The Northern Trust Economics team shares its outlook for the U.S. economy.

By Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

The Delta variant’s impact on supply chains and domestic spending slowed economic activity in the third quarter. Consumer confidence dipped noticeably, and businesses’ outlook dimmed somewhat. Rising inflation, the product of goods and labor shortages, has been a concern.

That said, the fundamentals remain strong. Economic output has returned to its pre-pandemic level. Household and business balance sheets are in good shape, and consumer savings are still elevated. An improving health situation should lead to renewed consumer buoyancy, and a resilient labor market recovery will underpin incomes amid reduced fiscal impulse.

Downside risks stem from the uncertainty around the fiscal situation in Washington, the path of the virus, and the possibility that supply constraints could linger for longer, weighing heavily on production and consumption.

The worst of the pandemic may be behind us, but so is the best of this recovery. We expect the U.S. economy to return to more normal growth rates in the second half of 2022.

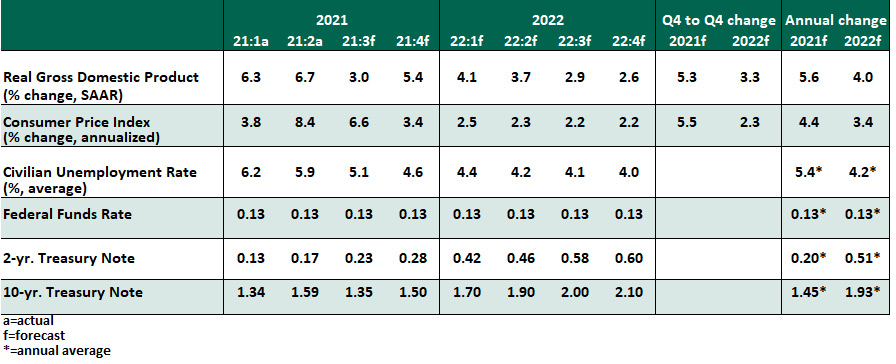

Key Economic Indicators

Influences on the Forecast

- The labor market is facing supply constraints. The September employment report showed that job creation slowed despite persistent labor shortages. The modest labor supply boost from the expiration of unemployment benefits and the reopening of schools was offset by rising COVID-19 infections. Payrolls are still 5.3 million below the February 2020 peak.

- Labor force participation fell modestly in September, a surprising outcome. We continue to expect participation to show strong gains in coming months, as workers are tempted by rising wages and scores of open positions. Those already working are trading up for better jobs at a record rate.

- The virus caused households to shy away from traveling and eating out. Yet retail sales recorded a strong gain in August. This substitution of goods for services (and vice versa) has been a theme throughout the recovery. Household savings remain elevated, although some of them are cautionary.

- Problems in global supply chains have gotten worse. The Delta variant hit China and other southeast Asian countries hard, which prevented the replenishing of inventories. The auto sector was a particular casualty, as production was limited by a shortage of circuitry.

- With a policy support-driven surge in demand outpacing supply, inflation has been running uncomfortably high. Headline inflation remains elevated at 5.4% year-over-year in September, but there are signs that some of the transitory effects are starting to wear off. As supply bottlenecks clear and base effects continue to fade, inflation will decelerate, although recent surges in housing costs and global energy and food prices could alter the trajectory.

- The housing market is another area of the economy dealing with shortages. Housing inventories remain tight, and home prices have risen by 20% over the past year. While a sharp reversal in lumber prices should have taken some steam out of prices, higher costs for other construction inputs could keep the housing market hot in the near term.

- U.S. fiscal situation is as muddied as ever. Treasury default risks were temporarily avoided, after Congress agreed to raise the debt ceiling by $480 billion. But the increase in the limit will only be enough to fund the government into December. Congress still needs to pass a budget for fiscal year 2022 to avoid a government shutdown after December 3. Plus, the future of the infrastructure bill along with a larger reconciliation package is hanging in balance.

- With the debt ceiling can kicked down the road, an adequate September jobs report and elevated inflation should set the stage for the Federal Reserve to start tapering its quantitative easing purchases in November. In our base case, we are not expecting a rate lift-off next year. However, a sustained inflation threat could force the central bank to act sooner.

View PDF versionCopyright © Northern Trust