by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

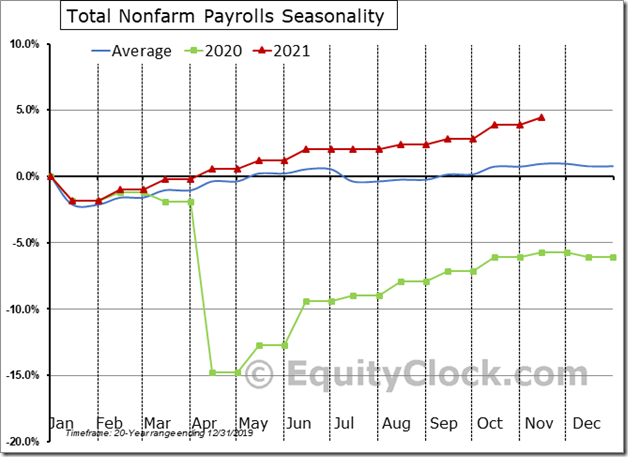

Yet again, the seasonal adjustment factor is providing a distorted view of the health of the labor market. Payrolls in the US were higher by 778,000 (NSA), or 0.5%, in November, stronger than the 0.2% increase that is average for the month. $STUDY $MACRO #Economy #Employment #NFP

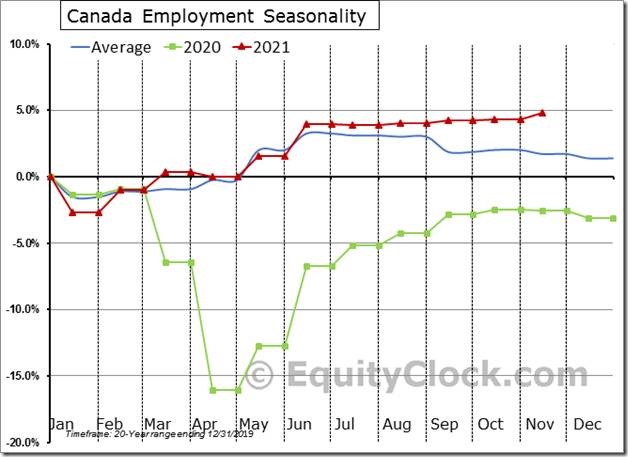

Employment in Canada diverged from seasonal norms in November, rising by 93,600 (NSA), or 0.5%, much stronger than the 0.3% decline that is normal for this second to last month of the year. $MACRO $STUDY #CDNecon #CAD

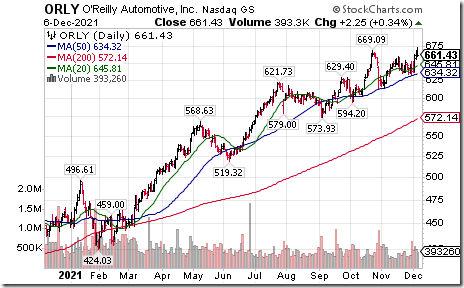

O’Reilly $ORLY a NASDAQ 100 stock moved above $669.09 to an all-time high extending an intermediate uptrend.

Abbott Labs $ABT an S&P 100 stock moved above $131.60 to an all-time high extending an intermediate uptrend.

Fastenal $FAST a NASDAQ 100 stock moved above$61.76 to an all-time high extending an intermediate uptrend.

AbbVie $ABBV an S&P 100 stock moved above $120.07 to an all-time high extending an intermediate uptrend.

Tesla $TSLA a NASDAQ 100 stock moved below $978.60 completing a double top pattern.

Seattle Genetics $SGEN a NASDAQ 100 stock moved below another intermediate support level at $147.47 extending an intermediate downtrend.

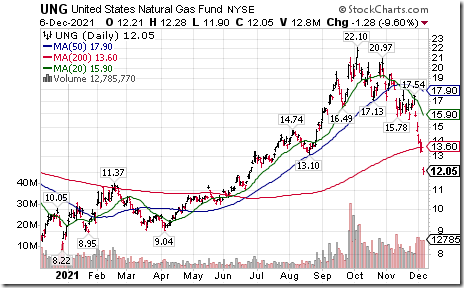

Natural Gas ETN $UNG moved below another intermediate support level at $13.10 extending an intermediate downtrend.

BCE $BCE.CA a TSX 60 stock moved above $66.20 to an all-time high extending an intermediate uptrend.

Trader’s Corner

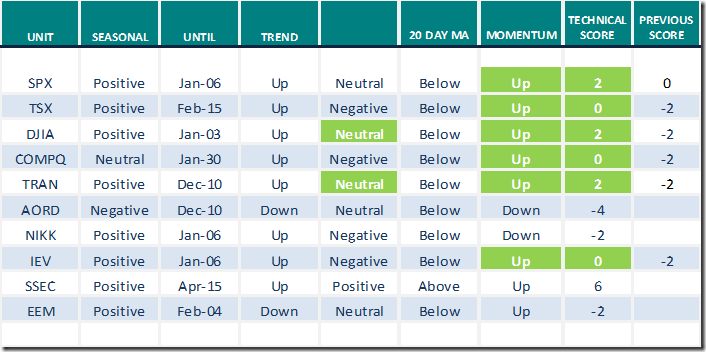

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.6th 2021

Green: Increase from previous day

Red: Decrease from previous day

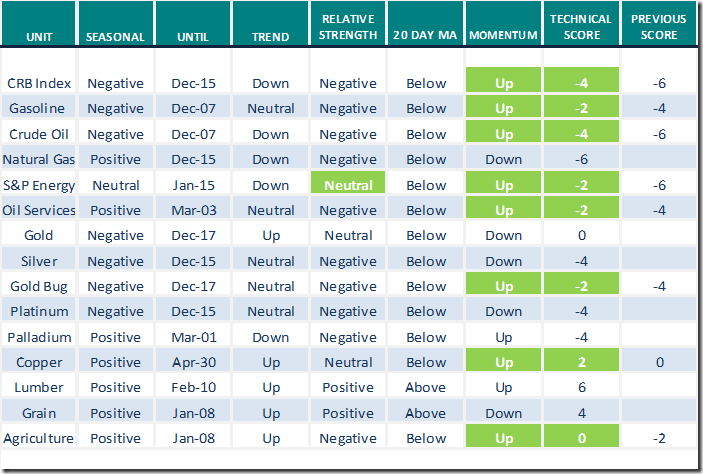

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.6th 2021

Green: Increase from previous day

Red: Decrease from previous day

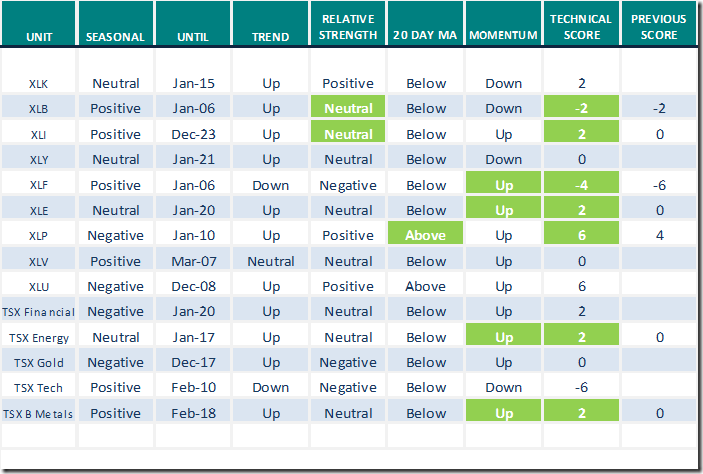

Sectors

Daily Seasonal/Technical Sector Trends for Dec.6th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links offered by Valued Providers

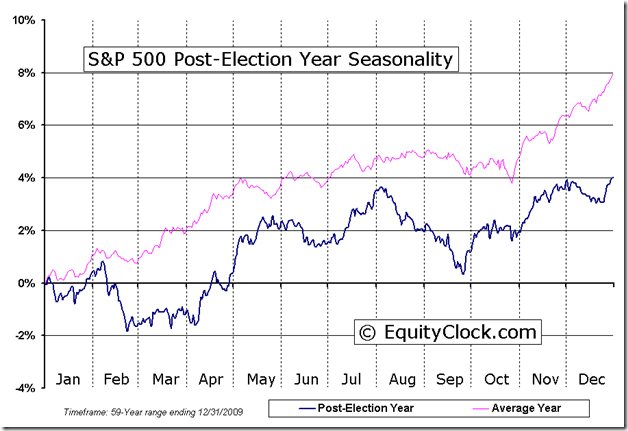

Larry Williams asks “Will we get a Christmas Rally this year”?

Will We Get a Christmas Rally? | Larry Williams Special Presentation (12.06.21) – YouTube

Editor’s note: The S&P 500 Index has a history of moving higher from mid-December to the first week in January during Post Presidential Election years.

Sprott Research says ”Gold correction nearing its end”

Sprott Monthly Report: Gold Correction Nearing its End

S&P 500 Momentum Barometers

The intermediate term Barometer added 9.62 to 51.10 yesterday. It remained Neutral and moving higher.

The long term Barometer gained 6.21 to 66.53 yesterday. It remains Overbought and moving higher.

TSX Momentum Barometers

The intermediate term Barometer jumped 12.04 to 37.50 yesterday. It remains Oversold and moving higher.

The long term Barometer advanced 5.09 to 55.56 yesterday. It remains Neutral and moving higher.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.