by Carl Tannenbaum, Executive Vice President, and Chief Economist, Northern Trust

Personal trading could undermine public trust in the Federal Reserve.

The Federal Reserve compiles and publishes a great deal of information about the finances of American households and businesses. The quarterly Flow of Funds report and the triennial Survey of Consumer Finances are the leading expressions of this effort.

More recently, the finances of senior Fed officials have been getting a lot of attention. It recently came to light that several members of the Federal Open Market Committee were particularly active in the markets during the early part of last year, when the Fed was contemplating what to do about the pandemic. Somehow, the activity did not trigger an ethics objection; the reallocations proved fortuitous when markets rallied on the back of easier monetary policy.

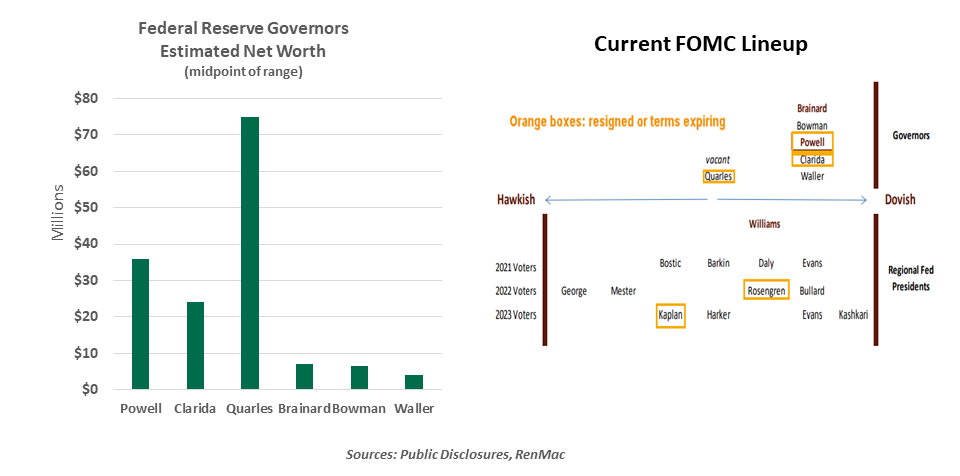

Senior Fed officials often come to the central bank after lengthy experience in the private sector. As a result, many have considerable net worth and portfolios that occasionally need rebalancing. It isn’t unusual for them to initiate transactions in the markets. But the timing in this case is certainly cause for question.

Trading by Fed officials during critical periods has cast the organization in a bad light.

For an institution that has high standards for integrity, this is a very bad look. Two regional Fed Presidents named in the reports have announced their retirements, and a sitting Governor has faced questions about the propriety of his actions. Federal Reserve Chairman Jerome Powell has promised a full investigation; potential remedies include requiring Governors to put their assets into trust, and prohibiting trading during a broader set of time periods.

Detractors say the Fed is unelected and unaccountable, yet has tremendous influence on policy and people’s lives. The notion that leaders might be putting their own interests ahead of the public trust is not helpful to the organization’s standing, or its ability to carry out policy.

The turnover and turbulence resulting from these financial revelations comes at a particularly bad time. The Fed was already looking ahead to a series of changes in personnel; the Chairman’s term and those of the two Vice Chairmen all expire soon. Two regional Fed banks are now searching for new leaders, who will participate in policy discussions next year.

As it tries to navigate an exit strategy from the extraordinary support provided during the pandemic, the Fed cannot afford to be short-handed and short of support. The Fed should move swiftly to reinforce its policies, its personnel, and its reputation.

Copyright © Northern Trust