by Talley Léger, Invesco Canada

Investors are feeling fearful about several issues. But Talley Léger believes inflation, Chinese growth concerns, and coronavirus cases should become less scary as time goes on.

Halloween is right around the corner, and investors are feeling fearful about a number of valid issues. Fortunately, I believe we’re seeing signs that these concerns should become less scary as time goes on. Below I discuss three of these issues in particular: Inflation, Chinese economic growth, and coronavirus cases.

Scare #1 – Inflation

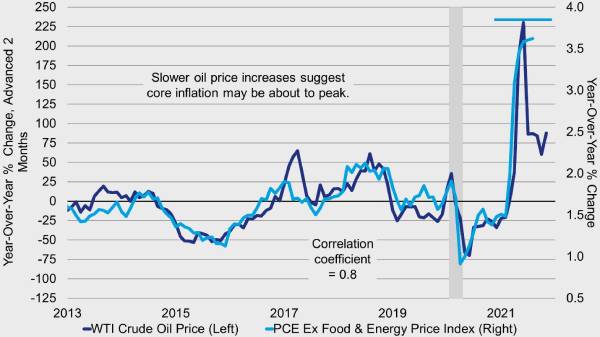

First and foremost on their list of worries is an inflation “scare” that’s currently gripping the marketplace. As shown in Figure 1, U.S. core personal spending inflation (which excludes food and energy prices) has soared above 3.6% year-over-year, the fastest pace since the early 1990s. However, oil price inflation – a key driver of headline inflation – has decelerated sharply as oil prices have risen at a significantly slower pace. In my view, the strong influence and leading characteristic of oil points to an easing of non-food and energy inflation, albeit with a lagged effect.

Figure 1: Spoiler alert – Are oil prices previewing how this “scary” inflation movie ends?

Oil price inflation (dark blue, pushed forward) and U.S. core personal spending inflation (light blue) since 2013

Granted, this is a different environment than the one experienced over 12 years ago. Indeed, U.S. consumers and banks are in solid shape by comparison, and the strength of the “at-home” economy has pushed up the prices of highly visible goods and services in the near term.

Is it possible that both the tactical and structural views on inflation are correct? After a rapid reflationary bounce, assuming pandemic-related production bottlenecks and labour shortages eventually subside, are we destined to return to the structurally-impaired economic environment that existed before the pandemic? That could happen if the secular forces capping trend inflation remain in place. Time will tell, as always, but I prefer the latter view as a long-term investor.

Scare #2 – Chinese growth

Leading economic indicators are softening across regions, including an acute slowing of the second-largest economy in the world, China. Indeed, Chinese real gross domestic product (GDP) growth has downshifted from a double-digit pace in the first quarter of this year to a mid-to-high single-digit pace in the second quarter.

Why? After a phenomenally successful reflationary campaign in 2020, Chinese policymakers slammed the brakes in early 2021 – partly expressed by a temporary spike in Shanghai interbank rates – to rein in the froth and excess they thought was developing. As a result, Chinese stocks have lagged their U.S. counterparts this year alongside slowing money growth.1

Figure 3: Chinese stocks have languished alongside slowing money growth

China money supply growth (dark blue) and stock market returns (light blue) since 2000

Beijing’s overreaction and the economic slowdown that it engendered also challenged cyclical stock market leadership in the U.S., which I think has presented another attractive entry point for patient investors.

Intuitively, there has been a close connection between money supply growth and stock market returns over time. After all, money generally goes to where it’s treated best. And when there’s excess liquidity sloshing around in the financial system, it tends to work its way into the stock market first.

Fortunately, the Chinese monetary authorities have cut reserve requirements for their banks, injected capital back into their system and fostered a renewed decline in interbank rates. In the past, interest rate cuts have been followed by accelerating money supply growth about half a year down the road, as illustrated in Figure 4. If that relationship continues to hold, I’d expect a rising tide of money to lift Chinese and emerging market stocks in general.

Figure 4: Rate cuts by Beijing today may mean higher money supply tomorrow, which could bode well for Chinese and EM stocks

China institutional interest rate (dark blue, reversed, pushed forward) and money supply growth (light blue) since 2008

Scare #3 – SARS-CoV-2 cases

I’m not a virologist, I’m just an investment strategist. But when it comes to “corona-variants,” I think the last chart may provide some comfort to investors.

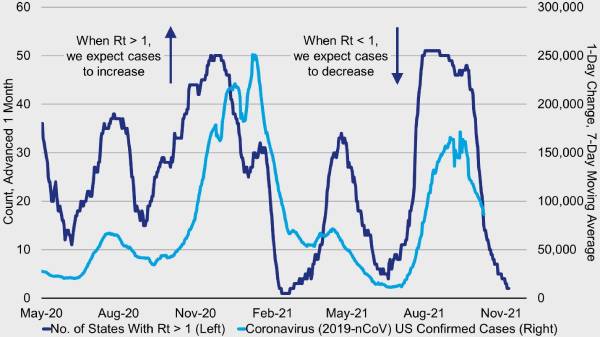

The effective reproductive number (Rt) of the coronavirus is the average number of people that an individual infected on a given day (t) is expected to go on to infect. When Rt is greater than 1, we expect cases to increase in the near future. When Rt is less than 1, we expect cases to decrease in the near future.

Encouragingly, Rt has declined sharply by U.S. state, meaning newly-infected people are infecting others (so-called “secondary infections”) at a shrinking rate. That shows good potential for the coincident U.S. national case count, which lags the Rt state count by about a month (Figure 5)!

Figure 5: Newly-infected people are infecting others at a shrinking rate in the U.S.

Number of U.S. states with growing secondary infections (dark blue, pushed forward) and U.S. cases (light blue) since 2020

Have courage

The bottom line is that financial conditions are still historically easy, and policymakers generally remain supportive of economic growth, albeit at a more sustainable pace. Amidst an ongoing economic expansion, I believe stocks and corporate bonds are the asset classes of choice.

Planetary gravity and the natural laws suggest decelerating but positive returns on cyclicals in the year ahead. In other words, cyclicality (e.g., corporate bonds, stocks, economy-sensitive sectors) can still work … just not as well as it did over the past year, in my view.

At some point, cyclical returns could even re-accelerate as the current scares begin to subside. Recall that the longest business cycle on record faced many challenges that proved to be buying opportunities, including the 2011 eurozone debt crisis, 2015/16 China hard landing, 2018/19 trade wars, etc.

Against that backdrop, I think investors should focus on pro-cyclical regions, countries, asset classes and market segments in their portfolios.

1 In local currency terms, the New York Stock Exchange is up 11% while the Shanghai Stock Exchange is up just 3% year to date as of Oct. 15, 2021. Past performance is not a guarantee of future results.

This post was first published at the official blog of Invesco Canada.