by Russ Koesterich, Portfolio Manager, Blackrock

BlackRock portfolio manager Russ Koesterich, CFA discusses the headwinds gold is facing and alternative hedges to consider in current markets.

For a market caught between strong growth, rising inflation, soaring stocks, and falling bonds, gold has not done much; the yellow metal has been range-bound since June.

As I discussed last winter, gold is struggling with volatile real rates, a firmer dollar and declining efficacy as a hedge. And despite gold’s reputation as an inflation hedge, it’s track record is mixed. For now, I would look elsewhere to hedge inflation and maintain a lower exposure to gold.

Stuck in the middle

While gold has bounced, rallying 4% from the fall low, it remains stuck in a range, between $1,750 an $1,850 an ounce. For investors who consider gold a unique inflation hedge this seems odd. With inflation at multi-year highs gold should be up, not down 6% year-to-date.

Despite the pickup in inflation, gold is still struggling with several headwinds. While growth is decelerating, it is likely to remain above trend in the coming quarters. Given historically low real yields and strong growth, the next move in real interest rates (i.e. the rate after inflation) is more likely to be up than down, a headwind for gold. At the same time, the dollar has been firm, another negative turn compared to last year.

What about gold’s role as an equity hedge? Again, the situation has not improved. Gold has become more correlated with stocks. Since the early spring gold’s correlation with U.S. equities has been around 0.4, well above the levels that prevailed last summer. In less quantitative terms: Gold is increasingly moving with stocks, making it an unreliable hedge.

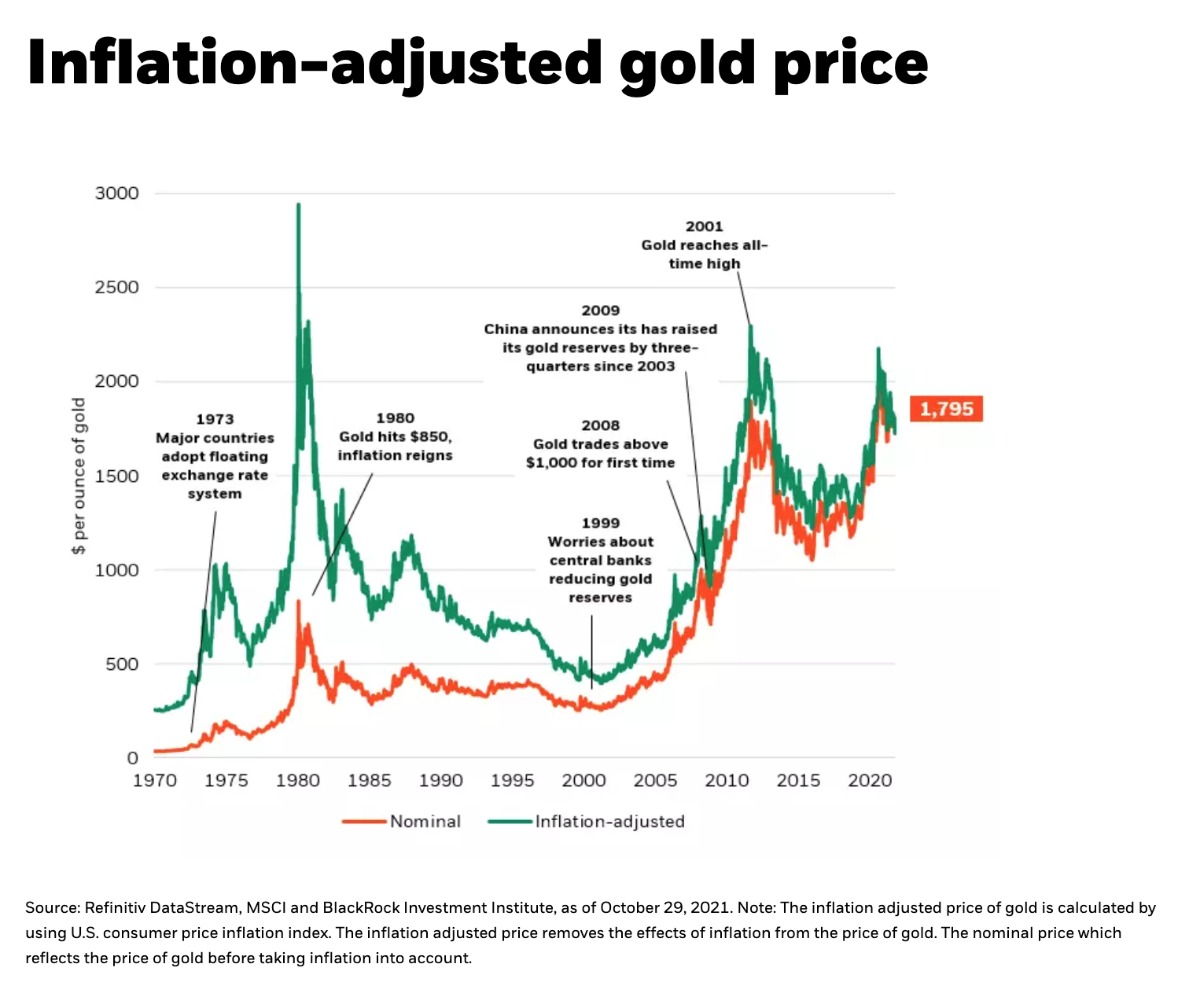

Gold’s rising correlation with stocks might be forgiven if it were fulfilling its traditional role as an inflation hedge. But while gold holds its own over the very long term, it is not a particularly reliable hedge outside of multi-decade horizons (see Chart 1). For most of the year gold has exhibited virtually no correlation with daily or weekly moves in long-term inflation expectations.

Alternative hedges

If gold is not the primary hedge for inflation, where else should investors look? Many are pointing to Bitcoin. While rising adaptation of crypto currencies may continue to push prices higher, with extreme volatility and a short track record, Bitcoin’s value as an inflation hedge is unclear.

Instead, today’s best hedge is arguably one of the simplest: cyclical equities able to maintain pricing power. While gold has not kept up with rising inflation expectations, many cyclical industries – including energy, materials and select consumer names – have.

One other option for those investors who want to include physical stores of value: silver. Unlike gold, silver has significant industrial uses and has recently tended to co-move with near-term inflation expectations. While not a “silver bullet,” silver can be part of the arsenal.

Russ KoesterichRuss Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Russ KoesterichRuss Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.