocks over value stocks in an era decidedly lacking in (nominal) growth opportunities. We are well acquainted with this market environment.

Living with inflation and growth uncertainty

But what about the alternative scenario where inflation fails to fall back to pre-COVID levels? For the Fed to just keep policy close to neutral, higher inflation implies higher terminal rates. A 3% inflation rate implies a policy rate of 3.25-3.50%—a full 100 bps higher than currently priced—just to get back to neutral.

You might need to actually get policy tight to achieve stable inflation. That requires moving policy rates above the level of inflation. But even a small real positive interest rate at the short end might cascade across financial markets in ways that tighten financial conditions aggressively. Either that forces the Fed’s hand to ease back on tightening or makes the smaller amount of tightening that much more effective as it transmits through financial conditions. The portfolio rebalance effect could now go in the opposite direction with risk assets becoming less appealing and the perceived loss of wealth hurting confidence and spending.

How much sensitivity to financial conditions has over a decade of unconventional QE policy sown? No one can be certain, but the impact of portfolio risk shifting in response to easing financial conditions has been slow and methodical over the decade. Behavioral finance highlights the reverse is unlikely to be similar. Loss aversion means a more rapid rebalance—which partially explains the “tantrum” like behavior we often see in financial markets. Markets grind upwards and gap downwards. Such risks are now much more likely given the Fed no longer has all three of its main policy objectives aligned. Taking the fight to inflation means risking both full employment and financial stability.

Managing the side effects of an inflation vaccination

Investing in this shifting environment requires recognizing the new risks. Investors should evaluate allocations relative to forecasted future risks and rely less on past results as a guide. For stock and bond allocations, it is imperative to question the health of historical negative correlations given the toll that inflation and rising rates can have on bond returns. Many investors are entering an environment they have little to zero experience navigating. That leads to the search for solutions between alternative asset classes and alternative investment strategies.

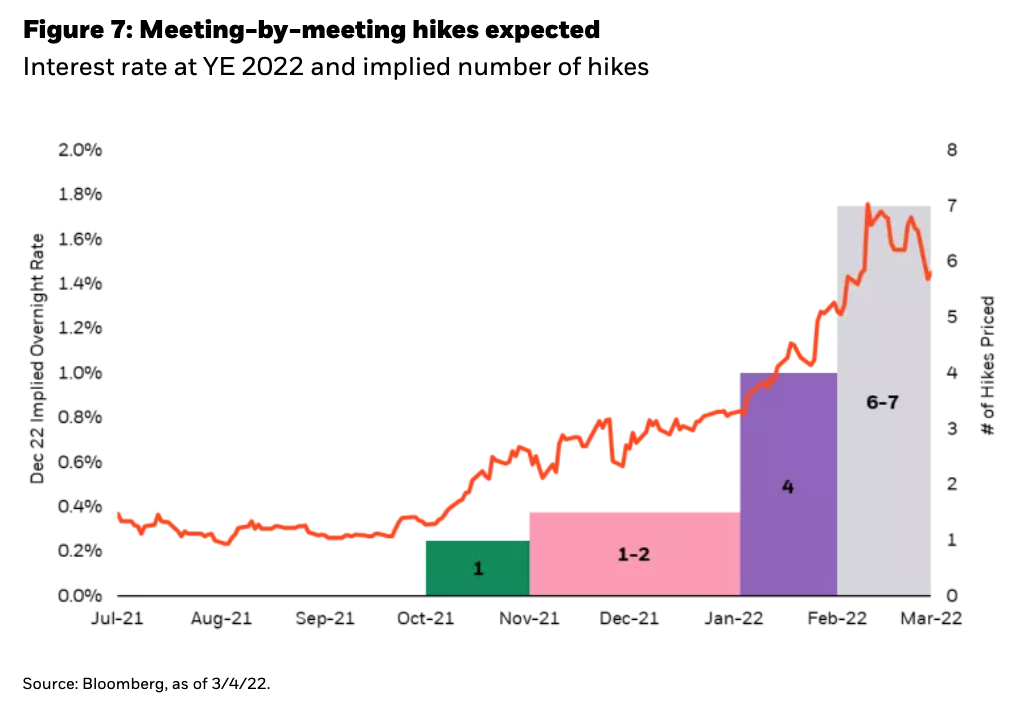

In asset classes, the market has now moved to fully price in meeting-by-meeting hikes in 2022 (Figure 7), improving the risk reward to the short end of the yield curve. Longer-maturity assets retain their flight to quality benefits but may become more vulnerable as they approach the terminal rate if inflation fails to fall as much as forecast.

Higher credit risk assets, such as high yield and emerging market debt, look less appealing given the higher yields available in risk-free rates. However, widening in credit spreads is helping by providing some more risk premia to a recessionary or stagflationary outlook. For the near-term, we find safer assets in Investment Grade and MBS more attractive given their higher exposure to risk-free rates and less credit spread exposure.

The Russian invasion coming on top of the already difficult inflationary outlook further raises the uncertainty for both risk-free and risky assets. In such an environment, it may be prudent to augment portfolio asset allocations, which are dominated by “beta” risk, with “alpha” return sources. New sources of diversification and return may be needed as inflation undermines the traditional diversifying properties of bonds.