by Don Vialoux, EquityClock.com

‘Tomorrow is the first blank page of a 365-page book. Write a good one.’

Brad Paisley

Technical Notes released yesterday at

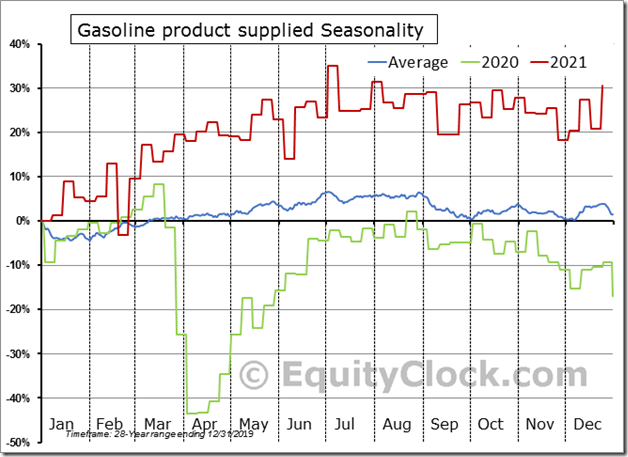

The demand profile of the energy market remains impressive and we are benefitting via our allocation to commodities in our Super Simple Seasonal Portfolio. equityclock.com/2021/12/29/… $USO $CL_F $GSG $UGA

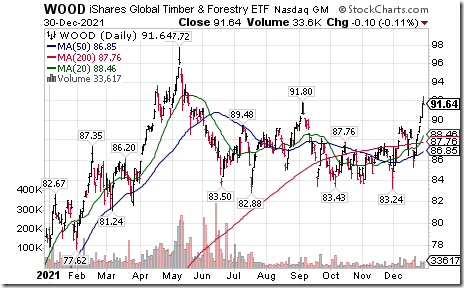

Timber and Forest Products iShares $WOOD moved above $91.80 extending an intermediate uptrend.

Water Resources ETF $PHO moved above $60.92 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to the end of April. If a subscriber to EquityClock, see https://charts.equityclock.com/invesco-water-resources-etf-nasdpho-seasonal-chart

Trader’s Corner

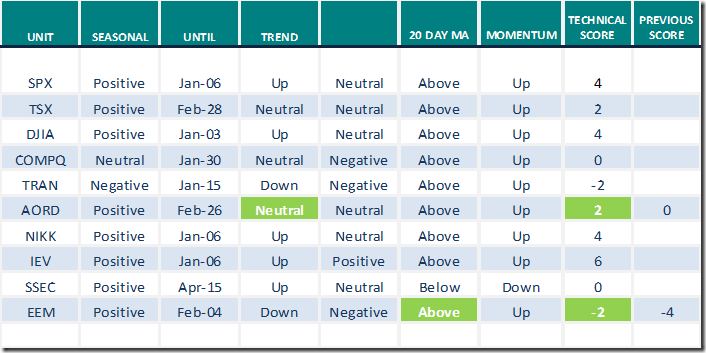

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.30th 2021

Green: Increase from previous day

Red: Decrease from previous day

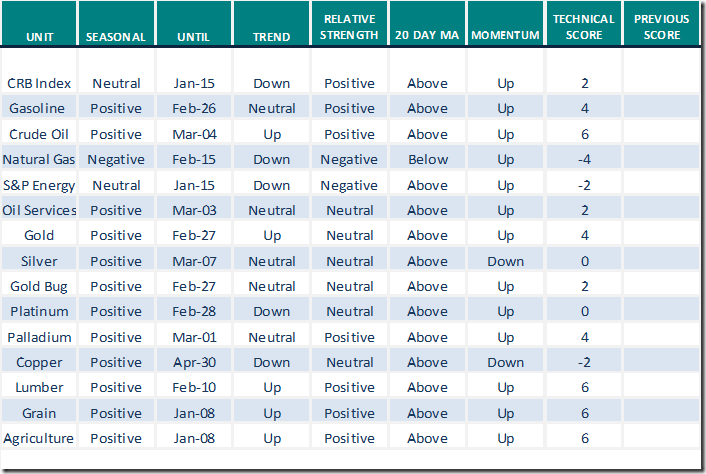

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.30th 2021

Green: Increase from previous day

Red: Decrease from previous day

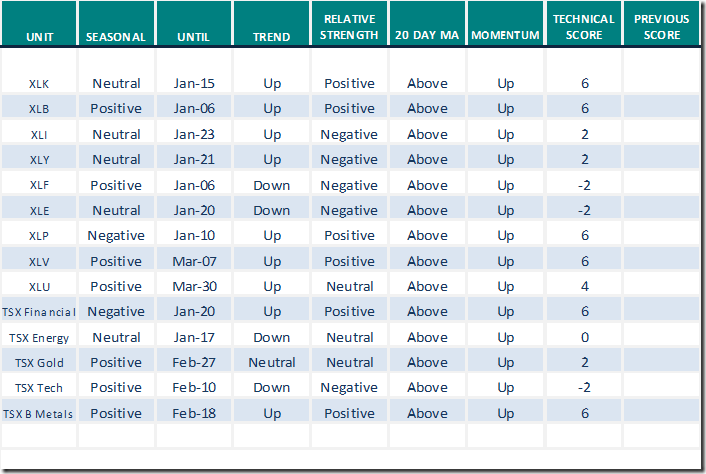

Sectors

Daily Seasonal/Technical Sector Trends for Dec.30th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Link from Valued Provider

Michael Campbell’s Year In Review

December 29th Episode – Year in Review (mikesmoneytalks.ca)

China’s Technology Sector Awakens

Weakness in the Chinese technology sector primarily in recent months due primarily to a government crackdown on key business members of major companies suddenly reversed yesterday.

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences on a real and relative basis (relative to the S&P 500 Index) for gold and gold equities/ETFs are strongly positive from mid-December to the end of February.

Seasonal strength by the sector appeared on schedule this year.

S&P 500 Momentum Barometer

The intermediate term Barometer slipped 1.40 to 70.14 yesterday. It remains Overbought.

The long term Barometer was unchanged at 74.35 yesterday. It remains Overbought.

TSX Momentum Barometer

The intermediate term Barometer added 3.10 to 53.10 yesterday. It remains Neutral.

The long term Barometer slipped 1.77 to 59.73 yesterday. It changed from Overbought to Neutral on a drop below 60.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0011_thumb-17.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0021_thumb-17.png)

![clip_image004[1] clip_image004[1]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0041_thumb-7.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0025_thumb.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0035_thumb.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2021/12/clip_image0045_thumb.png)