by Gargi Pal Chaudhuri, Blackock

After years of inflation readings well below 2%, financial markets are pricing in a post-COVID economic recovery and the potential for “reflation” through the second half of 2021 and beyond.1

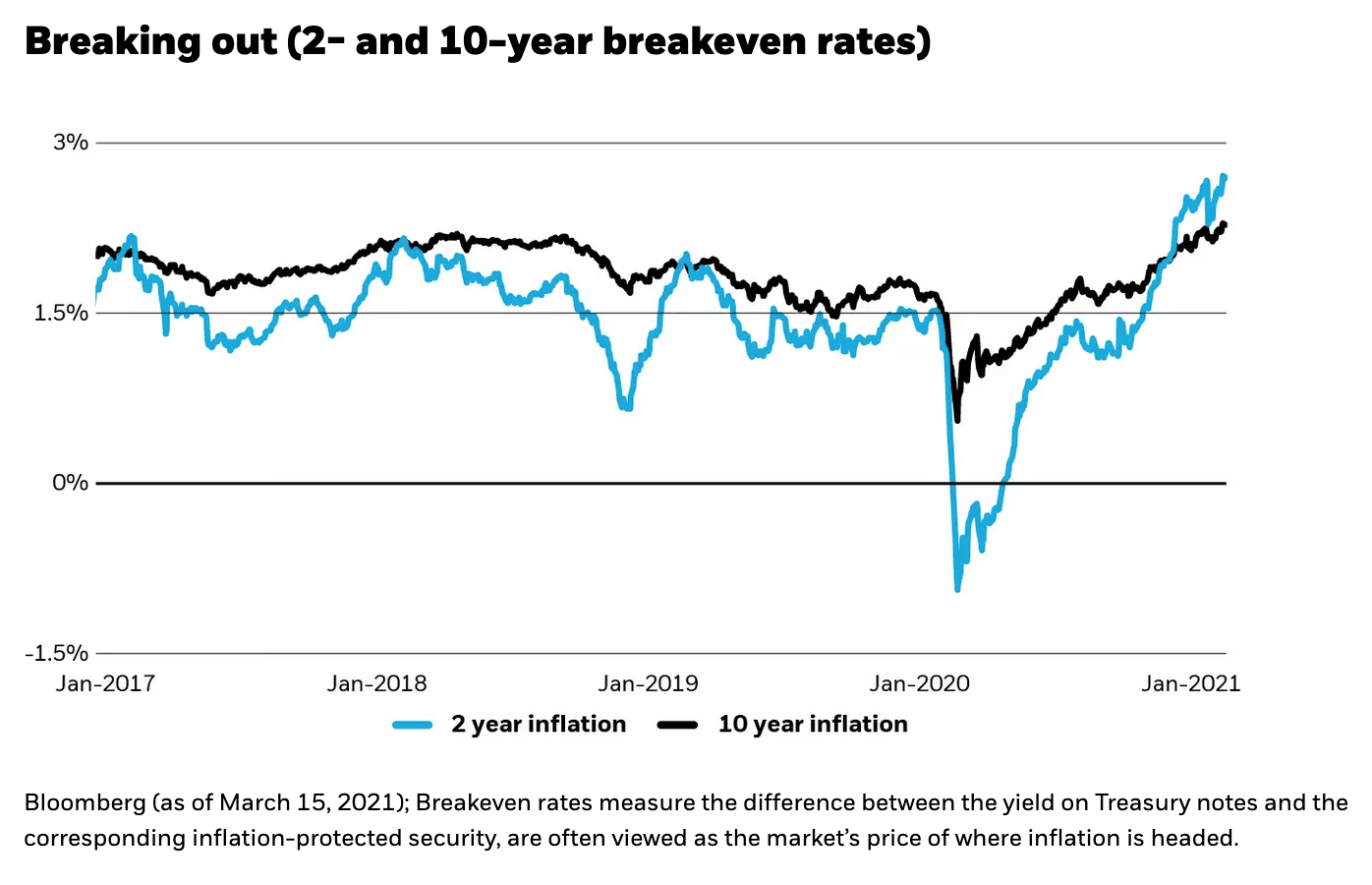

Long-term bond yields are up, flows into reflation-themed products are accelerating, and forward-looking measures of inflation expectations are near the highest in years.

A higher-inflation regime has meaningful implications for what drivers pay per gallon at the pump, what it costs to buy shoes and other clothing, and what returns investors can expect from their portfolios.

Four potential reasons inflation expectations are rising

Market-based expectations of inflation have been rising recently — here’s why:

- Policy: The U.S Federal Reserve is willing to tolerate higher inflation and laid this out in their Flexible Average Inflation Targeting (FAIT) framework announced last August. Fed officials reiterated in their March 17 FOMC meeting that FAIT will seek to achieve inflation that averages 2% over time, and that following periods in which inflation has run below 2%, the central bank will seek to let it run above 2%. Given that the Fed will keep interest rates at a low level until they achieve FAIT, all else equal, this policy should support inflation.

- Fiscal boost: With President Biden signing an additional $1.9 trillion fiscal relief package, the total fiscal stimulus efforts provided in the wake of COVID-19 is about double the pandemic-inflicted loss in U.S. - gross domestic product and is close to 25% of 2020 GDP. While such stimulus should aid recovery in the near term, it can also have inflationary impacts in the longer term.

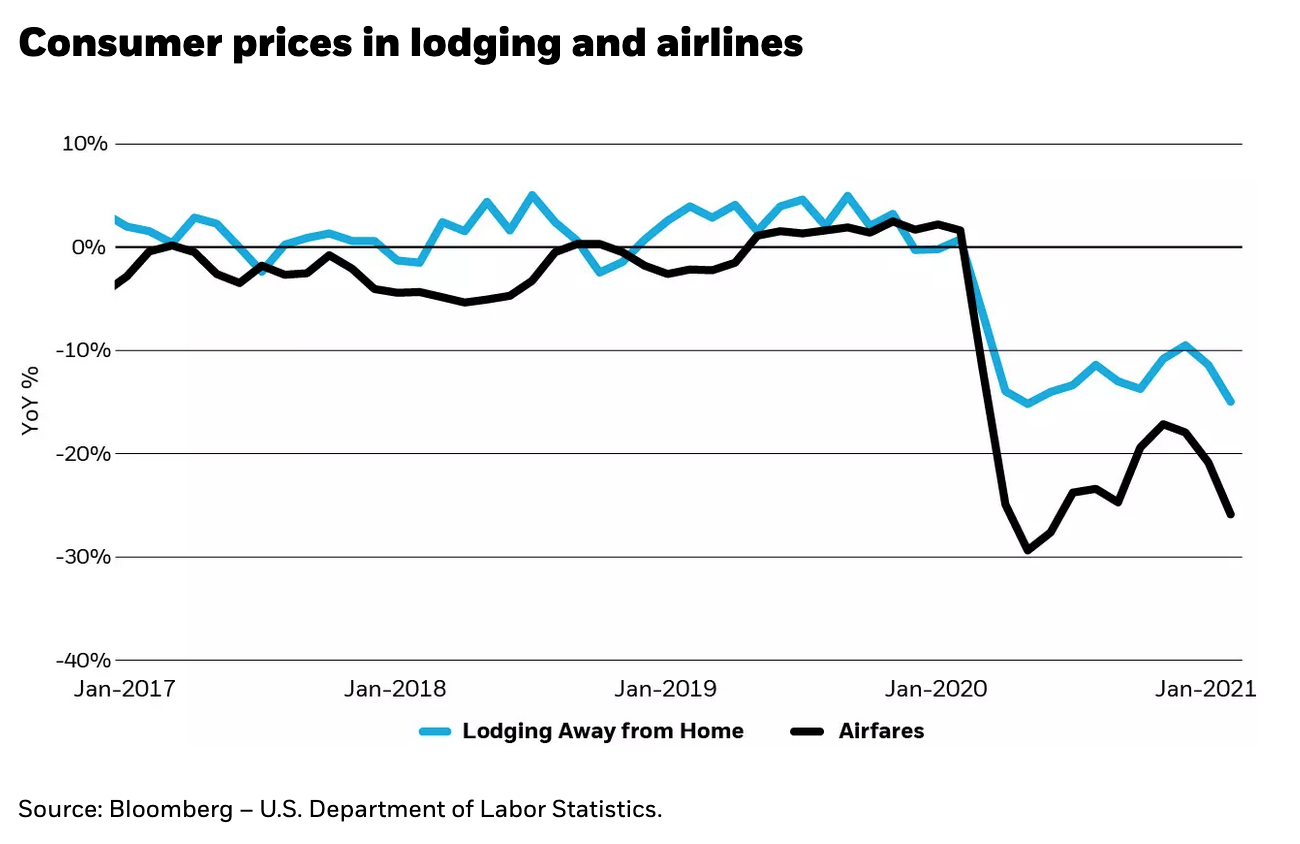

- Pent-up demand: Personal income has surged as a result of unemployment benefits, since consumers haven’t been able to spend freely due to COVID-19 restrictions. The result is a jump in the U.S. personal savings rate from a low of 8% pre-pandemic to 20.5% in January.2 As economies open and more of the U.S. population is vaccinated, we expect savings to translate into a surge in spending as some of the “pent-up demand” is unleashed. Restaurants, movie theatres, sports arenas, airlines, hotels — all areas of the economy that were largely closed for the past year — should rebound with a commensurate rise in inflation in these sectors.

- Rising production costs: As companies rethink their supply chains and seek out ways to eliminate or reduce supply chain concentration in one region of the globe, production costs could move higher as industries consider more than just the lowest-cost options. Additionally, the weaker dollar, some supply bottlenecks as a result of higher demand post reopening, combined with higher shipping costs, higher energy prices, materials and other input costs, can also give way to higher inflation in certain goods.

How high is too high?

The BlackRock Investment Institute believes that the U.S. Core Consumer Price Index (core inflation doesn’t take into consideration food and energy prices that tend to be very volatile) can rise from current run rate of 1.3% over the next 12-18 months, and could rise above 2.5% over the medium term.3 While we believe some of this pick-up in inflation will be transitory and related to the reopening, there may also be some areas of sustained inflationary pressure.

In the near term, the goods sector will continue to lead the inflation trend as has been the case since the start of the pandemic, as will components of the services sector such as airfares, hotels and other leisure activities. As the economy improves and the unemployment rate continues to decline, some of the recent downward pressure on rental inflation may also abate and lead to a more sustained inflationary environment.

However, we don’t think this is going to be a “runaway” inflation as seen in the 1970s because of structural factors that are disinflationary, such as aging demographics and the impact of technology on pricing. Older people who no longer draw wages and innovations with lower costs can be longer-term factors keeping a lid on inflation. The impact of technology and more of shopping continuing to move away from brick and mortar stores to online will continue to put downward pressure on prices over the long term.

Even so, over the next few months, we believe investors may want to focus on the near-term rise in inflation. Flows have increased into asset classes that seek to protect against rising inflation, and interest rates in U.S. 10-year Treasury bonds have risen 69 basis points since the start of the year, partly reflecting expectations for higher inflation.4

Prepping portfolios for “reflation”

Investors can tilt portfolios to position for higher inflation across different asset classes, and exchange traded funds provide ways to add diversification.

Fixed income: Investors might consider short term or floating-rate fixed income products have tended to perform well as rates increase, or consider short-duration government bonds, which have tended to be less sensitive than long-duration bonds to rising interest rates.

Commodities: Commodities including energy, metals and agriculture have been among the strongest-performing assets of 2021, and we think there is room for more demand based on accelerating global growth, tight inventories and supply chain shifts that favor localized production.

Summing it up

Four factors could support an inflationary backdrop in 2021: monetary policy, fiscal stimulus, pent-up demand and rising production costs. While inflation should pick up from its current run rate of 1.3%, we see little fear of runaway inflation due to structural issues such as an aging population and the disinflationary impact of technology.

Since inflation tends to rise in tandem with economic growth, we think certain parts of the equity market, commodities and bond markets can help hedge portfolios for the upcoming rise in inflation.

Copyright © Blackrock