by Stephen Duench, CFA®, AGF Management Ltd.

Equity investors don’t have much to complain about these days. Since bottoming in March of 2020, most stock markets around the world have rallied almost uninterrupted and made huge gains in the process. Yet one thing that many of them have sorely missed during this latest run higher is dividend growth and the extra “oomph” it usually provides to portfolios.

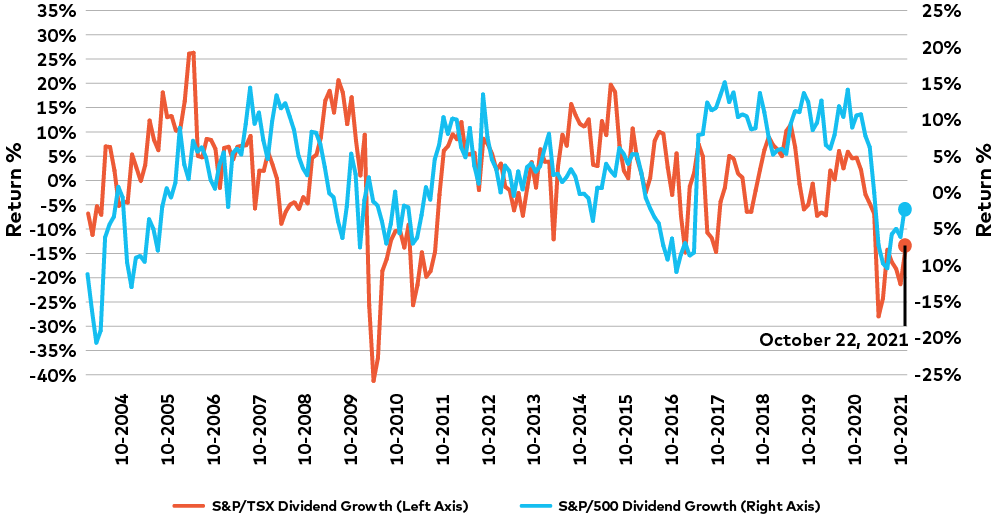

In fact, according to our research, almost no North American companies have increased their dividends since the global pandemic hit almost two years ago – at least when compiled in aggregate. And perhaps even worse, stocks that did grow their dividends haven’t been rewarded for it as they typically were in the past. For example, dividend growers listed on the S&P/TSX composite index in Canada underperformed the broad index by more than 15% earlier this year and they continue to lag today. Moreover, U.S. dividend growers listed on the S&P 500 Index haven’t fared much better, our research shows. (see chart below)

Dividend Growth Performance

Source: AGFiQ with data from FactSet as of October 22, 2021. Performance is based on 12-month rolling average.

Clearly, then, dividend growth has been a disappointment of late, but as tough as it’s been, at least now there are grounds to believe the factor can roar back and soon be a catalyst for outperformance once again.

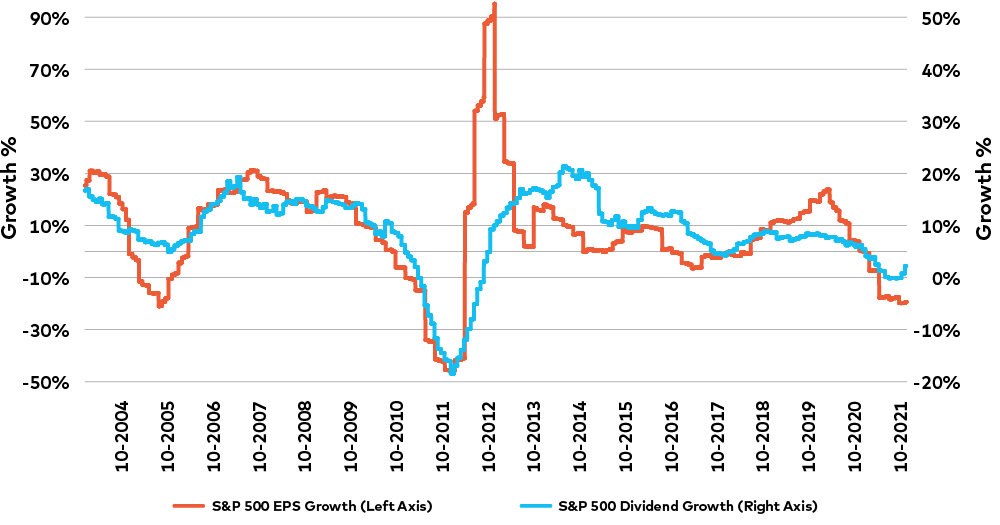

Among the most obvious reasons for optimism is the idea that better earnings growth will eventually lead to better dividend growth based on their strong positive correlation to each other. Considering the recent spike in U.S. earnings growth to above 30% — the highest level in almost a decade – it’s reasonable to speculate that U.S. dividend growth will range anywhere between 9% to 15% in the near term, and that’s perhaps being conversative. (see chart below)

Earnings Growth vs. Dividend Growth

Source: AGFiQ with data from FactSet as of October 26, 2021. Earnings growth based on six-month forward earnings.

If dividend growth does rise to those levels, it may be expected that North America’s Financials sector will have something to do with it. In particular, after being told by governments to restrict dividend increases at the height of the pandemic, both Canadian and U.S. banks are now cleared to resume them, and some have already begun. Similarly, life insurance companies and REITs should, on average, be ready to raise their payouts, too.

Still, Financials may not be the only sector where investors are likely to find dividend growth opportunities. Energy and Materials are two areas of the market that dividend growth has already spiked more recently, and this should continue given generally strong fundamentals and improving cash flow. At the same time, companies in non-cyclical sectors that exhibit these same traits can also be expected to raise their dividends going forward.

Another positive wrinkle in all of this relates to share buybacks – or the potential lack of them going forward. While it made more sense for companies to repurchase stock than increase dividends last year when valuations were depressed, that may no longer be the case. Not only have valuations risen substantially, making share buybacks more expensive, but a new 1% tax proposal on U.S. corporate buybacks now making the rounds in Washington, D.C., could be an additional strike against repurchasing stock versus paying a dividend.

Of course, none of this guarantees that dividend growers will outperform going forward, but the probability is enhanced for companies that grow their dividend more aggressively than those who don’t, our research shows. So, if dividend growth truly is back, investors may not want to miss out on it.

******

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

This document is for use by Canadian accredited investors, European professional investors, U.S. qualified investors or for advisors to support the assessment of investment suitability for investors.

The commentaries contained herein are provided as a general source of information based on information available as of November 15, 2021 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

®The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

RO:1922871

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.