by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

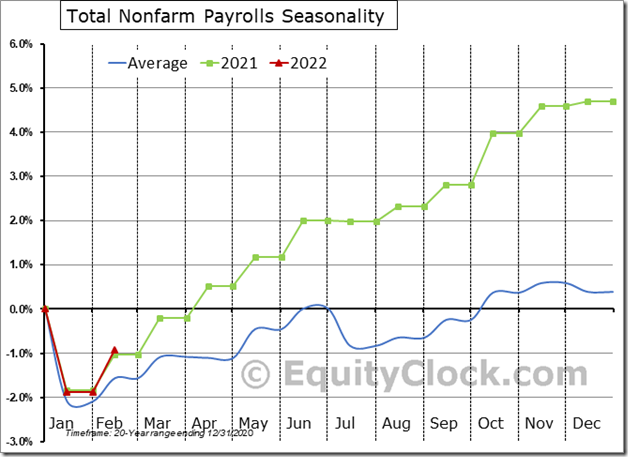

Payroll growth in the US was record setting in February, higher by 1.457 million, or 1.0% (NSA) compared to the month prior. This is double the 0.5% increase that is average for the second month of the year. $STUDY $MACRO #Economy #Employment $ADP $PAYX $RHI

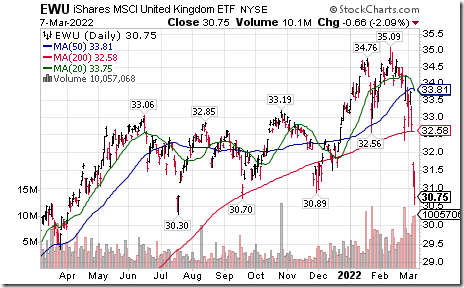

United Kingdom iShares $EWU moved below $30.89 extending an intermediate downtrend.

Junior Gold Miners ETF $GDXJ moved above $47.36 extending an intermediate uptrend.

Semiconductor iShares $SOXX moved below $433.28 extending an intermediate downtrend.

Analog Devices $ADI a NASDAQ 100 stock moved below $150.45 extending an intermediate downtrend.

More semiconductor breakdowns! KLA Tencor $KLAC a NASDAQ 100 stock moved below another intermediate support level at 316.33 extending an intermediate downtrend.

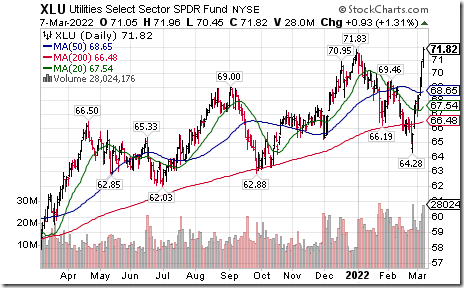

Utilities SPDRs $XLU moved above $71.83 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable until at least mid-June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/utilities-select-sector-spdr-fund-nysexlu-seasonal-chart

Bed Bath & Beyond $BBBY moved above $18.04 and $25.72 extending an intermediate uptrend. The stock is subject to take over rumors after an activist investor purchased a 9.8% interest in the stock.

Visa $V a Dow Jones Industrial Average stock moved below intermediate support at $195.33

Franco-Nevada $FNV $FNV.CA moved above US$163.09 and Cdn$204.36 extending an intermediate uptrend.

Another Canadian gold producer breakout! Agnico-Eagle $AEM.CA a TSX 60 stock moved above Cdn.$72.30 extending an intermediate uptrend. Seasonal influences are favourable to the end of August. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/agnico-eagle-mines-ltd-tseaem-seasonal-chart

Railway stocks on both sides of the border are moving higher. Canadian Pacific $CP.CA moved above Cdn$98.75 and Cdn$99.36 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to the end of May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/canadian-pacific-railway-seasonal-chart

CSX $CSX a NASDAQ 100 stock moved above $37.90 extending an intermediate uptrend. Seasonal influences are favourable until at least the end of April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/csx-corporation-nysecsx-seasonal-chart

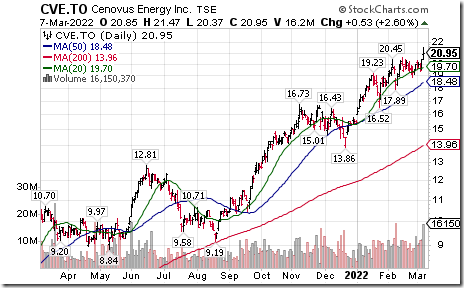

Cenovus $CVE.CA a TSX 60 stock moved above Cdn$20.45 extending an intermediate uptrend

George Weston $WN.CA a TSX 60 stock moved above $150.63 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to the end of May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/george-weston-limited-tsewn-seasonal-chart

Duke Energy $DUK an S&P 100 stock moved above $106.27 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to the end of April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/duke-energy-corporation-nyseduk-seasonal-chart

JD $JD a NASDAQ 100 stock moved below $62.17 extending an intermediate downtrend.

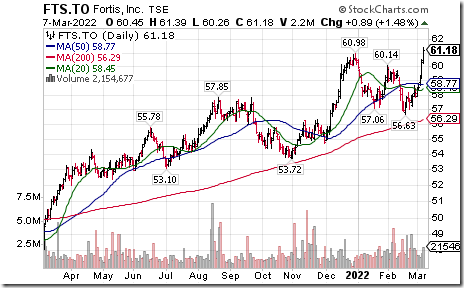

Fortis $FTS.CA a TSX 60 stock moved above Cdn$60.98 to an all-time high extending an intermediate uptrend

Dollarama $DOL.CA a TSX 60 stock moved above $68.65 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable until at least mid-July and frequently to mid-October. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/dollarama-inc-tsedol-seasonal-chart

Trader’s Corner

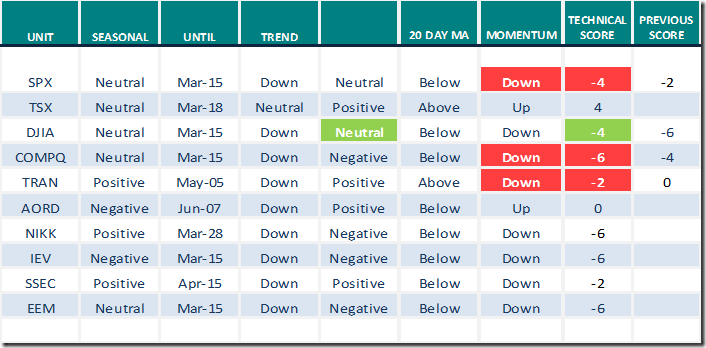

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

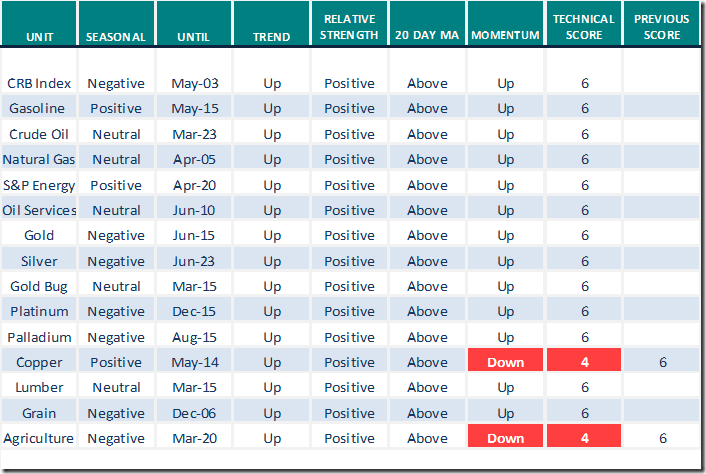

Commodities

Daily Seasonal/Technical Commodities Trends for March 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

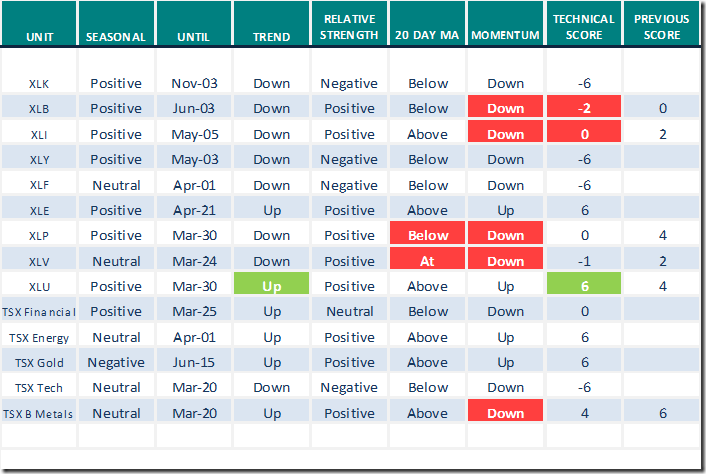

Sectors

Daily Seasonal/Technical Sector Trends for March 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Next CATA Meeting

Next virtual (i.e..Zoom) meeting for members of the Canadian Association for Technical Analysis is scheduled this evening at 8:00 PM. Presenter is Tom Bowley, a frequent contributor to StockCharts.com. Not a CATA member yet? Everyone is welcome. Contact: CATA Meeting March 8 with Tom Bowley – Events – Canadian Association for Technical Analysis (clubexpress.com)

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.