by Don Vialoux, EquityClock.com

The Bottom Line

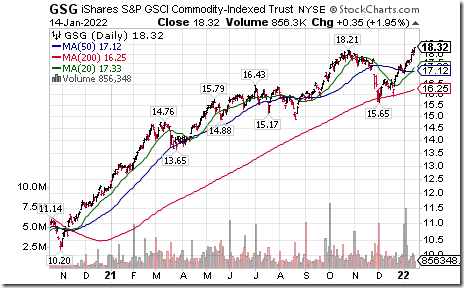

Despite higher long term Treasury bond yields,

The U.S. Dollar moved lower last week

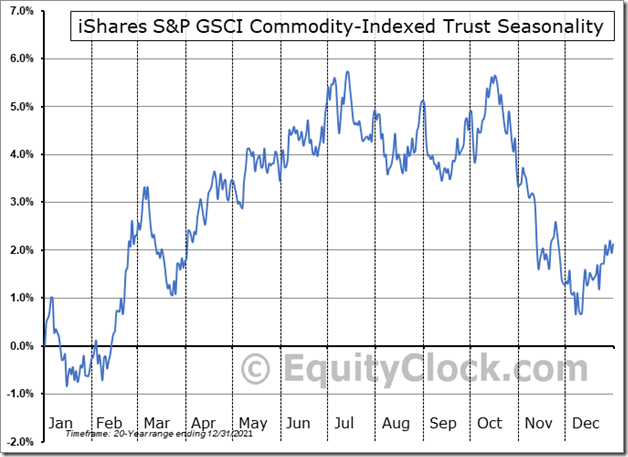

Triggering strength in industrial commodities priced in U.S. Dollars

‘Tis the season for industrial commodity prices to move higher until at least late February and frequently until mid-July!

Observations

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved lower last week. It changed from Overbought to Neutral. Trend remained down. See Momentum Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) moved lower again last week. It remained Overbought. Trend remained down. See Momentum Barometer chart at the end of this report.

Intermediate term technical indicator for Canadian equity markets remained Neutral last week. . See Momentum Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) also remained Neutral last week. See Momentum Barometer chart at the end of this report.

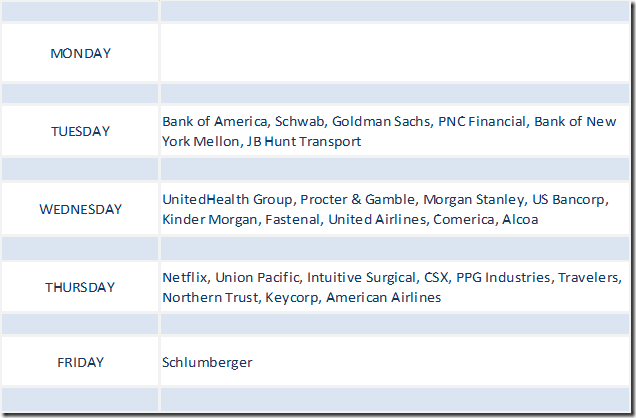

Consensus estimates for earnings and revenues for 2021 by S&P 500 companies moved slightly higher from last week. According to www.FactSet.com earnings in the fourth quarter are projected to increase 21.8% (versus previous 21.7%) and revenues are projected to increase 12.9%. Earnings for all of 2021 are projected to increase 45.3% (versus previous 45.2%) and revenues are projected to increase 15.9%. As of Thursday, only four S&P 500 companies had reported fiscal fourth quarter results. On Friday, several “money center” financials reported higher than consensus results.

Consensus estimates for earnings and revenues for 2022 by S&P 500 companies prior to last Friday were virtually unchanged. Consensus earnings on a year-over-year basis for the first quarter are projected to increase 6.2% (versus previous 6.3 %) and revenues are expected to increase 9.7%. Earnings in the second quarter are expected to increase 4.2% and revenues are expected to increase 7.7% (versus previous 7.6%). Consensus earnings for all of 2022 by S&P 500 companies are projected to increase 9.4% and revenues are projected to increase 7.6%.

Economic News This Week

Canadian December Consumer Price Index to be released at 8:30 AM EST on Tuesday is expected to increase 0.2% versus a gain of 0.2% in November.

January Philly Fed Index to be released at 8:30 AM EST on Thursday is expected to increase to 18.5 from 15.4 in December.

December U.S. Existing Home Sales to be released at 10:00 AM EST on Thursday are expected to slip to 6.44 million from 6.46 million in November.

Canadian November Retail Sales to be released at 8:30 AM EST on Friday are expected to increase 1.0% versus a gain of 1.6% in October. Excluding auto sales, consensus was an increase of 1.5% versus a gain of 1.3% in October.

December Leading Economic Indicators to be released at 10:00 AM EST on Friday are expected to increase 0.8% versus a gain of 1.1% in November.

Selected Earnings News This Week

Another 38 S&P 500 companies (including four Dow Jones Industrial Average companies) are scheduled to release quarterly results this week.

Trader’s Corner

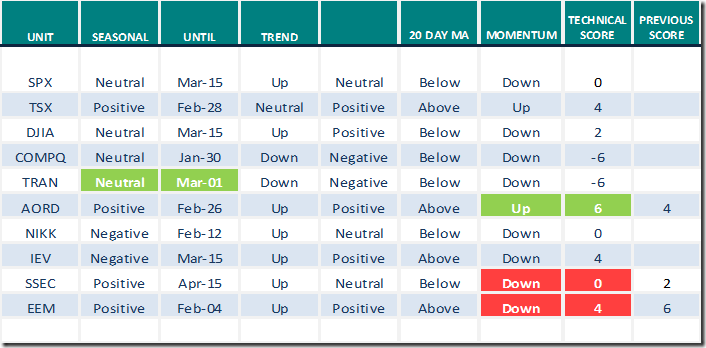

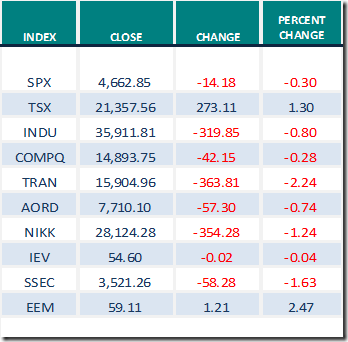

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.14th 2022

Green: Increase from previous day

Red: Decrease from previous day

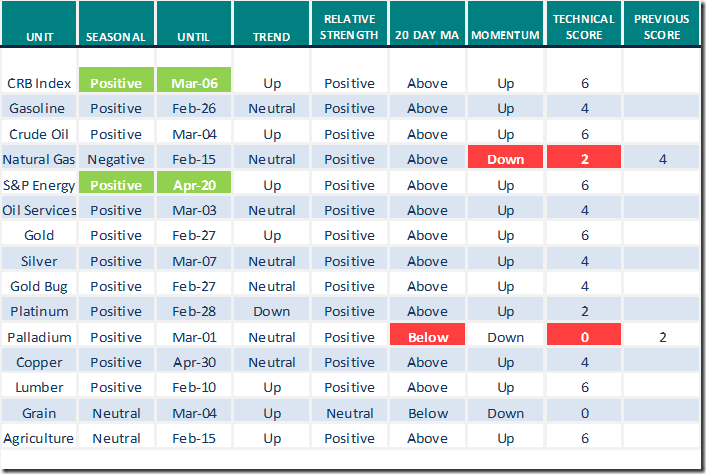

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.14th 2022

Green: Increase from previous day

Red: Decrease from previous day

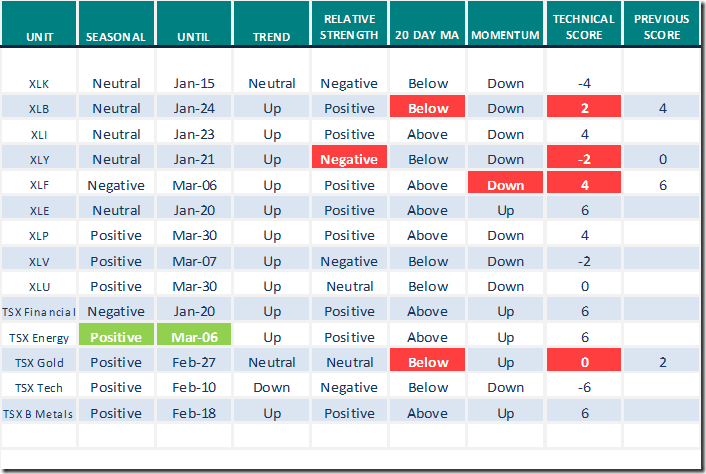

Sectors

Daily Seasonal/Technical Sector Trends for Jan.14th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Providers

2022 Outlook: Martin Pring and Bruce Fraser

Editor’s Note: an excellent long term point of view on equity and commodity markets!

https://www.youtube.com/watch?v=3eG3jzLkUR4

Mark Leibovit asks “Are there early warning sell signals on U.S. equity markets”?

Are There Early Warning Sell Signals? – HoweStreet

Mark Bunting and www.uncommonsenseinvestor.com notes

Nine Secrets to Buffett Colleague’s 20%+ Average Annual Gain Over 25 Years – Uncommon Sense Investor

When to Sell: Excerpts From Howard Marks’ New Memo – Uncommon Sense Investor

Greg Schnell discusses “Commodity Sunshine”

Commodity Sunshine | The Canadian Technician | StockCharts.com

Michael Campbell’s Money Talks for January 15th 2022

January 15th Episode (mikesmoneytalks.ca)

Technical Scoop

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

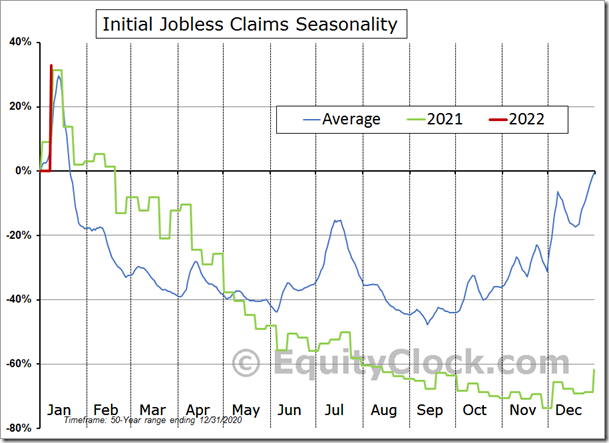

Coincident indicators are pointing to strains in the economy as Omicron forces Americans into isolation. equityclock.com/2022/01/13/… $STUDY $MACRO #Economy $SPX

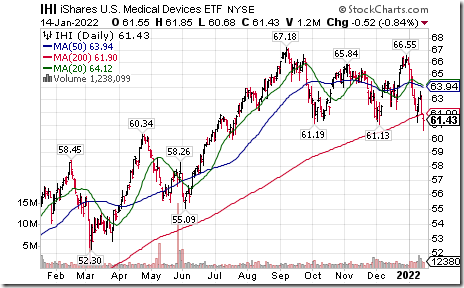

Medical Devices iShares $IHI moved below $61.13 completing a double top pattern.

Home Depot $HD a Dow Jones Industrial Average stock moved below $380.90 completing a double top pattern.

Dollar Tree $DLTR a NASDAQ 100 stock moved below $132.40 completing a double top pattern.

eBay $EBAY a NASDAQ 100 stock moved below $62.82 extending an intermediate downtrend.

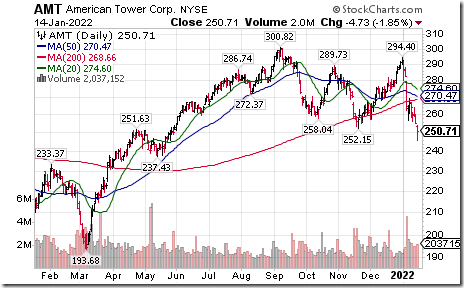

American Tower $AMT an S&P 100 stock moved below $252.15 extending an intermediate downtrend.

PayPal $PYPL a NASDAQ 100 stock moved below $179.15 extending an intermediate downtrend.

Check Point $CHKP a NASDAQ 100 stock moved above intermediate resistance at $124.36

Editor’s Note: Seasonal influences are favourable to mid-February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/check-point-software-technologies-nasdchkp-seasonal-chart

Altria $MO an S&P 100 stock moved above $49.80 to a 42 month high extending an intermediate uptrend. Seasonal influences are favourable to at least March 8th . If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/altria-group-inc-nysemo-seasonal-chart

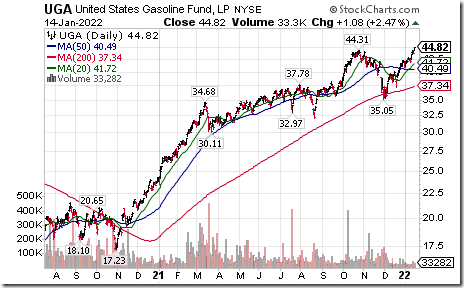

Gasoline ETN $UGA moved above $44.31 to a seven year high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable until at least early March and frequently to the end of May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/united-states-gasoline-fund-lp-seasonal-chart

SNC Lavalin $SNC.CA a TSX 60 stock moved below $29.01 extending an intermediate downtrend.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 4.41 on Friday and dropped 6.62 last week to 57.51. It changed on Friday from Overbought to Neutral on a move below 60.00. Trend is down.

The long term Barometer slipped 3.41 on Friday and 3.80 last week to 67.74. It remains Overbought. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer eased 0.90 on Friday, but added 0.90 last week to 50.68. It remains Neutral.

The long term Barometer slipped 1.81 on Friday and lost 3.08 last week. It remained Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.