by Marcus Axthelm and Mo Haghbin, Invesco Canada

What is driving factor investing and investor experiences? Find out by exploring Invesco’s 2021 Global Factor Investing Study.

The 2021 Invesco Global Factor Investing Study continues our research into global factor investing, a form of investing in which securities are chosen based on attributes that have tended to offer favourable risk and return patterns over time.

This year, we surveyed over 130 institutional investors and 111 retail investors in the U.S. that are collectively responsible for managing over $31 trillion USD in assets (as of March 31, 2021) to identify four themes behind the drivers of factor investing, investor experiences, and methods of implementation:

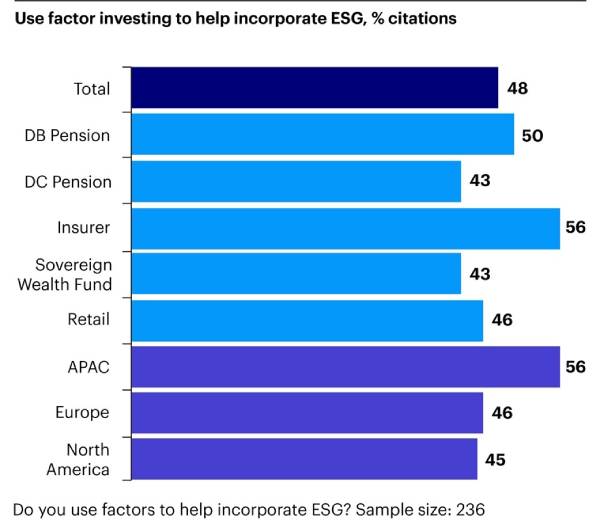

Theme 1: Increasing focus on the potential benefits of ESG (Environmental, Social and Governance) incorporation leads investors toward a factor-based approach

- Around half of factor investors are using factor investing to help incorporate ESG, driven by the pursuit of enhanced investment performance and control over exposures.

- Factor investing is seen as more compatible with ESG than a market-weighted approach, but behind fundamental active; despite this, ESG is more likely to be pushing investors toward factor investing than fundamental active.

- Respondents expressed a widespread belief that ESG can potentially enhance performance, while there is a lack of consensus as to whether ESG itself should be defined as an investment factor.

- Investor demand for ESG factor products is clear. However, a lack of products and challenges around communication remain.

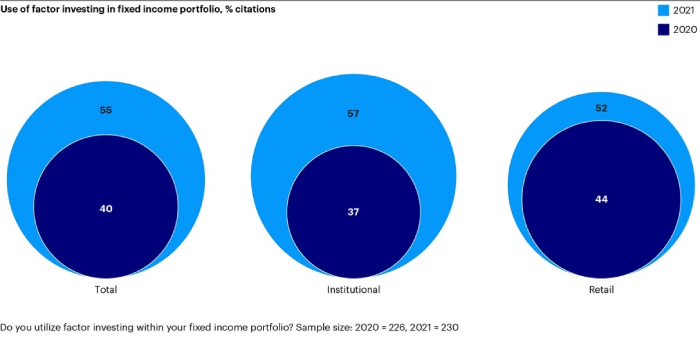

Theme 2: The rise of factor investing in fixed income continues

- Investors believe fixed income factor strategies are on par with active in targeting investment factors, but behind active in targeting macro factors.

- Fixed income factor allocations rise year on year, with investors incorporating both macro and investment factors, aiming for performance in a low-yield market environment.

- Respondents noted challenges related to a lack of product and technology. Use of fixed income factor ETFs is muted in comparison with equities.

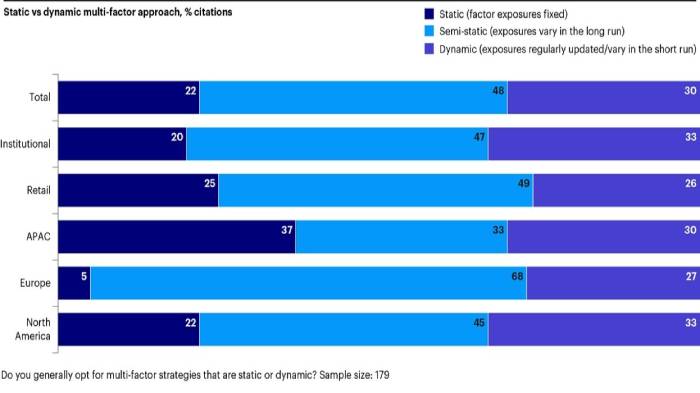

Theme 3: Investors use multi-factor approaches and manage exposures more actively

- Almost half of factor investors make long-term strategic adjustments to exposures, while 30% make short-run tactical adjustments.

- Dynamism looks set to accelerate with 41% of respondents expecting to be more dynamic over the next two years.

- Despite sophisticated implementation of analytics among some factor investors, there is appetite for better tools for monitoring exposures and attributing performance.

- Use of factor ETFs is accelerating rapidly, driven by the broad range of use cases including tactical allocations as portfolio completion tools.

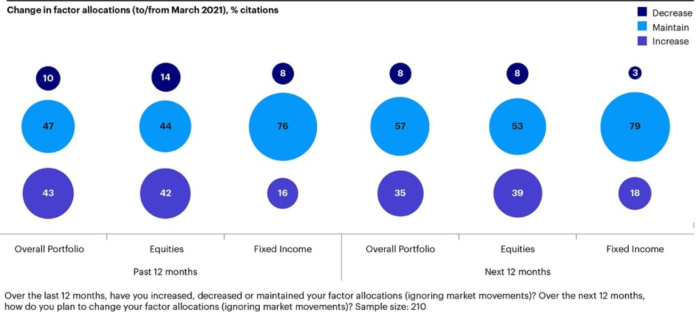

Theme 4: Factor allocations rise as post-pandemic recovery attracts investors to value

- Factor allocations are continuing to rise, with 43% of respondents increasing allocations over the past year and 35% planning an increase in the next year, compared to just 8% planning a decrease.

- This has been partly driven by increased allocations to value, as well as broader adoption of factors across portfolios.

Explore the full 2021 Global Factor Investing Study (only available in English)

This post was first published at the official blog of Invesco Canada.