by Carl Tannenbaum, Executive Vice President, and Chief Economist, Ryan Boyle, and Vaibhav Tandon, Northern Trust

The Northern Trust Economics team shares its outlook for the U.S. economy.

Shortages have challenged the recovery throughout this year, in a number of ways. Difficulties in supply chains and a slow return to work have persisted, while the costs of energy and housing are on the rise. These conditions are not expected to be permanent, but they are difficult to live through.

Economic growth lost some momentum in the third quarter, but indicators of employment and consumer activity suggest the year will end on a strong note. Holiday spending will provide a boost; not only does consumer demand remain strong, but more families will return to in-person contact after deferring celebrations last year.

It is too soon to say the economy has returned to normal. COVID-19 remains a threat, fiscal policy has become less supportive, and inflation is out of range. But a year of up-and-down recovery should conclude with a few months of cheer.

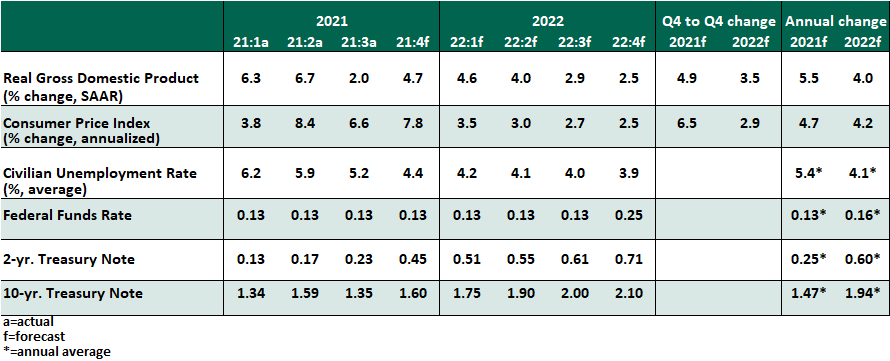

Key Economic Indicators

Influences on the Forecast

- Inflation readings remain hot, with the Consumer Price Index (CPI) gaining 6.2% year over year in October. Inflation this month was broad-based, with high demand and limited supply pushing up prices in sectors including energy, food, shelter and vehicles. These gains are unlikely to reverse, and we expect inflation to remain elevated through the first half of 2022. While we do not believe we are at risk of a sustained inflation runup, this “transitory” interval is enduring longer than we had hoped.

- The employment situation summary for October showed substantial improvement in the labor force, with 531,000 jobs added in October, plus upward revisions of 235,000 to prior months. The unemployment rate fell to 4.6%. While encouraging, much ground is left to recover. Payrolls remain 4.2 million lower than their February 2020 peak, and the total labor force participation rate has stalled all year. We continue to expect many workers to re-enter the labor force in the coming months.

- As anticipated, the Federal Reserve has begun the taper of its asset purchases, reducing purchase volumes by $15 billion progressively in November and December. If the taper continues at that pace, balance sheet expansion will conclude in the summer, clearing the way for rate increases. Steady employment gains and high inflation are exactly the circumstances in which the Fed should raise rates, and we now expect the first Federal Funds Rate increase in late 2022. Speculation of earlier action is overstated, as the Fed has not wavered in its patient decision-making at any time in this cycle.

- Gross domestic product (GDP) grew at a disappointing 2.0% annualized rate in the third quarter.

- Real consumer spending growth fell to only 1.6% (annualized) after double-digit gains in the first half. Durable goods spending led the decline as big-ticket items, notably automobiles, were not available. We view much of that spending as deferred, not lost.

- Supply chain struggles were manifest in the data, apparent in declines for residential investment and business investment in structures. Inventories are on a three-quarter streak of depletion. As supplies catch up with demand, inventory rebuilding will help to lift GDP in the year ahead.

- Congress has passed the bipartisan infrastructure bill that features $550 billion of new federal investments in roads, bridges, mass transit, airports, ports, broadband and water systems. With a five-year spending horizon, the bill does not alter the course of our growth forecast, but it will support a continued recovery in employment and higher productivity.

- Debate continues over the contents of a partisan social spending package. Meanwhile, the continuing resolution to fund the federal government expires December 3, and the minor lift of the debt ceiling has set the stage for another showdown next month. We expect the reconciliation bill to advance all of these items together, but its path to ratification will be contentious.

- The refrain may feel familiar, but it still holds true: The path of the economy is linked to the path of the virus. U.S. case counts have stopped their decline, and the winter surge a year ago looms large in our memory. However, new treatments, booster shots and broader vaccine eligibility bode well for the populace’s ability to live productively with the virus.

Copyright © Northern Trust