by Alessio de Longis, Invesco Canada

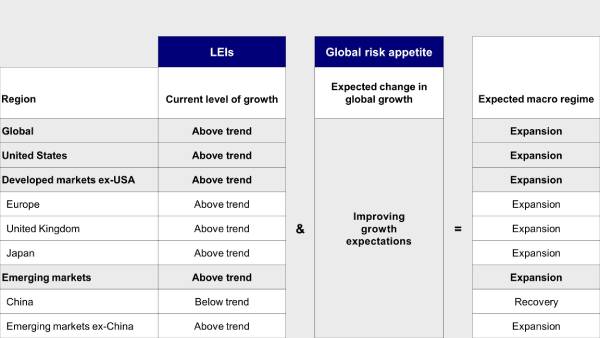

Despite the weakening in global leading economic indicators, our framework still points toward an expansionary regime. Alessio de Longis believes growth expectations are likely to improve over the remainder of the year, extending this expansion by a few more months.

Macro update

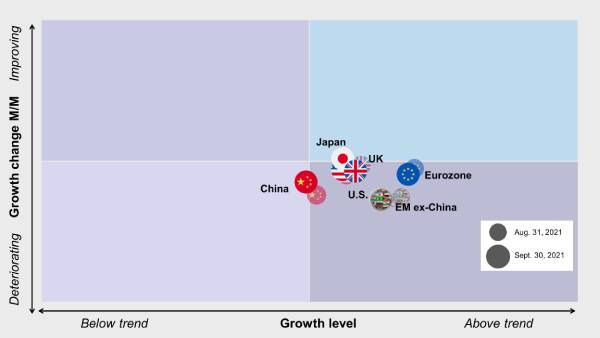

Leading economic indicators continue to decelerate at a moderate pace across regions. However, the breadth of this deceleration is narrowing across parts of the economy. In the United States, weakness remains concentrated in consumer sentiment surveys, while business surveys, manufacturing activity, and housing indicators have improved in recent months. We see the gradual re-steepening in the yield curve as a positive sign in the medium term, incentivizing credit creation by the financial sector and supporting future economic growth.

In the eurozone and the UK, peaking production expectations and falling inventories suggest the rebound in the inventory cycle has run its course. Eurozone manufacturing business surveys, a key bellwether of the global cycle given the high exposure to global trade channels, continue to signal elevated activity, and are yet to presage a clear downturn in the cycle.

In Asia, deceleration in manufacturing surveys, housing indicators, and industrial production have contributed to a noticeable slowdown in growth, with business surveys for manufacturing and service sectors in China suggesting below-trend growth in the near term.

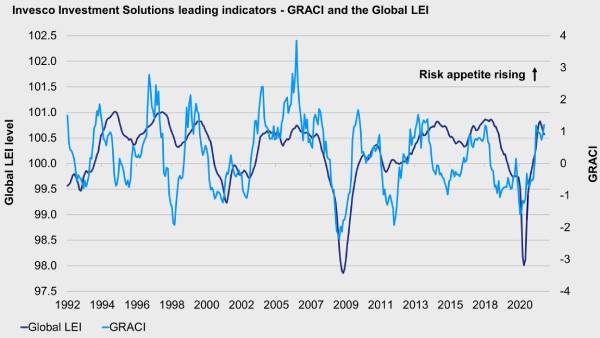

Despite this broad-based softening in economic data, our macro regime framework remains in an expansionary regime, driven by our assessment that global risk appetite remains on a rising trend despite the moderate weakness in global equity markets over the past few weeks. Based on our framework, we believe growth expectations are likely to improve over the remainder of the year, extending this expansion by a few more months (Figures 1, 2, and 3).

Figure 1: Macro framework points to an expansionary regime, China begins its recovery

Figure 2: Leading economic indicators continue to decelerate at a moderate pace across regions

Figure 3: Global risk appetite remains on a rising trend despite the moderate weakness in global equity markets over the past few weeks

On the COVID-19 front, evidence continues to suggest a decline in daily reported cases around the world. Further analysis of coronavirus effective reproductive numbers (Rt) in the U.S. indicates these trends are likely to improve further.1

Headlines from China surrounding Evergrande’s debt situation continue to feature prominently in the market narrative. Based on financial and economic exposures, we don’t expect contagion risk to spread beyond local high yield debt markets. It is noteworthy that, despite the unfavourable headlines, emerging market equities have matched the performance of developed market equities over the past two months,2 potentially suggesting that valuations are already reflecting some of the long-standing concerns around China’s overextended real estate sector, regulatory interventions, and slower growth targets.

Finally, as discussed last month, while inflation is likely to remain well above target in the next few quarters, we believe it has peaked and should gradually decline back to its long-term average. This view is also consistent with central banks’ projections and consensus expectations from economic forecasters.

The bottom line is that our macro framework still points toward a positive backdrop for equities, cyclical assets, and emerging markets.

Investment positioning

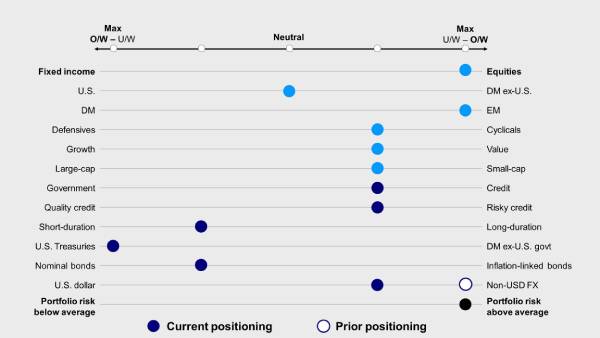

- Within equities, we favour emerging markets, driven by above-trend global growth, rising risk appetite, and medium-term U.S. dollar depreciation to support the asset class. We remain tilted in favour of (small) size and value across regions. In addition, we are tilted in favour of momentum, which currently captures value and smaller-capitalization equities, therefore concentrating risk in cyclical factors and reducing factor portfolio diversification relative to the past few years. (Figure 4 and 5)

- In fixed income, we favour risky credit despite tight spreads, seeking income in a low-volatility environment. We are overweight high yield, bank loans, and emerging markets debt at the expense of investment grade credit and government bonds. We favour U.S. Treasuries over other developed government bond markets given the yield advantage. (Figure 4)

- In currency markets, we reduced our overweight exposure to foreign currencies in light of negative growth surprises in developed markets outside the U.S. While valuations still point toward a long-term U.S. dollar depreciation cycle, recent underperformance in growth outside the U.S., relative to expectations, mitigates the near-term potential for foreign currency strength. Within developed markets, we favour the euro, the yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar. In emerging markets, we favour high yielders with attractive valuations such as the Russian ruble, the Indian rupee, and the Indonesian rupiah.

Figure 4: Relative tactical asset allocation positioning

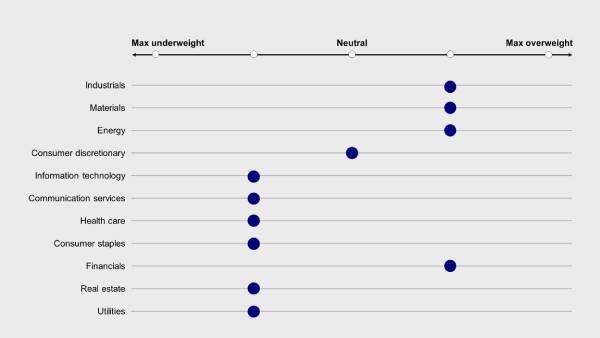

Figure 5: Tactical sector positioning

1 Source: Research from www.CovidEstim.org. Rt= effective reproductive number of the coronavirus. Rt represents the average number of people likely to be infected by each infected individual on day t. When Rt < 1, expected cases are likely to decrease in the near future.

2 Source: Bloomberg L.P. as of Sept. 30, 2021. Emerging markets refers to the MSCI Emerging Markets Index and DM refers to the MSCI World Index. Past performance does not guarantee future results.

This post was first published at the official blog of Invesco Canada.